Can Gold And The US Federal Debt Return To Its 20-Year Correlated Relationship?

Strengths

- Gold rebounded from the lowest level in seven weeks following Federal Reserve Chair Janet Yellen’s comments signaling that an interest rate increase isn’t imminent. Analysts are now coalescing around September for an initial rate hike.

- Gold climbed to the highest in a week after Chinese buyers returned from holidays and investors speculated the Fed will continue to keep rates low. Volumes for the Shanghai Gold Exchange’s benchmark spot contract more than doubled on Wednesday as investors in China returned from the week-long Lunar New Year holiday.

- Gold futures bounced back after a government report showed that the U.S. economy expanded at a slower pace than previously estimated in the fourth quarter. The U.S. grew at a 2.2 percent annualized rate, lower than the initial 2.6 percent estimate.

Weaknesses

- Gold could be heading for its biggest monthly drop since September. This comes amid concern that U.S. borrowing costs will rise along with the bailout deal reached for Greece curtailing demand for the safe-haven metal.

- The gold and silver fixes, along with other commodity benchmarks, have come under increased scrutiny by regulators in both Europe and the U.S. since a London Interbank Offered Rate manipulation case in 2012. Furthermore, Switzerland’s competition commission WEKO is probing possible manipulation of price fixing in the precious metals market.

- Barclays, HSBC and Deutsche Bank are among at least 10 international banks being investigated by the U.S. Department of Justice for alleged rigging of the precious metals market. The Gold Anti-Trust Action Committee is claiming that precious metals prices are being heavily manipulated by the big commercial banks in collusion with the U.S. Fed and other central banks.

Opportunities

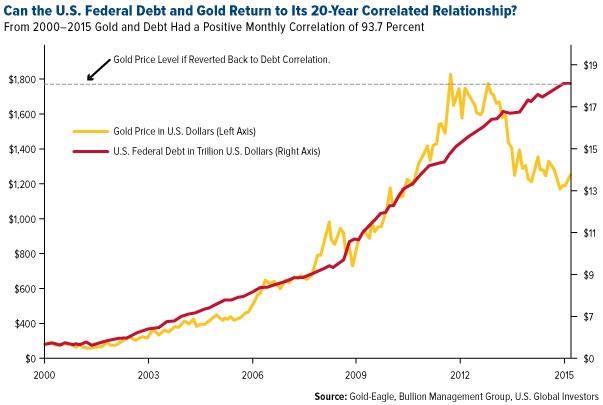

- Nick Barisheff, CEO of Bullion Management Group, claims that between 2000 and 2015 the U.S. debt and the gold price have had a positive correlation of 93.7 percent. However, since 2012 the relationship has decoupled. To get back to the correlated relationship, the gold price would have to return to around $1,800, implying that gold is undervalued at current levels.

- Orex Minerals announced it has entered into a joint venture with Agnico-Eagle Mines for the development of Orex’s Barsele gold project in Sweden. The proposed joint venture would see Agnico-Eagle earn 55 percent of the project through the payment of $10 million and would also see the company commit to spend $7 million on the project over the next three years. What is interesting is that Orex Minerals has a $30 million market cap, so the $10 million put up by Agnico-Eagle represents about one-third of Orex’s market value. Orex also has three other projects, one which is already in a joint-venture agreement with Fresnillo. The management team at Orex has again proven that it is adept at structuring deals as it had previously arranged for Orko Silver to be sold to First Majestic, only to be outbid by Coeur Mining.

- The recently published 2014 Fraser Institute Survey ranks Finland, Saskatchewan, Nevada, Manitoba, Western Australia, Quebec, Wyoming, Newfoundland and Labrador, the Yukon and Alaska as the top 10 jurisdictions for mining investment.

Threats

- That same survey mentioned above also ranked Malaysia, Hungary, Kenya, Honduras, Solomon Islands, Egypt, Guatemala, Bulgaria, Nigeria and Sudan as the least attractive jurisdictions for mining investment.

- The central banks of Switzerland, Sweden and Denmark are now imposing negative interest rates on bank deposits. Analysts at Commonwealth Bank of Australia claim that almost a quarter of worldwide central bank reserves now carry a negative yield. The risk is that negative rates backfire and could result in even lower demand. Additionally, Citigroup said in a report last month that “there are no serious arguments against creating a financial system where nominal rates can be set with equal ease at negative 5 percent as at 5 percent.”

- AngloGold Ashanti, Gold Fields, Sibanye Gold and Harmony Gold Mining have been trying unsuccessfully for at least a decade to link pay increases to efficiency gains. They will try again by lobbying for this in the wage negotiations with employees, set to begin in April.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of