Can Gold Rally Despite A Strong Dollar?

Summary

-

Gold shrugs off dollar strength due to a confluence of overseas factors.

-

The gold mining stocks, however, are showing more strength than gold.

-

Investors should focus on relative strength among mining shares.

Gold is facing what is potentially its toughest test of the year right now. Its attempt at rallying despite a strengthening dollar will test not only the buying power of the gold bulls who believe the metal can rally despite the powerful headwind from gold’s currency component, but also the belief by many investors that higher risk assets offer better value than gold right now. In today’s commentary, we’ll focus on this conflict as I’ll make the case that while gold can make some headway against a strong dollar in the immediate term, a weaker dollar is definitely needed to catalyze a sustainable rally in the intermediate-to-longer term.

The price of gold prices rose to a one-month high on Thursday after the European Central Bank (ECB) pledged to keep interest rates steady through the summer of 2019. Elsewhere, investors worried over data showing that China’s economy was weaker than anticipated. Spot gold gained 0.3 percent to close at $1,303 after peaking at $1,309 intraday. August gold futures settled up $7, or 0.5 percent, at $1,308.

The National Bureau of Statistics released data in Beijing on Thursday which revealed that investment, retail sales and industrial production all slowed in May. The slowdowns in investment and retail sales were especially sharp and were unanticipated by most analysts. China’s central bank has acknowledged that the government’s attempt at curbing lending in recent months has negatively impacted most segments of the country’s economy. This news helped bolster gold’s safe haven demand despite a sharp rally in the U.S. dollar on Thursday.

This leads us to the question posed in today’s headline, namely: “Can gold rally despite a strong dollar?” As I intimated in the opening paragraph, yes, gold can indeed rally despite a strengthening U.S. currency. This has happened several times in recent years, although it must be emphasized that gold and the dollar move concurrently only on a short-term basis. Eventually, continued strength in the dollar will undermine gold due to the metal’s currency component, as we’ve also seen in the recent past.

What has to happen to allow this unusual situation of a simultaneous rally in gold and the dollar is a special situation. Normally, that situation involves a set of unique circumstances which stimulate safe haven purchases of gold despite a rising dollar. That doesn’t happen very often, although the most conspicuous example of this occurred in the early part of 2010, when the dollar was strengthening as the U.S. economy was recovering from the Great Recession, while at the same time investors were spooked by global market weakness.

Could the present afford a parallel case where both gold and the dollar can rise concurrently? It’s too early to answer that question, although if China continues to weaken along with continued volatility in the euro zone (as this article suggests), there would certainly be a strong case for owning gold in spite of a rising dollar.

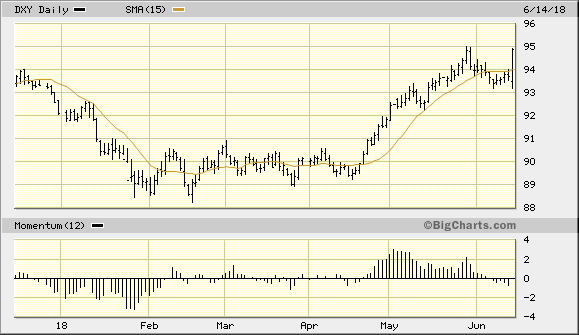

The U.S. dollar index (DXY) rose 1.42% on Thursday to a new high for the year after the latest FOMC meeting. The U.S. central bank rose interest rates again by the expected 25 basis points. Gold had clearly discounted this move and rose despite the increase in rates and resulting dollar index rally, which can be viewed as a short-term positive for the metal. It shows that there is some genuine demand for gold in spite of the obvious competition from higher rates and a stronger currency.

Source: BigCharts

Meanwhile, China said on Thursday it was ready to respond if U.S. President Trump activated tariffs on Chinese goods. Trade-related tensions are clearly supportive for gold in the near term, which could be another reason for gold’s refusal to wilt in the face of a rising DXY.

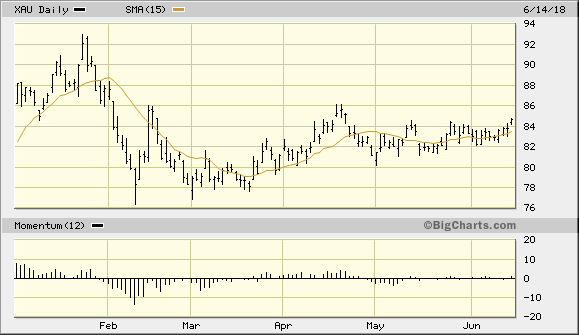

By far the most supportive aspect for gold in the near term are the gold mining stocks. The PHLX Gold/Silver Index (XAU) has been showing some notable technical improvement on an immediate-term basis, and this is supportive of gold to the extent that the XAU has historically led the physical metal at critical junctures. Shown here is the XAU daily chart along with its 15-day moving average. The index is in the process of establishing a short-term rising trend, which in turn could lead to a more substantial rise if internal improvements already underway continue in the coming weeks.

Source: BigCharts

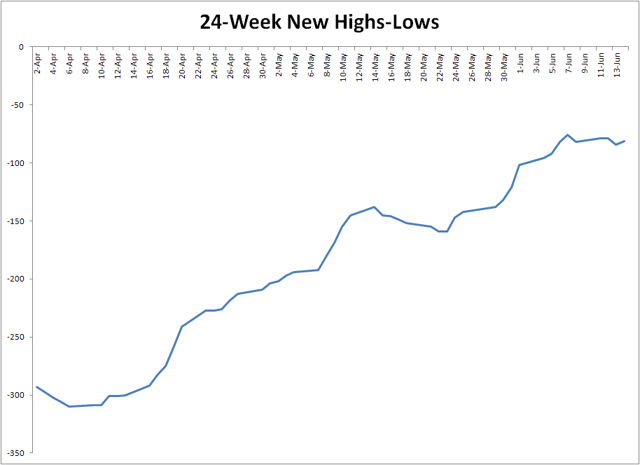

In recent commentaries, I’ve mentioned the improvement in the intermediate-term (3-6 month) internal momentum for the 50 most actively traded gold stocks. This is measured by looking at the 24-week rate of change of the new highs and lows of those stocks, shown below. This indicator tells us that the path of least resistance for the actively traded gold stocks as a group is improving on an interim basis. Thus, we could be in for a livelier market for gold stocks this summer despite the trendless action of the XAU since April.

Source: WSJ

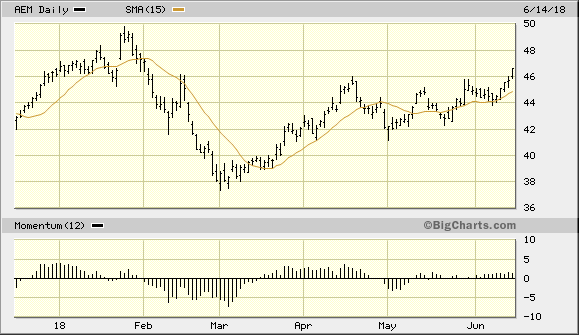

For now, investors should focus their attention on the actively-traded mining shares which have already established relative strength compared to the XAU index. Examples of relative strength standouts among the blue chip mining stocks include Agnico Eagle Mines Ltd. (AEM), Gold Resource Corp. (GORO), and Pan American Silver Corp. (PAAS).

Source: BigCharts

While there's a strong chance that gold will follow silver's lead in the immediate term by rallying, we should ideally see the dollar index fall back before getting the all-clear signal on initiating new interim positions in gold. Otherwise, any rallies from here are likely to be tenuous due to headwinds from a strong dollar. Therefore, no new trading positions are recommended in the iShares Gold Trust (IAU).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

*********