Canadian Gold Output Could Grow 80 Percent

Strengths

· The best performing metal this week was silver, up 0.43 percent as hedge funds cut their bearish outlook. After mostly bearish opinions last week, gold traders are leaning more bullish this week on the yellow metal’s performance. BullionVault’s Gold Investor Index rose last month to 54.1, up from 52.7 the prior month, when it was at the lowest level since August 2017, according to Bloomberg.

· The gold price fell briefly after the release of jobs numbers on Friday; however, it recovered as the dollar fell. On Thursday the gold price rose after China warned of a response to the recently imposed steel and aluminum import tariffs.

· Australian gold mine production in 2017 hit its highest level since 1999 at 301 tons, worth almost A$16 billion, according to Bloomberg First World. Australia is the world’s second largest gold producer behind only China. Those rankings may change as findings released this week from Wood Mackenzie say that Canada’s gold output could grow 80 percent, making it the second largest global producer. Canada is currently the fifth largest producer.

Weaknesses

· The worst performing metal this week was gold, up 0.04 percent. Gold was heading for its third weekly decline as tensions rise with North Korea as President Trump announced he would be willing to meet with the regime’s leader. The largest consumer of gold, India, saw imports fall 31 percent in February on the heels of a 10 percent import tax. Imports for the nation spiked in January knowing that the tax would be implemented February 1.

· Africa’s largest copper producer, the Democratic Republic of Congo, cancelled contracts last minute that guaranteed some producers would be exempt from a royalty increase. Congo is also the world’s biggest source of cobalt and could implement a royalty of 10 percent on the metal, up from 2 percent. These new regulations significantly increase the cost of doing business in the mineral-rich African nation.

· Tahoe Resources Inc. announced that its Guatemalan mine will be required to undergo further environmental and anthropological testing, resulting in additional delays to the restart of production.

Opportunities

· Ecuador’s new mining minister, Rebeca Illescas, reassured investors in an interview this week that the nation will continue to be a burgeoning hotspot for gold and copper mining, reports Bloomberg. Illescas said “We are working to improve tax conditions. It’s important that everyone wins – companies, communities and the state.” At least 28 mining companies have established a presence in Ecuador. Illescas also said that Ecuador is working to eliminate a windfall tax.

· The CBOE/COMEX Gold Volatility Index fell for a third straight week and the largest ETFs tracking gold prices saw their longest run of inflows since last September, writes Bloomberg. This indicates investors are turning to gold as a hedge against the prospect of rising inflation. Dominic Schnider, head of commodities and Asia-Pacific foreign exchange at the UBS wealth-management unit, said this week that “gold has done its job in a portfolio as a diversifier” and that if a trade war does occur it will hit base metals and benefit gold.

· Cardinal Resources Limited released positive drill results at its Namdini Gold Project in Ghana. The company reported a 50 percent increase in the indicated category, up from the previous estimate in September. Highlights include 6.5Moz of gold contained at 1.13g/t. Leagold also reported positive findings at its Los Filos gold mine in Mexico, with reserves increasing by 59 percent from the previous year, which will increase the life of the mine.

Threats

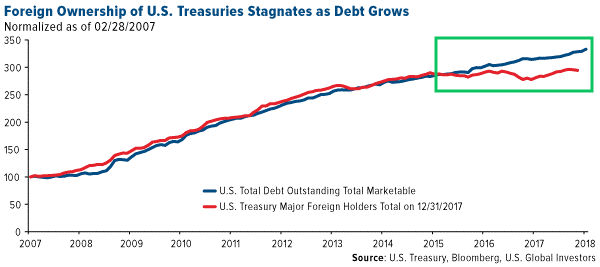

· An economic contraction could happen as soon as next year, reports Bloomberg, with indicators such as Fed policy makers boosting rates and record corporate debt backing up this theory. But if you add in the tariffs that Trump signed this week, will other countries respond by purchasing less U.S. debt? See the chart below. Speaking of debt, U.S. household debt rose in the fourth quarter at the fastest pace since 2007. Other concerns regarding a market correction come from JPMorgan’s executive Daniel Pinto, writes Bloomberg. Pinto warns that equity markets could fall as much as 40 percent in the next two to three years.

· It may be positive that Victoria Gold Corp announced this week it has entered into documentation with Orion Mine Finance, Osisko Gold Royalties and Caterpillar Financial Services. This comprehensive financing package will fully fund the development of the Eagle Gold project, reports Bloomberg. The package totals approximately C$505 million. Osisko has agreed to purchase on a private placement basis, 100 million common shares of Victoria at C$0.50 per share, for total financing by Osisko of C$148 million including the Royalty Purchase, the article continues. The fact that the project was financed with only corporate interest, and not by the street, speaks to the issue that investors are only chasing exposure to gold’s bullion beta and they are not taking the time to analyze the merits of an investment that might deliver some alpha.

· Should Gold Fields’ local unit in Ghana receive government permission to dismiss more than 2,000 of its staff, as it starts the process of hiring a contractor to operate its biggest mine in the West African Nation, the company might end up answering to union members. According to Bloomberg, Ghana’s largest mineworkers’ union plans to protest and strike throughout the operations if the government gives its go-ahead for the layoffs, allowing the contractor to take over the operation.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of