Central Banks Will Help Forge The Future Price Of Gold

Central Gold Reseves By Country

http://en.wikipedia.org/wiki/Gold_reserve

Whom To Believe On Gold: Central Banks Or Bloomberg?

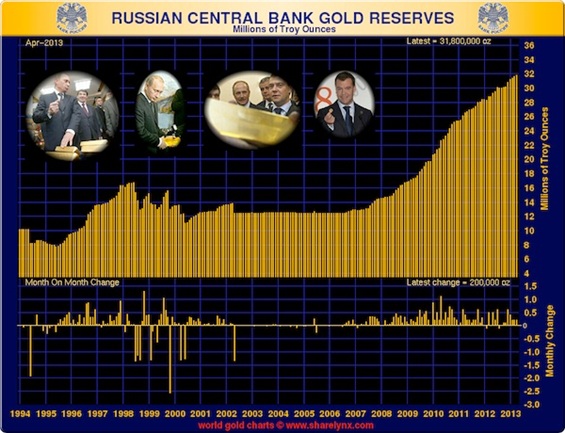

Bloomberg reported recently that Russia is now the world's biggest gold buyer, its central bank having added 570 tonnes (18.3 million troy ounces) over the past decade. At $1,650/ounce, that's $30.1 billion worth of gold.

Russia’s Central Bank Is Gorging On Gold:

Russia: The Sleeping Giant Of Gold Producing Countries

(How the bear is preparing for a global currency war) :

Russia’s Central Bank Gold Reserves (have increased 167% during last six years since 2007):

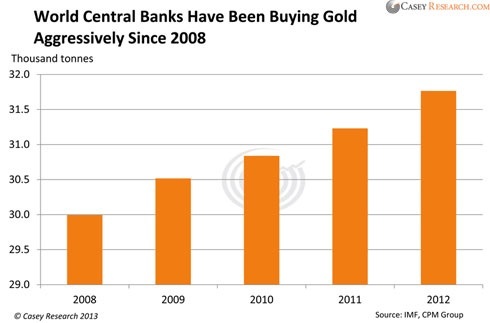

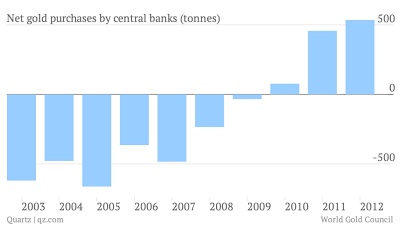

Russia isn't alone, of course. Central banks as a group have been net buyers for at least two years now. But the 2012 data trickling out shows that the amount of tonnage being added is breaking records.

Here's a picture of total Central Bank reserves since the financial crisis hit.

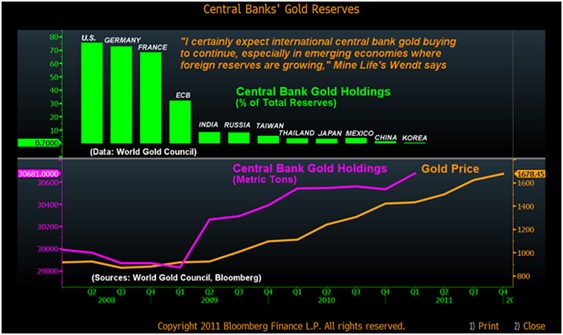

Chart Of Central Bank Gold Holdings

Since 2008 the gold price has increased in tandem with growing Central Bank holdings.

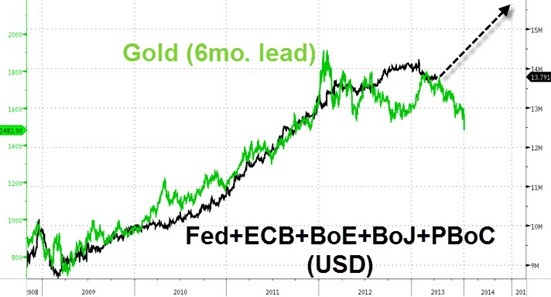

During the past five years, the USA, Euro Union, Bank of England, Bank of Japan and even The Peoples Bank of China have deployed Quantitative Easing , while the balance sheets of these world Central Banks exploded . Consequently, each time Gold has front-run that move...

Some of the most notable Central Bank Gold buying over the last few years has included that of China, India & Russia.

Central Banks Buying More Gold And Alternative Assets (Including Chinese Renminbi), Diversifying Away From US Dollar And Euro: WGC

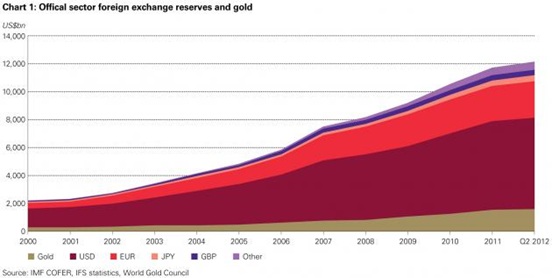

Against a backdrop of continued global economic uncertainty, central banks have begun to reduce reserve portfolio allocations to U.S. dollars and euros while increasing purchases of traditional assets such as gold and new alternatives including Chinese renminbi, a report issued by the World Gold Council said on Wednesday. Here is the graph showing the relentlessly inexorable growth in the Official Total Foreign Reserves and gold:

Central Banks To Accumulate Gold For Another 5 Years At Least

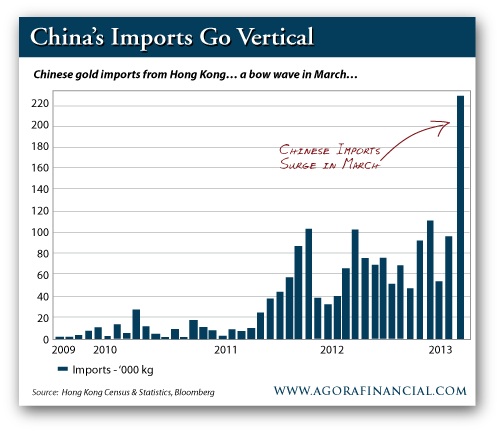

Chinese November Gold Imports Soar To 91 Tons; 2012 Total 720 Tons. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011. Chinese Gold Imports From Hong Kong accelerate month after month after month:

The China Gold Rush Is In High Gear

As you may have heard, China’s gold purchases for 2013 got off to a slow start. After hitting a record high of 114 metric tons in December of 2012, gold imports dropped to 51 tons in January of this year.

In February imports shot higher to 97 tons. That’s well above 2012’s average monthly import numbers. Clearly demand was starting to perk higher.

This week the numbers for March hit the airwaves…like a sonic boom…

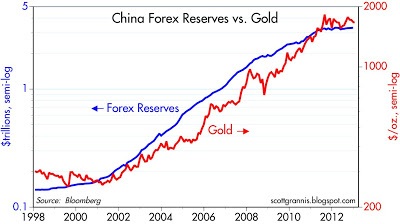

China’s FOREX Reserves vs The Price Of Gold

I find the above chart fascinating. It compares the rise in China's FOREX reserves with the rise in the dollar price of gold, both of which have been impressive to say the least. Both China’s Total Foreign Reserves and the price of gold increased by many orders of magnitude over roughly the same period.

Don Luskin, a monetary expert explains how China's FOREX reserves are connected to the rise in the price of gold. He argues that the outstanding stock of gold is relatively fixed—growing only about 3% per year—but that the demand for gold has jumped by orders of magnitude since China, India, and other emerging markets have enjoyed explosive growth and prosperity gains. In other words, the number of potential buyers of gold has risen much faster than the supply of gold, so naturally gold's price has increased. This is not a story about massive money printing and hyper-inflationary consequences, it is a story about a surge in the demand for the limited supply of gold…WHICH SHOULD CONTINUE UNABATED FOR THE NEXT 5 YEARS.

Central Bank Gold Buying Will Not Abate…In Fact It Will Accelerate

Central Banks also will help boost demand for bullion as they expand reserves. Nations from Brazil to Russia added 534.6 tonnes last year, the most since 1964, and may buy 450 to 550 tonnes this year, according to the World Gold Council in London.

Based upon the above, the logical forecast is that gold will never reach a PEAK PRICE. Nonetheless, there will be brief periods of correction when the price of gold rises too far too fast. However, these will be godsend opportunities to accumulate gold on the cheap. Obviously, Today Is One Of Those Times.

********

I.M. Vronsky

GOLD-EAGLE