China Gold Dragons

Why Is China Hoarding So Much Gold?

What in the world is China up to? Why are the Chinese hoarding so much gold? Does China plan to back the Yuan with gold and turn it into a global reserve currency? Could it be possible that China actually intends for the Yuan to eventually replace the U.S. dollar as the primary reserve currency of the planet? Most people in the western world assume that China just wants a “seat at the table” and is content to let the United States run the show. But that isn’t the case at all. The truth is that China doesn’t just want to compete with the United States. Rather, China actually plans to replace the United States as the dominant economic power on the planet. In fact, China already accounts for more global trade than the United States does. So what would happen one day if China announced that it was backing the Yuan with gold and that it would no longer be using the U.S. dollar in international trade? It would cause a financial shift so cataclysmic that it is hard to even imagine. Most of those that write about the “death of the U.S. dollar” usually fail to point out that China is holding a lot of the cards as far as the fate of the dollar is concerned. China owns about a trillion dollars of our debt, China is the second largest economy on the planet, and nobody uses the dollar in international trade more than China does except for the United States. Up until now, China has had to use the U.S. dollar in international trade because there has not been an attractive alternative. But a gold-backed Yuan would change all of that very rapidly.

And without a doubt, the Chinese government has already been very busy promoting the use of the Yuan in international trade. In a recent note, John McCormick of RBS Group stated the following…

For China, having a global reserve currency is not just about economics. It is also about power.

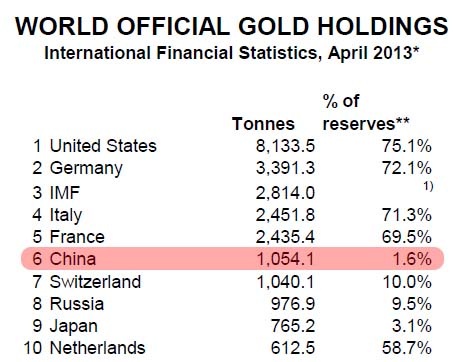

China just has one big stumbling block to get over, before the Renminbi (RMB)will be accepted as a global reserve currency: IT'S CALLED GOLD !!! China just "ain't" got enough gold to back up its currency. In fact China has only 2 percent of its Total Foreign Reserves in gold...vs the U.S. that boasts 76 percent gold reserves.

Like the man said: China can't cut the 'monetary mustard" until it buys up a few years total world annual gold production. This might take The Peoples Bank of China 5-10 years to accomplish. It is estimated China might need accumulate 30,000 to 35,000 tonnes to be in the same ballpark with the USA. Meanwhile, the price of gold will correspondingly go ballistic to new yearly all-time record highs.

To be sure in this event HUI and XAU stocks will rise parabolically.

*****

Financial crises in the US and Europe mean the world needs a new, more stable global reserve currency, and trade in RMB is growing rapidly. In the FX market, for example, figures show that trading volumes are now around USD 5-6 Billion daily – double what they were a year ago.

A number of factors suggest that the Chinese authorities want to make RMB internationalisation happen by 2015.

China’s new leadership faces a number of problems. The country’s economy is slowing and, although we would expect the rate of GDP growth to pick up a little, it is unlikely to be a steep rebound.

But promoting RMB as a global reserve currency, with all the economic benefits that will bring in addition to exerting more political influence on the global stage, clearly remains high on Beijing’s agenda.

Similar sentiments were echoed in a recent article in the Wall Street Journal...

Beijing is undertaking a long, gradual campaign to establish the Yuan as a more market-oriented, international currency. China's State Council, or cabinet, said in a statement this month that the country would draft a plan to allow the Yuan to become fully convertible. Meanwhile, the People's Bank of China is guiding the currency higher and set the median point of its permitted daily trading band last week at the strongest level ever.

We don't hear much about these sorts of things in the western media, but the convertibility of the Chinese Yuan is a very big deal. Up until recently, the Yuan was only directly convertible into dollars and yen. But now that is rapidly changing. So far this year, the Chinese government has entered into currency convertibility agreements with Australia and New Zealand.

So instead of having to change Yuan into U.S. dollars to trade with Australia and New Zealand, now China can cut U.S. dollars completely out of the process.

But right now there is nothing that really gives the Chinese Yuan a significant competitive edge over the U.S. dollar. If Chinese authorities truly want the Yuan to end up replacing the U.S. dollar as the primary reserve currency of the planet, they need to do something that will make the rest of the world want to use it.

*****

How much gold would China have to control to back Yuan?

CHINA is the world's largest buyer of U.S. Treasuries

Only Japan comes close - here is the table of

MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES (in billions of dollars)

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

China’s Total Foreign Exchange Reserves:

2001-2011 and Estimates for 2012

Year ……………………….Billions of U.S. Dollars

2001……………………………...……215.6

2002……………………………..…… 291.1

2003……………………………..…… 403.3

2004 ……………………………..……609.9

2005 ……………………………..……818.9

2006………………………………. 1,068.5

2007………………………………. 1,528.2

2008………………………………. 1,946.0

2009………………………………..2,399.2

2010………………………………. 2,847.3

2011 ……………………………….3,181.1

2012 ….……………….....3,300.0 (projected)

Compound Annual Growth rate is 26% (The world’s fastest CAGR in Total Foreign Reserves).

Imprudently, 98% of China's Total Foreign Exchange Reserves are in fiat (paper) money - only 2% is today in hard currency gold. To be sure over 30% of the above are in U.S. Treasuries. Needless to say this constitutes a very dangerous FOREX RISK.

*****

CHINA GOES FOR THE GOLD

Gold mining in the People's Republic of China has recently made that country the world's largest gold producer.

South Africa had until recently been the world's largest gold producer for 101 years straight since 1905. The major reasons for this change in position had been due to South African production falling by 50% in the past decade as production costs there have risen, more stringent safety regulations have been implemented, and existing mines have become depleted.

CHINA TODAY IS THE GLOBAL GOLD KING…both as gold producer and gold consumer.

*****

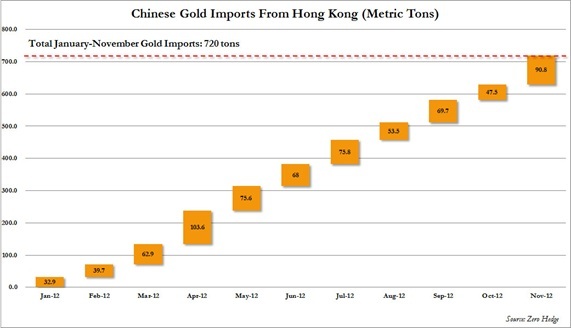

Chinese gold imports from Hong Kong (11-month graph) . Here is the monthly series showing the inexorable surge in Chinese gold imports.

Indicatively, should the full year total import number indeed print in the 800 tons range, it will mean that in one year China, whose official reserve holdings are still a negligible 1054 (and realistically at least double, if not triple, this number), will have imported more gold than the official holdings of Japan, last pegged at 765 tons (and well more than the ECB's 502 tons).

Finally, putting the November import number in context: In 2012 China bought some $39 billion worth of gold. How many US Treasuries did China buy in the same time period? Under $10 billion! CLEARLY, China is accelerating its gold purchases.

*****

Russia, Greece, Turkey, Other Central Banks Buy Gold; China’s PBOC Buying

Gold is being supported by continued diversification from central banks and signs of increased physical demand which is countering continued outflows in ETF holdings.

Russia, Greece, Turkey, Kazakhstan and Azerbaijan expanded their gold reserves for a seventh straight month in April, buying bullion to diversify foreign exchange reserves due to concerns about the dollar and the euro.

Central banks are buying gold as an overall strategy of FOREX portfolio diversification. Moreover, the recent price drop will not deter them from a long term policy of diversification into gold. Indeed the dumping of ETF gold holdings are eagerly being snapped up by global Central Banks.

Gold Price (Nominal) and Central Bank Net Buying/ Selling (1971-2013)

China’s foreign currency reserves have surged more than 700% since 2004 and are now enough to buy every central bank’s official gold supply - twice.

China’s foreign reserves surpassed the value of all official bullion holdings in January 2004 and rose to $3.3 trillion at the end of 2012 and are at $3.4 trillion today.

We are confident that the PBOC is quietly accumulating gold and we expect another announcement from the PBOC, possibly this year, when they again disclose to the market that they drastically increased their gold reserves – possibly from 1,054 tonnes to between 2,000 and 3,000 tonnes.

*****

HOW MUCH GOLD MUST CHINA BUY in order to achieve the following 3 vital monetary goals:

To dramatically decrease China's potentially lethal FOREX risk where 98 percent of its Total Foreign Reserves are in paper currencies - and only 2 percent in gold.

To effectively reduce the U.S. T-Bond holdings of over $1 TRILLION (approximately 30 percent of its Total Foreign Reserves) to a prudent 5%-10%.

To create conditions to pave the way for the Renminbi to become universally accepted as a GLOBAL RESERVE CURRENCY.

The burning question to achieve these three noteworthy invaluable goals is:

HOW MUCH GOLD MUST CHINA BUY?

CHINA'S GOLD HOLDINGS ARE PITTANCE ...compared to major world countries:

Question: BUT HOW MUCH GOLD CAN CHINA BUY?

Here's a down and dirty estimate...based on the following premises:

That the price of gold remains at a constant $1500/oz (hardly likely if China is constantly buying)

China has $3,300,000,000,000 of its Total Foreign Reserves to spend (but their TFR increases 26% per annum....that's +26% yearly!!!

World gold mine production is 2600 metric tons/year

There are approximately 32,500 troy oz per metric ton

Simple arithmetic says China could conceivably buy 68,000 metric tons...equivalent to 26 years annual mine supply. ( NOTE: Today the world’s existing gold above ground is a tad more than 171,000 metric tons). Contemplate China’s monumental task to be able to honestly say its currency is backed by gold. In effect China must accumulate nearly 40% of all the gold in the world. Fat Chance !!!!

There's precious little backing "Chinese Money"

Take peek at different country's gold reserves as a percent of their respective Total Foreign Reserves:

All the major developed countries of the world (USA, Germany, Italy, France) gold holding are an average of 73% of their total Foreign Reserves. This contrasts sharply with China, which has less than 2% of its Total Foreign Reserves in gold.

http://en.wikipedia.org/wiki/Gold_reserve

*****

Central-Bank Gold Buying Seen Reaching 493 Tons in 2012

Central banks will increase gold purchases to 493 metric tons this year as they keep expanding reserves to diversify from the dollar and guard against a potential gain in inflation, Thomson Reuters GFMS said.

“We expect the official sector to remain a significant gold buyer for some time to come,” GFMS said. “Although we expect to see continued purchases, a more aggressive scale of acquisitions than current levels is highly unlikely due to the limited size of the gold market, particularly when compared with some countries’ foreign-exchange holdings.

*****

Central Banks Will Help Forge The Future Price Of Gold

China will indeed have a run for its money (pardon the pun) if it wants to accumulate enough gold for its Renminbi to become the WORLD'S RESERVE CURRENCY...because the Sino nation will be competing with many Countries' Central Banks in the race to beef-up their own GOLD RESERVES as a percent of respective Total Foreign Reserves.

Central Bank Gold Reserves Analysis

https://www.gold-eagle.com/editorials_12/vronsky052513.html

Based upon the above, the logical forecast is that gold will never reach a PEAK PRICE. Nonetheless, there will be brief periods of correction when the price of gold rises too far too fast. However, these will be godsend opportunities to accumulate gold on the cheap. Obviously, Today Is One Of Those Times.

*****

A GOLD BACKED RENMINBI/YUAN

But right now there is nothing that really gives the Chinese Yuan a significant competitive edge over the U.S. dollar. If Chinese authorities truly want the Yuan to end up replacing the U.S. dollar as the primary reserve currency of the planet, they need to do something that will make the rest of the world want to use it.

And they could do that by backing the Yuan with gold. In fact, there are persistent rumors that China has been busily preparing for that.

"A number of factors suggest that the Chinese authorities want to make RMB internationalisation happen by 2015." And I ask: “Can Pigs Fly?!”

*****

China must buy much, much, much more gold

China is clearly trying to position the Yuan/Renminbi as the alternative global reserve currency. The Chinese likely realise that they will need to surpass the U.S. Federal Reserve’s official, but unaudited, gold holding of 8,133.5 metric tons.

To equal the gold backing of the US$, China would need to buy about 7,000 tons of gold. HOWEVER, China has 5-10 times more currency in circulation than the USA. Therefore, China may be obliged to buy 25,000 to 35,000 metric tons if it pretends to compete with the USA.

Here’s yet another concrete reason why China has A LONG WAY TO GO before it can say the Renminbi is backed by gold: U.S. DOLLAR IN CIRCULATION vs China Renminbi In Circulation

There was approximately US$1.19 trillion in circulation as of May 22, 2013, of which $1.15 trillion was in Federal Reserve notes.

http://www.federalreserve.gov/faqs/currency_12773.htm

USA data:

US$1,190,000,000,000 in circulation

There are 32,150 troy oz per metric ton

USA has 8,133 metric ton or 261,475,950 oz of gold

USA has $4,551 in circulation for each oz of gold in reserves.

China data:

RMB5,020,000,000,000 in circulation

China has 1,054 metric tons or only 33,886,100 oz of gold

China has RMB148,143 in circulation for each oz of gold in reserves.

Obviously, the USA has 33 TIMES MORE GOLD BACKING for its total currency in circulation...than China has for its Renminbi.

Consequently, if the Sino nation has any serious intention for its Renminbi become the World's Global Currency, it better get cracking in snapping up gold before the price goes parabolic into orbit.

In this regard the following erudite and comprehensive analysis will underline the enormity of the monumental task China is facing:

China’s Gross Shortage of GOLD RESERVES

https://www.gold-eagle.com/editorials_12/vronsky020813.html

HOW MUCH GOLD CAN CHINA BUY

https://www.gold-eagle.com/editorials_12/drdoolittle052513.html

*****

Here is a chart showing the Yuan price of gold (2008 to present).

http://stockcharts.com/h-sc/ui?s=$GOLD:CNY&p=W&yr=5&mn=1&dy=0&id=p48200576930

HOWEVER, if China indeed is able to back its currency with gold, the Sino nation might well rename its currency from Renminbi to CHINA GOLD DRAGONS…which may look like this: