Control Is An Illusion – But I May Go Long Bonds Again

The pundits and the media were debating for several weeks leading up to the last Fed meeting about what the Fed was going to do and the effect they thought it would have on the market. And, it amazes that the great majority of the market does not realize how much of a waste of time these debates really are.

But, as I often note, many market participants and analysts are simply not burdened by the facts. If they really would review the facts of market history, they would learn that there is no one that can control the market. PERIOD.

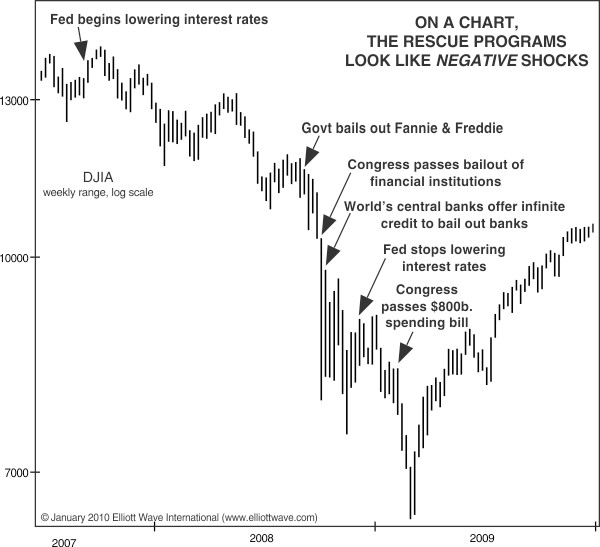

For those that believe otherwise, and are so certain that the government or the Fed can control our markets with their actions, please review this chart. Hopefully you will see just how powerless any entity is if they attempt to prevent market declines.

In fact, I have written about this many times and have outlined many periods of time during which it was abundantly clear that no entity can prevent market declines.

Within past write ups, I even highlighted how we have seen more double digit market declines since the advent of the Plunge Protection Team than before:

In fact, the following instances are just some of the highlights of volatility since the supposed inception of the Plunge Protection Team:

- February of 2001: Equity markets declined of 22% within seven weeks;

- September of 2001: Equity markets declined 17% within three weeks;

- July of 2002: Equity markets declined 22% within three weeks;

- September of 2008: Equity markets declined 12% within one week;

- October of 2008: Equity markets declined 30% within two weeks;

- November of 2008: Equity markets declined 25% within three weeks;

- February of 2009: Equity markets declined 23% within three weeks.

- May of 2010: Equity markets experienced a "Flash Crash." Specifically, the market started out the day down over 30 points in the S&P500 and proceeded to lose another 70 points within minutes. That is a loss of 9% in one day, but the market did manage to close down only 3.1% in one day!

- July of 2011: Equity markets declined 18% within two weeks

- August 2015: Equity markets decline 11% within one week

- January 2016: Equity markets decline 13% within three weeks

- January 2018: Equity market decline 16% within three weeks

- October 2018: Equity market decline 12% within three weeks

- December 2018: Equity market declines 13% within 3 weeks

Based upon these facts, you can even argue that significant stock market "plunges" have become more common events since the advent of the Plunge Protection Team, especially since we have experienced more significant "plunges" within the 20 years after the supposed creation of the "Team" than in the 20 year period before.

In fact, in a prior article, I even outlined how central banks have clearly been unable to control their own currencies, as I have noted the US and China currencies as historical examples.

*********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of