Crude Collapse Concerns COMEX Gold Futures

After watching front month NYMEX crude oil futures collapse into negative pricing on Monday, you should be sure to consider the possibility of an exact opposite scenario playing out one day soon in COMEX gold futures.

What happened Monday in NYMEX crude oil? It can be summarized this way:

- The May20 crude oil contract was scheduled to go off the board and into delivery on Tuesday, April 21.

- Anyone long the contract after Tuesday the 21st would be assumed to stand for delivery through the NYMEX facility in Cushing, Oklahoma.

- But storage facilities in Cushing are reported to be "full". As such, there is no need or demand for holding these May20 contracts into delivery. Where would you put it?

- Those parties that remained long the May20 contract thus needed to sell. However, to sell you also need a buyer—someone interested in adding a long or covering an existing short.

- And in this case, there were NO BUYERS. Thus, what you saw was a true bidless market.

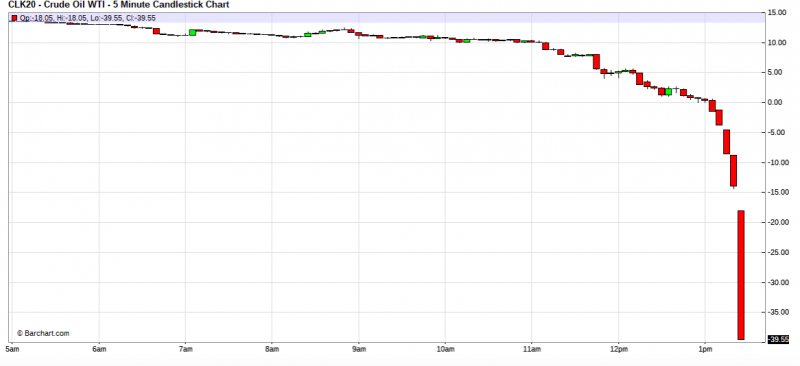

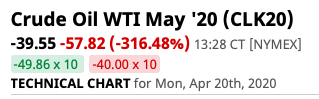

- The result? See below:

Without any parties looking to buy creating an actual bid-ask spread, the bidless market is an environment where only sellers exist on the offer. Price then resets lower and lower until buyers finally emerge. In NYMEX crude, that "price" was actually NEGATIVE. Amazing.

And it was all caused by a glut of the physical commodity. With no demand for the underlying physical, the price discovered through derivative trading collapsed.

Consider now the potential for a diametrically opposite situation in COMEX gold. Why and how could this unfold?

- COMEX gold also has "delivery month" contracts that serve as the "front month" for trading purposes until they go off the board and into delivery—at which time the trading volume rolls into the next scheduled month.

- In delivery, anyone still long the contract can stand for delivery through the COMEX vaults in New York. (And now might also stand for fractional ownership of bullion bars in London, too.)

- But global demand for physical gold outstrips supply at present, as many refineries, mines, and mints are closed worldwide due to Covid-19.

- Thus we are seeing a growing need/demand to hold COMEX contracts into delivery. For the current month of Apr20, total gold deliveries on COMEX exceed 3,000,000 ounces. This is more than 3X the usual demand for a "delivery month".

- If an extreme shortage develops—or if any sort of "run" on the bullion bank fractional reserve system begins—demand for delivery through the COMEX and LBMA will soar.

- Demand for the front/delivery month contract will surge. However, to buy a contract, you will also need a seller—someone interested in adding a short or selling an existing long.

- And in this case, there may be NO SELLERS. Thus, what you may see is a true offerless market.

- The potential result? The exact opposite of what you witnessed Monday in NYMEX crude oil.

Could this opposite scenario actually play out in COMEX gold? You may be reluctant to say yes, as this type of situation would seem unlikely and unprecedented. However, prior to Monday, April 20, the idea of negative pricing for the world's most important commodity was similarly unlikely and unprecedented.

We now know that quite literally ANYTHING is possible in 2020. From global pandemics to economic collapse to QE∞ to -$40 crude. As such, a complete implosion and restructuring of the global pricing scheme for precious metal is not out of the question in the weeks and months ahead.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use. You may copy, link to or quote from the above for your use only, provided that proper attribution to the source and author is given and you do not modify the content. Click Here to read our Article Syndication Policy.

*********