Is Demand For Gold Dropping?

Strengths

The best performing precious metal for the week was gold, but still off 6.04%. U.S consumer prices rose in May by more than consensus expectations. CPI jumped 5% from the prior year, with many price jumps reflecting shorter term price gains from pandemic-induced supply shortages. The Federal Reserve believes most of these price changes will prove to be transitory. Economists Sarah House and Shannon Seery, at Well Fargo & Co., believe that inflationary pressure will broaden out rather than sinking back to pre-pandemic levels.

Alamos Gold reported one of its best drilling results at the Island Gold mine, which will allow it to expand to both the east and west. Reserves at this location have increased by 1 million ounces over the past year. According to Raymond James, Torex Gold announced an updated mineral resource estimate for its Media Luna project, which now consists of a gold-equivalent indicated resource of 3.54 million ounces at an average grade of 5.27 grams per ton, reflecting a 58% increase in contained AuEq metal compared to the previously reported estimate. Of the indicated resource, 61% of the contained value is attributable to gold.

Debswana Diamond Co., a unit of De Beers Plc, unearthed a 1,098-carat stone in Botswana on June 1, the largest since the company began operations five decades ago. Preliminary analysis suggests the stone is the world’s third-largest gem-quality diamond ever, after the Cullinan Diamond that was discovered in South Africa in 1905 and the Lesedi la Rona that was found in Botswana in 2015, according to Debswana acting Managing Director Lynette Armstrong.

Weaknesses

The worst performing precious metal for the week was palladium, down 10.86%. According to Bloomberg, Burkina Faso's government has ordered that artisanal mining activities in the two gold-rich localities of Oudalan and Yagha areas should cease after jihadists killed more than 130 people.

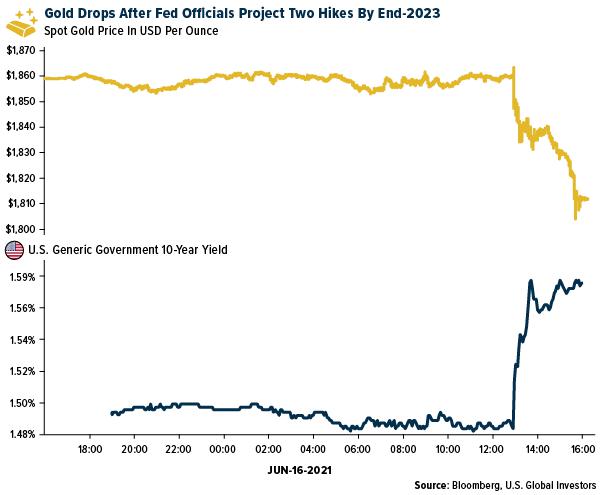

Gold extended its decline as a U.S. bond rally lost steam ahead of this week’s Federal Reserve meeting. Bullion retreated on Monday as Treasury yields ticked higher, making the non-interest-bearing metal seem less attractive to some investors. At the Fed meeting, the timeline for interest rate increases was pulled forward, implying that stimulus that buoyed the metal will be decreased. They also indicated that there may be two increases by the end of 2023.

Gold demand seems to be dropping. Swiss gold exports fell 37% in May. Sales to India fell 96% to 2 tons. Shipments to China fell 19% to 32.8 tons and exports to Hong Kong dropped to 3.8 tons. Swiss gold imports declined 11% month-to-month as well, to 164 tons.

Opportunities

Fiore Gold announced it is acquiring the Illipah property from Waterton for $200,000 in cash plus 1.3 million shares. This past producing property is just 20 miles from the company's Gold Rock project and has very similar geology. Fiore’s geology team will be able to apply their knowledge of this geology and quickly generate first pass drill targets at the newly acquired property. The company will be reviewing the existing geologic data, doing surface mapping and sampling while permitting is underway before launching a drill program early next year.

Yamana Gold announced Friday that it is acquiring Globex Mining's Francoeur, Arntfield and Lac Fortune Gold properties for a total consideration of C$15 million. The properties, two of which are past producing, are adjacent to the west of the Wasamac project, thus adding potential exploration upside. Yamana believes that mineralization at these properties is like that of Wasamac, based on historical production records, drilling and recent exploration efforts.

E79 Resources share price gained slightly more that 300% over the past week on released drill results for its Happy Valley Gold Prospect in Vitoria, Australia. Drill hole HVD002 intersected 0.70 meters at 99.00 g/t Au at 94.90 meters downhole. Drill hole HVD003 intersected 0.6 meter at 147 g/t Au from 165.2m downhole and 11.10 meters of 160.45 g/t Au from 190.4m downhole. E79 Resources was testing the down-dip extensions of previously mined high-grade structures in the 1870s.

Threats

COVID-19 continues to plague remote international mining. Mining companies are throwing their weight behind vaccination efforts as the pandemic continues to ravage much of the developing world. Miners are offering vaccines and bolstering healthcare services to employees and surrounding communities. The effort is focused on poorer nations, where healthcare systems are weak, vaccines are scarce and inoculation campaigns lag far behind those in the West. Anglo American PLC has said it is spending as much as $30 million to support the global rollout of COVID-19 vaccines across its footprint. Other miners, from Glencore to Rio Tinto, have been offering support to local governments during the pandemic, from conducting screening and mobile testing to donating extra beds for hospitals and clinics.

Kinross Gold announced that mill operations at Tasiast in Mauritania have been temporarily suspended due to a fire that broke out on June 15. No injuries were reported on site. The company is currently assessing the damage and potential impact to the mine. Tasiast represents about 13% of Kinross’ 2021 production.

Crypto assets such as Bitcoin continue to present a challenge to gold. Paul Tudor Jones, the head of Tudor Investments, believes that 5% of a portfolio should be in crypto assets. It serves as a diversifier, much like gold or commodities. However, the Bank of International Settlements recently issued guidance that banks should apply $1,250% risk weight for bitcoin. This factor along with minimal capital requirements of 8% results in the bank having to hold at least the same amount in offsetting assets to counter the volatility of Bitcoin. This will make it less capital efficient for the banks to hold crypto assets and reject their adoption.

**********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of