The Dollar Is Rising

“The problem with central banks is that they increase the quantity of money in the same way that the problem with piping sewage into a swimming pool increases the quantity of water.”

It’s not really about the quantity, is it? It’s about the quality.

We believe that millions of people can see that the quality of the dollar and its derivatives—such as the euro, pound, etc.—have falling quality. Most of them are not (today) betting that therefore an ounce of gold will buy more of them. They are in stocks or real estate, which “should keep up with inflation” they think. We wonder if their child was in the pool, if they would think that an inflatable duck would keep up with the effluent…

However, sufficient numbers of people are speculating in gold and silver. This is what adds energy to these markets, and it’s energy that causes the price to move in both directions. There is little agreement (in the broader sense) about whether gold is going up or going down in the intermediate term.

There was some agreement that the Trump election would cause the former. That was when the dollar was a lot weaker than it is today. Before the election, the greenback was worth about 24mg of gold or 1.7g of silver. As of Friday, it rose to 25.7mg gold and 1.9g silver.

We suggest that you think of the dollar’s value in gold, rather than gold’s value in dollars. You know that the dollar has unstable value, which is generally falling for many reasons including that the Fed has a deliberate policy of debasement. We believe the dollar is not suitable for measuring value especially over longer periods of time, and manifestly not suited to putting a value on gold. Price is not the same concept as value.

Now it appears president-elect Trump is talking about a trillion-dollar stimulus program. Will this finally cause a breakdown in the dollar? Will it cause a breakdown in the Treasury bond market?

These, by the way, are separate questions. The dollar could be sold, if savers prefer pounds or euros or yen or yuan or some other dirty shirt that happens to be derived from the dollar. We see the usual suspects claiming that the dollar will collapse soon, or even that its collapse is imminent. From their writings, you would not know that the dollar is in an uptrend. A strong uptrend. An uptrend that goes back to 2011 or arguably 2008.

You would not know, from reading this stuff, that the dollar is higher in terms of the other paper currencies than it has been since 2003. It’s at a 13-year high. So far.

The dollar could be sold, in preference to gold too. However, that is not really happening in a big way right now, obviously.

The question of the interest rate is separate. The dollar is a closed loop system. So whether the dollar sells off against the euro, or whether it is bought against the yuan (as now) the interest rate is unaffected. The interest rate is set inside the dollar system. It is the inverse (conceptually) of the price of the bond.

Nearly everyone today believes that the bond has to head down because Janet Yellen. Or because Donald Trump. Or because quantity of effluent money. Nope. That is not how it works. For those interested, Keith has written a theory of interest and prices.

By the way, the same market that has given us a weak Treasury bond price is also giving us a strong junk bond market and endlessly rising equities. At least one of the three (A) falling Treasuries, (B) rising junk bonds, and (C) rising stocks is wrong. And possibly all three.

The dollar is literally backed by the Treasury bond. If you don’t like the low interest rate on the bond, then why would you prefer the dollar? Dollar cash has no yield. If you don’t like the risk of default of the Treasury, then you are no better off holding the dollar. There are few guarantees in finance, but I guarantee you that if the Treasury defaults on the bond, the Fed will default on the dollar.

And likewise, if you don’t like the Treasury, because inflation, you are definitely going to hate junk bonds. In a rising interest rate environment where there are gazillions of dollars of debt that have to be constantly rolled (not to mention the use of short-term financing of long-term assets), the marginal debtor will be squeezed to default. The US government is most certainly not the marginal debtor. That would be a junk bond issuer. Or many.

And in a rising rates environment, you will take no comfort in stocks. Forget the linear thinking of “keeping up with inflation”. Think of the yield of a stock. Why should stock yields go down and down, while Treasury yields go up and up? Why should stocks—with all the risks of owning the equity tranche of the capital structure—have a lower yield than the Treasury bond?

The Treasury bond is not riskless, contra the propaganda taught in finance since the end of the gold standard. However, stocks are certainly risk-full.

So where to from here?

We will update the pictures of the gold and silver fundamentals below. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

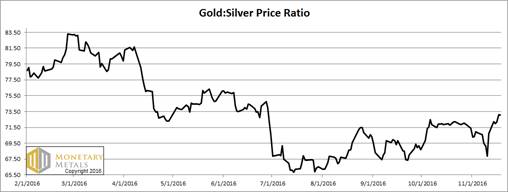

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose some more this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of gold, measured in dollars, dropped twenty bucks this week (shown as a rise in the price of the dollar, measured in gold, the green line on the chart). The scarcity as depicted by the cobasis fell. And remember, at this point there is unbalanced selling of the December contract as all longs have to sell unless they have $121,000 per contract to stand for delivery.

With a falling price of gold, and at the same time a falling scarcity, it’s no wonder that the Monetary Metals fundamental price of gold dropped. It’s still more than fifty bucks over the market price, but about fifty bucks below where it was last Friday. It seems the buying of physical gold metal has subsided somewhat.

Our old friend Backwardation is almost gone. The cobasis fell from 30 bps to 6bps.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, we had a price drop of about 80 cents. And what did the cobasis do? It went sideways. Silver did not become more scarce at the lower price. And this is according to the December contract with its unbalanced selling. Which affects silver more than gold.

Farther-out contracts have a falling cobasis. That is silver became less scarce, and more abundant. Even while its price dropped almost 5 percent.

The fundamentals of silver, which were weak last week just took a big dive. The Monetary Metals fundamental price of silver was already a buck thirty under the market price. Now, it is more than two bucks under the new, lower market price.

Market participants are warring. A battle is raging between those who think the swimming pool is half full and those who think it’s half empty.

© 2016 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the