Dow Jones Industrial Average: Signs That A Market Crash Is Coming

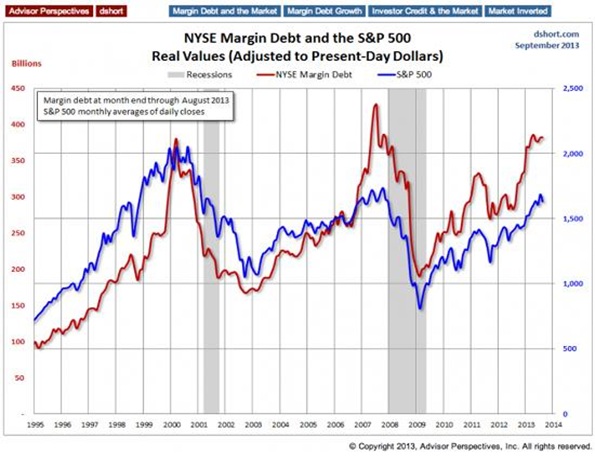

The last two times they spiked this way, the following year was pretty brutal. See the next chart, which tracks the S&P500 (NYSEARCA:SPY) and margin debt, the amount of money investors are borrowing against their shares of stock to buy more stock.

The chart seems to show that when investors are optimistic enough to use leverage to invest in already-risky stocks, then the good times have pretty much run their course and something nasty is imminent. If recent history is our guide, it is now time to either take some money off the table or short the hell out of the big indexes – or whatever else you like to do when the market looks overbought.

But this conclusion is only valid if we’re in the same stage of the credit bubble as during those two previous sentiment peaks. In 2000 and 2007, to take just one measure of financial stability, the federal government’s debt was $6 trillion and $8 trillion, respectively, versus $17 trillion today. Plenty of other leverage metrics are also way up, indicating that the US is much further down the path of currency debasement than it was just a few years ago.

So the question becomes: at what point does a quantitative difference become qualitative? When does the phase change occur?

The next chart shows why this question is more than academic. In the early stages of Zimbabwe’s epic hyperinflation, its stock market rose from 2,000 to over 40,000 in one year. Presumably a lot of indicators similar to margin debt were by then pointing to a blow-off top and screaming “sell” to students of history.

Then the market proceeded to run up to 4,000,000. What happened? The country ran its printing press flat-out and inflated away its currency, so the price of pretty much every tangible asset, when measured in Zimbabwean dollars, went parabolic. Since equities represent part ownership of companies, and most non-financial companies own tangible assets, their value went up as well. Not enough to increase in real terms (versus gold, for instance) but enough to make shorting that market a really bad idea.

So are we 2007 America or 2006 Zimbabwe? A lot is riding on the answer.

********

This article is brought to you courtesy of John Rubino from Dollar Collapse.