An Environmentally Green Golden Opportunity

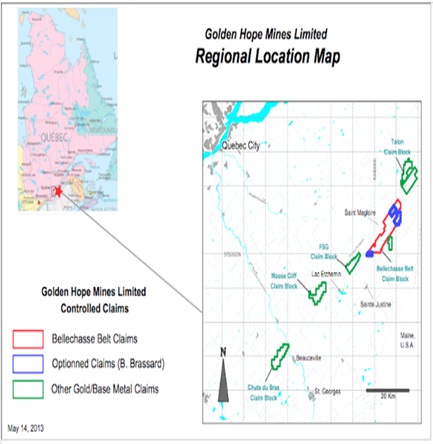

The inherent risk associated with the junior mining sector steers many prospective investors away from opportunities. Commonly cited reasons for resistance include the speculative nature of the properties being prospected and foggy relationships with governmental bodies. Golden Hope Mines Limited (TSX: GNH, Pink Sheets: GOLHF) largely dispels both of those concerns in one fell swoop through its flagship property – The Bellchasse-Timmins gold deposit. The Bellechasse property lies at the end of the Appalachian range of mountains, located in Bellechasse, Panet and Ware Townships approximately 110 km southeast of Quebec City (Quebec, Canada) and about 70 km northeast of the town of Saint-Georges. The 100% owned property covers a large part of the most prospective areas for gold mineralization in the Beauce Region. The Beauce Region of southern Quebec has a rich history of gold mining. Gold is widely found throughout the region both as placer and hard rock deposits. The region was the scene of Canada's first gold rush in the 1850's, decades before the famous Klondike gold rush. Two of the largest gold nuggets found in Canada came from the Beauce Region, the Kilgour nugget at 52 ounces and the McDonald nugget at 45 ounces. The pedigree of the property is immediately apparent, with drill tests revealing significant gold deposits as seen and discussed below. With the property located in a region of Canada that has traditional roots in mining and favourable mining policies and infrastructure, Golden Hope Mines is teeming with tangible potential. Investors would be wise to take a closer at Golden Hope Mines, as their stock price is increasing exponentially, having grown from a meager $0.13 in early May to its current stature at $0.55.

The inherent risk associated with the junior mining sector steers many prospective investors away from opportunities. Commonly cited reasons for resistance include the speculative nature of the properties being prospected and foggy relationships with governmental bodies. Golden Hope Mines Limited (TSX: GNH, Pink Sheets: GOLHF) largely dispels both of those concerns in one fell swoop through its flagship property – The Bellchasse-Timmins gold deposit. The Bellechasse property lies at the end of the Appalachian range of mountains, located in Bellechasse, Panet and Ware Townships approximately 110 km southeast of Quebec City (Quebec, Canada) and about 70 km northeast of the town of Saint-Georges. The 100% owned property covers a large part of the most prospective areas for gold mineralization in the Beauce Region. The Beauce Region of southern Quebec has a rich history of gold mining. Gold is widely found throughout the region both as placer and hard rock deposits. The region was the scene of Canada's first gold rush in the 1850's, decades before the famous Klondike gold rush. Two of the largest gold nuggets found in Canada came from the Beauce Region, the Kilgour nugget at 52 ounces and the McDonald nugget at 45 ounces. The pedigree of the property is immediately apparent, with drill tests revealing significant gold deposits as seen and discussed below. With the property located in a region of Canada that has traditional roots in mining and favourable mining policies and infrastructure, Golden Hope Mines is teeming with tangible potential. Investors would be wise to take a closer at Golden Hope Mines, as their stock price is increasing exponentially, having grown from a meager $0.13 in early May to its current stature at $0.55.

Golden Hope Mines Limited, or “the Company” is a Canadian organization focused on growing shareholder value through the acquisition, exploration, and development of potential gold and base metal projects with both underground and open-pit mining. The Company’s primary goal is the development of the Bellchassee-Timmins gold deposit, describing its location as an under-developed and under-explored region of one of the world’s friendliest mining jurisdictions with excellent access and low cost infrastructure. The Company’s experienced management team remains one of its most valuable assets, spearheaded by Chairman and Director, Larry Edward Hoover. Mr. Hoover’s principal occupation is President and CEO of Larry Hoover Consulting Services Inc., where he focuses on delivering consulting services and providing research reports, scientific/technical support, and fundraising assistance for the junior exploration sector. Surrounding himself with a management team possessing similarly impressive experience in all facets of the junior mining sector, Mr. Hoover is poised to lead the Company toward profits via successful gold extraction.

In terms of financial assets, Golden Hope Mines maintains a strong balance sheet. The Company holds $20,340,369 in assets with a mere $1,083,146 in long-term liabilities. This demonstrates not only the health of the organization, but also the prudence of the management team to avoid incurring significant debt during the relatively sluggish market that currently plagues the junior mining sector. Though the Company has not generated any revenue for the 2015 period, as a mining exploration company, the lack of steady income is common and should not cause alarm. Following a successful fundraising campaign, the Golden Hope Mines will be prepared to extract gold and profit from the Bellchasse-Timmins deposit.

Bellchasse-Timmins Gold Deposit – Property Information

Investors, extractors and academics alike are enthusiastic about the potential of the Bellchasee-Timmins Gold Deposit, and their excitement is fully justified. The Quebec property,which is currently the subject of a MSc thesis at Université du Québec à Montréal, covers an area of continental collision in which transform faulting is common. Locally, this collision terrain is part of the Appalachian Mountain fold belt. Widespread gold mineralization has historically been found between Bellechasse and west of the Chaudiére River. Mineralization with potential economic interest is hosted in zones of fracturing and brecciation in the older instrusives or other pre-existing competent rocks in structural features related to regional trans-current/transform faults. The Bellechasse project consists of multiple known gold-bearing areas as seen below:

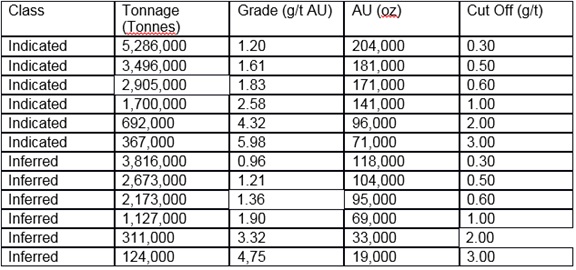

As noted in the introduction, the prestige of the Bellchasse-Timmins gold deposit is evident and clearly visible in the above results. The Bellechasse-Timmins gold deposit falls within a region where support from different levels of government can be expected due the economic downturn in forestry, a mainstay of the region, potentially allowing GNH a substantial portion of the necessary funds to begin production from of grants and debt, thereby keeping dilution minimal, as the property is ready for extraction and has potential for serious reward.

Is it Time to Buy?

The tangible potential of Golden Hope Mines’ Bellchasse-Timmins gold deposit suggests that the Company is on track to see significant profits from the property in the near future. Having a successful NI 43-101 resource estimate available, there is less visible risk investing with the Company, as major levels of gold have been identified on the property. Since much of the gold is at or near surface, we believe the capex required to begin production should be very modest. With the Company’s shares rising drastically since May, it is recommended that interested investors move quickly to reap the rewards that will be extracted from the location. The pedigree of the property is clear, and now that the Company is prepared to execute a strategic extraction plan, expect share prices and profits to grow. With a market cap under $10million, and several hundred thousand near surface ounces defined, the share price is currently at a compelling value. As gold projects advance and move nearer to revenue generating status, company market caps and valuations have a tendency to increase providing early investors with substantial gains.

Disclaimer

Junior Gold Report’ Newsletter: Junior Gold Report’s Newsletter is published as a copyright publication of Junior Gold Report (JGR). No Guarantee as to Content: Although JGR attempts to research thoroughly and present information based on sources we believe to be reliable, there are no guarantees as to the accuracy or completeness of the information contained herein. Any statements expressed are subject to change without notice. JGR, its associates, authors, and affiliates are not responsible for errors or omissions. Consideration for Services: JGR, it’s editor, affiliates, associates, partners, family members, or contractors may have an interest or position in featured, written-up companies, as well as sponsored companies which compensate JGR. JGR has been paid by the company written up. Thus, multiple conflicts of interests exist. Therefore, information provided herewithin should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. No Offer to Sell Securities: JGR is not a registered investment advisor. JGR is intended for informational, educational and research purposes only. It is not to be considered as investment advice. Subscribers are encouraged to conduct their own research and due diligence, and consult with their own independent financial and tax advisors with respect to any investment opportunity. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the companies mentioned herein. Links: JGR may contain links to related websites for stock quotes, charts, etc. JGR is not responsible for the content of or the privacy practices of these sites. Release of Liability: By reading JGR, you agree to hold Junior Gold Report its associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Forward Looking Statements Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including "will", "believes", "may", "expects", "should", "seeks", "anticipates", "has potential to", or "intends' or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company's business model; future operations, products and services; the impact of regulatory initiatives on the Company's operations; the size of and opportunities related to the market for the Company's products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.

********

The opinions and information provided are those of the author and not Gold-Eagle 5000 LLC. Gold-Eagle 5000, LLC does not endorse nor recommend the opinions expressed in the article which are those of the author.