Fastest Rate Of Central Bank Gold Buying Since 1971

Strengths

-

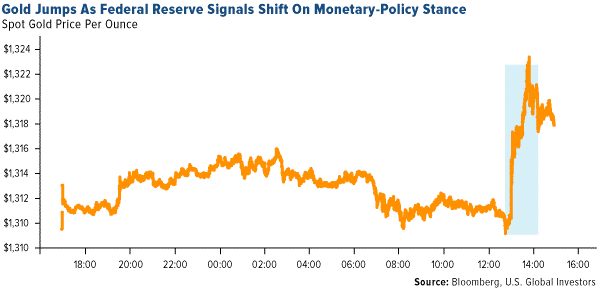

The best performing metal this week was gold, up 1.11 percent. Gold traders were bullish on the outlook for a 12th straight week and the most bullish in five weeks, according to the weekly Bloomberg survey. The yellow metal is up more than 2 percent for the year and is set for a fourth monthly gain. This comes as the dollar is down for a third month. Gold saw a boost in particular on Wednesday when the Federal Reserve signaled that it’s moving away from its bias toward higher U.S. borrowing costs, which boosts the appeal of gold.

-

Demand for gold in China, the world’s number one consumer, rose 5.7 percent in 2018 to 1,151 tonnes, says the China Gold Association. Jewelry consumption was also up 5.7 percent, while bar demand was up 3.2 percent. China, also the world’s top gold miner, saw output fall 5.9 percent to 401 tonnes last year. According to the World Gold Council (WGC), demand will remain steady in 2019, even as there are signs of slowing economic growth and political uncertainties.

-

U.S. Mint data showed this week that gold coin sales rose to 65,000 ounces in January, the most in two years. This comes after several months of “horribly lacking” sales, says Peter Thomas at metals broker Zaner Group. Net purchases of gold holdings in ETFs are now at 2.01 million ounces for the year, according to data compiled by Bloomberg. For the first time in what seems like forever, ETFs also added silver to their holdings. On Thursday alone there were 1.18 million troy ounces added – the largest one-day increase since November 13.

Weaknesses

· The worst performing metal this week was palladium, down 0.66 percent as hedge funds cut their net long position to the lowest in six weeks. U.S. pending home sales fell in December for the third straight month. This is another sign that the housing market is weakening amid elevated property prices and higher borrowing costs, writes Bloomberg. GFMS wrote in a report this week that it sees gold at $1,292 an ounce in 2019, compared to current prices sitting around $1,309. They write that demand for defensive assets such as gold is likely to pick up on deepening economic concerns, but that physical markets are likely to be subdued because of high price levels.

· Venezuela is preparing to send 15 metric tonnes of its central bank reserves to the UAE, as the country’s economy struggles and President Nicolas Maduro faces opposition from within and abroad to step down as leader. U.S. National Security Advisor John Bolton wrote in a tweet on Wednesday: “My advice to bankers, brokers, traders, facilitators, and other businesses: don’t deal in gold, oil, or other Venezuelan commodities being stolen from the Venezuelan people by the Maduro mafia.”

· After several weeks of increasing gold reserves week-on-week, data from the Turkish central bank showed that reserves fell $555 million from the prior week. As of January 25, Turkey’s holdings were worth $19.9 billion, down 22 percent year-over-year.

Opportunities

· The Federal Open Market Committee (FOMC) released several decisions this week that could be positive for gold. As summarized by David Doyle at Macquarie Group, those changes are: being patient in market future adjustments and removing forward guidance on further rate hikes. The balance sheet normalization path is also flexible, and the Fed is willing to use the balance sheet if economic conditions warrant it. Brown Brother Harriman wrote that the Fed sent a clear signal to buy equities and sell the dollar, which is positive for gold.

· Central banks globally are buying gold at the fastest rate since 1971 when the gold standard was ended in the United States. Governments purchased 651.5 tonnes of gold in 2018, which is a 74 percent increase from the previous year. Metals Focus forecasts that these central banks might purchase another 600 tonnes in 2019. Russia and Turkey were among the largest buyers last year. Russia bought 274.3 tonnes of the yellow metal in an effort to de-dollarize its reserves. Gold consumption in India could be on the mend in 2019, as it is an election year, which could boost spending in the world’s second largest gold consuming country, according to the WGC.

· Silver could see a boost from increased solar power demand in sub-Saharan Africa. Bloomberg’s Takehiro Kawahara writes that “favorable economics and demand from commercial and industrial clients, largely mining companies and manufacturers, means more solar sales are being made directly to businesses.” Two gold miners rethought their strategies and shuttered projects that could have been non-economical. Iamgold shelved its Cote project construction while Eldorado suspended the advancement of a mill project in Turkey. These decisions to shutter potentially marginal expansion projects were immediately rewarded with significant share price gains for the two companies making good capital allocation decisions.

Threats

· The U.S. Treasury Department announced on Wednesday that it plans to issue another record-breaking amount of debt, creating growing criticism and questioning of whether President Donald Trump’s tax cuts will pay for themselves. The Treasury is raising its long-term debt issuance at its quarterly refunding auctions to $84 billion, which is $1 billion more than three months ago, writes Bloomberg. Debt sales have already risen past those last seen after the worst economic crisis since the Great Depression.

· In more Venezuela gold news, a Russian plane arrived in Caracas on Wednesday to take away 20 tonnes of gold, but then the plane left the country without the gold. The Maduro regime then halted its plans to ship the gold out of the country after the U.S. issued a warning for other countries not to deal with Venezuela’s gold.

· Juan Guaido, recognized by many nations as Venezuela’s true leader, wrote in a letter to the U.K. asking the Bank of England to not allow Maduro access to $1.2 billion in Venezuelan gold reserves held in the country. There is a risk, however, that if Guaido gains power, he could turn around and sell the gold, too.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of