Fed Sticks With Gradual Hikes…As Gold Prices Climb

Strengths

· The best performing metal this week was silver, up 0.14 percent. Gold traders were back to bullish this week after gold bounced off its 200-day moving average after dropping to its lowest since December on Tuesday, according to the Bloomberg weekly survey of traders. The yellow metal fluctuated on Friday morning after the jobs report came out with mixed signals on low unemployment but fewer-than-expected jobs added. The United Arab Emirates rolled back a 5 percent valued-added tax on gold, diamonds and precious metals this week, intending to maintain the country’s ranking on ease of doing business as well as stimulate transactions, reports Gulf Business.

· The Federal Reserve signaled this week that it is willing to allow inflation to exceed the 2 percent goal by adding a reference to the “symmetric” nature of the inflation target. Analysts consider that this is significant in that it underscores the fact that deviations from the target to the upside will be treated equally as deviations to the downside and that the FOMC has tolerated inflation below target for a long time.

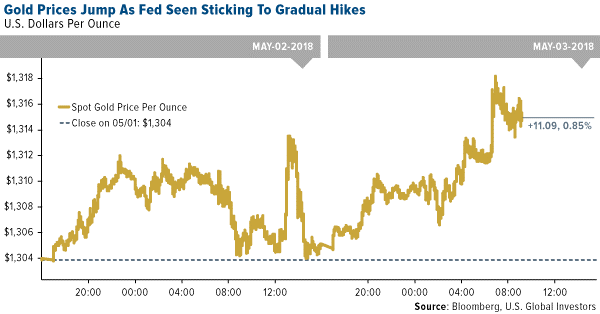

· As seen in the chart below, gold climbed significantly after the Federal Reserve announced it would stick to a steady path of interest rate increases this year. Gold also rebounded this week as investors weighed the uncertainty of whether or not the U.S. will withdraw from the Iranian nuclear accord. WTI crude oil prices are up nearly 13 percent year-to-date, and a higher oil price is generally a signal of rising inflation, which is historically positive for the gold price. Gold demand in Iran soared to a three-year high of 9.3 tons in the first quarter, reports Bloomberg.

Weaknesses

· The worst performing metal this week was gold, down 0.60 percent. Gold fell earlier this week due to a strong dollar and got close to erasing the gains experienced this year so far. Stephen Innes, head of trading for Asia Pacific at Oanda Corp., wrote in a report this week that “rising interest rates and a firming dollar remain bearish risks for gold and silver.” The world’s largest ETF backed by gold saw its biggest daily outflow in three months with close to $186 million taken out on Tuesday before the start of the Fed meeting.

· BullionVault’s Gold Investor Index fell to its lowest level since August early this week to 52.5, down from 53.7 in March. Bloomberg reports that a reading above 50 indicates more buyers than sellers among clients. Perth Mint released April sales figures showing that gold coin and minted bar sales were down compared to the prior month, from 29,883 ounces in March to 15,161 ounces in April. Sales of U.S. Mint American Eagle gold coins have also fallen and dropped to their weakest levels since 2007, while silver coin purchases for April rose 10 percent higher than last year.

· The World Gold Council released its first quarter report on Thursday showing that global gold demand was down 6 percent quarter-over-quarter and down 7 percent year-over-year to 973 metric tons. China, the world’s largest gold consumer, saw demand increase 7 percent, while India, the second largest consumer, saw demand fall 12 percent. The drop in gold demand in India can be attributed to a steady rise in prices in the last three months and tighter credit to jewelers after a bank fraud, reports Bloomberg First World.

Opportunities

· Although the U.S. dollar has been on a hot streak as of late, which is usually negative for gold, some think that the uptrend won’t continue for long. Automated trend-followers have moved to neutral from a big short position on the dollar in recent weeks and now they’ve blown through all their stop-losses. Bloomberg writes that dollar bears are no longer fighting a headwind posted by automated buying from a group with combined assets of around $277 billion.

· Mike McGlone, commodity strategist at Bloomberg Intelligence, writes that gold should be on the rise due to continued mean reversion and gold awakening from its narrowest 52-week trading range in 13 years. Egyptian billionaire and Orascom Telecom Chairmain Naguib Sawiris said that he expects gold price to rise to $1,800 per ounce. Sawiris recently transferred half of his $5.7 billion net worth into bullion.

· Detour Gold reported a tough quarter Friday and advised the market of another mine plan revision that resulted in the stock falling about 35 percent over the next two trading sessions. Dan Rollins of RBC published a note calling for someone to take over the company. Detour has typically traded with a premium due to the large production base and long life, but lack of flexibility with regard to grade, risk they can turn a consistent profit, has not been fully appreciated. Generally, buyers of assets the size of Detour have been puck shy to get back into the acquisition game. However, Detour could be in the crosshairs of a Canadian based company(s) that does not already have operations in Canada, where they might also be able to harvest some tax losses to offset the takeover premium, much like Eldorado Gold’s purchase of Integra Gold last year.

Threats

· Deutsche Bank research, using its database of 45 countries, found that the deteriorating fiscal and external situation for the U.S. has increased the probably of a U.S. debt crisis by 7 percentage points, to a level around 16 percent. Demand for U.S. debt abroad has been trending lower in recent years and the bid-to-cover ratio has been declining, including for T-bills and 2-year and 10-year Treasury auctions. The U.S. set a first-quarter record by borrowing $488 billion, $47 billion more than estimated. However, Treasury Secretary Steven Mnuchin said in an interview on Monday that “I think the market can easily handle it.”

· Although there has been an increase in gold exploration budgets, there has not been a subsequent increase in gold discoveries. Mining Weekly writes that $54.3 billion has been allocated to gold exploration over the past decade, which is 60 percent higher than the preceding 18-year period. However, only 215.5 million ounces of gold has been discovered in the most recent 10 years, compared with 1.73 billion ounces in the preceding 18 years.

· RBC Capital Markets writes that since 2017 the average daily trading value of gold has declined to an average of around $1.6 billion, which it believes is indicative of a reduced level in interest in precious metal equities. Previously the combined daily trading value of the gold miners and junior gold miners ETFs rose from around $790 million in 2007 to a peak of $2.4 billion in 2016.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of