Financial Asset Valuations Continue to Deflate

If I were to speak of the sum total of the market’s action so for 2022, what would I say? Maybe something from Bob Dylan; something like “A Hard Rain’s a Gonna Fall.” Forget about financial assets being historically overvalued. They have been for decades, since Alan Greenspan managed “monetary policy” in the late 1980s. The stock market’s real problems today are structural, complications that have been festering for years, and now coming into view in 2022:

- Rising CPI Inflation,

- Rising Bond Yields,

- The Establishment’s incompetence is diverting its focus, domestically and internationally, into situations it doesn’t understand, and are proving to be totally ignorant of how best to deal with.

- The most significant bearish factor is; no longer is bureaucratic Washington trusted to do the right thing. It’s actually worse than that. Only fourteen months into office, the Biden mis-Administration has become an international laughing stock that no one but the media takes seriously.

Like it or not, since WWII, bull markets in financial assets happen during times when Washington’s politicians and bureaucrats were honest and competent, and the banking system and US dollar were strong.

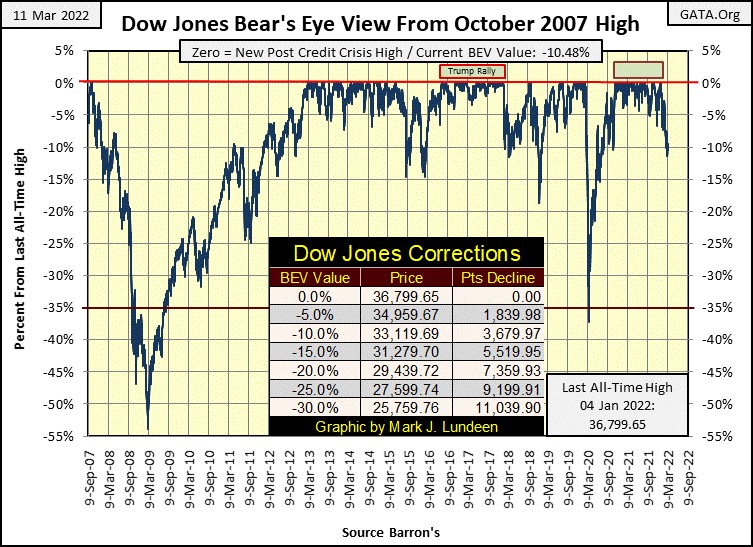

Okay, since WWII this has never been true, not for a day. However, that didn’t matter. What mattered was the market had confidence all was right with the world. With the Dow Jones at the close of this week closing below its BEV -10% line, CONFIDENCE in the bull market on Wall Street is fading.

The Dow Jones in its daily bar chart below continues its pattern of descending tops and bottoms. This technical pattern has continued since the Dow Jones last all-time high on January 3rd. If the Dow Jones sees a daily close below 32,500, that would not be good for the bulls. How far can the Dow Jones go down before we see a selling panic develop in the stock market?

Does the stock market have to see a selling panic? No, not if it turns around and once again begins rising towards new all-time highs. Speaking for myself; my CONFIDENCE that the stock market is capable of doing that isn’t what it used to be. I think that is true for a growing number of investors.

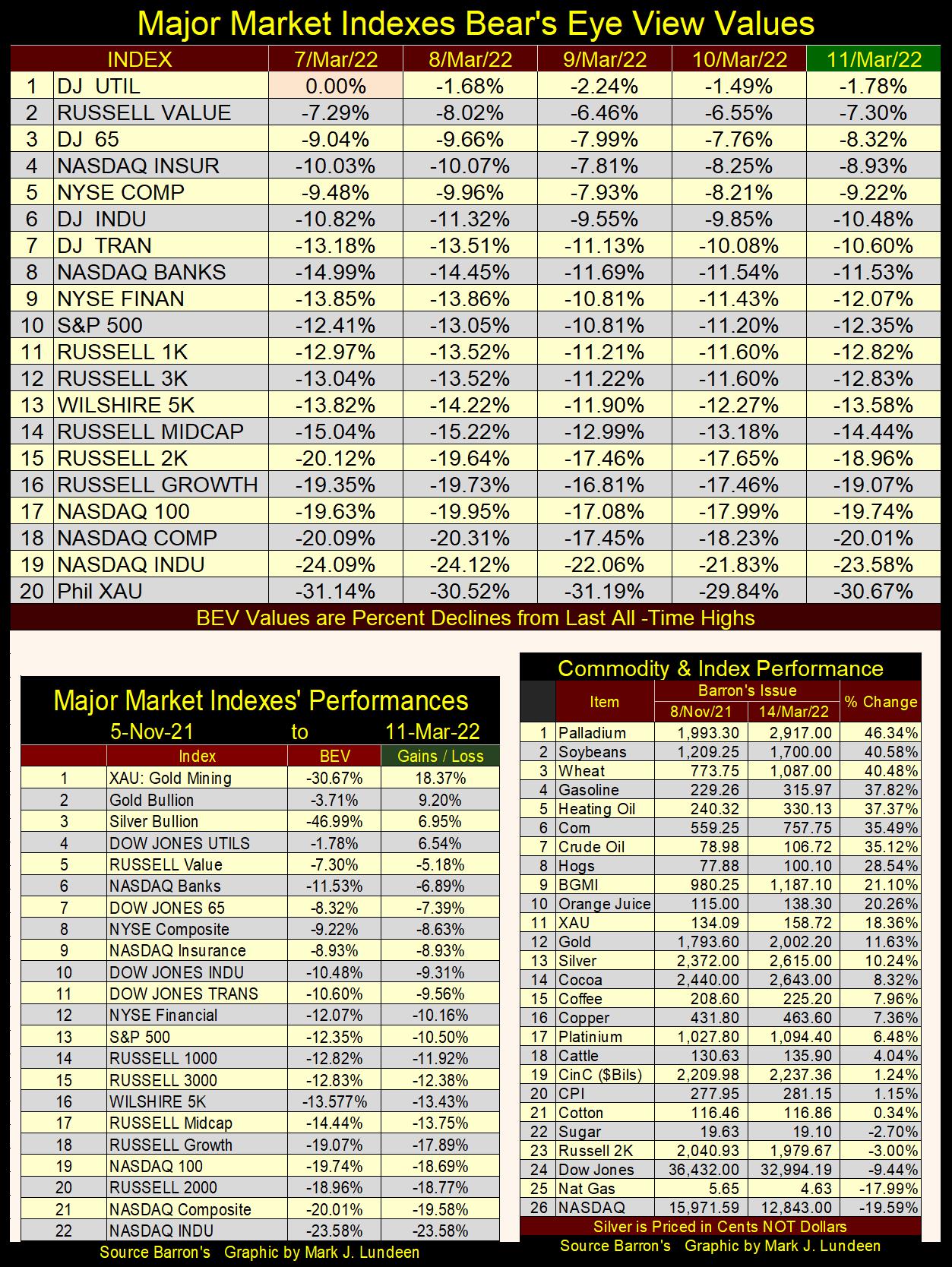

Looking at my table of the BEV values for the major market indexes below, it's not just the Dow Jones seeing its BEV value deflating ever farther from its last all-time high. All of the major market indexes are also suffering from deflation, most of them more than the Dow Jones as “liquidity” flows from Wall Street.

On Monday the Dow Jones Utility Average saw a new BEV Zero, then remaining in scoring position (BEV -0.01% to -4.99%) for the rest of the week. But the other major indexes have all deflated below scoring position, and continue trending towards ever deeper double-digit BEV values.

Looking at the table listing major market indexes performances (above left), since November 5th, a week where seventeen of the above indexes made multiple BEV Zeros, the stock market has seen its valuations deflate.

In the table for commodities prices to the right, since early November of last year, many commodities have inflated by double-digit percentages. And it’s not only energy prices up by big double digit percentages.

Many avocates for gold and silver still complain of poor market action for the old monetary metals – me too! But since early last November, how many money managers, or retail investors wished they invested in gold and silver, instead of the hot NASDAQ glamor issues?

I don’t know exactly what is going to happen in the next few months. It’s possible the stock market will rebound as commodity prices come down from their current highs. But on a longer term, I anticpate these two trends will continue; deflating stock & bond markets / inflating commodies (which includes gold and silver). It’s only a matter of time; weeks, months or years before money now sitting in the financial markets, begins a bum’s rush into commodities, as investment capital flees deflation, seeking the safety found in inflating commodities valuations.

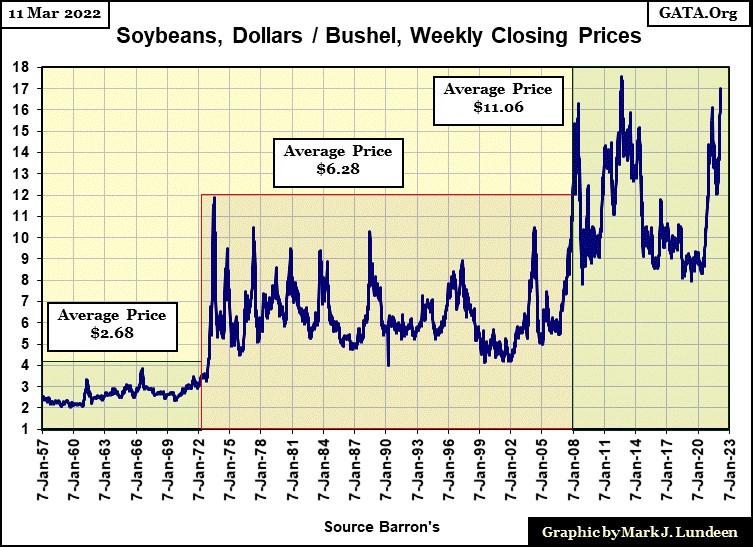

Here is a chart for soybeans going back to 1957, data is weekly. This is also a history of “monetary policy”, where the effects of the past half century of inflationary monetary policy can be seen.

- Before August 1971, when the US Government eliminated the Bretton Wood’s $35 gold peg, soybeans traded for fifteen years between $2 and $4.

- Shortly after the dollar was taken off the gold standard, soybeans for the next thirty-six years traded between $4 and $10.

- Then came the sub-prime mortgage debacle, and its three bouts of QE. Soybeans soon began trading between $8 and $17.

- Now two years following Fed Chairman Powell’s massive Not QE#4, I’m expecting soybeans to once again trade in a higher range of prices, far from where they are now.

Since 1957, there are many of other commodities that record this same history of US “monetary policy.” As an investor, you want to know where the flow-of-funds are coming from, and going to. As best as I can tell, right now this flow-of-funds are flowing from financial assets like stocks and bonds, into commodities. For most retail investors, the best way to play that is by purchasing gold and silver bullion, as well as the mining companies that produce them.

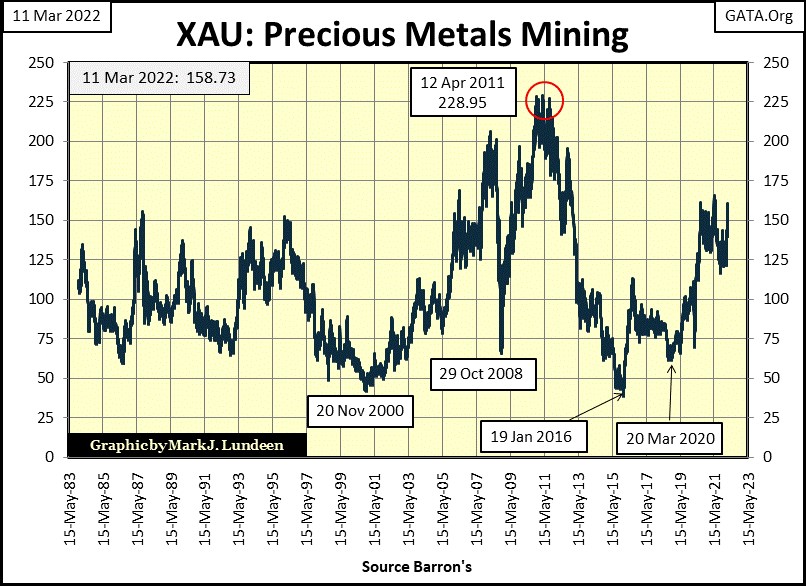

In March 2022, I like the gold and silver miners, as unlike most of the stock market, the precious metals miners have not seen vast flows-of-funds for the past few decades. Let’s look at the XAU below. It first traded in 1983, closing its first day of trading at 103. This week it closed at 158, for a thirty-nine year advance of 54%. Of course, in January 2016, the XAU found itself down by massive 84% from its all-time highs of April 2011, a loss of valuation that a decade later still hasn’t been made good.

I admit it, since the early 1980s gold and silver mining has provided more pain than pleasure to the market. But in March 2022, that is precisly what I find so attractive about them; these miners are an undervalued and underowned, commodity based stock group. How long will they remain so as the bull market in commodities continues?

In my above table listing BEV values for the major indexes, the XAU is the only group since November 2021 that has advanced, rising from a BEV of -43% four months ago, to close on Thursday of this week at BEV -29.84%. That’s an advance in dollar terms of about 20%. “Market experts” aren’t recommending gold miners, but so far for 2022, the XAU and Barron’s Gold Mining Index (BGMI) are the best performing stock indexes I follow.

For those who still insist on exposure to the broad-stock market, here’s the table for NYSE 52Wk Highs and Lows below. Since late January, the NYSE has seen only three days with more 52Wk Highs than 52Wk Lows, with the largest positive net of only 28 on March 2nd. What is to be seen below is a story of deflation in the stock market. I fear there will be much more to follow before Mr Bear is finished with the NYSE.

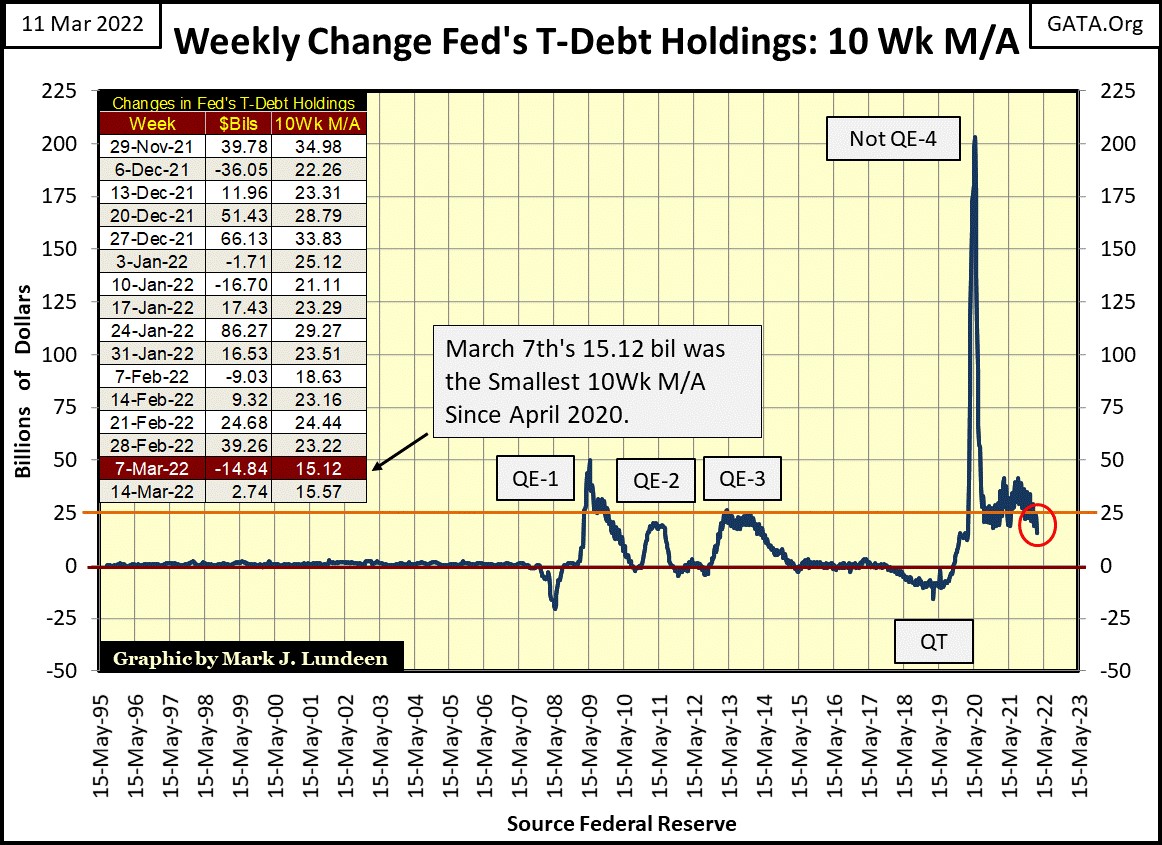

If you’re still a bull, the follow trend in “monetary policy” is BAD NEWS! The idiot savants at the FOMC are reducing their weekly “injections of liquidity” into the market. For a market advance that was propelled by massive “injections of liquidity”, like ours since April 2020, this isn’t a positive development in the market.

I circled this week’s data in the plot below. This 10Wk M/A seemed to be trending into new, and lower territory. So, I checked the weekly values of this 10Wk M/A going back to March 2020, when Powell’s Not QE#4 really took off, and last week’s value was the smallest since April 2020.

In past public statements, Chairman Powell said the Federal Reserve was going to begin raising interest rates, and moderating “liquidity injected” into the financial system. I doubted him at the time, but I don’t any more.

Keep in mind that the last time the FOMC did this was during its QT above. Their QT was terminated in October 2019 as overnight repo rates spiked above 20%, at which time Powell’s Not QE#4 officially began, small at first. His Not QE#4 spiked up during the March 2020 flash crash, when corporate bond yield began spiking and the stock market crashed. Since then, (the last two years) the Not QE#4 has been “injecting” massive amounts of “liquidity” into the market weekly, but now the FOMC hopes they can return “monetary policy” back to normal levels.

As I see things, if they continue reducing the volume of “liquidity” they “inject” into the market, I expect we’ll see another flash crash sometime in 2022. I wonder what their Not QE#5 will look like in the chart above?

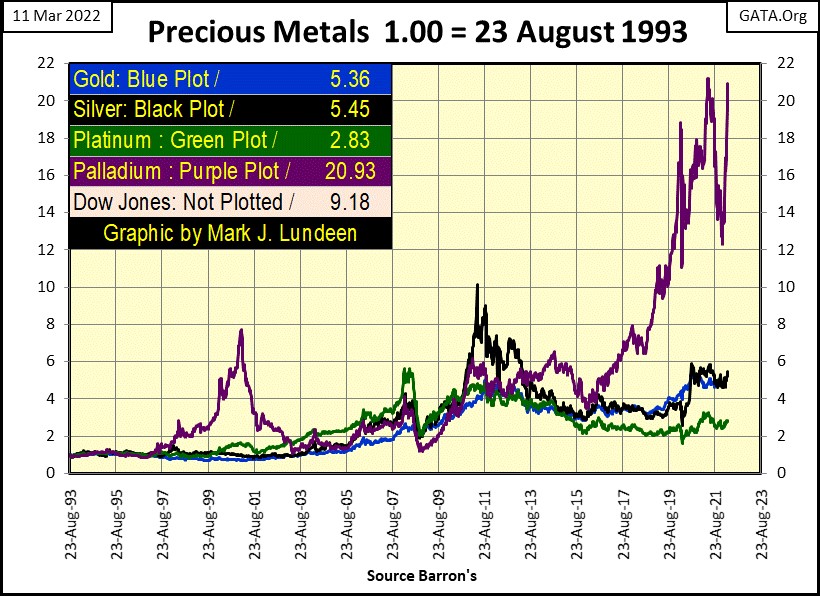

The following is an interesting chart of the precious metals, along with the Dow Jones, which isn’t plotted. The data is indexed to 23 August 1993 = 1.00. So, palladium this week is up by 20.93 times its price in August 1993. Palladium used to be the most boring precious metal to follow. But that was thirty years ago. Today, palladium is the rock star in the precious metals’ universe.

Should we consider palladium as an investment? Looking at the chart below, it’s apparent the horse palladium has been riding left the barn long ago. As far as the precious metals are concerned, I’d say gold and silver remain investors best choice.

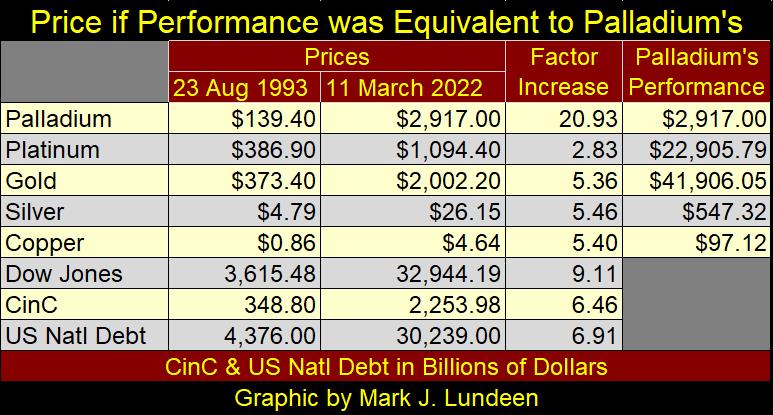

I was looking at this chart, and wondered what the price of the other metals would be had they too seen palladium’s factor of increase of 20.93. So, I made up the table below to see, and the results were interesting.

I make no claim for the predictive ability of the table below, and you would be wise not to either. But with Washington and Wall Street using the dollar and the national debt (Treasury Market) as their play things, the desirability of the US dollar in the global markets will continue to diminish, ultimately to zero. At that point, what will be the dollar price of these metals, or anything else; infinity? I believe that is how this works.

As even Bill Gates doesn’t have that kind of money, maybe that’s why he has become one of the largest, if not the largest holder of farm land in the United States. The people at the top know what is coming, and so are taking steps to protect themselves.

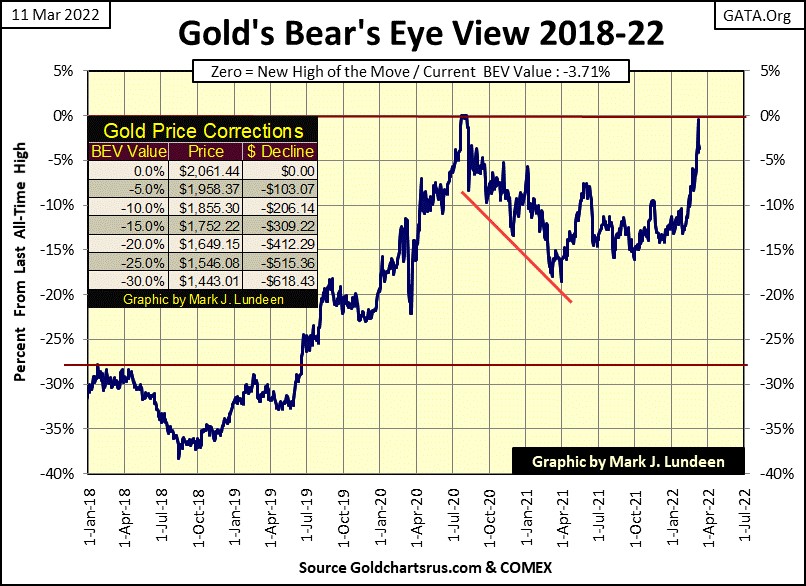

It looks like gold hit a new BEV Zero this week in its BEV chart below. It didn’t, but came close on Tuesday when it saw a BEV of -0.45% ($2,052). Give it some time and that will change.

Gold and its step sum below continue looking very positive. What else is there to say, but darn if it doesn’t look like gold is in a bull market?

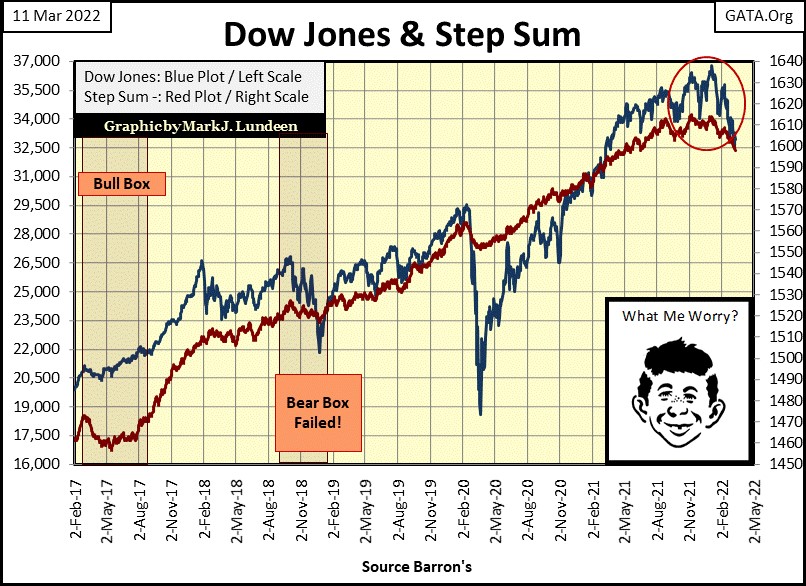

Unlike gold above, the Dow Jones below is seeing its price and step sum plots going the wrong way; for the bulls anyway. I can’t imagine a bear complain about what the Dow Jones price and step sum plots have done below since last November.

We’re actually watching a slow-motion crash below, a significant market event that has yet to capture the attention of the investing public or the financial media.

One of these days we’ll all wake up and see the “market experts” on CNBC having a hard time explaining how, from out of nowhere, the bottom of the market just fell out from under it. But that won’t be true; the Dow Jones and other major market indexes I follow have been developing problems since last November.

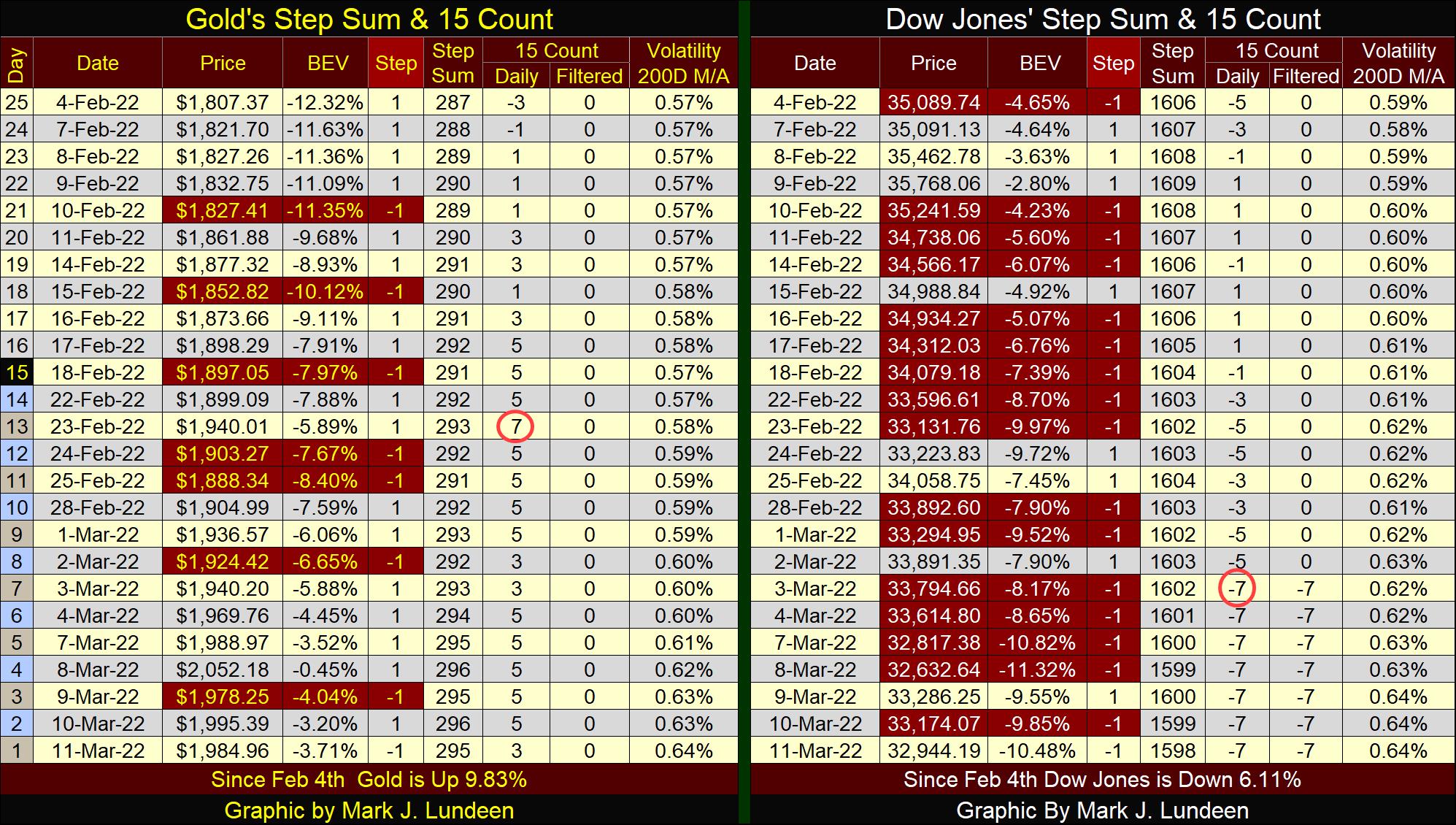

What is up with golds’ and the Dow Jones’ step sum tables below? A few things worth noting, such as their daily volatility’s 200Day M/A. For both, their daily volatility is rising, and soon could be something over 1.0%. If so, that is good news for the gold bulls, but very bad news for the stock market bulls.

Look at the days highlighted in red below. These days are down days in the market, which along with the advancing days, provide the data required to compute the step sum plots, and the 15 counts.

Looking at gold, since February 4th it has seen only seven down days, with gold up by 9.83%. Gold became an overbought market when on February 23rd its 15-count increased to a +7. Overbought markets are markets due for a price pullback. But since February 23rd where is gold’s price pullback, as its 15-count pulled back from +7 on February 23rd, to a +3 at this week’s close?

Along with rising daily volatility in the gold market, this is really good market action for gold.

On the other hand, in its step sum table above, the Dow Jones is looking very tired. For the last seven days seen above, the Dow Jones has seen a -7 for its 15-count. That makes the Dow Jones a very oversold market. But oversold markets don’t like being that oversold, so they tend to have a nice bounce, but so far not for the Dow Jones now in March 2022.

Trump was right, though you wouldn’t know that by watching the usual suspects in the main-stream media. Here’s a little video on what Trump told NATO on single sourcing their energy from Russia back in 2018. At the time Europe laughed at him. Note; they aren’t laughing at him now.

https://www.youtube.com/watch?v=Zfq9FwU5-rA

I haven’t spent much time on the situation between Russia and Ukraine, as I knew almost nothing about it. That plus our political, academic, entertainment and media establishments of 2022 are filled with aging hippy “peace activists” and leftwing “antiwar activists” from the Vietnam-War era. Other than reporting on how much “America sucks”, these people have no desire to tell us the truth about anything, except maybe that Russia now sucks too.

I’ll be blunt; a half century ago America’s current power elite were America hating, pro-Marxist / Maoist radicals. Looking at their managing of the United States since bumbling Joe Biden entered the Oval Office, their worldview that America needs to be knocked down a few notches haven’t changed. Having this understanding of today’s leadership of the United States, I don’t trust much of what I see from their propaganda outlets on cable TV or in the internet.

So, the video below from the Fox’s Tucker Carlson came as a surprise to me, where he reported the United States is funding biological-warfare labs in the Ukraine. What’s with that? Actually, I’ve heard of this at least ten days ago on INFOWARS, when they reported that one of the reasons Russia invaded Ukraine was to wipe out American biolabs developing bio-weapons a few miles from the Russian border.

If so, and I think this is so, what in the hell is going on in the darkest corners of Washington DC? This is what they’re spending my tax money on? What else are they hiding? I still don’t consider Putin an angel, but I’m beginning to doubt he is the devil the Biden mis-Administration would have me believe him to be.

The video is about ten minutes long, and provides ample reason to doubt any narrative from the media concerning the situation in Ukraine.

https://www.youtube.com/watch?v=g2cwGscanAg

Laura Ingraham has a great video on Biden’s new lockdown of the American people via rising gasoline prices. One thing for certain; the more power and money that flows to the Federal Government, the poorer the American middle class becomes. And that isn’t an accident.

https://www.youtube.com/watch?v=wZYestex2RM

Publishing Note: I have some family business to attend to next week. My next article will be published Sunday morning, March 27th.

Mark J. Lundeen

********