FOMC Minutes Reveal An Important Shift That’s Key For Gold, Too

Yesterday, the Fed released minutes from its last meeting. They show an important shift among the meeting participants. In September, the FOMC turned more worried about the state of the U.S. economy, while just six weeks later in October, the Committee felt more optimistic again. Indeed, the central bankers noted that certain downside risks had softened:

Uncertainties associated with trade tensions as well as geopolitical risks had eased somewhat, though they remained elevated (…) Some risks were seen to have eased a bit, although they remained elevated. There were some tentative signs that trade tensions were easing, the probability of a no-deal Brexit was judged to have lessened, and some other geopolitical tensions had diminished.

The participants also worried less about the yield curve and the recessionary risk:

Several participants noted that statistical models designed to gauge the probability of recession, including those based on information from the yield curve, suggested that the likelihood of a recession occurring over the medium term had fallen somewhat over the intermeeting period.

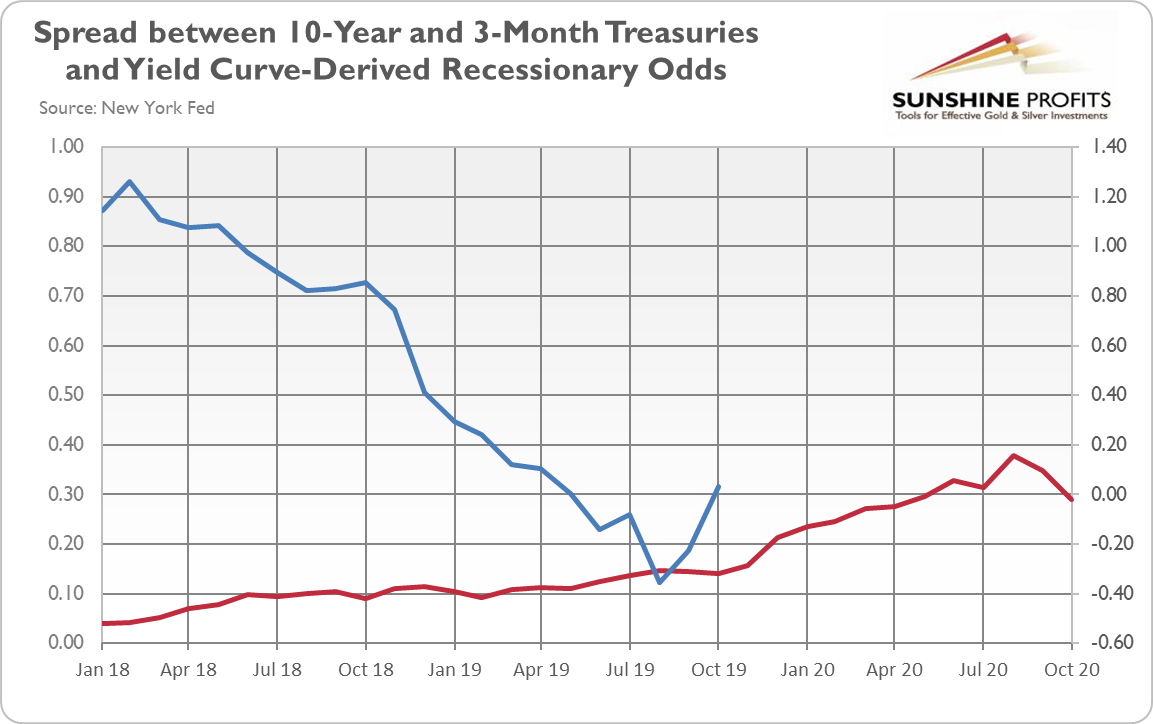

Indeed, the yield curve has ceased to be inverted and has recently returned to positive territory. Consequently, the yield curve-derived recessionary odds have declined from 38 percent in August to 29 percent in October, as the chart below shows.

Chart 1: Spread between 10-year and 3-month Treasuries (blue line, right axis, in %) and the yield curve-derived recessionary odds (red line, left axis, in %, New York Fed’s model) from January 2018 to October 2019.

However, the fact that the yield curve has become standard again does not mean that the risk of recession disappeared. Reinversions do not erase previous inversions. The damage has been done. The yield curve that has reverted to the normal may thus be the quiet before the storm. Indeed, some experts start to count down to recession when the yield curve becomes positive after the preceding inversion.

The FOMC members discussed not only the economic situation but also what tools to use in the next recession. In a rare case of unanimity, all Fed officials said they opposed the negative interest rates in case of a downturn, as both the ECB and BoJ have done:

All participants judged that negative interest rates currently did not appear to be an attractive monetary policy tool in the United States. Participants commented that there was limited scope to bring the policy rate into negative territory, that the evidence on the beneficial effects of negative interest rates abroad was mixed, and that it was unclear what effects negative rates might have on the willingness of financial intermediaries to lend and on the spending plans of households and businesses. Participants noted that negative interest rates would entail risks of introducing significant complexity or distortions to the financial system. In particular, some participants cautioned that the financial system in the United States is considerably different from those in countries that implemented negative interest rate policies, and that negative rates could have more significant adverse effects on market functioning and financial stability here than abroad.

However, there is hope for NIRP! After all, President Trump supports negative rates, so the Fed added sentence that it could rethink its stance in the future. Of course, who wouldn’t be open to new solutions should the conditions change!

Notwithstanding these considerations, participants did not rule out the possibility that circumstances could arise in which it might be appropriate to reassess the potential role of negative interest rates as a policy tool.

Gold prices dropped in their initial reaction to the FOMC minutes, but the price action has been muted. But would you like to know what to expect from the Fed in the future and how it could affect the yellow metal? If so, I encourage you to read the full version of today’s Fundamental Gold Report, which analyzes the Fed’s stance and its impact on the precious metals market in more detail. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

********