Forecast: Mid-Term Picture For Gold And US Stocks

Last week's trading saw gold forming its low in Monday's session, here doing so with the tag of the 1806.50 figure. From there, a straight shot higher was seen into late- week, with the metal running all the way up to a Friday peak of 1904.60 - also ending the week at or near the same.

Gold Market, Short-Term

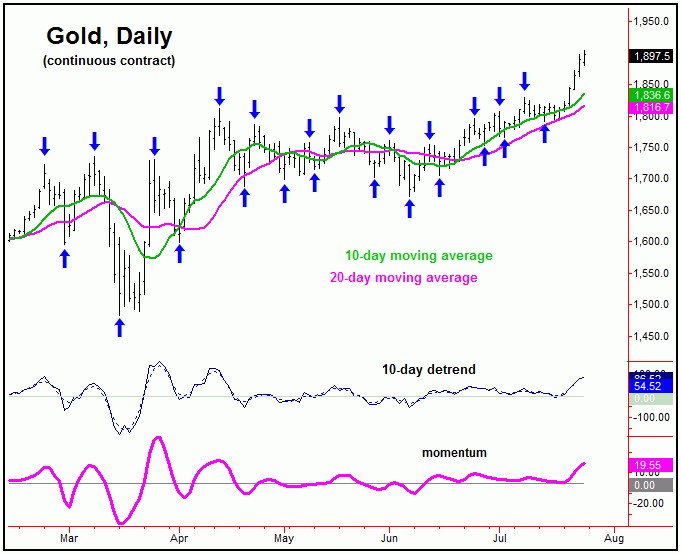

For the very short-term, the next smaller-degree peak should come from the smallest tracked cycle, the 10-day component. With the recent action, this cycle is now 8 trading days along - and with that is into extended territory. Here is our 10-day wave:

Normal peaks with this 10-day cycle - when in a bullishly moving trend - tend to be made on or after the 6-8 day mark. With that, a quick correction of a day or three off the top can materialize at anytime. And, following my rule that a cycle will revert back to a moving average approximately 85-90% of the time, the 10-day moving average would act as an ideal magnet to that decline.

Stepping back, we are still awaiting confirmation of a slightly larger-degree correction playing out into the month of August. As mentioned last weekend, with no confirm of a peak in place, there was the potential for a spike back to or above the highs - which we obviously saw with the action into last week. Overall, gold should be headed much higher, with a recently confirmed upside target from the four-year wave (more on this in a bit). The next chart again shows the 72-day cycle:

From the comments made over the past month, the last trough for the 72-day cycle was projected to materialize around mid-June, with its actual low coming in slightly on the early side, made with the June 8th tag of 1671.70. From there, the analysis called for a minimum new high for the larger swing into mid-July or later, then to be on the lookout for the next decent correction phase into August - which is also the seasonal bottoming window for gold.

In terms of patterns, due to the configuration of the larger 310-day and four-year cycles that we track, we continue expect any correction(s) for gold to end up as countertrend affairs - to be followed by higher highs, upon completion. Thus, if a decline does manage to play out in the coming weeks, it should look to be bought, in the anticipation of higher highs to follow.

Gold, Longer-Term

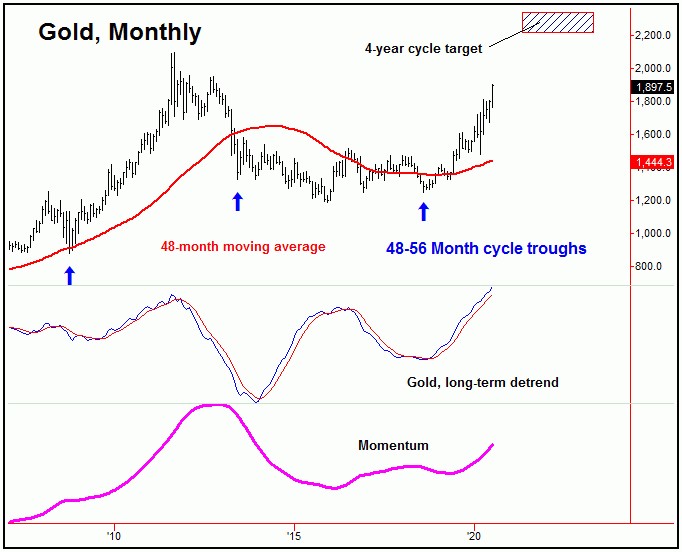

In taking a look at the longer-term view for gold, the largest-tracked wave is the four-year cycle, which is shown below:

The chart above shows the four-year wave, which is seen as heading higher into at least later this year. What is noteworthy is that this wave has recently confirmed a new upside target to the 2212.00 - 2340.56 region - which is well above current price levels. When these targets are triggered, they have an 85% odds of eventually being reached - and with that we have to assume that this target range will be met in the coming months, before any larger-degree peak attempts to form.

For the bigger picture, the upper end of this target range (i.e., 2340's, but with a wide plus or minus variance) is also a major resistance level for gold, and could well be the spot that tops this four-year cycle - for a larger-degree decline into next year. We'll reassess this potential in the coming months, as the action plays out.

U.S. Stock Market

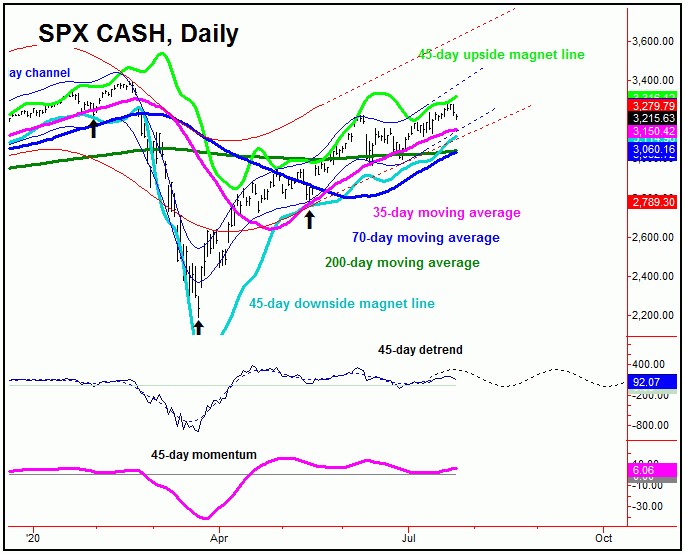

As mentioned in my article from last weekend, the next correction of significance was expected to come from our 45-day cycle, which is shown again on the chart below:

From last weekend: "the ideal path has favored a move up to the 3260-3280's or better on the SPX before the 45-day wave tops, though time is starting to run out on this scenario - with the wave now back in topping range. Once it does top out, we should see a decent decline playing out in the days/weeks to follow, a move which is expected to end up as another countertrend affair - holding above the prior 45-day trough of 2965.66 SPX CASH, seen back in June. If correct, higher highs should play out on the next swing up, where we will be looking for the next mid-term top to form."

As noted in recent weeks, there was the potential for the SPX to reach up to the 3260- 3280 region on the recent upward phase of the 45-day cycle, which did in fact play out into last week, with the index running all the way up to a high of 3279.99 - before selling down sharply off the same to end the week.

With the above said and noted, the ideal path is looking for additional correction in the coming weeks, before setting up what is anticipated to be a countertrend bottom with our 45-day component. What follows should be higher highs on the next swing up with this wave into September/October.

The Mid-Term Picture for U.S. Stocks

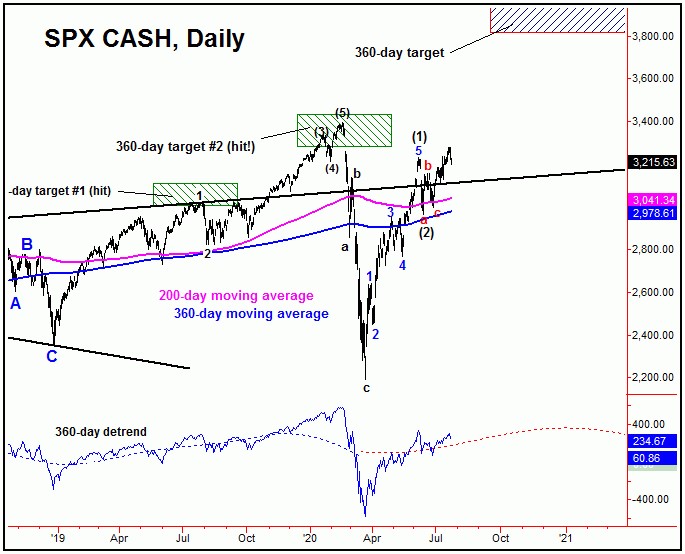

For the bigger picture, one of our larger-tracked waves with the SPX is the 360-day cycle, which is shown on the chart below:

Of note with the above chart is that this 360-day cycle recently confirmed a new upside target to the 3812.56 - 3960.44 SPX CASH region - which is obviously well above current price levels. With that, we have to view any and all corrections (such as with the aforementioned 45-day cycle) as buying opportunities, in the anticipation of this target range eventually being met. How soon it would be met is speculation for now, though a late-end expectation seems to be the Summer of 2021. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/