Geopolitics: The Big Driver For Gold

Fiat bugs have been desperately trying to call a top in gold and silver. They were just waylaid (again) by geopolitical events in Venezuela and…

The fallout could be even more bullish for the world’s mightiest money which of course is gold.

Iran is now a boiling cauldron of discontent. The citizens shout, “Death to the dictator!” and the US government threatens to attack the regime.

Meantime, in Asia, Chinese social media is filled with purported plans to take out the leaders of the government of Taiwan… in the same way that Maduro was taken out.

Further, President Donnie’s fantasy of personally ending the Ukraine war in 24 hours is dead and gone. The bottom line:

The geopolitical drivers for gold are incredibly strong and are arguably even more important (for now) than government debt.

Gold appears to have broken upside from the October highs and the pullback to my $4260 buy zone for gamblers is a technically normal event.

Investors with no gold should not waste time waiting for a major price sale to buy. Instead, a grub stake (small size buy) is the best way for an investor to introduce themselves to this spectacular market.

From there, more substantial purchases can be made on big price sales into big support.

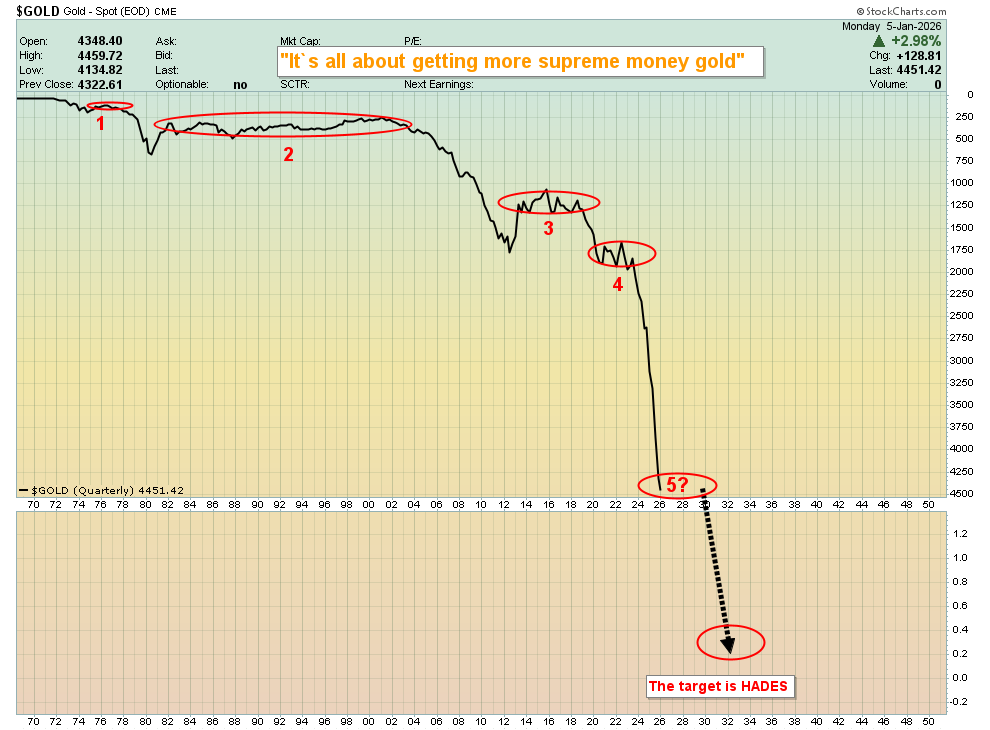

Citizens must buy almost everything with their government’s horrid fiat money, so their focus (in the early stages of fiat) is on getting more fiat rather than getting more gold.

As time passes, the purchasing power of fiat becomes exponentially worse and eventually the citizens are forced to begin focusing on gold.

That’s the stage America is poised to enter in the next few years. It will be a glorious time for citizens who have already made gold their personal currency of choice… and for everyone else the transition could be quite unnerving.

This is the spectacular platinum chart. Platinum isn’t money, but it’s fabulous metal and a great tool to use to get more gold.

My suggestion was to buy platinum in the sub $1000 zone and sell 30%-70% of it at $1800-$2400… with the proceeds earmarked for gold. I chose the 70% number for myself, and the remaining 30% is a lifetime hold.

What about silver? Well, the great news is that silver could regain its status as… money. Rumours continue to swirl about central bank interest in this glorious metal. Also, the robots age is beginning. Millions of robots will be produced to replace millions of workers and…

Most will likely eventually be powered by electricity from solar panels. Silver is required for the panels. Some manufacturers will switch to copper, but a $100 price floor for silver looks inevitable.

For a look at this metal’s exciting price action against gold:

With the prospect of silver becoming recognized as money again, my recommendation is to sell no more than 30% of it into the current ascent that has taken it into my target zone on this chart.

As with platinum, profits need to be allocated not into failed fiat… but into gold.

Another tool of significance for gold-oriented investors is uranium. To view a stunning yellowcake stocks chart (URNM ETF),

An inverse H&S bull continuation pattern is in play, and it features a very bullish high right shoulder.

Note the Stochastics (14,7,7 series) buy signal in play at the bottom of the chart. In a nutshell, yellowcake stocks are as close as it gets to a “no brainer” buy for momentum-oriented investors.

The miners?

This may be… the world’s most bullish chart. I’ve urged mine stock investors to keep an eye on the CDNX as an indicator for the potential upside for all types of gold and silver mining stocks. The right shoulder could be a bull wedge that is set to launch a glorious breakout for outrageously undervalued miners.

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

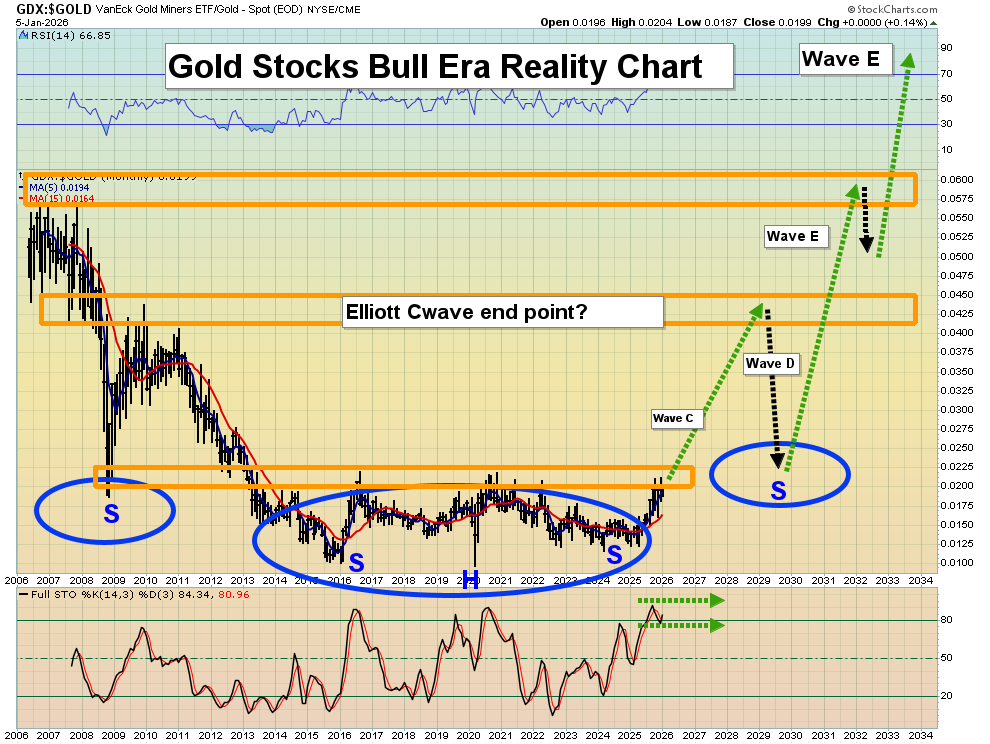

This is the “mouthwatering” GDX versus gold chart. I urged investors to watch for a Stochastics (14,3,3 series) flatline event. Now it’s here and a surge over the neckline of the massive inverse H&S pattern looks imminent.

In a nutshell, if an investment can’t rise strongly against supreme money gold, there’s no point buying it; the investor can simply buy gold. In the case of the miners, they looks ready to stage one of the greatest wealth building events in the history of markets. The only question is… are savvy citizens onboard?

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: