Global Indexes

Here is our monthly update on global indexes for our international investors.

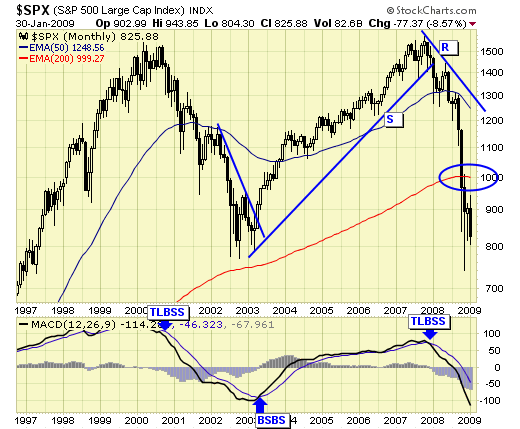

$SPX - sell signal in January 2008 ended the buy signal of May 2003.

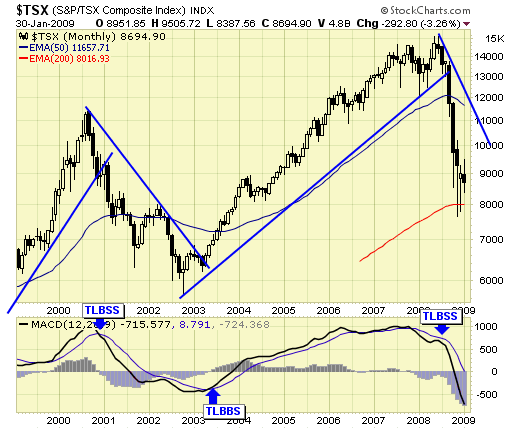

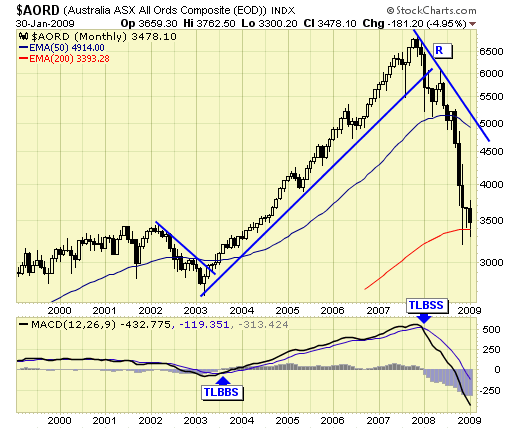

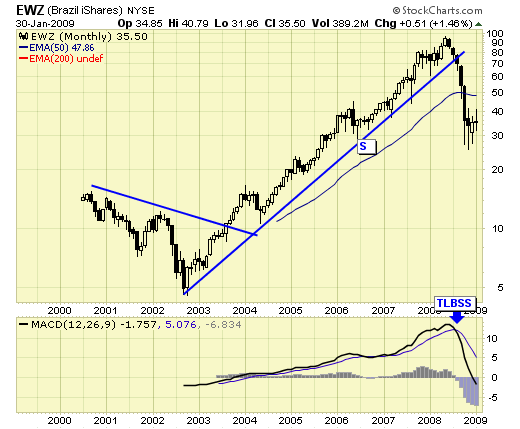

Most other major indexes around the world follow this pattern.

$SPX is down 41% since our major sell signal was confirmed in January one year ago.

$TSX - down 26% since our major sell signal.

Australia is down 40% since our major sell signal.

Brazil is down 52% since our major sell signal.

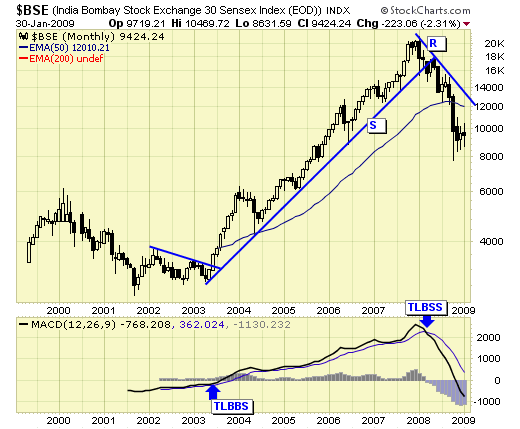

India is down 40% since the major sell signal.

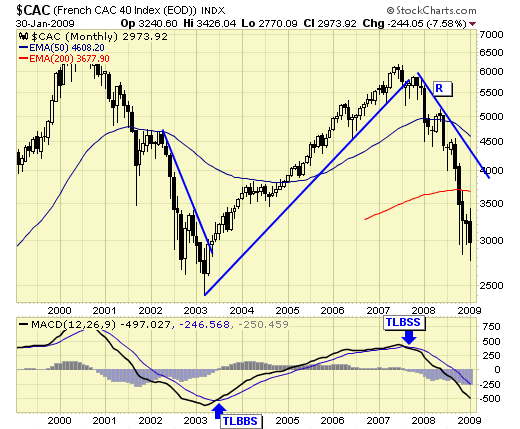

France is down 48% since the major sell signal.

C'est la vie.

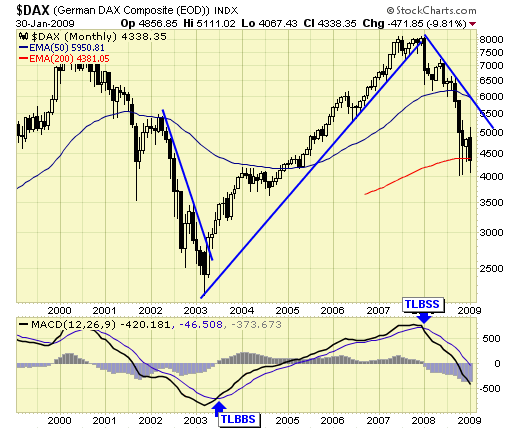

Germany is down 37%.....

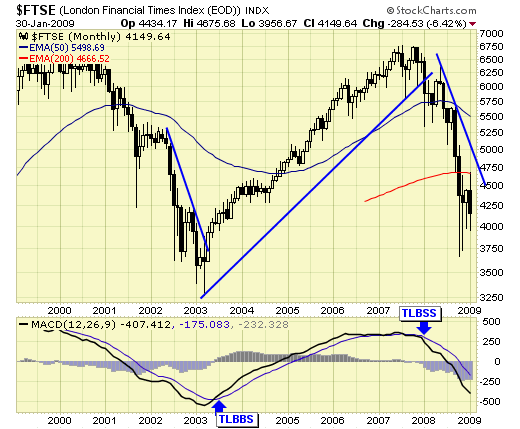

London is down 30%........pity.

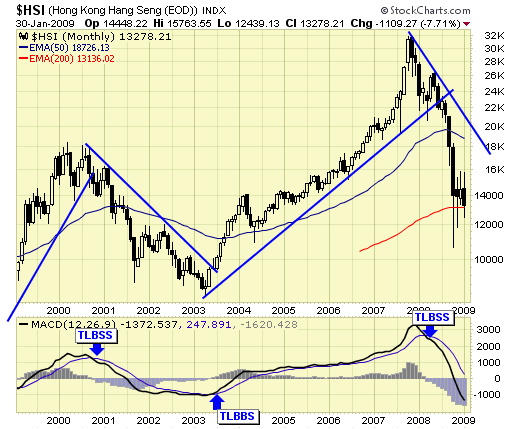

Hong Kong is down 40% since the major sell.

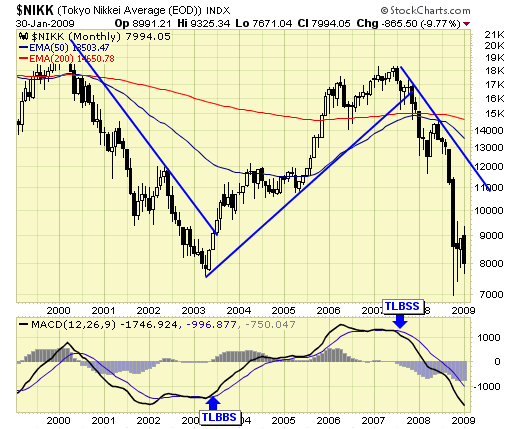

Tokyo is down 50% since the major sell…

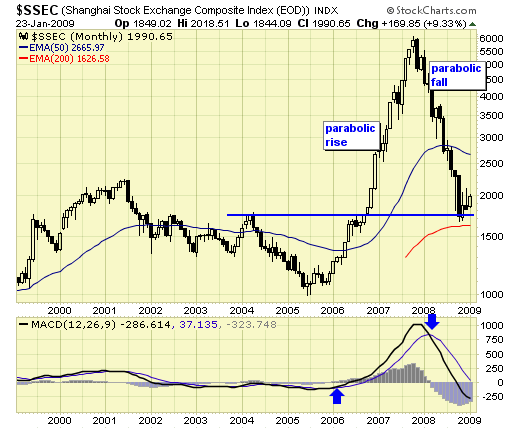

Shanghai is down 56% since the major sell.

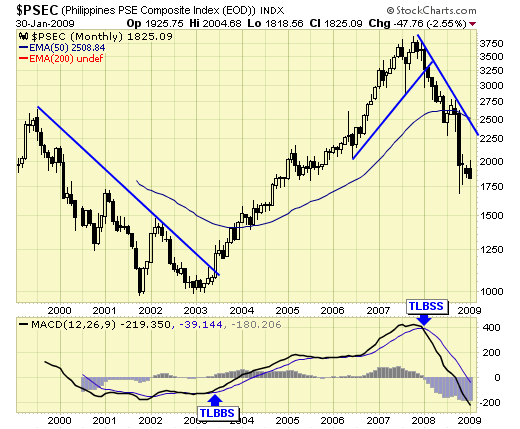

Philippines is down 42% since the major sell..

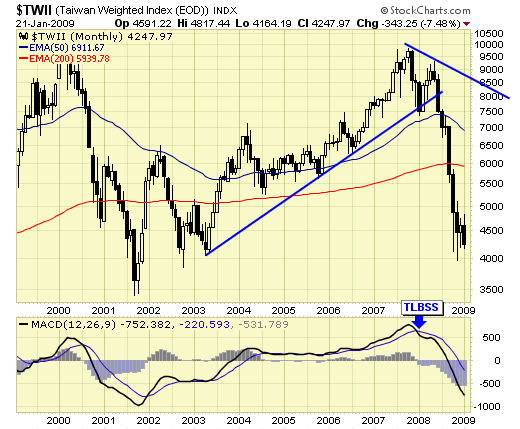

Taiwan is down 44% since the major sell.

Summary

All global indexes we track remain on major sell signals this month.

Long term investors continue to stay in cash or fully hedged.

Traders please check our traders log to see current open positions and opportunities.

********

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.