Gold’s Plan for Christmas - Shine or Create a Shooting Star Pattern?

Gold’s rally was just stopped by the resistance provided by its previous high and its 60-week moving average. Will gold now reverse?

The shape of this and last week’s price moves provides the answer.

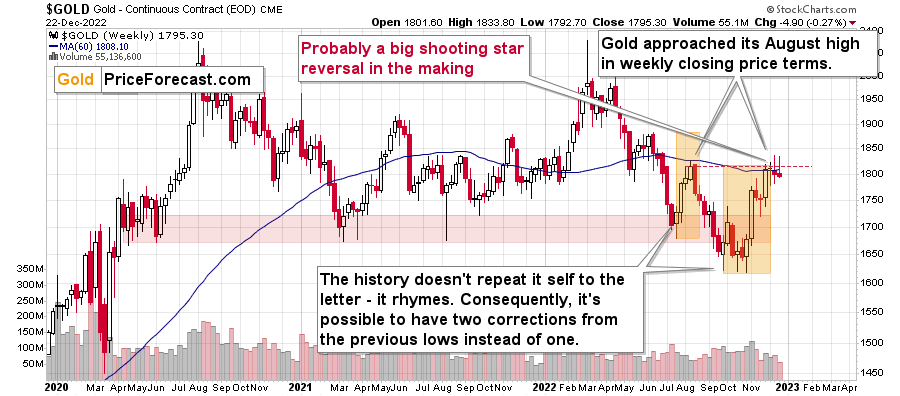

The above chart features gold price in terms of weekly candlesticks. As you can see, it just approached its August high.

And gold failed to move above it once again.

The resistance held.

What is even more bearish is the fact that gold is likely about to form another weekly shooting star (reversal) candlestick, the second in a row. “Likely,” because the week is not over yet.

The “shooting star” candlestick is formed when the price moves up on an intraday or (here) intraweek basis and then erases this upswing before the day (here: week) is over.

This is a very powerful bearish indication, especially that it has now been repeated.

Given today’s pre-market moves in gold and silver (both are up just slightly, with gold trading below $1,800), it seems that the reversal candlestick will soon be a fact.

This – along with the failed attempt to move above the August high – has profoundly bearish implications for the following weeks.

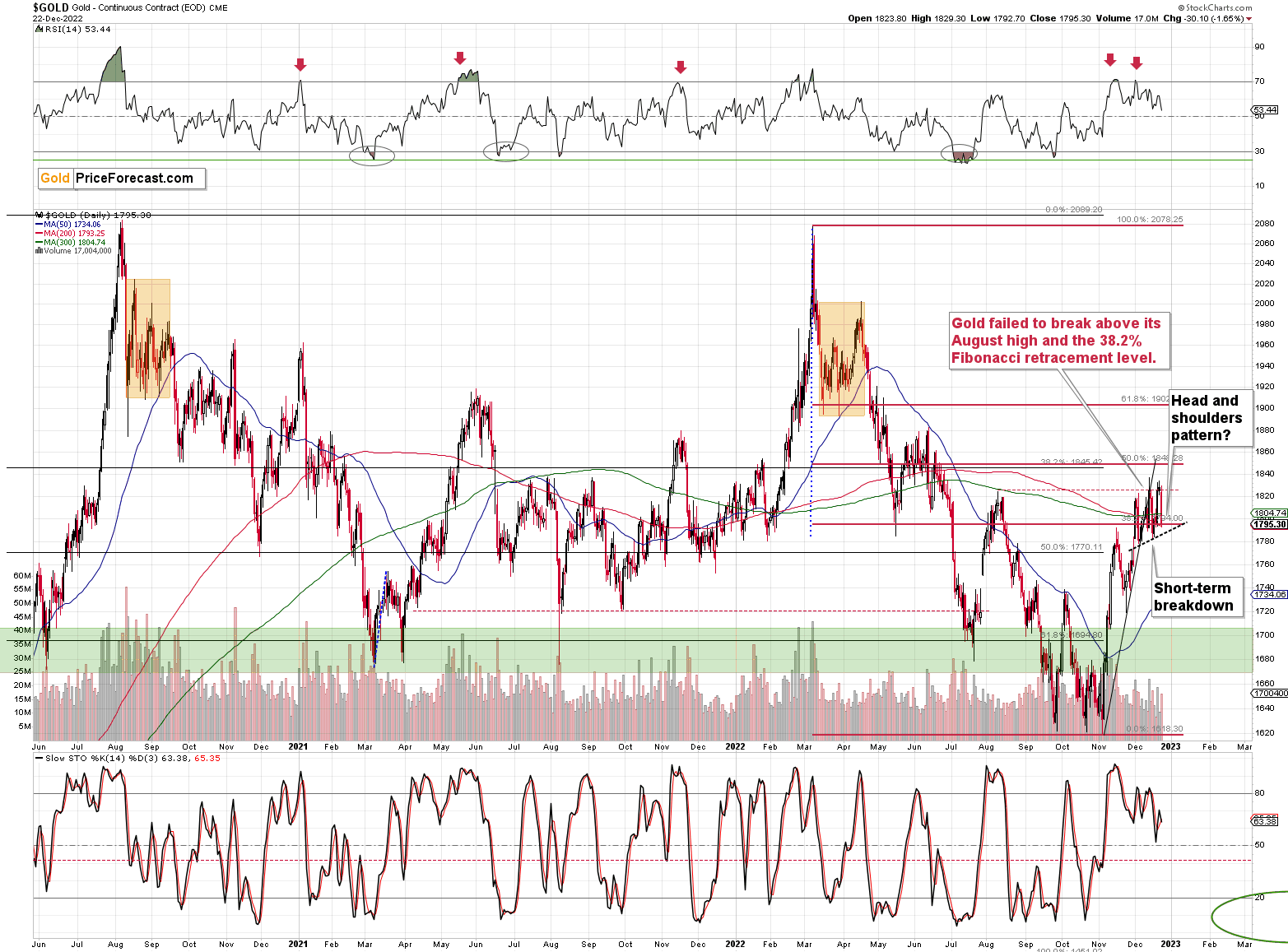

Gold, just like many other markets (i.e., stock prices), recently corrected slightly more than 38.2% of its previous move. Then it invalidated this small breakout. It happened more than once, so this bearish indication was strengthened.

The same goes for gold’s attempt to move above its August high – the one that failed. It too strengthened the bearish case for the following weeks.

Please note that the above is taking place shortly after two sell signals from the RSI indicator, which further confirms the bearish nature of the recent price moves.

Gold’s breakdown below the rising, short-term, black support line makes the short-term outlook even more bearish.

And now, based on this week’s failed attempt to rally once again, gold is likely to form a head and shoulders top pattern. For now, this formation is just potential, as we’ll need to see a confirmed breakdown below the neck level (dashed, black line) first.

Given the above technical picture, rising real interest rates and the USD Index that has likely formed its medium-term bottom, the outlook for gold is very bearish for the following weeks and months.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,