Gold About To Accelerate But Avoid Trudeau’s Fascist Kleptocracy

Gold investors should stay away from countries like Canada, with fascists leaders. As gold is now breaking out to new highs (more later in this article), both old and new gold investors must be very careful how and where they keep their precious metals. Canada is no longer safe for gold investments.

Trudeau has issued an executive decree that gives him full emergency powers to punish the people who are involved with the truck drivers’ blockade. This action should have been taken by the courts in order to follow the rule of law. Instead, Trudeau has given himself the power to seize bank accounts of the people and also cancel their insurance.

The emergency act which he has invoked is intended for real emergencies and not for squashing protests against his unpopular policies.

BEWARE OF TRUDEAU’S ASSET GRABBING FASCIST POLICIES

So Trudeau doesn’t care about the law. He is part of Schwab’s WEF (World Economic Forum) cohorts, a group that believes they are above the law and that future leaders should be selected by the WEF crowd and not elected.

Rick Rule of Sprott recently said in an interview that Trudeau’s action is:

“A NAKED, BOLD, FASCIST ACT”

When leaders of so-called democratic countries take the law into their own hands, we need to start worrying about the jurisdictional safety of such a country. So far Trudeau has given himself the right to seize their bank accounts, but there is no reason why he wouldn’t go further and grab other assets, such as stocks or the content of their bank deposit boxes including gold and silver vaulted with depositories in Canada such as the Royal Mint, Loomis or Brinks.

And why would Trudeau not take similar measures and grab the people’s assets for any arbitrary reason including to replenish the government coffers due to his inept management of the economy?

Any investor who holds assets in Canada should now worry about what else Trudeau will do to put Canada in line with Schwab’s Stakeholder Capitalism agenda to take all assets away from the people. This agenda has little to do with free capitalism but will instead lead to fascism.

Since Trudeau is one of Schwab’s crown princes, he is one of the first leaders of the Western world to implement the WEF policies.

Investors must therefore not just worry about the safety of their assets from a financial point of view but also jurisdictional. To keep your assets in a country with fascist tendencies is not just unwise but dangerous for your financial health.

HEAVILY INDEBTED COUNTRIES WILL TAKE DESPERATE MEASURES

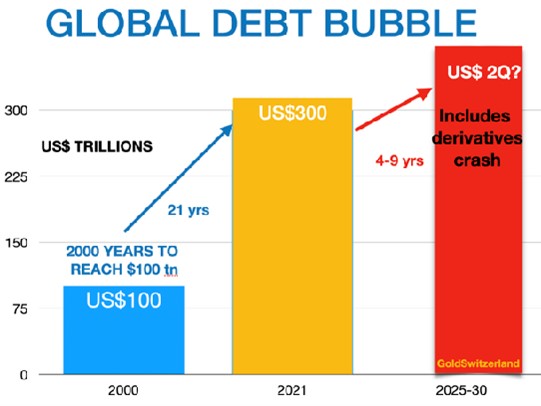

Global debts and deficits are now rising exponentially, up almost 4X since 2000 to over $300 trillion. These exploding debts which can never be repaid will force desperate governments and leaders around the world to take desperate measures in futile attempts to shore up their countries’ finances.

RULE OF LAW AND DIRECT DEMOCRACY – A PREREQUISITE FOR SAFETY

Since physical gold (and silver) is the ultimate insurance against governments’ total mismanagement of a country’s finances, it is absolutely critical to store these precious metals in a jurisdiction with a long standing tradition of rule of law. A long history of real democracy is also essential.

Even more important is a country with Direct Democracy where capricious and fascist leaders can’t invoke emergency powers at a whim.

Switzerland is the only country in the world with a well established system of Direct Democracy, the origins of which stem from the foundation of Switzerland and Swiss democracy in 1291.

Any proposed law in Switzerland has to go through a process of review by the Cantonal governments, political parties as well as non-governmental organisations before it is passed by parliament.

Very importantly, the Swiss people has a veto-right on any new law. If 50,000 citizens sign a form demanding a referendum, such a referendum must be held. If the referendum results in a win for the people, the proposed law is cancelled.

Also, referendums on constitutional changes are mandatory.

The same rules apply also for referendums on cantonal and communal levels.

SWISS POPULAR INITIATIVES – PEOPLE POWER

There are also referendums based on Popular Initiatives. These require a list of 100,000 signatures in order to present a new law or a change in the constitution. A famous Popular Initiative was a constitutional amendment to ban the construction of new minarets in 2009. This particular Initiative won the referendum. When that happens, the text in the Initiative becomes part of the constitution and cannot be changed by the government or parliament. Only a future referendum can change it.

Thus, Switzerland has real People Power which doesn’t exist in any other country in the world in such a precise manner. It would be impossible for the Swiss government to get away with what Trudeau has just done.

THE SWISS PRESIDENCY IS MERELY CEREMONIAL

The role of President in Switzerland changes every year between the seven members of government. This role is primarily ceremonial as the president has no special powers but is First Among Equals. The President simultaneously runs his own department. The current Swiss President, Ignazio Cassis heads the Federal Department of Foreign Affairs.

FINANCIAL ASSETS ARE NOT SAFE IN CANADA

Coming back to Trudeau, as I said, his power grab in Canada could never happen in Switzerland.

It obviously follows that Switzerland’s political and constitutional system gives investors a much greater degree of safety and peace of mind – a safety which is unparalleled in the world.

It is pretty obvious that people who have bank accounts or physical gold and silver stored in Canada should really worry about the safety of their assets when a capricious leader gives himself unlimited rights to grab such assets with fascist powers.

GOLD WILL SOON BE A “MUST HAVE” ASSET

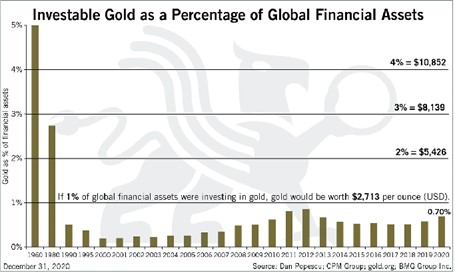

In 1960 investable gold was 5% of world financial assets and today it is between 0.5-0.7%.

Investors love for booming stock, bond and property markets has resulted in gold being a forgotten and irrelevant asset. This in spite of gold being the best performing asset class in this century with gold having outperformed the Dow (ex dividends) by a factor of 2X.

But this will soon change.

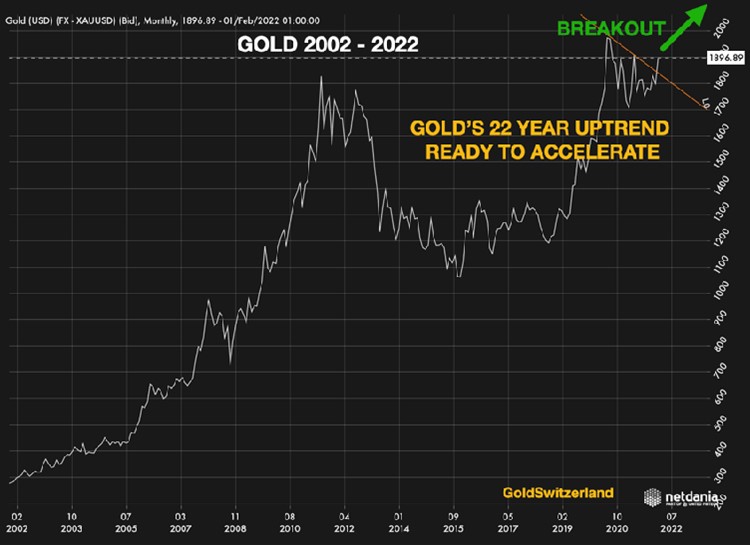

Since the August 2020 $2,075 peak, after having risen $900 in 2 years, gold has been in a long consolidation. As the chart below shows, this consolidation now seems to be finished and gold is on its way to much, MUCH higher levels.

Both fundamental and technical factors are now in full support of gold.

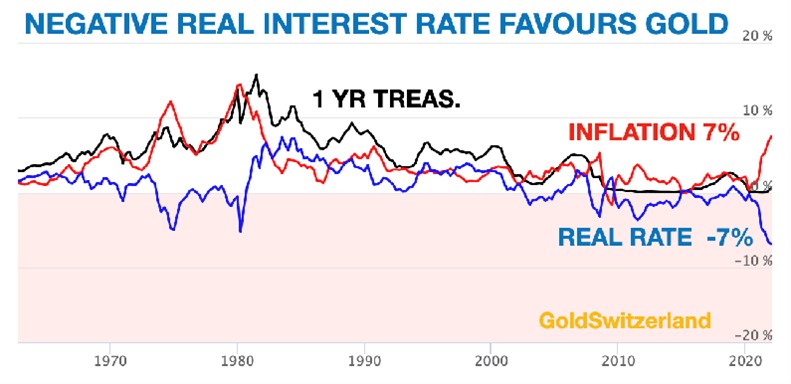

For example, the US has the highest inflation in 40 years combined with strongly negative real rates

FED CONUNDRUM

The Fed has a conundrum with the imminent crash of bubble assets and in particular the coming stock market crash. With inflation at a 40 year high and real inflation well above the published figures, any significant QE would create further inflation and also explode the already ginormous Fed balance sheet of $9 trillion, leading to a collapse of the dollar. The dollar will of course collapse whatever the Fed does but further QE at this stage will exacerbate the dollar collapse at a fast speed of knot.

FED WILL NOT SAVE STOCK MARKET INVESTORS

This time stock market investors will not be saved by the Fed and all the dip buyers will haemorrhage as any market correction will be brief when stocks crash to ever lower lows. So the Mega Manipulating Fed Wizards as I described in a previous article, will clearly fail this time!

The historical wealth destruction that I discussed in a recent article has started. Today on 22/2/22 the Dow is closing at an 8 month low.

FED WILL LOSE CONTROL OF INTEREST RATES

Another nightmare scenario for the Fed is that the interest cycle has bottomed. With a Fed debt of $9 trillion, a Federal debt of $30 trillion and total US debt of $86 trillion, the bankrupt US can ill afford any increase in rates.

What the Fed doesn’t understand, as they can never forecast anything with any degree of accuracy, is that higher and uncontrollable rates will eventually kill the US economy. Yes, the Fed will be forced to do unlimited QE to try to save the country. But this time, the new worthless dollars will also make the old dollars worth ZERO and this will be the end of another empire. No surprise of course for students of history since every empire and every currency has crashed into total oblivion.

IN PERIODS OF CRISIS GOLD HAS ALWAYS LOOKED AFTER ITS HOLDERS

Throughout history, gold has always been the asset to save people in a crisis. Since gold is the only money that has survived EVER, its superb virtues cannot be disputed.

As I have shown above, with only 0.5-0.7% of investors holding gold, almost nobody is prepared for what is coming next. And still these catastrophic events have taken place at regular intervals during thousands of years. But in spite of history people never learn and think it is different today. I suggest that rather than learning the hard way, you hold enough physical gold to protect yourself and your family against the coming cataclysm.

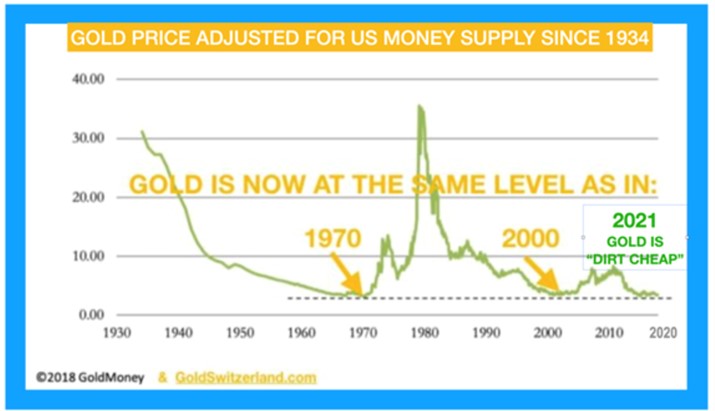

As I show in many of my articles, gold is now as cheap, in relation to US money supply, as it was in 1971 at $35 and in 2000 at $290.

As gold price is about to reflect the massive amount of money that has been created in this century as well as the tsunami of money printing coming, there will be very little time to buy gold at current levels of $1,900.

********

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and