Gold And Silver – Newton’s Third Law Is About Ready To [Over]React. Be Prepared

Our clarion call is for the physical market to soon takeover the actual price for buying and selling. When, we do not know? Timing is now less critical than actual possession, from this point forward.

The probability of a new low, in futures, may be 50-50. It was much higher, a month ago. The odds of successfully picking a bottom are remote. Not to pick on Richard Dennis, but he is a poster boy for losing big time when he tried to pick a bottom in sugar, to the extent of decimating one or a few of his funds. How hard could it have been to lose so much money buying sugar when it was under 5 cents, at the time?

The point is, never think you know more about the market than the market itself. It is for that reason we always say to follow the market’s lead. Too many try to get ahead of it, speculating that it will catch up to one’s brilliant “market timing.” Margin departments are usually the first ones to let the ego-driven speculators know that their [questionable] prescience has gotten a little more expensive, in the process.

The odds of being able to buy physical gold and silver, at current levels, diminish with each passing month. In terms of pricing for buying physical precious metals, [PMs], we are more than likely looking at the lows. The timing for buying and holding as much gold and silver as you can will not be much better than at current prices for a few generations. If anyone wants to pick a bottom in physical gold and silver, the odds are against them.

If silver were to go to $140 the ounce, will it matter if you paid $20 or $24? Same for gold.

Here is how we see it.

If there is one law that is not on any known government’s books, but one which none of them can avoid, it is Newton’s Third Law of Motion: To every action there is always an equal and opposite reaction. All government, Keynesian, and central planner idiots abuse this law profusely, and at the expense of the masses, throughout history. Every one and awhile, it catches up to them, and we stand fortunate enough to be the beneficiaries for decades suppressed prices.

Decades, we say, and not just since the 2011 highs. The New World Order, [NWO] has had marching orders for their central bankers to keep gold prices low, especially since the United States was placed into their receivership hands by Socialist Franklin Delano Roosevelt, in 1933. Price has been steadily rising, ever since, with a few upside bursts that the NWO has tried to contain. That is about to come to an end.

The fiat game has run its course. [We covered the ruse of Federal Reserve Notes, [FRNS], in last week’s commentary, [See When Precious Metals Bottom Is Irrelevant To Your Financial Health, click on http://bit.ly/12Uz4Q6, if you missed it.] We also said there is no evidence of a change in trend. That was last week. This week is different.

JP Morgan has been the recognized culprit for suppressing the paper market by naked shorting by the tens of thousands of contracts. It does not matter if others were acting in concert, the intervention was intentional: Scare everyone out of the gold and silver market. It worked, in a small part, pretty much destroying the futures market, and it failed on a grand scale by attracting world-wide pent-up demand for bargain prices!

The natural law of supply and demand has been unnaturally distorted, and the fiat buzzards are about to have their paper asses handed back to them, with their heads still up there. The final push to keep PM prices artificially low has created such a tightly coiled spring that once the pressure lets up, or is forced up, the reaction is going to push gold and silver to levels unknown that will be equal and opposite to the misplaced energy keeping them down.

Leave to central planners to convert the Law Of Supply and Demand to Unintended Consequences, once Newton’s Third Law Of Motion takes its course. The economy has been eviscerated by central bank fiat debt, Wall Street greed, all enabled and protected by the NWO’s corporate federal government. In all likelihood, things will worsen during this cleansing process, for those in power will hang on to the bitter end.

Let no one ever forget that the Fed, a privately held corporation NOT under US control, [but in total control of the US], was modeled after the Weimar banking system. The Weimar banking system was designed for one purpose and one purpose only, to enrich the bankers at the expense and destruction of the German economy. Mission accomplished.

The Weimar banking system was imported to this country in 1913, when the Federal Reserve Act, a mirror of the Weimar banking system, was passed. The privately owned federal reserve was established for one purpose and one purpose only, to enrich its owners at the expense of the US economy. “Mission accomplished,” as Bush the inept Jr would say.

None of this matters, any more. Either you see the handwriting on the wall or you do not. Can there be yet one more push to the downside in PMs? Yes. Will there be? The odds of that suicidal banker event diminish with each passing day. Do not play Russian roulette with the timing of your purchases, anymore. In fact, the Russians, [and the Chinese, and the Indians, and the Turks, and the Arabs] have been the willing beneficiaries of this blatantly stupid move by Western central bankers to scare people away from owning precious metals.

As far as the futures and their artificial prices are concerned, the bear market is starting to fray around the edges. For the first time in months, we opted to go long gold in futures. It may be just a short-term trade, but the signal to buy was clear. An update of the charts:

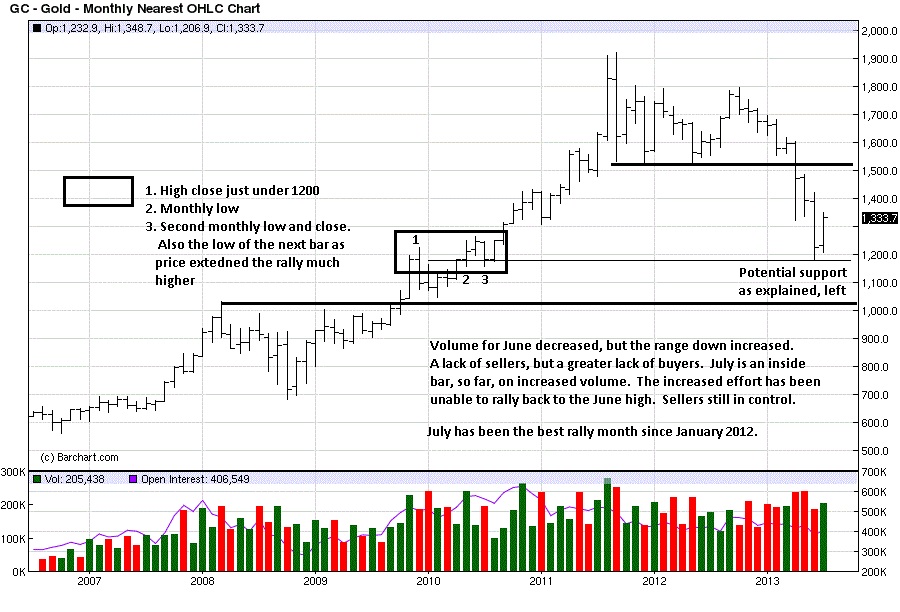

We have been aware of, but have not commented on the potential support from the level indicated by points 1, 2, and 3. Futures have not signaled a definitive bottom, but we are of the solid belief that the physical market may soon become the more accurate pricing mechanism.

There is one trading scheme that calls for a buy and hold whenever price rallies and closes at the highest level in a four-week period. That is a mechanical process, but one for which we have some degree of respect within the context of developing market activity.

It is no accident that gold was able to rally as strongly as it did , and have that rally fall in line with the 4 week higher close scheme. It is something we will continue to watch.

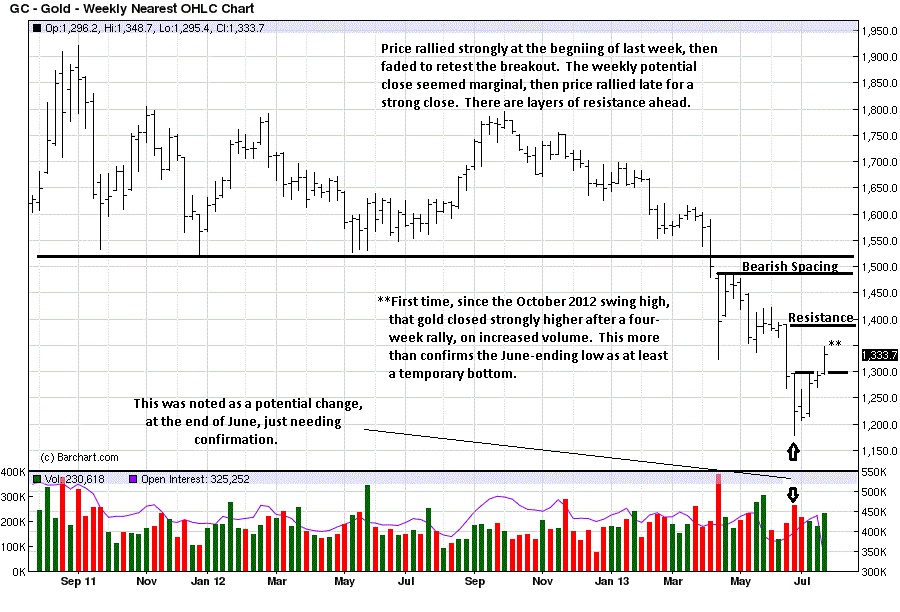

We gave advance warning of the upside potential, given confirmation, in our commentary, Purely A Mental Game Right Now. Do Not Blink, click on http://bit.ly/14fT8R0, second chart, at the end of June.

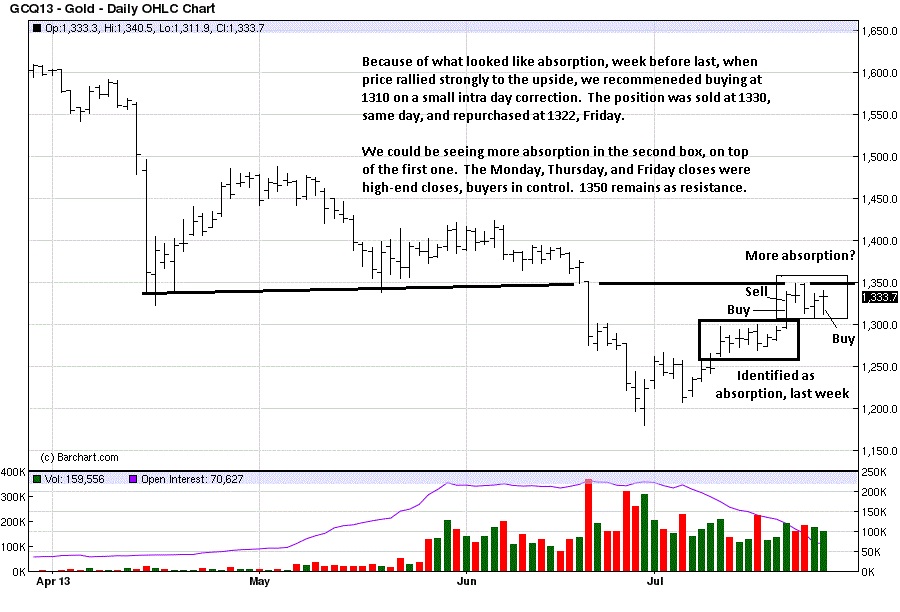

Last week’s call for buyers absorbing the effort of sellers, just under 1300 was spot on. Once price rallied above that area, it did so on strength not seen for some time in the gold market. We recommended buying, as stated in the chart comments.

It is possible that another level of absorption may be forming, in the second box. Price activity will confirm or negate that, possibly next week

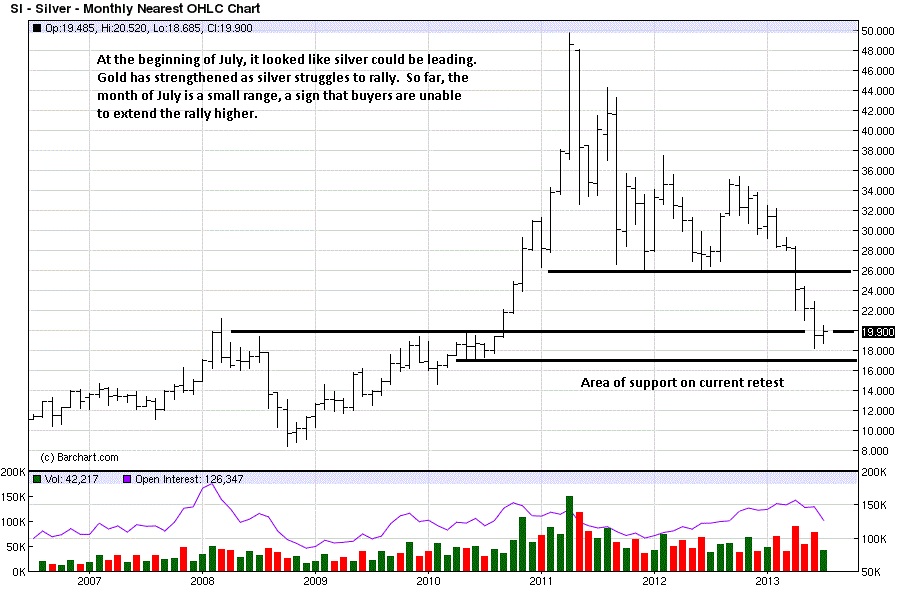

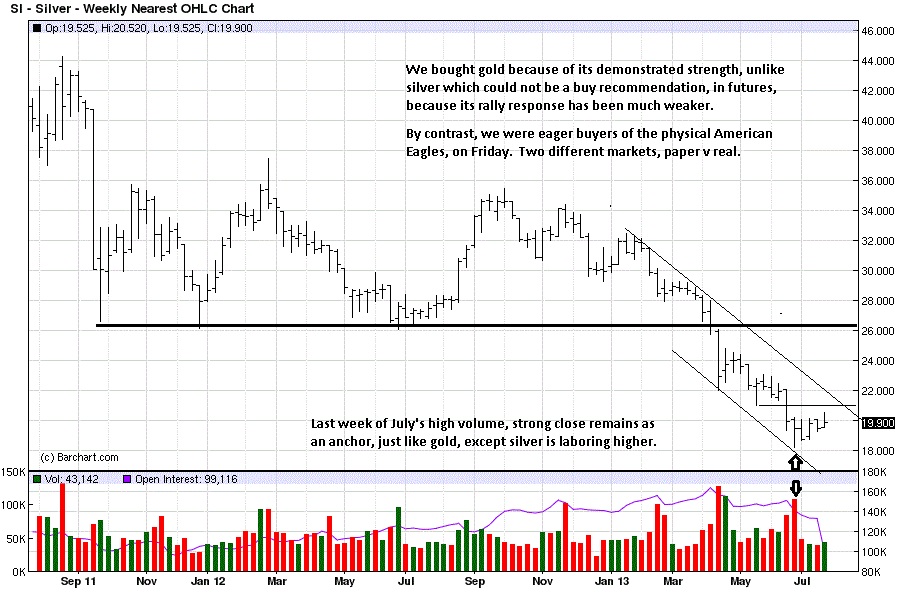

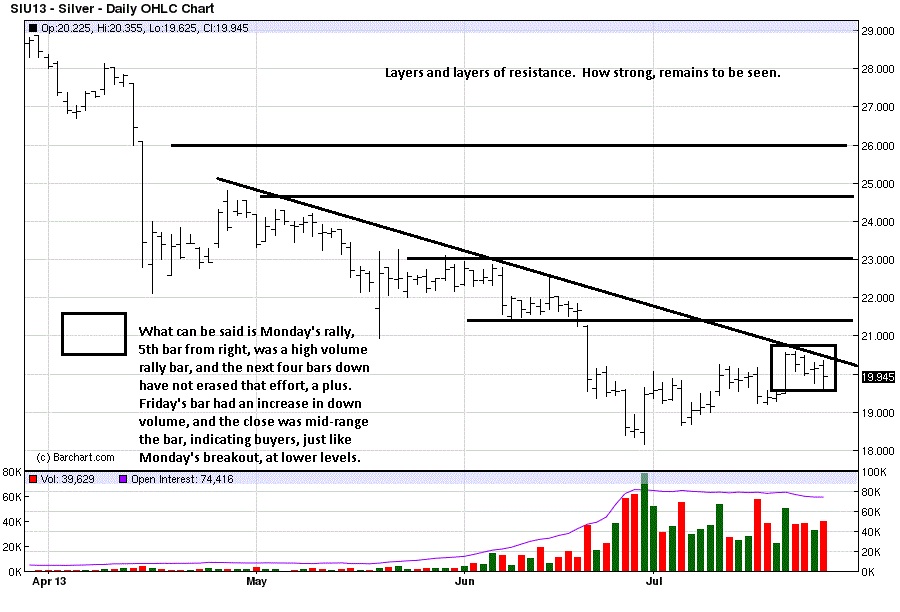

The argument for silver is not as compelling, chartwise, as explained.

It looked like silver was signaling earlier than gold, in the past month, and note was made of its high volume, strong close, at the end of June, similar to gold, http://bit.ly/14fT8R0, fourth chart, making several observations about it.

Will gold pull silver up, or will silver act as a drag on the current rally in gold? Each has to be viewed separately for decision-making purposes. Right now gold is favored, and it would be a mistake to buy silver over gold in the hopes it will catch up. Buy silver futures when developing market activity signals a buy, as occurred in gold.

The window of opportunity to buy physical gold and silver continues to narrow. Like the housing market top was known to be coming, when it came, those who waited too long regretted it. When the bottom for the physical PMs is known as a certainty, those who waited for a “better price” may also regret that decision. It is all about choice.

We choose now for buying and holding physical gold and silver. We are on the long side in gold futures, but that can change on any given day.

- See more at: http://edgetraderplus.com/market-commentaries/gold-and-silver-newtons-th...