Gold And Silver: The Range Trade

Gold is at a point where most of the horrific Corona crisis news is priced in, the US economy continues to strengthen, and not enough government handout money has been spent by Main Street to create inflation.

As I’ve been saying for several days, gold is likely to enter a range trade and stay there…

Until the risks of inflation become more of a concern for big-name money managers.

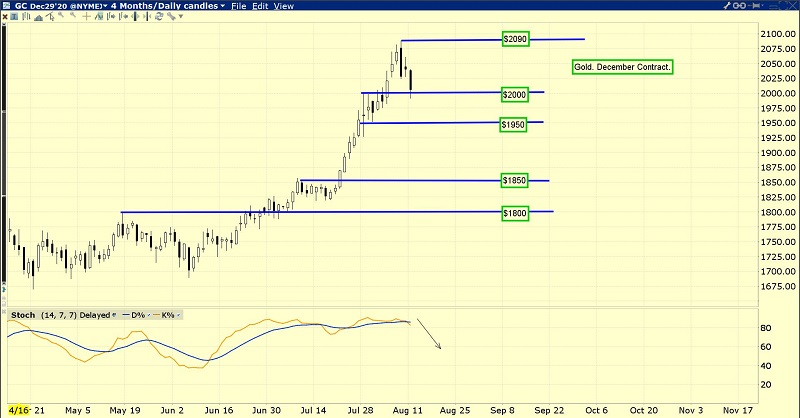

The December futures gold chart. The $2090 area is likely to mark the top of the range, and there is good support at $2000, $1950, $1850, and $1800.

Any one of these support zones could mark the low of the range.

Tactics? I’m a buyer of high carat (22 and 24) gold jewellery here and at $1950. Gold bars, coins, and ETFs can be bought on a deeper dip to $1850 and $1800.

The lower end of the range is likely to be created by Asian physical buyers. While leveraged Western hedge funds trim positions to meet margin calls, the current “price sale” will see fearless Asian power buyers move into the market.

Tactics? I’m a buyer of high carat (22 and 24) gold jewellery here, and at $1950. Gold bars, coins, and ETFs can be bought at $1850 and $1800.

It’s not as emotionally taxing to hold jewellery as it is to hold other investments in gold. Simply put, the main reason Indians have been able to accumulate so much gold is because of their focus on jewellery.

The interesting silver chart. Technically, “hi ho silver” looks much better than gold.

A Biden win in the US election would likely see enormous spending on clean energy, and that’s good news for silver price enthusiasts.

Even if he loses, the 5G systems being rolled out globally should increase demand, while mine supply growth remains modest.

Incredibly, silver could keep rallying to fresh highs even if gold dips to one of my lower support zones.

Regardless of whether the republicans or democrats win the US election, the real winners are more debt, more money printing, more spending, and more scapegoating that could become outright war mongering. All of that is great news for both gold and silver.

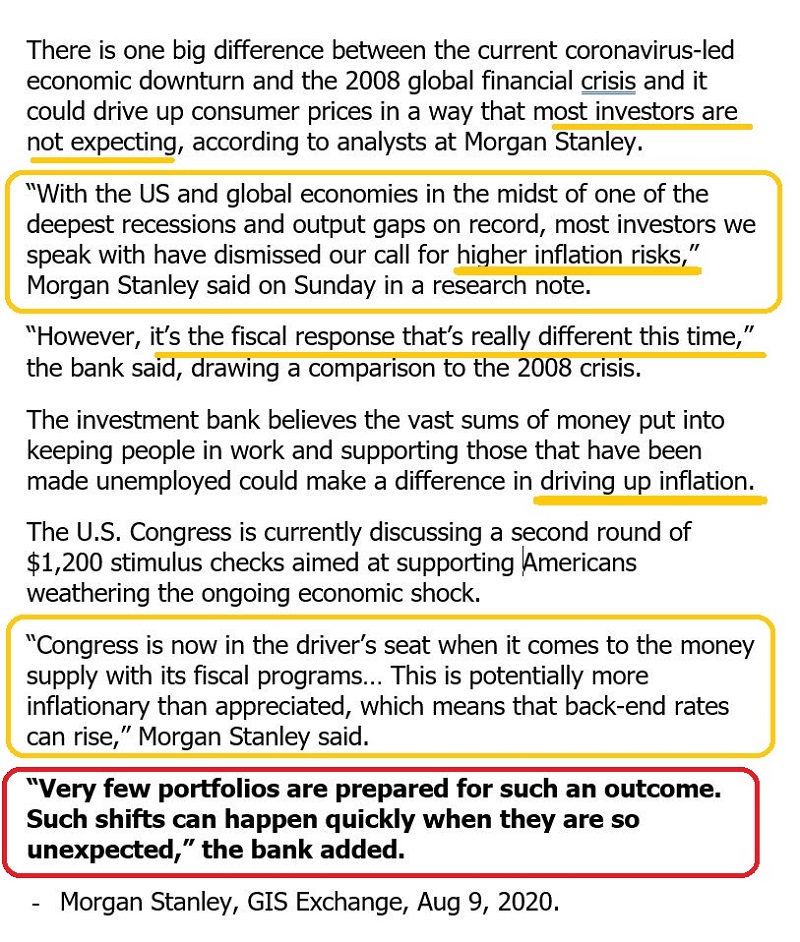

Investors need to stay focused on the big picture, which is the obsession of government with solving every crisis with scapegoating, more debt, and money printing.

This insanity is most obvious in the United States, but it’s also a global horror. Since 2008, most of the Fed’s printed money has gone to government and banks, but now it’s starting to flow to Main Street.

That will create a vicious inflationary shock, but significant investor patience is required.

The important GDX chart. Mining stock investors must stay focused on minor trend highs and lows. Almost everything else is just technical noise.

Uptrends are defined as higher minor trend highs and high minor trend lows. When the nearest low is tested and violated in an uptrend, which is happening with the $41 low price now, investors can book some profit and await a deeper pullback before rebuying.

The other strategy is to wait for the price to start making fresh minor trend highs again. Some individual miners will keep making highs if bullion and the ETFs swoon, while others will experience corrective action.

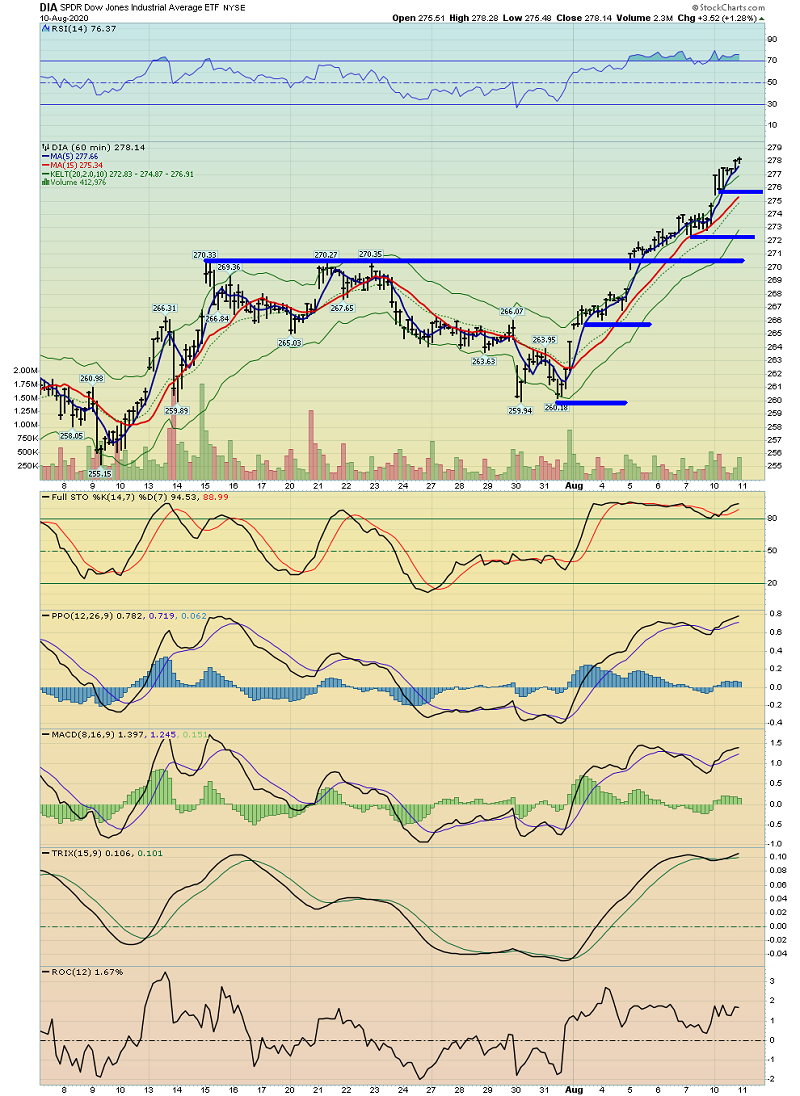

The DIA (US stock market) chart.

As real yields stabilize, temporarily ahead of inflation, the Dow is likely to crush the Nasdaq, much like silver can outperform gold. Bank stocks can also catch a bid in this environment.

The silver stocks ETF daily chart. The current uptrend is still in force as long as the $46.50 minor trend low is not violated.

A dip under $46.50 calls for profit booking and then some patience to see the uptrend re-invigorated with a fresh pattern of highs and lows. Hi, ho, silver!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Tools & Rules” report. I highlight three hot junior stocks that look set for corrective action and three that do not! Key investor tactics for each stock are included in the report.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: