Gold And Silver Reversals – Impossible Not To Notice

What a remarkable day Friday has been! Going into the U.S. session open, we have seen gold challenging its early-June highs. The barrage of geopolitical news has been deafening and gold had literally nowhere to go but up. But something “unexpected” yet totally predictable happened to those who have jumped on the gold bandwagon. Friday’s U.S. session has sent gold lower. On huge volume. And not only gold, that is. Those looking at the charts’ bigger picture, those familiar with our analyses, hadn’t been surprised. Now that the dust is settled and gold pushes lower, let’s examine the aftermath. And draw lessons for the days ahead.

Gold Reverses

Friday’s reversal was the most important development of the previous week. Initially gold rallied on Iran-related note and went on to rise to its long-term resistance. Shortly after touching the resistance line, gold topped right in the middle of the target area that we first mentioned to our subscribers on June 7, and then on June 10 within the free gold article on our website.

And it took place on huge volume.

Not only that – the RSI Indicator is very close to the 70 level and the reversal took place right before gold cyclical turning point. What else happened? Gold moved to new 2019 highs but only in intraday terms. If we focus on the closing prices, which are more important in some ways, this was gold’s third highest close of the year. From this perspective, the true high was formed in February, the early June high was a failed attempt to move above it, and we can say the same thing about Friday’s price action. In fact, Friday’s movement, was – by itself – a failed attempt to close above the early-June highs.

The combination of gold’s reaching the very long-term resistance line, the immediate invalidation of the breakout to new 2019 highs, huge volume, proximity of the cyclical turning point, and RSI almost at the 70 level all suggest that the 2019 top for gold is in.

Did we see anything similar in silver?

You bet.

Silver Reverses, Too

The white metal declined on Friday, while having temporarily outperformed gold on the upside. This is as bearish as it gets in case of the silver – gold dynamics. Big reversal on huge volume is a bearish sign for all markets, but seeing the above-mentioned specific relative performance makes it extremely bearish.

Silver is likely to move to new 2019 lows relatively soon. Perhaps even this month.

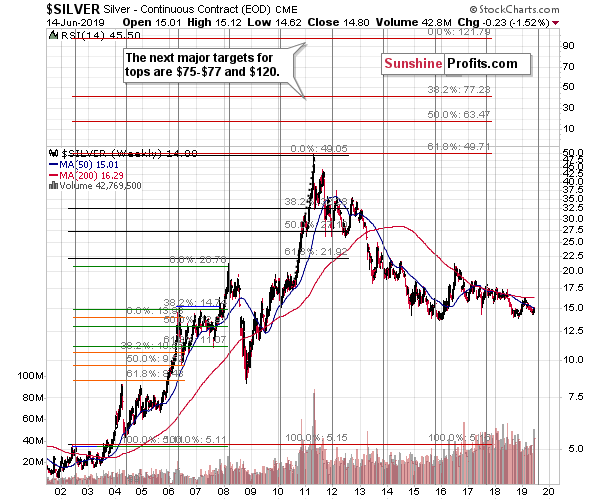

Before moving to mining stocks and the USD Index, we would like to show you a silver price prediction technique that you might not remember. After all, we previously commented on it many months ago.

The reason is that we simply don’t comment too often on the things that don’t really change. For instance, we like gold’s and silver’s fundamental picture with the long-term in mind and we expect gold to move much higher in the following years. But it doesn’t change from day to day, week to week, or even month to month, so that’s not something that we’re going to discuss very frequently.

The same is the case with silver’s very long-term cycles. This is something that is useful every 2 years or so, which means that there’s little reason to discuss it in the meantime. Now it’s a good time to get back to this topic, as the next very long-term turning point is just around the corner.

Turning points can work in both ways: they can be tops and they can be bottoms. All in all, it means that volatility is likely to increase and that something big is likely to happen. Given that silver is on a verge of breaking below the 2018 and 2015 lows, this “something big” could be a massive decline. Thus, Friday’s powerful reversal might have been the start of something epic.

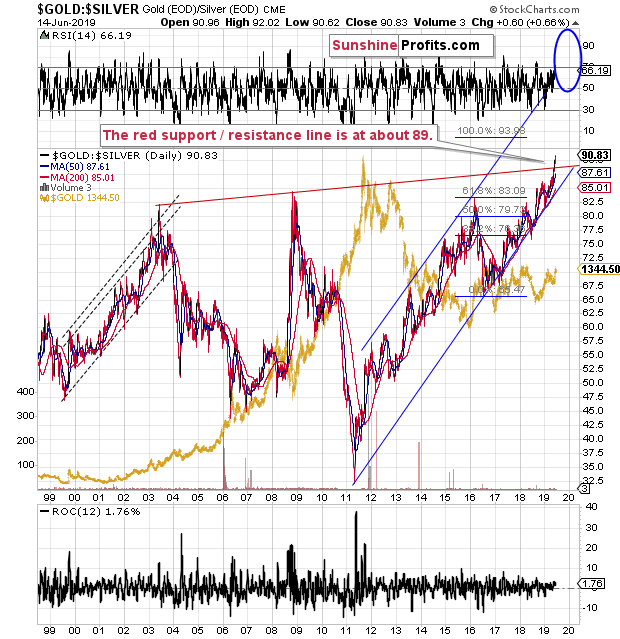

Why would silver break lower instead of rallying? For instance, because gold is topping and the gold to silver ratio is after a major breakout.

The ratio is not only well above the 2003 and 2008 highs, but also above the rising line that is based on them.

The massive moves in the precious metals market are characterized by big medium-term moves in the gold-silver ratio in the opposite direction. For instance, in 2008, the ratio soared as both precious metals declined, and in 2011, the ratio plunged when both metals rallied. The current breakout points to a big, medium-term decline in the precious metals sector. Combining this knowledge with silver and gold’s reversal and the looming silver long-term turning point suggests that we’re going to see a big decline in the price of silver in the following months, and - quite likely - weeks.

Today's article is a small sample of what our subscribers enjoy on a daily basis. They know about both the market changes and our trading position changes exactly when they happen. Apart from the above, we've also shared with them the detailed analysis of the miners and the USD Index outlook. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,