Gold Bulls Will Have To Wait

Last week was full of interesting economic data. We analyze them to show that gold bulls have to be patient. The data suggest that the US economy remains healthy. So far.

Inflationary Pressure Eases

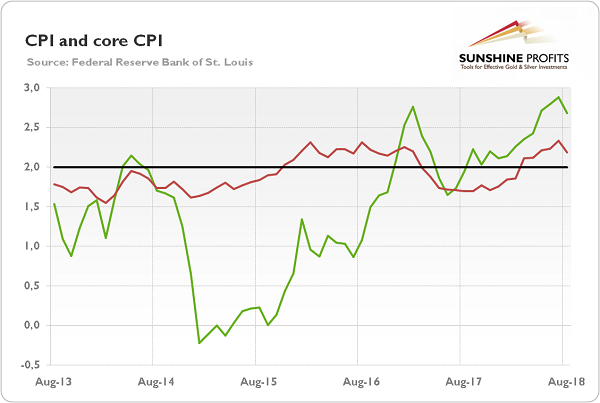

On August the 24th, 2018, we published Gold News Monitor in which we wondered whether inflation has peaked. Now, we know the answer: it indeed peaked in July. The CPI has reached 2.7 percent in August over the last 12 months, a slowdown from 2.9 percent in the previous month, as one can see in the chart below. It was the first decline in annual rate in almost a year. The yearly change in the core CPI, which excludes food and energy, also decelerated from 2.4 to 2.2 percent.

Chart 1: U.S. CPI (green line, annual % change) and core CPI (red line, annual % change) from August 2013 to August 2018.

On a monthly basis, the CPI rose 0.2 percent, the fifth straight increase. It was the same change as in July. The core index increased 0.1 percent, following 0.2-percent rise in the previous month. Overall, the inflationary pressure eased somewhat in August. However, inflation remains slightly above the Fed’s target.

Retail Sales Rise Modestly

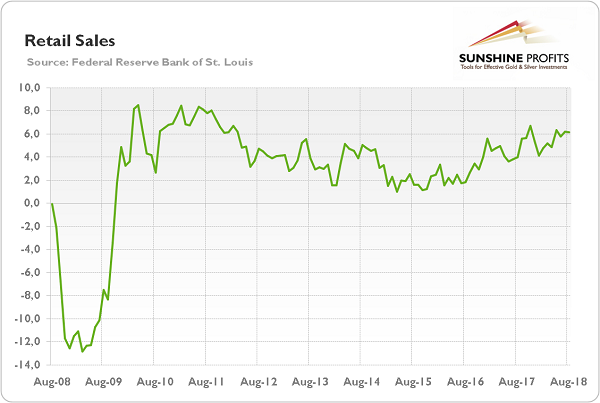

Retail sales rose only by 0.1 percent in August. However, a scant increase followed 0.7 percent jump in July, so it is understandable. Moreover, the retail sales have surged 6.6 percent over the last 12 months. The advance retail sales excluding food services jumped 6.2 percent, as the chart below shows.

Chart 2: Retail sales (advance numbers; excluding food services, annual % change) from August 2008 to August 2018.

The chart suggests that the US retail sector remains generally solid. It should not be surprising as fundamentals behind the consumer spending are positive: strong job gains, accelerating wage growth (we covered this issue last week), improving household balance sheets, and increasing wealth due to the rising asset prices.

Industrial Production Positively Surprises

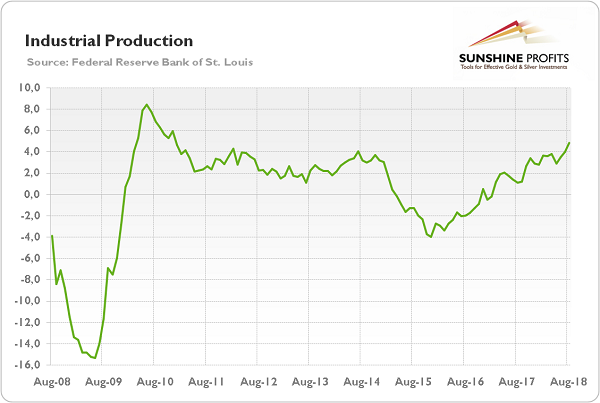

Industrial production rose 0.4 percent in August, the same as in July. It was the third straight gain, which was above the Wall Street’s expectations of 0.3-percent increase. On the annual basis, industrial production jumped 4.9 percent, the fastest change since the end of 2010, as one can see in the chart below.

Chart 3: Industrial production (annual % change) from August 2008 to August 2018.

The acceleration in industrial production suggests that – unfortunately for the gold bulls – the risk of immediate recession in the US is rather limited. What is important is that the rise in industrial production was driven by production of motor vehicles and parts, which is sensitive to the business cycle.

Implications for Gold

What does it all mean for the gold market? Well, we do not have good news. Inflation is limited and it eased somewhat in August. However, the change was not big and was generally expected. It should not alter the Fed’s policy of gradual tightening. Moreover, both the retail sales and industrial production look solid on the annual basis. As a reminder, both indices are taken into account by the NBER to determine the recession. Hence, it seems that the US economy remains healthy. As Charles Evans, Chicago Fed President, has recently said, it “is firing on all cylinders”. Gold has to still wait for its moment of glory.

How long? Well, nobody knows it for sure. For example, Roubini and Rosa forecast that by 2020 the economic stimulus will run out and the stage will be set for another downturn. If they are right, which might be the case, the gold will shine. But the current US economic data and general macroeconomic conditions are not bullishly supportive for the yellow metal.

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.