Gold: The Fog of War

Source: Truth Social

No one knows the real cause of the Great Depression. What we do know is that an economic slowdown deteriorated into a recession and then, the Great Crash morphed into the Great Depression of 1929. There were multitude of reasons given, from the Roaring Twenties bust, to the speculative market orgy, to the great industrialization of America. The absence of institutional governance also played a role, allowing greed to gain control as investment trusts—unmanageable blind pools—attracted capital in a pyramid form. Additionally, there was a glaring disparity in wealth, with the wealthiest 5% of the population owning 30% of the nation's wealth.

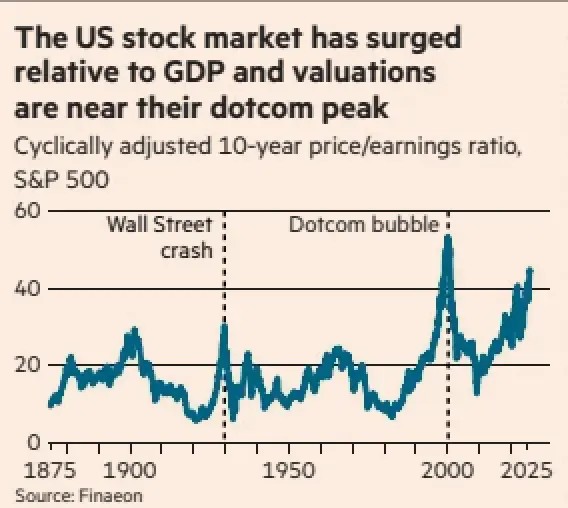

When the music stopped, those structures imploded, crushing both rich and poor alike. In the wake of the 1929 stock market crash, the Securities Exchange Commission (SEC), Federal Deposit Insurance Corporate and Federal Trade Commission (FTC) were created since so many investors lost money. The ultimate irony was the Glass-Steagall Act created in 1933, to separate commercial banking from investment banking was repealed in 1999, and the banks were a contributing factor in the 2008 financial crisis. Additionally, there is still a disproportionate concentration of wealth, with an estimated 10% of Americans with the highest incomes, controlling a staggering 50% of all consumer expenditures up from a third in the 1990s. Meanwhile the big Wall Street banks have loaned, sold and underwrote more securities to the public and, according to Gallup, 60 percent of US households have some exposure to the stock market, with about $250 trillion or 51 percent of total financial assets invested in the shadow banking sector, according to the Financial Stability Board (FSB).

Mr. Trump’s Liberation Day boosted tariffs to the highest since the Great Depression and although a full-blown trade war has not broken out, the inflationary effects were limited by a “TACO” presidential retreat, that rolled back levies but with American businesses and consumers absorbing the increased costs. That’s the good news. The bad news is that we avoided a world recession due more to the restraint of America’s trading partners in not retaliating, like the Smoot-Hawley Tariff tit-for-tat retaliation that helped cause the Great Depression. Worrisome is that Trump’s tariff blackmail on NATO allies opposed to his takeover of Greenland, undermines NATO itself, and despite another “negotiated arrangement,” bolsters the “sell America” case.

A hundred years later, can it happen again?

Wars, Wars and More Wars

World War I (1914-1918) was caused by a toxic combination of tensions including imperial rivalries between Britain, France and Germany and a divided alliance system. The spark was the assassination of Archduke Ferdinand by a Serbrian nationalist setting off a chain of events that turned a regional conflict into World War I. World War II (1939-1945) was caused by aggressive totalitarian regimes after the Treaty of Versailles crippled Germany, which paved the way for Hitler to assume power as the Great Depression destabilized democracies. The spark then was Germany’s invasion of Poland, bringing Britain and France to declare war.

The common denominator of those wars was imperialistic ambitions and of course the sinking finances of the actors. Few would give much odds for another World War and fewer another depression. However we believe that the future is as unpredictable as the president of the United States, and now like then, the combination of erosion of rules, America’s stretched finances, Trump’s imperialism and economic warfare makes for a familiar uncertain future.

To be sure, Mr. Trump’s unorthodox New Deal in Washington adds another layer of risk, ushering a new era with foreign policy geared to raw military and economic power. He has gone “all in” for economic growth, ahead of the midterms with a super expansionary fiscal policy, while waging wars of the sort of trade, currency, and now resource. Will it be enough to avoid a recession, depression or World War? In unleashing the dogs of war, Mr. Trump believes that he can reshape the world without consequences.

Unlike the period of the Great Depression, money supply continues to grow. In fact, money supply has increased every month in the last quarter, and measured year over year, grew at 4.76 percent. Since 2000 after the global financial crisis, M2 has grown by nearly 160 percent. Although Mr. Trump and Fed officials consider this growth “restrictive,” money supply is at its highest level at $22.3 trillion, fueling of course the stock market bubble and avoiding for now, a repeat of the Great Depression. However it is Mr. Trump’s fiscal indiscipline that raises risk.

We believe that we are entering a war economy paradigm with capital and supply shortages that makes borrowings more expensive, because of America’s weakened finances where they must spend $1 trillion on interest alone, more than the $900 billion spent on defense. Mr. Trump’s erratic foreign ambitions means that traditional allies cannot depend on the US and, with a deteriorating balance sheet, unpredictable foreign policy and a divided state of America, foreign investors are concerned about keeping their investments in dollars or dollar securities.

The Trump administration has dismantled the institutional foundations that once made America great and protected the nation from major economic collapse. And in testing the limits of executive powers (with little pushback), his erratic geopolitical adventures and mismanagement of economic policy, pushes government spending to the highest ever. Mr. Trump leaves the nation vulnerable, assuming ever larger risks, when this is not the time to gamble with luck. We believe Mr. Trump has brought to a close three decades as the global hegemon, and is now entering a war economy paradigm that greatly increases inflation risks, depleting America’s power in the same way that Great Britain, once the world’s leading power in the early part of the century, was destroyed by its World War I debts.

Guns and Butter has Returned, and With it, Inflation

It is not surprising that inflationary pressures are expanding globally. In fact, today’s investor exuberance is due largely to Trump’s fiscal excess as he becomes the biggest spending president in history, at a time when inflation is increasing, interest rates are suppressed and hegemonic power is shifting. In his second term, his fiscal ill-discipline includes an ambitious level of spending along with significant tax cuts from his One Big Beautiful Bill. Moreover in funding wars overseas, this president has chosen guns over butter, a repeat of the 60s era, and as before, a tipping point. Of concern Milton Friedman, notable American economist, argued that “inflation is always and everywhere a monetary phenomenon.”

Bubbles don’t deflate under their own weight. Rising interest rates and tightening financial conditions have preceded every bubble over the past century, including the Great Depression. From 1929 to 1933 deflation worsened the economic situation, reaching 10 percent in 1931 and 1932. Money supply contracted 30 percent from 1929-1933 due to the banking implosion, forcing the US off the gold standard to allow them to inflate their way out of the depression. Then in the Seventies, President Johnson’s spending on both “the Great Society” and war in Vietnam created the “Guns and Butter” era that resulted in the Great Inflation, forcing Chair Paul Volcker to hike rates to save the economy from collapse.

America’s spending problem and looming red ink is unlike anything seen in US peacetime history. Healthcare alone costs 17 percent of GDP, contributing to budget deficits of 8 percent of GDP, at a time when the economy is growing. Despite denying it, Trump’s obsession with tariffs has proved to be inflationary with inflation higher than it was during Biden’s last months in office. A war on resources has begun as a result of tariffs, upsetting supply lines and causing stockpiling, which has increased demand for all commodities at a rate not seen since World War II. Small actions often develop their own momentum. Debt stands at all-time highs of $39 trillion, heightening the risk for more inflation, made worse by the debt monetization carried out by the Fed, the same practice which led to hyperinflationary Weimar Germany in the Twenties, and war.

Yet, in celebrating daily record stock market highs, the president claims that inflation is down but in fact is higher than when he was elected. After dismissing the cost-of-living crisis as a “Democratic hoax,” Trump’s golden age has instead favoured tech billionaires, Wall Street cronies, the odd steel company and the very wealthy. On the other hand on Main Street, economic angst is so bad that the Trump administration was forced to rescind tariffs on grocery items, like beef, pasta and Brazilian coffee, in an admission that the tariffs have increased the cost of living. According to a Politico Poll, nearly half of Americans find groceries, utility bills, health care, housing and transportation difficult to afford, hurting Trump’s popularity and it has been estimated that Trump’s tariffs will cost the average household $1,200. According to the Lawrence Berkley-led analysis, electricity prices have increased by 23% between 2019 and 2024, further driving up inflation. Since then, the amount of electricity has increased by 6.9% in the 12 months leading up to the end of November 2025. Already Fed governor Stephen Miran, a Trump ally has said that “phantom inflation” has distorted the inflation picture. Such is the concern that there are even fissures among the president’s MAGA followers, doubting the president’s promise to lower prices. Two different worlds.

Affordability is a big problem for Mr. Trump, and today that reality has come home to roost, important because the November midterm elections which controls both chambers of Congress will be up for grabs this year. After all, consumers are America's lifeblood, which is problematic when the jobless rate is 4.4 percent—higher than it was during the president's first term. With inventories exhausted, the impact of Trump’s tariffs are only now beginning to be felt as the logistic sectors of rails, ports and freight are now recording significant declines in shipments. It is inflation that will be the Trump administration’s Achilles heel.

Simply the US is in a fiscal mess. America’s unsustainable deficit of 8 percent of GDP will head higher because Mr. Trump thinks that he can grow out of the problem. However, America's gross debt to GDP ratio is already 125%, making it the world's greatest debtor at about $39 trillion. Bigger deficits mean hotter growth but also tighter monetary policy. As a result, there has been an overt attack on the independence of the Fed and attempts to change Fed Chair Jay Powell, before more supplicant members are appointed to the board this year. It is all about power. Mr. Trump who controls all levels of government, now wants to control the Federal Reserve, no matter what the law says. That power would allow him to print as much money as he wants and by lowering interest rates, money would be free again – and so would inflation.

And since the Fed also oversees the banking system, Mr. Trump would get control of his own piggy bank and the banking system. No need for the Chinese or Canadians to buy Treasuries, just print more. Of concern is that sharp interest rate cuts when inflation is running above target, would fuel higher inflation, causing a rush out of dollar assets. The Fed’s independence is thus a red line, a key part of the stability of the dollar. Nonetheless whatever happens, inflation and borrowing costs are set to go much higher, notwithstanding the Trump’s administration’s convoluted financial gymnastics that erodes trust in America’s institutions. History shows that when inflation rears its head, stocks and bonds will fall.

The Art of The Deal

The president also plays fast and loose with the law creating enormous legal uncertainties. Under his tenure, the Justice Department has been decimated as he ignores legal judgments by the Courts, defies Congress and his “pay for play” is a policy carried throughout each department. Courts have ruled that the president’s deployment of the National Guard in the nation’s capital and other cities is illegal. Yet federal troops are still deployed on city streets. The Supreme Court will soon rule on the legality of Trump’s usage of emergency authority, which covers roughly half of the $200 billion in IEEPA tariffs collected to date. Already American companies like Costco have sued for billions of dollars of refunds and, not surprisingly the White House has contingent workarounds, but the outcome will become a legal mess (US vs US). The US has long been considered a nation of laws. What happens if those laws are ignored?

The president once boasted, "Trade wars are good and easy to win." Not when his tariffs had a domino effect at home, costing American farmers, companies, and consumers billions or even trillions of dollars. Tariffs have impacted US manufacturing but not the way the Trump administration planned. Rather than tariffs produce a “made in US” manufacturing boom, they are a bust as the Institute for Supply Management reported that activity was down for the ninth consecutive month in November, as more than 50,000 manufacturing jobs were lost. Job creation is at a standstill.

The main problem is that America is at the brink of an implosion from the long-standing imbalances in the US financial system. US debt to GDP sits at the highest since World War II and the deficits need to be financed. Mr. Trump’s radical policies have tipped the scales with wars everywhere from a trade war, currency war and now wars on the continent and Middle East. Moreover the president wants a 50 percent increase in defense spending to $1.5 trillion while being the largest debtor in the world. There is no margin for error on the fiscal side because America First, is America alone.

In perverse circular fashion, Trump will hand out $12 billion in farm-aid to farmers, a key segment of the president’s base, who face steep losses because of tariffs. Those payments are supposed to come from tariffs, which is interesting because much of the pain comes from these tariffs. However since the United States has dropped tariffs on China, revenues are negligible. In his first term, Trump bailed out farmers for about $23 billion to compensate for the damaging Chinese boycott which deepened the fiscal hole. And a year ago, Congress passed yet another $10 billion bailout package. All in all, the bailouts are a band-aid and only cover 25 percent of farmers’ losses. No wonder farm bankruptcies were up 50 percent in the first half of last year. The auto industry too received tariff relief allowing deductions on car loans. The president’s policy illiteracy includes promising everyone a $2,000 tariff rebate (after the $5,000 DOGE dividend), which is the proverbial “chicken in every pot” promise, in recognition that his tariffs are causing more economic pain at home than abroad. Neither has yet to been paid.

Might Makes Right

Amid the clamor of the media’s obsession over the end of democracy or Trump’s brutish ways, few note or refuse to accept the new reality of “might makes right” or “guns over butter.” Trump promised change – and it took two terms to hit his stride. After all, Russia’s invasion of Ukraine while meeting universal condemnation still rages on, despite ineffective sanctions, universal handwringing, and diplomacy built around endless negotiations. This president is a serial disrupter and there is nothing yet to stop him. Conventions, traditions and laws are not guardrails for this president. Rules? This president makes up his own rules, ignores others, and there is no opposition, only sounds of silence. Where does this all lead?

Unfortunately, history tells us the answers. Protests? Demonstration, op-eds and other media handwringing have not changed Trump’s agenda one iota. Lawsuits? Some of the top law firms now provide legal help to the federal government pro-bono. Universities? They caved in years ago when threats of ending their funding forced dean resignations and U-turns in departments. Congress? They too have been silent, amid a universal sound of silence. The reality is there are no consequences, guardrails nor a Congress to reign in this president’s impulses. In a New York Times article, Mr. Trump believes that only he, is the arbiter of any limits to his authority, not treaties nor international law.

And what of the guardrail of the separation of powers between the federal government and states set out in the Constitution? Trump’s Venezuelan adventure without Congressional votes creates more uncertainty, increasing risk both abroad and at home, particularly when he leaves the rest of Maduro’s repressive regime in power. Mr. Trump has increased his presidential powers at the expense of a dysfunctional Congress and now wages a battle between the federal government and the states over everything from control of the country’s power grid, AI, immigration and policing powers. The president has resurrected long-standing differences, threatening to invoke the 19th century Insurrection Act to deploy federal troops in certain states, thereby exposing the faultlines and different cultures between the blue and red states, which could have serious long-term consequences, including war at home. America is at war, with itself.

PAX Americana

Mr. Trump’s world view is through the lens of a 19th century expansionist Monroe doctrine that asserts a distinct US sphere of influence in the Western hemisphere. The president uses soft and sometimes selective hard power to promote US interests, including the takeover of Venezuela for oil that American oil companies do not want. Unfortunately, his attempt to “make America great again” ratchets up the risks of a World War III, in an attempt to reverse America’s industrial and economic decline.

Although the US remains central to the world order, the world has shifted to a multipolar order, accelerated by Mr. Trump’s isolationist policy, unraveling global integration and even its rules. In a move that further isolates the United States, the US skipped the G20 meeting in South Africa, abrogated the Paris climate accord, suspended US foreign aid and withdrew from scores of international groups and agencies of which most were affiliated with the United Nations. In issuing a modern-day version of the Monroe Doctrine of 1823 that asserts US primacy in the Americas, he shifts foreign policy, placing the Western Hemisphere at the top of America’s priorities. The Trump Corollary’s distain of Europe’s cultural and religious differences are seen as threats, not strengths, reinforcing well-worn disputes over defense spending, immigration and climate change. On Greenland, the president is turning US allies into China’s or Russia’s friends. Mr. Trump’s world view envisages a world carved into great power spheres of influence by peer players-US (Western Hemisphere), Russia (Europe) and China (Asia), with each master of their respective domain, creating more friction than stability. Of concern is that this modern day “law of the jungle,” elevates former foes and places economics and trade at the center of the relationship, undercuts allies and partners.

In erecting a wall around the US, the US risks replicating Britain’s ill-fated Brexit move that severed relations with Europe, leaving a much-reduced GDP with investment off 18 percent, according to a recent US study. The Trump Corollary is not altogether consistent. It states that America does not wish to dominate and must invest in economics, energy, military, technology and finance, but puzzling because of his fixation to annex Greenland, on the other side of the world which threatens NATO’s Article 5 itself. Trump’s usage of Teddy Roosevelt’s “police power,” a modern-day form of gunboat diplomacy also raises profound questions about international law and constitutional law, that bypasses Congress. After America’s failures at regime change in Iraq, Afghanistan, and Libya, Venezuela is fraught with risk. Trump’s doctrine to “run” Venezuela could create another Haitian problem in his backyard, where paramilitaries and violent actors rule the country. In prioritizing the Western Hemisphere for Latin America’s resources and right-wing allies, Canada for now appears to be left out of Trump’s 19th century-like doctrine.

Foreign policy is increasingly merged with the President’s private commercial interests. The dealmaker’s common denominator of what’s in it for the US, is a form of “tribute” or “golden share,” and for the Trump family’s private interests, a subtle form of “pay for play”. The administration argues that Mr. Trump’s transactional dealing benefits the American people. Being president has its privileges. The president’s crypto ventures made the first family another billion. Yet, in both politics and business, Mr. Trump’s world is one without restrictions. Everything is for sale, including integrity.

China, Forging A New World

Although US/Chinese imports fell 20 percent from a year earlier, China as an innovation powerhouse has found new markets to replace America. As a result, China achieved a record $1.2 trillion trade surplus last year, with rising exports to Europe, Latin America, Southeast Asia, and Africa. Simply China is not dependent on America for security nor markets, and its manufacturing dominance gives it more options to bypass US with workarounds, exposing how much America is reliant on China. By comparison, US exports grew 3 percent in August to $259.3 billion which was mostly due to dealers moving gold shipments overseas, highlighting the folly of Trump’s trade war. Not so lucky are others like the EU, who were asked to do more burden-sharing or lose the American defense umbrella. And despite Mr. Trump declaring multiple trade deals, only 15 have been signed.

Decoupling may have been a goal but Trump has discovered that both economies are integrated closely. As a result there is more of a mercantile relationship yet both remain cautious, keeping sanctions and some tariffs in place. Trump is getting his summit in the Spring and China can now import those prized H200 chips, helping its artificial intelligence buildout, but only after paying a 25 percent “royalty” to the government. The common denominator of course is money. On energy however, America’s takeover of Venezuela disrupts an important source of heavy crude once backed by $60 billion of Chinese loans. Trump’s blatant grab of Venezuelan oil will cost tens of billions to resurrect and escalates tensions with China, just when the US was working on a détente.

Almost two thirds of the US economy is devoted to consumer spending and only 10 percent to exports, resulting in an imbalance between manufacturing and services. Manufacturing accounts for only 16 percent of US GDP, as opposed to 70 percent for services. Trump is spending billions maybe trillions to close the gap, ironically emulating a form of Chinese-style state capitalism. In the race to beat China, US tech spent almost $400 billion on AI related infrastructure, while China will spend $100 billion preferring a simpler lower-cost open-source alternative, that produced the revolutionary “DeepSeek” chip in its pursuit of tech self-reliance.

What Mr. Trump misses is that the processing of the majority of critical minerals and other commodities is done in China, not at home. China today dominates the rare earth supply chain, accounting for 70 percent of mining of minerals, 90 percent of processing and 93 percent of rare earth magnet manufacturing. Tariffs, sanctions or bluster won’t close the gap because the US is dependent upon China for 74 percent of rare earths. China has leveraged this advantage by expanding its flagship infrastructure Belt and Road Initiative (BRI), financing megaprojects and green power with 150 countries. In the looming war for resources, it is China’s processing dominance of critical minerals, global manufacturing and importantly, holder of US debt that gives it the ultimate weapon in a currency or resource war.

And China is not the only country with leverage. Canada has stood up to America’s bullying and the stars and stripes are not yet flying over Ottawa. Canada is the largest exporter of oil to the US while providing electricity, copper and aluminum needed by the Americans. Canadians have a goods deficit with the US and are the largest buyers of American vehicles, machinery and food, but tariffs have slowed purchases. Although within the Western Hemisphere, America’s threats to scrap USMCA and indifference to Canada and its resources, prompted a pivot towards China, and more investment. Canada can’t replace the US as its principal trading partner but needs to move outside the US orbit. After all, a rapprochement with China opens a market of $1.4 billion consumers, serves as a creditable alternative to our unpredictable neighbour to the south and doesn’t want to make Canada its 23rd province.

The Great Monetary Debasement

Trust erodes when governance is transactional rather than principled. Mr. Trump’s efforts to opt for economic growth at all cost undermines confidence, trust and safety in the US dollar, which fell almost 10 percent last year against a basket of currencies. It is a slippery slope. Just as his trade policies are a rupture from decades of established practices, his foreign policy with a predatory mercantile bias, does not share the values or loyalties needed for a transnational worldview. As an example of his newfound capitalist agenda, the US military umbrella extended for Europe has strings attached, forcing Germany to approve a whopping $59 billion of largely American weaponry. Meanwhile Italy too is pushing the defense spending envelope to 3.5 percent of GDP by 2035. That alone pushes public debt above 145 percent of GDP as the world moves to a wartime economy, with fortified supply chains of semiconductors, rare earths and weaponry. For some it is just the price of sovereignty.

Today Donald Trump is using both fiscal and monetary policy to spur growth, at the expense of America’s stretched finances, resulting in $2 trillion deficits as far as the eye can see. America already relies on foreign savings to sustain its large and growing deficits, with Europe alone owning $8 trillion of US bonds and equities. He has even enlisted Wall Street's leveraged trading tactics of private and hedge players to help finance the growing deficits, increasing the possibility of a debt mountain avalanche through the use of derivatives of mass destruction. Widespread leverage, loose regulation, and derivatives contributed to the sub-prime bubble that finally burst in the late 2000s, plunging the country into a severe recession. Today, Mr. Trump’s growth at all cost has led to excess liquidity sloshing into the casino-like stock markets, resurrecting sky-high valuations and “animal spirits”. Almost a century ago the same monetary accommodation and rampant speculation led to the bubble whose bursting triggered the Great Depression. If the Fed becomes another political tool, artificially suppressed rates and currency devaluation will only deepen America’s problem, and generate more inflation and hurt consumers, the backbone of the US economy. Déjà vu.

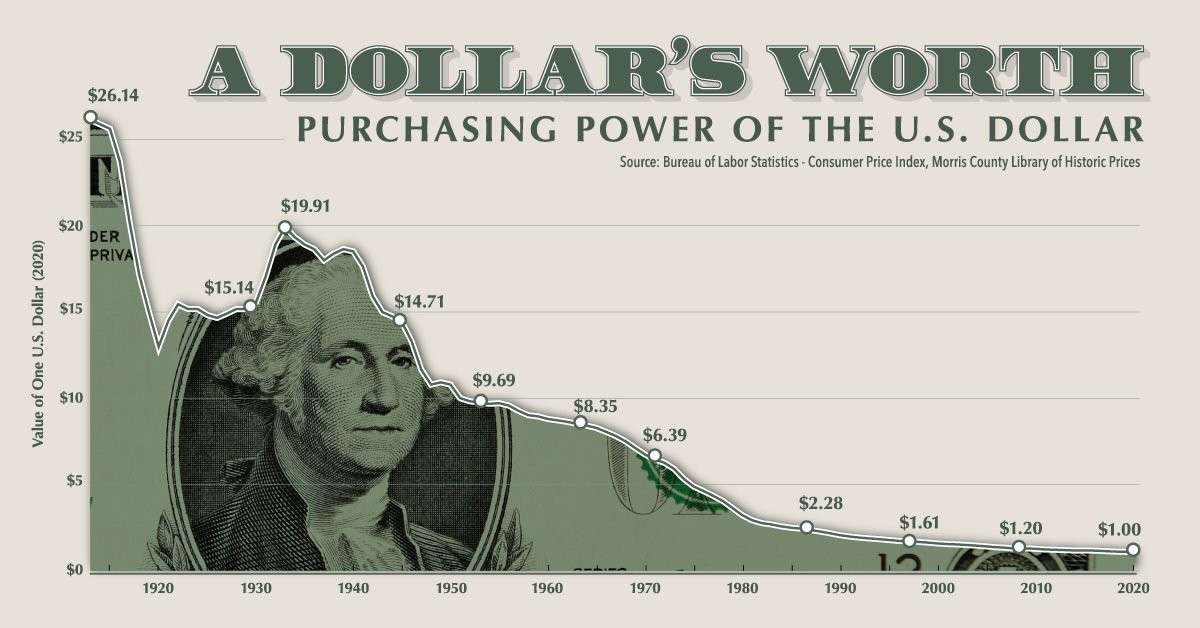

Historically money had value, backed sometimes by gold and even silver during the US civil war. In China, silver too was a monetary metal. That changed when politicians opted for paper currencies because it could be printed without discipline. Today a risk premium is developing for US assets, causing some to hedge their bets. Mr. Trump wants a weaker dollar. He better be careful what he wishes for, as the dumping of Treasuries would force interest rates sharply higher, create contagion and maybe a depression. America’s deficits must be financed, yet foreigners are balking as the US debases their currency to fund their deficits. Crypto won’t fill the gap. Trust in US assets is melting away fast. America consumes much more than it produces and owes abroad much more than it owns. China and others hold a lot of US debt in the form of Treasuries and Donald Trump’s unpredictable moves and dedollarization damages confidence in the US financial system. Since capital is mobile, a “sell America” dollar depreciation would accelerate the erosion of the post-1945 Bretton Woods order. History may echo but never repeats. Each time is different. With fewer friends today, America is not too big to fail.

The Best Trump Trade Is Gold

Gold reserves are now more crucial than ever, especially since Washington has become erratic and untrustworthy. The US dollar now makes up less than 40 percent of global currency reserves, the lowest in two decades. Gold has become the second largest international currency after the dollar, outperforming equities, bonds, and even bitcoin last year. China has reduced its US Treasury holdings from $1.3 billion in 2013 to a paltry $689 billion, while its gold reserves have tripled since 2020. China has bought gold for 13 consecutive months at the expense of the depreciating dollar. In the absence of a dollar alternative, gold is a central banker’s best option as a reserve asset. In addition to central bank buyers, asset managers, retail investors and now crypto players have also become big buyers of gold bullion. After all, the best Trump trade is gold.

Source: factoryfitnesscenter.com

Central banks purchased more than 1,000 tonnes annually, or 25 percent of global supplies over the past three years, in an effort to diversify away from the US dollar as geopolitical risks dominated the global outlook. Gold surged 70 percent since Mr. Trump took office, topping $5,000/oz. Central banks are expected to continue increasing their reserves since many of the factors behind the chart-topping rally remains intact. Gold has become precious, in fact a critical mineral. Noteworthy the BRICS 10-country partnership which has emerged as a counterweight to the West, has rapidly increased their gold holdings as part of a dedollarization drive, increasing holdings by 102 percent since 2020. The group also established a precious metal exchange with Beijing that allows the exchange of gold and other precious metals. China is the largest producer and consumer of gold and holds almost 10 percent of its reserves with the Shanghai Gold Exchange (SGE) becoming the largest physical gold player in the world.

Meantime another money alternative, bitcoin, fell 34% to $90,000. Governments are considering creating cybercurrencies because of the challenges of funding their deficits. Cybercurrencies’ value depends on selling it at a higher price to others. Unlike gold which has a limited supply, cyber has no limits in creation, which can be duplicated with the click of a computer, raising security issues. One of the newer cybercoins are stablecoins, tokens pegged to assets such as the US dollar or US Treasury bills. This digital asset is being viewed as an alternate solution to finance the enormous US Treasury debt. Congress introduced the “Genius Act” regulating stablecoins but close analysis of the act shows that much of the so-called deposits are not short-term Treasury bills, but alternatives. In reality, Peter is paying Paul with this "substitute" for cash. US Treasury Secretary Bessent estimates that stablecoins could grow from $300 billion to $3 trillion by 2030. Today the largest stablecoin is Tether, USDt, a US token backed by US Treasury bills with over 500 million users. Tether recently launched Tether Gold which purchases gold in becoming the largest private holder. Yet Tether is not regulated and the company has yet to provide a full audit of its reserves. Tether is opaque, handy because drug smugglers, criminals and money launderers are big users. The foundation of money is trust. With the US dollar losing investor trust, will Tether help regain that trust?

Gold Is a Critical Mineral

Silver too has gone parabolic, hitting $94 per ounce on increased demand from electric cars and computing chips. A key driver though is China, which produces 65 percent of the world’s silver, recently imposed export controls in yet another reaction to tariffs, that caused a scramble for physical supplies, ending an arbitrage between the west. The move also caused stockpiling on fears of new tariffs squeezing an already tight physical market. CME’s Comex consequently imposed $25,000 margin requirements per future contract, reminiscent of the Hunt brothers short squeeze in 1980. This time the margin boost aggravated an already acute shortage of physical supplies, hurting the big Wall Street players. Silver like gold will head higher.

Having reached our $5,000/oz target, we continue to expect higher prices for gold and the next stop is $6,000/oz, but not the peak. Gold is a timeless store of value and lately an index of currency fears, an alternative to the dollar. Driving factors include continued currency debasement as Americans continue to live beyond their means. Geopolitical uncertainties in a world where uncertainty has become the norm has pushed up physical demand, led this time by sovereign governments, central banks and private equity funds. Surprisingly gold shares remain under-owned and unloved. Gold mines are cheap with most AISC between $1,500/oz to $1,600/oz, thus generating record profits with gold averaging $4,100/oz in Q4.

The problem however is the industry is not replacing declining reserves. Simply the industry has not found enough gold. Consequently M&A activity was hot last year and a wave of activity is expected to reshape an industry with depleting reserves. Buying rather than building offers more value, given the lengthy time to bring production on stream. Only now are dollars being spent on exploration, the lifeblood of discoveries.

Today the market is valuing reserves in the ground at about $2,000/oz and there are some producers ahead of themselves. Others are cheap, trading at discounts. Consequently selectivity is important and we suggest a list of developers who earlier discovered gold deposits, outlined reserves, derisked projects and need only financing. Grade will be important so we expect producer costs to rise as some bring on lower grade ounces to boost production. Another group we advocate are those producers with increasing reserve profiles, since both investors and companies are expected to value more highly reserves in the ground. In that category we believe there is attractive upside potential with B2Gold, Endeavour Mining, Barrick and Eldorado Gold as their in situ reserves become increasingly valuable. Despite the starting gun fired last year, gold share’s bull market has only just begun.

Recommendations

Agnico Eagle Mines Ltd.

Agnico Eagle Mines topped the $100 billion market cap and is the largest Canadian gold producer with 11 mines in Canada, Finland, Mexico and Australia. In Nunavut, the miner represents 25 percent of GDP which will grow when Hope Bay comes on stream. Agnico produced 3.4 million ounces last year and will grow organically for the next couple years with five brownfield pipeline projects including Odyssey underground at Canadian Malartic, Upper Beaver, Detour, San Nicolas and Hope Bay. Agnico has effective zero debt, strong management and attractive growth prospects. Agnico should produce 3.4 million ounces this year at AISC at $1,300/oz and we continue to like Agnico Eagle here.

Barrick Mining Corp.

Barrick reached a deal with the Mali government that resulted in the return of Tier 1 asset Loulo-Gounkoto in exchange for higher royalties and tax agreement. Barrick also decided to monetize the Nevada Gold Mines (NGM) joint venture (Carlin, Cortez and Turquoise Ridge), the largest gold complex in the world because Barrick management believes that the parts are worth more than the whole. Ironically, while much attention was paid to the North American assets, it is the geographically risky assets which generate huge cash flow and are undervalued. A spinoff would reflect an upward revision and comes after Elliott Investment Management, a hedge fund took a $1 billion position in Barrick. With Mark Bristow gone, the company is expected to be more aggressive under John Thornton long time Chair. Meantime Barrick's Fourmile gold project is a key asset and under the joint venture agreement with Newmont, Fourmile is a Tier 1 asset with potential to produce more than 500,000 oz/year at AISC under $800/oz. Reserves are believed to be about 25 million ounces at a rich 15 g/t. Following the release of a feasibility study and valuation of Fourmile, the mine could be vended into the JV. We believe the move creates a number of potential accretive opportunities since in any potential spinoff, there is also the big Pueblo Viejo mine in the joint venture. We like Barrick here.

B2Gold Corp.

B2Gold’s Goose Mine in Nunavut came on stream at an excellent time with improved contributions from the Fekola Complex in Mali, Masbate in the Philippines and Otjikoto in Namibia. Goose’s average grade is about 6.82 g/t, among the highest in Canada. Goose is a combination open pit and underground mine and a company builder expected to produce about 300,000 oz/year. B2Gold is expanding Fekola Region which should produce 180,000 oz/year. A construction decision is expected at Antelope nearby Otjikoto to produce 65,000 oz/year. Gramalote in Columbia is expected to add about 227,000 oz/year in the first five years. B2Gold also maintains an extensive junior portfolio including stakes in Snowline, Founders and Prospector Metals. We like B2Gold shares for its growing production profile.

Centerra Gold Inc.

The Canadian based mid-tier producer has a great balance sheet but has been unsuccessful in its quest for a flagship asset after losing Kumtor in the Kyrgyz Republic. The producer has taken positions in a slew of juniors including Dryden Gold Corp. on hopes that acorns will grow into big trees. Centerra’s main producer is the Mt. Milligan copper/gold mine in BC and Öksüt in Türkiye. Centerra’s PFS confirms a phased $180 million outlay to extend Mt. Milligan’s life for another 10 years. Centerra continues to spend money restarting Thompson Creek’s moly operation and Langeloth facility in the US, but we think they are pouring good money after bad money. Öksüt meantime has a short life. Goldfield is an early development play with a modest resource in Nevada. The Kemess PEA restart however, in Toodoggone BC could be a factor producing 170,000 ounces annually but near term, the Street is paying very little for the mothballed producer. Nonetheless, the shares are cheap.

Eldorado Gold Corp.

Mid-tier producer Eldorado will have a strong quarter with contributions from Lamaque in Québec, Kışladağ in Türkiye and the big Skouries copper/gold project in Greece reached 90 percent completion which is coming on at a good time with first con expected in the current quarter and full commercial production for midyear. Olympias processing will be expanded by 30 percent. Eldorado has P+P gold reserves of 12.5 million ounces and production is expected to grow from 660,000 ounces this year to 720,000 ounces in 2027. We like the shares for growth over the next 3 years.

Endeavour Mining PLC

London-based Endeavour Mining shares have performed well despite operating in West Africa, a difficult jurisdiction. Endeavour is the largest gold producer in West Africa with an array of Tier 1 assets. Unlike others the company has been able to operate with the respective governments. Endeavour is a solid cash flow machine with a rising production profile. Noteworthy is that Luxenberg-based La Mancha is the largest shareholder and recently reduced its holding after Endeavour’s shares tripled. La Mancha is controlled by Egypt’s Sawaris family which will still hold a stake of more than 10 percent. Endeavour’s Sabodala-Massawa BIOX Expansion in Senegal performed well and Assafou in Côte d’Ivoire could be in production in second half of 2028. Houndé in Burkina Faso production was down. Endeavour acquired Egypt’s largest mine Centamin in 2019 which is a solid contributor. We continue to recommend Endeavour here.

IAMGOLD Corp.

IAMGOLD shares have performed well as Côté Gold came on stream reaching nameplate throughput in a timely quarter. Head grade was 1.18 g/t with AISC at $1,600/oz. Essakane in Burkina Faso contributed but Westwood in Québec continues to disappoint with AISC at $2,800/oz in Q3. Essakane has a short mine life with three remaining pits. Generating robust cash flow, IAMGOLD’s task is to paydown debt and improve its balance sheet. IAMGOLD acquired Northern Superior and Orbec on hopes of combining Nelligan and Monster Lake in a “hub and spoke” operation, with a central processing facility. However the project is in its early days. We prefer Eldorado here.

Kinross Gold Corp.

Senior producer Kinross has begun construction extending lives of three mature projects, Round Mountain Phase X, Bald Mountain (Redbird 2), and Kettle River in Washington which extends the lives adding about 400,000 GEO annually between 2029 and 2031 at AISC of $1,650/oz. The projects will be funded from existing robust cash flows, cost about $1.5 billion and at current price, provide a quick payback under 2 years. Phase X (3 g/t) extends Round Mountain life since the open pit runs out of ore and at Kettle River (5.8 g/t), the higher gold price allows restart of the mill to process underground ore about 40km away. Great Bear in Ontario is still years away from production. We prefer B2Gold here for upside potential.

Lundin Gold Inc.

Lundin Gold produced about 500,000 ounces from its flagship mine, Fruta del Norte (FDN) mine in Ecuador. Production surpassed guidance and is one of the world’s richest gold mines which should produce about 525,000 ounces at AISC of $1,150/oz based on average throughput of 5500 TPD. The company expects to bring on satellite deposits this year with an aggressive exploration programme, spending about $85 million following up three porphyry discoveries, Trancaloma, Castillo and Bonza Sur near FDN’s main workings. We continue to recommend the shares here.

Newmont Corp.

The world’s largest gold producer produced 6 million ounces. Costs continue to rise, a task left for new president Natascha Viljoen to fix. Ahafo North came on stream, leaving two projects in its organic pipeline. Growth is another problem as Natascha’s task will be to manage a diverse portfolio, rising costs and management as Newmont discovered that bigness is not always best. Other priorities are the balance sheet and allocating cash flows efficiently, a task that past management was poor at. We prefer Barrick here.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/.