Gold Forecast: ‘80s Or ‘90s All Over Again?

Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In the previous weeks we’ve been featuring multiple factors that are likely to result in lower gold, silver, and mining stock values in the following months. The very recent downswing is likely just the beginning of what’s to come. There are even more signals that point to this direction, though. There’s one more similarity to the past that we would like to discuss. It’s not something that is as important as the analogy to mid-90s, because the latter is confirmed by not only gold but the rest of the precious metals sector and the USD Index, but it’s quite important anyway.

One of the famous technical analysis sayings is that time is more important than price – when the time comes, the price will reverse. This means that making gold predictions with regard to time is more important than making gold predictions with regard to prices. There is definitely some truth to it. For instance, when silver outperforms gold close to a cyclical turning point, it’s difficult to say how high it will go, but it’s relatively easy to correctly estimate that this move is going to be short-lived.

The analogy in terms of time that we would like to discuss was featured in this article, and we will describe it in the long-story-short format below.

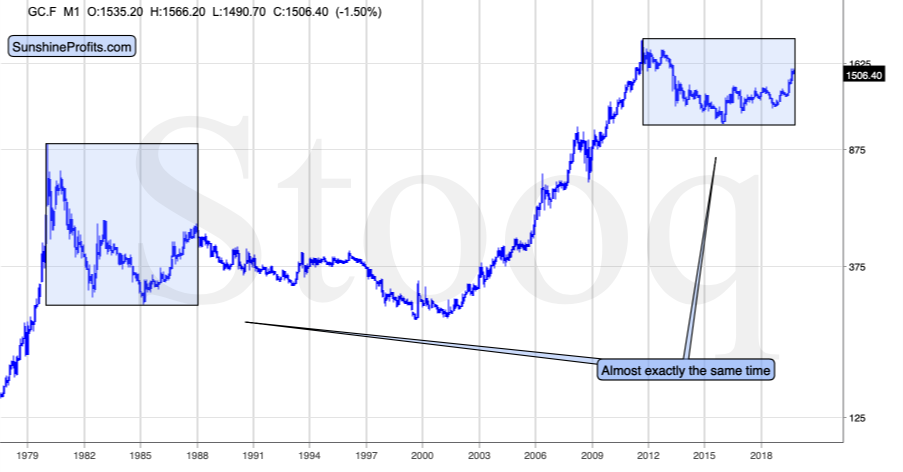

There was only one case from the past decades that was similar to the 2011 price spike in gold – the 1980 high. Consequently, it’s natural to check for similarities behind these tops. After all, the history tends to repeat itself. The similarity that we would like to emphasize here is that the current top formed in close tune with what happened in the late 80s.

Gold topped in January 1980 and it also topped in December 1987. That’s almost 8 years between these tops.

Gold topped in August 2011 and it also topped in August 2019. That’s exactly 8 years between these tops.

The decline that started in 1987 lasted over a decade. And it took almost 20 years for gold to come back above the 1987 high. There are many people that are invested in the gold market in the long run, but not many of them would be invested in it, if they knew that they have to wait over 15 years to realize any profits.

Now, we are not saying that gold will decline for as long as it did in 80s and 90s. In fact, it’s more likely that gold’s decline will be even sharper than what we saw in the second half of the 90s due to USD’s upcoming powerful rally. However, we are saying that being “long and strong” and patiently waiting for gold to rally once again might be a very costly decision here. And that’s regardless of what any CoT data would show in the meantime.

Also, let’s keep in mind that the decline is likely to be much worse in case of the mining stocks, just like it was the case in the late 90s.

Our August 19th comments on them remain up-to-date:

It's not easy to compare the two periods, because the most popular proxies for the mining stocks that we have right now (HUI Index and the GDX ETF were not available at that time). The HUI Index was launched on March 15, 1996, so a bit after the top in gold.

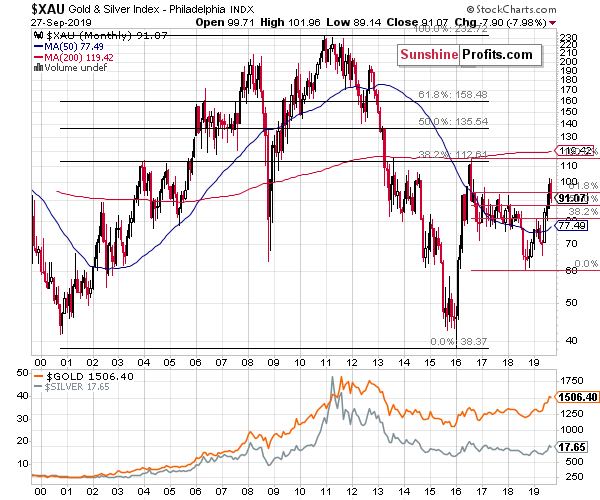

Fortunately, there are other proxies that we could use. The XAU Index for instance, has been around since January 1979 (interestingly, both were launched close to the major tops, and let's keep in mind that SLV ETF's launch marked a major top in silver as well).

The Index topped close to the previous major high (1987), but not at or above it.

Right now, the XAU Index topped relatively lower, but in a somewhat similar manner. The recent top formed a bit above 100, which is above the 61.8% Fibonacci retracement level. The high has therefore formed below the previous (2016) high but not at or above it.

And what happened next in the XAU Index in the 90s? The XAU Index topped a bit above 150 and then it declined to about 65, taking a bit more than 2 years to do so. It finally bottomed below 42 in 2000. It moved below the previous extreme low. Applying the same to the current situation suggests a move to about 30. Yes, it can happen, and it already did.

While we won't be able to check what the HUI Index did before 1996 as it wasn't trading yet, we can see how big the decline was in case of this particular index. The Index was launched at 200, a bit after the top, so the price at the top would have likely been a bit higher. The final bottom formed with the HUI at 35.31.

The most recent high was about 237, which might have been very close to the HUI's price at gold's February 1996 top, had it been trading at that time. Consequently, if the decline was to repeat itself, the target of 40 or so is not out of the question. Before dismissing it as impossible, please note that this kind of decline had already happened. And that’s definitely not something one wants to wait out while holding on to the long-term investments.

Summary

Summing up, the big decline in the precious metals sector appears to be finally underway. Once the USD Index takes off, it will likely serve as fuel to the fire-like decline. Let’s keep in mind that taking the big investment picture into account, out of the following: gold, silver, gold stocks, silver stocks, the recent upswing was visible only in case of gold. Most of the precious metals’ portfolio: silver, gold miners, and silver miners suggest that what we saw in the last several months is nothing more than a corrective upswing within a bigger downtrend.

We know that these are not pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months, but what’s profitable is rarely the thing that feels good initially. Forecasting higher gold prices without a bigger decline first is likely to be misleading. There will most likely be times when gold is trading well above the 2011 highs, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,