Gold Forecast: The Dollar Shines Brighter in the Summer Sun

It looks like the USDX tripped a bit during the hike, but we shouldn’t worry – history shows that the USD can reach the highest peaks in the summer.

It looks like the USDX tripped a bit during the hike, but we shouldn’t worry – history shows that the USD can reach the highest peaks in the summer.

Let’s start with the charts. What’s going on with the USD Index?

The U.S. currency moved slightly lower yesterday. It’s also slightly lower in today’s pre-market trading, but it’s not low enough to change anything on the technical front. The USD Index was at the 38.2% Fibonacci retracement after its short-term bottom, and it’s in the same place today as well. If it had moved below this threshold, it would change (only a little, but still) something, but since the USDX remains above this level, nothing changed.

And if the USD Index declines below the 38.2% Fibonacci retracement, it’s likely to find support just a little lower – at its 50% retracement, which coincides with the support provided by the previous lows.

What’s more, let’s take a look at the recent move higher in the value of the linear correlation coefficient between gold and the USD Index (bottom part of the chart). There were a few similar periods when it rallied and gold moved higher as well. I marked those cases with vertical dashed lines. In all three cases, it was right before gold turned south and declined in a quite profound manner. In one case (Sep. 2020), gold moved back and forth for several days before declining, but it then declined significantly anyway. The implications for gold and the rest of the precious metals sector are bearish.

The fact that the USD Index tends to start major rallies after small declines in the middle of the year also plays an important, bullish role. I marked that with vertical, red, dashed lines below.

Consequently, the impact on the precious metals sector is likely to be very negative rather sooner than later.

Gold moved higher by a few dollars yesterday, and it moved lower by a few dollars in today’s pre-market trading. Interestingly, while yesterday’s USD-gold link was normal, as the USDX declined (so it was normal for gold to move higher), today’s move lower in the gold price happened along with a small move lower in the USDX, which is bearish for the former.

Consequently, my yesterday’s comments on the above chart remain up-to-date:

Gold is demonstrating its early-2021 deception – back then, the yellow metal moved slightly above its previous highs following its initial collapse. And with the yellow metal correcting roughly 50% of its decline once again this time around (marked with purple rectangles), the price action is completely normal within the context of a medium-term downswing. Thus, while cooler heads have prevailed in July – following the yellow metal’s steep drawdown in June – a decline to the March lows (roughly $1,670) is likely the next stop along the bearish journey.

Mining Stocks and Silver

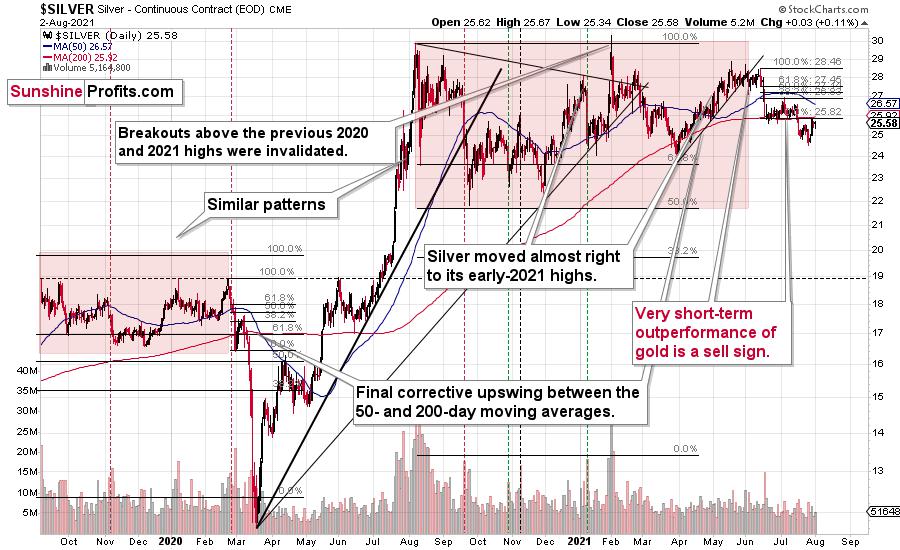

The situation in silver didn’t change either.

The white metal moved higher by just 3 cents, and it’s lower in today’s pre-market trading. It seems that the breakdown below the June lows was verified, as the silver price was unable to break back above them. Consequently, the next big move is likely to be to the downside.

As far as mining stocks are concerned, I wrote about the key long-term developments yesterday. Namely, the situation in the HUI Index continues to develop just as it developed in 2008 and 2012-2013. The implications are extremely bearish for the following months.

On a short-term basis, the GDX (seniors) and the GDXJ (junior miners) continue to consolidate, and with the RSI at the levels that previously triggered short-term reversals, it seems that it won’t take long for the miners to resume their downward path.

Being closest to their yearly lows, junior mining stocks continue to be the weakest part of the precious metals sector. Consequently, it seems that when the PMs decline, it will be the junior miners that will be affected most significantly.

Summary

To summarize, it seems that the bigger corrective upswing in gold might already be over and that we won’t have to wait for the current small correction to end either. While the next few days may (!) bring temporarily higher prices, it’s unlikely that they will hold. In particular, just as mining stocks had local corrections that didn’t change the nature of the huge medium-term declines in 2008 and 2012-2013, it’s unlikely that the current local correction will change anything.

And as silver often moves in close relation to the yellow metal, when gold falls, Silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,