Gold Forecast For The Next Year

Where will gold price be tomorrow, next week, next month, and next year? These are all questions that we are being asked on a regular basis. There are quite a few gold trading techniques that allow us to make predictions, but they often can be applied to only a specific term. For instance, silver’s outperformance is generally a bearish sign for the short term, but it doesn’t necessarily have any implications for the long run. In today’s analysis, we’ll feature our prediction regarding the price of gold for the following year, and we will use two technical techniques, and one general rule to back it up. There are multiple other factors pointing to much lower gold prices, but we want to focus on those that provide the exact target price.

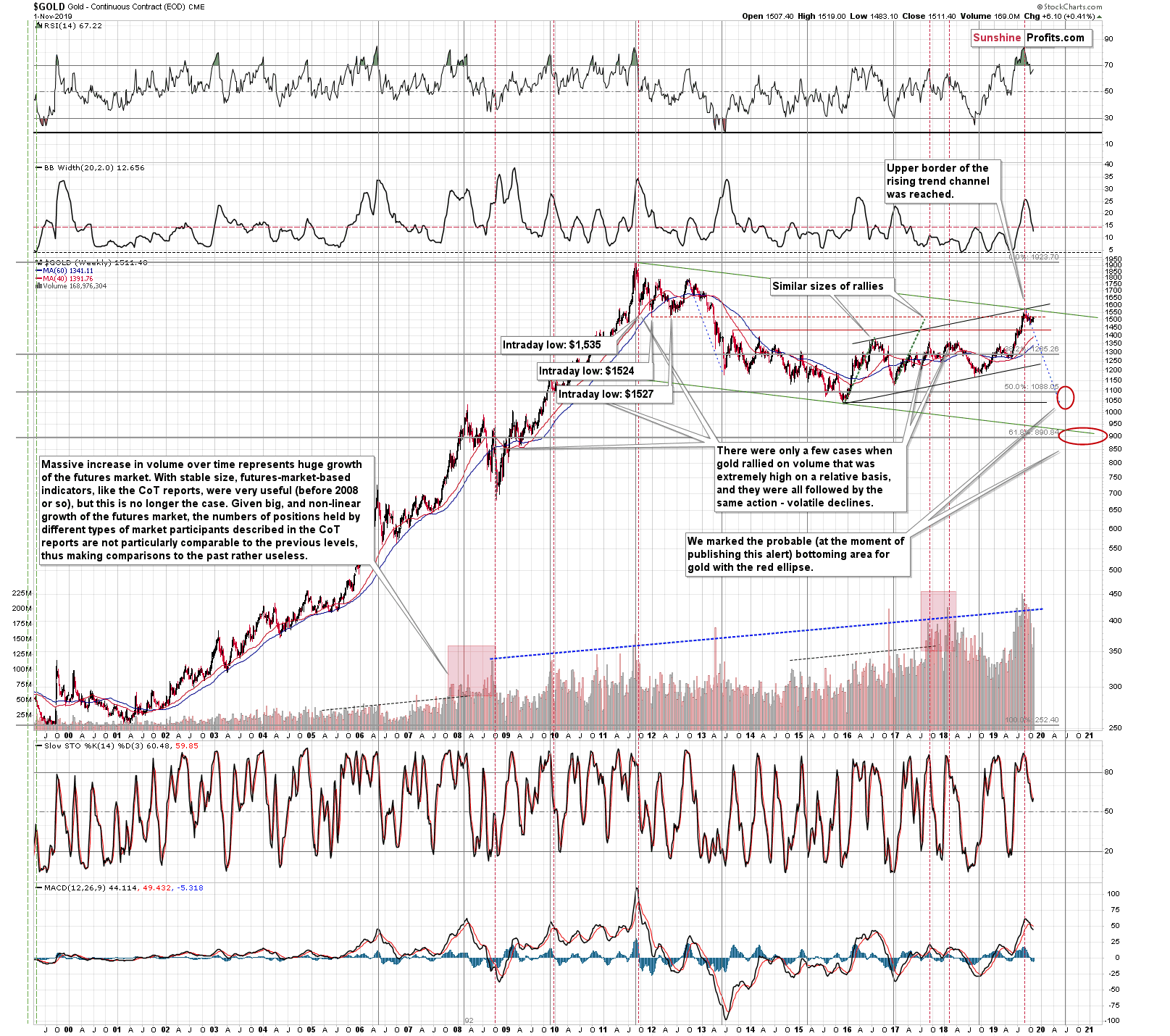

Let’s start with the bottom line – based on the data that we have right now, in our view, it’s likely that gold will fall to about $890 before starting a really strong and sustainable rally. Please take a look at the below chart for details.

In short, the $890 level is the combination of two critical support levels, and one additional fact. The supports are:

- the 61.8% Fibonacci retracement level (the most classic retracement) based on the entire bull market

- the lower border of the declining trend channel based on the 2011 high, the most recent high and the 2015 low

The former is more precise as – unlike the declining support line – this price doesn’t depend on time. The 61.8% is the most classic of all Fibonacci Retracements and – as a general rule – the more profound the price extremes on which the retracement is based, the more important the support that the latter provides. Since it’s hard to come up with a more profound price extremes than the start and the end of the biggest long-term upswing of the previous few decades, it’s only natural to expect this key retracement to serve as very strong support.

As you can see on the above gold chart, there is also another interim target that might be reached before gold declines to $890 and that’s about $1,050 – more or less where gold bottomed in late 2015. This level provides strong support on its own, but it’s a relatively good interim target because of also another factor – the analogy to the way gold declined in 2012 and 2013. The history tends to repeat itself after all, and if gold is about to slide in a major way, it might as well slide in a way that’s similar to how gold had already declined in the past.

The key question is… Why would gold want to decline at all? After all, it’s been rallying quite profoundly in the previous months and its already considerably higher than it was just a few years ago.

The answer to this question also answers a different question – why would gold decline below the 2015 bottom instead of rallying from higher levels?

The key detail is that back in 2015 gold was not hated enough for this to be THE bottom. People were relatively optimistic, we saw comments of gold analysts and gold promoters, we saw the outcome of the online polls, we saw our own e-mail inbox. There was neither major panic, nor hate toward gold. Gold was not loathed in the mass media. That's all what we should see at THE bottom and we didn't. Gold simply didn't get low enough. Now, gold breaking below $1,000 (which also means a visible breakdown below the 2015 bottom) is something that should trigger panic selling and make people hate it. That's the environment in which the true bottom is likely to form and the time to back up the truck with the precious metals. Consequently, for now, the greatest opportunity lies in making the most of the upcoming slide.

Summary

Summing up, it seems that the corrective medium-term upswing that we saw this years in gold is over and that the yellow metal's big decline is already underway (and that it had started in August as we had written previously). The big decline is likely to be bigger than many think as back in 2015 gold was not hated enough to be forming a true bottom. While gold is unlikely to stay below the 2015 low for long, it’s likely to move visibly below it in terms of price. It is only after this bottom that gold’s profound and sustainable rally is likely to begin.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis and stay updated on the articles that are normally not available to 99%+ investors, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up now.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,