Gold Forecast From The Non-USD Point Of View

In our previous article, we told you about a shocking analogy in gold stocks and what it implies for the following months for gold and the rest of the precious metals sector. Of course, gold stocks are not the only part of the precious metals market that practically “screams” that one should prepare for much lower gold and silver prices. Today, we’re going to look at what everyone looks but from an angle that’s known to just a few. Namely, in today’s analysis, we’re going to discuss gold’s performance in terms of the European currencies. Let’s start with the key European currency – the euro.

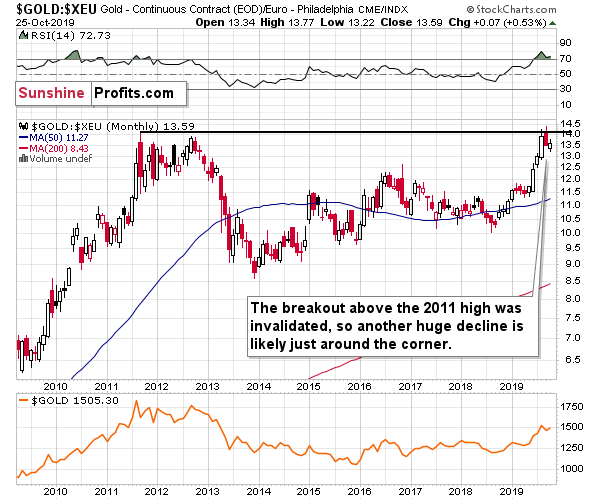

Gold priced in the euro moved a bit higher this month, but this move is relatively insignificant. It’s only a bit more than half of a percent. It didn’t change the implications of the September decline.

The September slide was important not only because it was the largest monthly decline of this year. It was crucial because during this month, gold broke above its 2011 high and then invalidated this move by closing well below it. Breakouts are signs of strength, but they are clear only after a given move is confirmed. Breakouts confirmation is necessary, because markets can move based on emotions that are so strong that the price gets way ahead of itself. This happens when buyers win over sellers despite the latter being stronger. Simply put, for a period of time, buyers are very determined to keep on buying, while the sellers are hesitating. This may cause the price to break above certain resistance levels that would normally remain unbroken.

This seems to have been the case with gold in terms of the euro. How can we tell that we saw this kind of reaction and not a true sign of strength? Because gold didn’t manage to stay at the elevated levels for long. The emotional reactions can be very strong, but they are often temporary – just like the brightest flame that burns quickest. Once all was said and done, gold reversed and plunged back below the 2011 high. The price was not ready to break above this important level, proving that the buyers were not as strong as they appeared. They were only temporarily more determined.

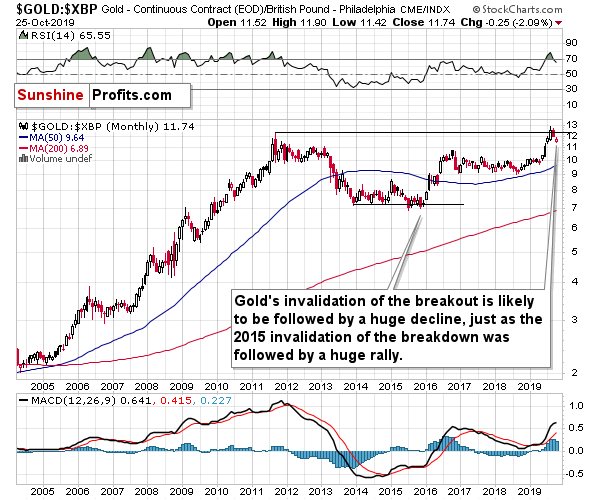

Those who use the British pound to buy gold reacted in the same way. The buyers’ strength was enormous, but temporary. The failed attempt to break above the previous highs proved that the market is not yet ready for much higher prices.

The key point about these failed attempts is that after we see one, it’s immediately obvious that the strength of a given market – here: gold – was much lower than it appeared. It is thus an immediate sell signal. In fact, invalidations of gold’s (or silver’s or miners’) breakouts are one of the most clear bearish gold trading tips. The moves that we are discussing and the price extreme that was almost broken are both significant, so the weight of the sell signal is important as well.

What does it mean? It means that gold is likely to slide in the following months in terms of both the euro and the British pound. The odds are that if gold slides in terms of these two currencies, it will slide in terms of the U.S. dollar as well, quite likely to an even greater extent.

Summary

Summing up, it seems that the corrective upswing in gold is over and that the yellow metal's big decline is already underway (and that it had started in August as we had written previously). The invalidation of breakout above the 2011 high in terms of the euro and in terms of the British pound confirms the bearish outlook.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months, but what’s profitable is rarely the thing that feels good initially. Predicting a rally in gold without a bigger decline first is likely to be misleading. There will most likely be times when gold is trading well above the 2011 highs, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up now.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,