Gold Forecast: How to Become Strong After a Massive Decline? Ask Gold Miners!

Gold, silver, and miners declined heavily in the past weeks, but it seems that they got too low, too fast, and now a quick rebound seems very likely.

On Friday, junior gold miners once again refused to decline below the $30 level, indicating that a rally was probable, which added to the list of bullish signals for the short term.

Interestingly, junior miners are now the strongest part of the precious metals sector (at least among its popular parts).

Junior miners (the GDXJ ETF) are the only ones of the above that just closed above their early-July lows. Senior miners (the GDX ETF) are only a little below their own early-July low, but gold (GLD) and silver (SLV) are much below their respective early-July lows.

Why would junior miners be so strong right now? One simple reason – because they had been so weak in the previous weeks. It’s not only a given market that usually (it’s almost always the case) doesn’t go up or down without periodic corrections, but one market’s relative performance to other markets.

So, what we see here, is not necessarily a reflection of junior miners’ “true strength,” but it’s just that since they have fallen the most, they are now bouncing more visibly. That’s likely it. Still, it seems that choosing junior mining stocks as a proxy for our current long position was a good idea.

Either way, the above chart provides us with one additional important detail.

The thing is that the GDXJ closed on Friday just a little below its declining short-term resistance line. The previous attempt to rally above it was invalidated, but given their relative strength, the recent reversals (one formed on huge volume), and the fact that GDXJ was quick to invalidate a tiny breakdown below $30, all suggest that a move higher is just around the corner.

In fact, looking at GDXJ’s performance in today’s early London trading, it seems very likely that it will be able to break above the above-mentioned declining resistance line this time.

Gold and silver futures are both up in today’s pre-market trading as well, and so is the general stock market. At the same time, the USD Index is down.

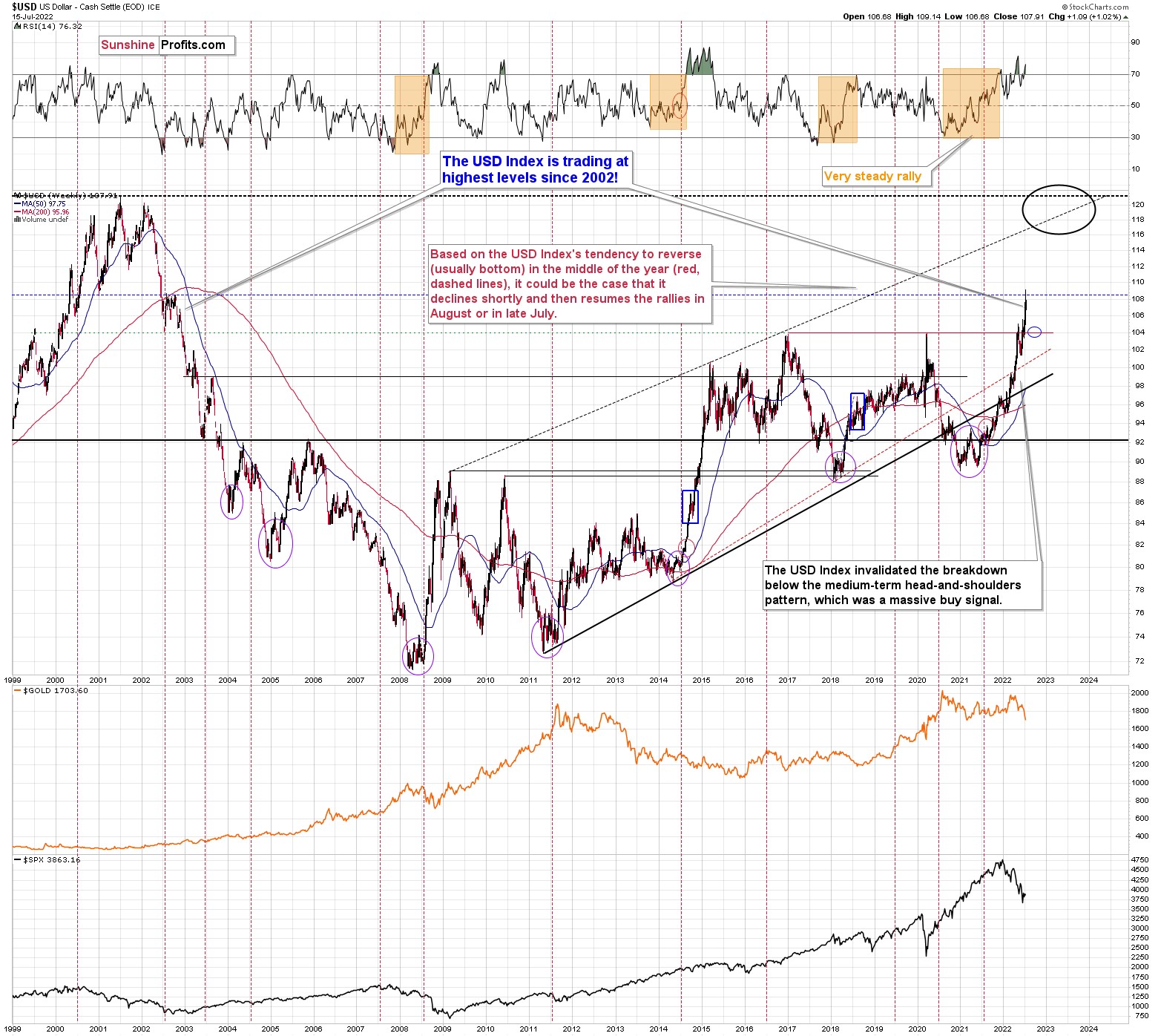

This is in perfect tune with what I wrote previously – the USDX reversed in a big way recently while reaching its long-term resistance.

Consequently, my previous comments on the above chart remain up-to-date:

The USD Index has quite likely formed a short-term top here, and it’s now likely to correct. How low would the USD Index be likely to move? Quite possibly to the 104 level or so, as that’s where we have very strong medium-term support. This support level is strengthened by the 1999 high (approximately), the 2002 low, the 2016 high, and the 2020 high – all very important highs.

Additionally, please note that the middle of the year is just around the corner, and that’s when the USD Index usually reverses, and it’s usually the case that those reversals are bottoms. I marked those cases with vertical red dashed lines. So, if the USD Index continues to correct here (and I think that it will), the decline might be rather short-lived.

All in all, it looks like the precious metals sector is going to rally and probably top close to the end of this month as the USD Index pulls back after a sizable rally.

Summary

Summing up, it seems that while the medium-term trend in the precious metals sector remains down, we are likely to see a corrective upswing soon. Based on the confirmations that we have seen recently (e.g. junior miners’ relative strength and reversals), the short-term outlook is bullish.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,