Gold Forecast: Is It Worth Going Through Fire And Water For The Central Bank?

With investors hitching their wagons to the Fed’s horse on May 4, they still believe that Chairman Jerome Powell can accomplish the impossible. Therefore, it’s all about following the man who will lead you to prosperity. However, while market participants’ faith in the Fed is profoundly short-sighted, I noted on Apr. 27 that pledging allegiance is how investors operate. I wrote:

With investors hitching their wagons to the Fed’s horse on May 4, they still believe that Chairman Jerome Powell can accomplish the impossible. Therefore, it’s all about following the man who will lead you to prosperity. However, while market participants’ faith in the Fed is profoundly short-sighted, I noted on Apr. 27 that pledging allegiance is how investors operate. I wrote:

“The PMs were mixed on Apr. 26, as mining stocks continued their material underperformance. Moreover, while investors will likely remain in ‘buy the dip’ mode until the very end, lower highs and lower lows should confront the S&P 500 and gold over the next few months. As a result, the medium-term outlook for the GDXJ ETF is profoundly bearish.”

Thus, while hope is not a strategy, it was clearly a popular opinion on May 4.

Please see below:

To explain, the red line above tracks the one-minute movement of the S&P 500, while the gold line above tracks the one-minute movement of the GDXJ ETF. If you analyze the relationship, you can see that both sank at the outset of Powell’s presser and then rallied into the close. As a result, a little bullish sentiment combined with some short-covering were the perfect ingredients for a sharp daily rally.

However, not only did the pair’s medium-term fundamentals not follow suit, they actually worsened. Therefore, while sentiment rules the day in the short term, their medium-term outlooks couldn’t be more treacherous.

To explain, the FOMC hiked interest rates by 50 basis points on May 4. Moreover, like I have been warning throughout the technical sections of the daily Gold & Silver Trading Alerts, we witnessed a ‘sell the rumor, buy the fact’ event. However, with the Fed increasingly hawked up, investors’ misguided optimism should evaporate over the next few months. An excerpt from the FOMC statement read:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong.”

“In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.”

As a result, while investors hear what they want to hear, the reality is that hawkish fireworks should light up the financial markets this summer.

Please see below:

Source: CNBC

In addition, Powell said: “We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

What are these “tools” he speaks of?

Source: CNBC

Thus, with Powell admitting that “blunt tools” are the only mechanism to curb inflation, the Fed’s pathway to lower prices should result in plenty of collateral damage. As a result, while the price action on May 4 suggests that normalization will be easy, the sentiment shift should be profound when reality sets in. To that point, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

Furthermore, Powell made the point for me on May 4:

Source: CNBC

Also noteworthy, when asked about curbing inflation without impairing the U.S. economy, Powell responded: “I would say I think we have a good chance to have a soft or softish landing, or outcome if you will. It doesn’t seem to be anywhere close to a downturn. The economy is strong and is well-positioned to handle tighter monetary policy.”

For context, referencing a “softish landing” completely lacks confidence, but it’s Powell’s way of recognizing reality without spooking the financial markets. Moreover, as one of the most important quotes of the press conference, he added:

“I do expect that this will be very challenging; it’s not going to be easy; and it may well depend on events that are not in our control. But our job is to use our tools to try to achieve that outcome, and that’s what we’re going to do.”

As such, with Powell noting that a soft landing "may well depend on events that are not in [their] control," he's essentially telling you that the Fed is past the point of managing this outbreak. In reality, inflation is like cancer. Once it spreads, it reaches a point where too much damage has been done to save the patient.

Thus, this is where we are now. With the Fed's "blunt tools" poised to inflict serious damage on the U.S. economy, the undesirable trade-off of supporting growth versus curbing inflation has the Fed in a material bind. As a result, investors severely underestimate the challenges that will confront them over the next several months.

To that point, remember what I wrote on Apr. 26?

The Federal National Mortgage Association (Fannie Mae) – a U.S. government-sponsored enterprise – released its Economic and Housing Outlook report on Apr. 19. An excerpt read:

“Our updated forecast includes an expectation of a modest recession in the latter half of 2023 (…).”

“While a ‘soft landing’ for the economy is possible, which is where inflation subsides without economic contraction, historically such an outcome is an exception, not the norm. With the most recent inflation readings at levels not seen since the early 1980s and wage growth exceeding that which is consistent with a 2-percent inflation objective, we believe the odds of a soft landing are even lower.”

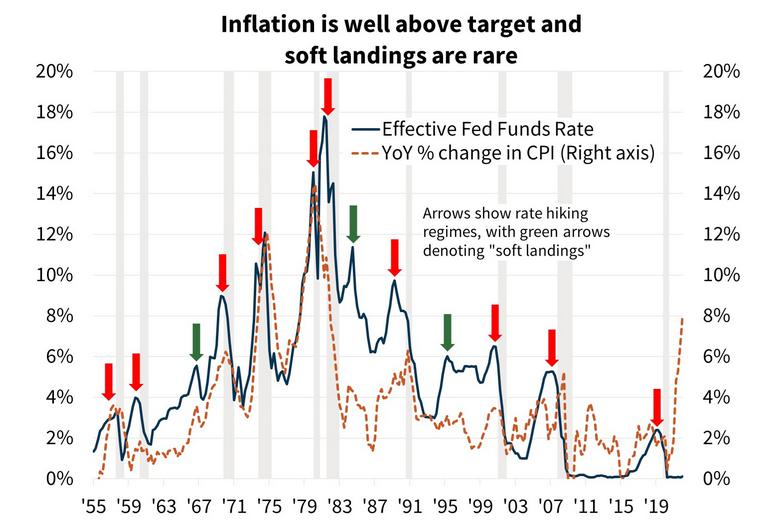

Please see below:

Source: Fannie Mae

To explain, the green line above tracks the U.S. federal funds rate, while the dashed brown line above tracks the YoY percentage change in the headline Consumer Price Index (CPI). More importantly, the red arrows above depict hard landings, while the green arrows above depict soft landings. As such, the odds are not in the Fed’s favor.

Even more revealing, if you analyze the green arrows near 67, 83, and 95, you can see that the YoY inflation (the dotted brown line) was no more than ~4.5%. As a result, all of the soft landings occurred alongside manageable inflation, not a headline CPI at 8.6%.

Won’t Go Down Without a Fight

Therefore, while history highlights the Fed’s ineptness at handling crises, history also highlights how investors follow the central bank off the cliff. Moreover, while Powell can convince the consensus that “a soft or softish landing” should materialize, please remember that “the fool wonders, the wise man asks.”

To explain, remember what I wrote on Nov. 4 following the FOMC meeting?

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

And now?

Source: CNBC

Likewise, remember what he said about the U.S. labor market and wage inflation? I wrote on Nov. 4:

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

For example, Powell said during his press conference that “the inflation that we’re seeing is really not due to a tight labor market. It’s due to bottlenecks and it’s due to shortages and it’s due to very strong demand meeting those (…). We don’t see troubling increases in wages, and we don’t expect those to emerge.”

And now?

Source: CNBC

As such, investors are either unaware of how wrong Powell has been, or they simply don't care. However, the comments in italics were made only six months ago. Either way, Fed officials' inability to see the forest through the trees should have drastic implications over the next several months. As evidence, when the "transitory" camp was brimming with confidence, I wrote on Apr. 30, 2021:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

Thus, the situation is unchanged. With Powell predicting that the impossible is achievable, his assertion of “a soft or softish landing” is laughable. Therefore, can you guess where this story is headed next?

Finally, it’s important to distinguish between where we are now and where we are likely headed. Regarding the latter, the “soft landing” crowd will likely be the 2023 version of the “transitory” crowd from 2021/2022. Regarding the former, the U.S. economy remains on solid footing RIGHT NOW. However, the dynamic only adds further fuel to the hawkish fire.

For example, Statistics Canada released its latest international merchandise trade update on May. 4. Now, the data is important because more than 77% of Canadian exports were sent to the U.S. in March. Therefore, the two economies are increasingly intertwined.

To that point, with exports to the U.S. hitting an all-time high of CA $49.234 billion, the data highlights how demand conditions in the U.S. remain resilient. As a result, the Fed’s “blunt tools” still have plenty of work to do.

Source: Statcan

The bottom line? It’s interesting how investors can repeat the same mistakes over and over again. Despite being burned by the Fed during the dot-com bubble and the global financial crisis (GFC), investors remain loyal followers. Moreover, even though the central bank’s inflation and labor market forecasts have been way off, investors’ confidence in Powell remains unwavering. As a result, while ‘fool me twice’ should have been enough, a third rendition will likely emerge over the medium term.

In conclusion, the PMs were mixed on May 4, as gold and silver didn’t participate in the bullish stampede. However, with investors severely underestimating the impact of seven to 12 rate hikes over nine months, the liquidity drain should materially depress the performances of the PMs and the S&P 500 as the drama unfolds.

Summary

Despite the ongoing Russian invasion of Ukraine, and despite gold being the traditional safe haven in times of turmoil, the overall outlook for the precious metals sector remains bearish for the next few months, and the medium-term outlook for the yellow metal remains pessimistic.

Since neither the USD Index nor real interest rates are likely to stop rising anytime soon, the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,