Gold Forecast: Massive Bearish Clouds Looming On The Horizon?

Contrary to yesterday’s long analysis, today’s issue is going to be rather short, as nothing really happened on the precious metals market yesterday. The thing that did happen was the USD Index moving higher.

Contrary to yesterday’s long analysis, today’s issue is going to be rather short, as nothing really happened on the precious metals market yesterday. The thing that did happen was the USD Index moving higher.

The U.S. currency index once again broke to new yearly highs, and – more importantly – it also broke above its rising trend channel. This breakout is not yet confirmed, but it is already notable. The implication of this breakout is that we’re likely to see a post-breakout rally at least equal in size to the height of the trading channel that the USDX just broke above. I marked the above with dotted lines in the above chart.

This means that a rally to about 97 has now become even more likely. That’s bearish for the precious metals market due to its historically low correlation with the USDX.

Still, we also have a bullish lining for the PMs here. The thing is that yesterday was once again a day when PMs and miners refused to decline despite USD’s rally. This is a bullish sign for the PMs as it shows their strength. Will this sign continue to hold? Will PMs rally? Does it invalidate the bearish outlook altogether, or is it just a small bullish blip on the radar that also indicates massive bearish clouds on the horizon?

Based on numerous other indications, I continue to think that the latter interpretation is more likely to be the correct one.

If the USDX rallies to 97 or so, then gold will have quite a few chances to catch up with its bearish reaction to the former’s strength.

Components of the Bearish Picture

Speaking of the gold price, there’s one factor that I didn’t feature yesterday. That’s the fact that right now gold is at a declining resistance line based on the previous medium-term 2021 highs. The highs are important, and so is the resistance line. This, plus the RSI very close to 70, plus the situation in the USD Index, creates a situation in which gold is likely to decline soon.

Just as gold did nothing yesterday, the same happened in the mining stocks - nothing. They (the GDX that is) once again moved to their recent intraday high on an intraday basis but ended the day below $35. This level has kept the rallies in check since late June, and now it has been strengthened by the 38.2% Fibonacci retracement level.

This, plus the fact that the RSI is above 70, creates a bearish picture. In fact, my previous comments on the above chart remain up-to-date:

To explain, the GDX ETF rallied on huge volume on Nov. 11 and there were only 4 cases in the recent past when we saw something like that after a visible short-term rally.

In EACH of those 4 cases, GDX was after a sharp daily rally.

In EACH of those 4 cases, GDX-based RSI indicator (upper part of the chart above) was trading close to 70.

The rallies that immediately preceded these 4 cases:

The July 27, 2020 session was immediately preceded by a 29-trading-day rally that took the GDX about 42% higher. It was 7 trading days before the final top (about 24% of time).

The November 5, 2020 session was immediately preceded by a 5-trading-day rally that took the GDX about 14%-15% higher (the high-volume day / the top). It was 1 trading day before the final top (20% of time).

The January 4, 2021 session was immediately preceded by a 26-trading-day rally that took the GDX about 17%-18% higher (the high-volume day / the top). It was 1 trading day before the final top (about 4% of time).

The May 17, 2021 session was immediately preceded by a 52-trading-day rally that took the GDX about 30% higher. It was 7 trading days before the final top (about 13% of time).

So, as you can see these sessions have even more in common than it seemed at the first sight. The sessions formed soon before the final tops (4% - 24% of time of the preceding rally before the final top), but the prices didn’t move much higher compared to how much they had already rallied before the high-volume sessions.

Consequently, since history tends to rhyme, we can expect the GDX ETF to move a bit higher here (but not significantly so) and we can expect this extra move higher to take between additional 0 to 7 trading days (based on the Nov. 12 session, so as of Nov. 16, it’s between 0 and 5 trading days).

Why 0 – 5 trading days (as of today – Nov. 16)? Because with the 4% timeline now in the rearview, the latter represents the updated 24% timeframe based on the preceding rally (that took 30 trading days).

Since it’s unlikely to take the mining stocks much higher, and the reversal could take place as soon as today, I don’t think that making adjustments to the current short positions in the mining stocks is justified from the risk to reward point of view.

Is there a meaningful resistance level that would be likely to trigger a decline in mining stocks? Yes! The GDX ETF is just below its 38.2% Fibonacci retracement level based on the August 2020 – September 2021 decline. The resistance is slightly above $35, so that’s when the final top could form.

As a result, those historical readings provided us with great shorting opportunities. And while I’m not increasing my short position, if I didn’t already have one in place, I would consider the current setup as offering a great risk-reward proposition.

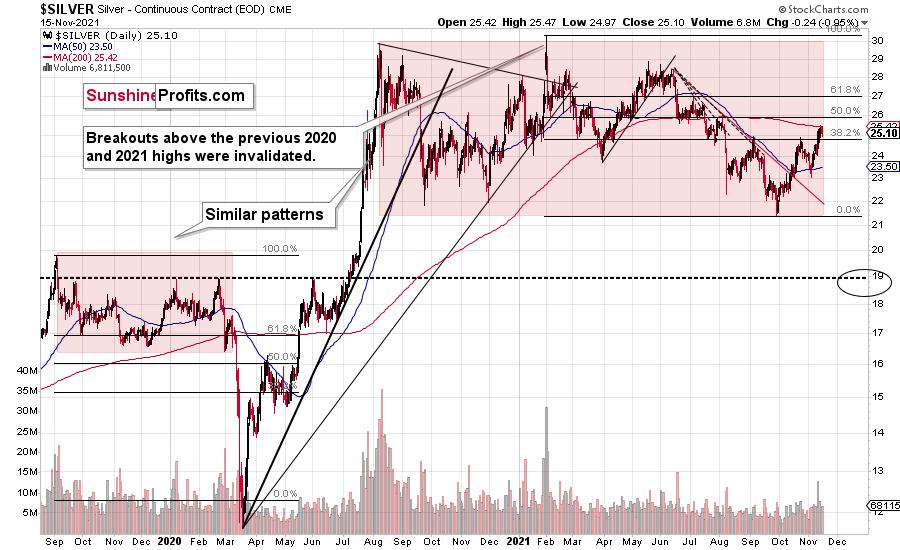

The Silver Concern

One thing that’s concerning for the short term is the fact that the silver price is not outperforming the price of gold right now.

As a reminder, whenever silver outperforms gold on a short-term basis, it indicates that a top might be just around the corner. However, it hasn’t outperformed recently, which might mean that the final top is not yet in.

In yesterday’s “Letters to the Editor” section, I wrote that, in my view, the chance of gold moving to $1,900 this week was less than 40%. I think it’s now – based on silver’s lack of outperformance and the PMs’ strength relative to the USD Index – closer to 50/50.

Still, please note that even if gold rallies here, it doesn’t mean that mining stocks must follow it to a major extent. If it’s the final part of the upswing, gold stocks are likely to underperform (while silver might outperform).

Summary

The PMs rallied last week, and their momentum has teetered on euphoria. However, when prices diverge from fundamentals, sharp sell-offs often occur when sentiment shifts. As a result, caution is warranted, and the PMs’ recent bout of optimism will likely end in disappointment. This disappointment could start within the next few days, based on analogies to very similar cases in mining stocks. The decline in the GDX could start right away or once it moves to or slightly above $35, quite likely in 0 – 5 trading days.

Since it seems that the PMs are likely about to start another short-term move lower more, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

And as silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,