Gold Forecast: Will Gold Fall Prey To Fed’s Predatory Plans?

Gold, silver, and mining stocks took advantage of their moment and transformed the tensions caused by the war in Ukraine to their benefit. However, all indications are that it is time to come down to earth and that the short-term spurt is over, although the military conflict continues.

Gold, silver, and mining stocks took advantage of their moment and transformed the tensions caused by the war in Ukraine to their benefit. However, all indications are that it is time to come down to earth and that the short-term spurt is over, although the military conflict continues.

Moreover, the Fed has not only announced an interest rate hike, but also predicted even more of them than was speculated, which is a very hawkish policy. In fact, even those members of the Federal Reserve who are considered typical doves are supporting it now. For the precious metals, this does not bode well for the medium term.

With rampant inflation forcing the Fed into a hawkish corner, I warned throughout 2021 that the end of looser-for-longer monetary policy would surprise investors. To explain, I wrote on Aug. 31:

With Fed Chairman Jerome Powell threading the dovish needle on Aug. 27, investors rejoiced as he downplayed the consequences of surging inflation. However, while his perpetual patience may elicit comfort in the short term, the medium-term ramifications could end up shocking the financial markets.

Case in point: while Powell allows the economy to run hot, his lack of prudence has left him far behind the inflation curve. With one policy mistake liable to result in an accelerated rate hike cycle once the Fed finally moves, his ability to placate investors could come under immense pressure.

Now, with the most dovish Fed official sounding the hawkish alarm on Mar. 18, the PMs could suffer a hard landing as the liquidity drain unfolds. To explain, Minneapolis Fed President Neel Kashkari preached patience throughout all of 2021. However, in an article written on Mar. 18, he stated:

“In the September 2021 Summary of Economic Projections (SEP), I estimated inflation would be 4.2 percent for 2021 and 1.8 percent for 2022. Actual inflation for 2021 ended up being 5.8 percent, and I just increased my forecast this week to 4.5 percent for 2022. PCE inflation for the 12 months through January was 6.1 percent. What happened, and why were my forecasts about inflation wrong?”

Well, after citing multiple factors including supply chain disruptions, wage inflation and resilient consumer demand, he concluded:

“The FOMC has already made a profound shift in the past six months with its forward guidance on the path of the federal funds rate and the balance sheet, and I believe the SEP we just released is sending a strong signal that further reinforces our commitment to achieving our inflation target. The first hike we announced this week demonstrates that we will follow through on our guidance with action.”

More importantly, though, he said:

Source: Neel Kashkari/Medium

- Doves Are Gone

Thus, the most dovish Fed official of them all expects the U.S. federal funds rate to hit 1.75% to 2% by the end of 2022. For context, this implies seven to eight rate hikes, which is in line or slightly more than the FOMC's median estimate of seven. Moreover, when the doves turn hawkish, the medium-term implications are often profound. While the PMs remain elevated for the time being, their fundamental outlooks continue to worsen.

To that point, other Fed officials also made the rounds on Mar. 18. For example, Richmond Fed President Thomas Barkin said that "think of [the SEP] as an indication that the extraordinary support of the pandemic era is unwinding." Moreover, he stated that the U.S. federal funds rate still has plenty of room to run.

Please see below:

Source: Reuters

Likewise, Fed Governor Christopher Waller told CNBC on Mar. 18 that “inflation is raging.” Moreover, he said that the neutral federal funds rate likely lies between 2% and 2.25%, and that the Fed should “try to be above that by the end of the year.” As a result, he’s advocating for more than eight or nine rate hikes by the end of 2022. For context, the neutral rate is the overnight lending rate that neither expands nor restricts the U.S. economy.

Furthermore, with inflation showing no signs of slowing down, Waller said that he expects a 50 basis point rate hike “at one or multiple meetings in the near future.”

Please see below:

ource: CNBC

If that wasn’t enough, St. Louis Fed President James Bullard went rogue on Mar. 18. Releasing a statement about his dissatisfaction with the FOMC’s 25 basis point rate hike, he stated:

“I dissented with the Federal Open Market Committee (FOMC) decision announced on March 16, 2022, to raise the target range for the federal funds rate by 25 basis points to 0.25% to 0.50%. In my view, raising the target range to 0.50% to 0.75% and implementing a plan for reducing the size of the Fed’s balance sheet would have been more appropriate actions.”

He added:

“The combination of strong real economic performance and unexpectedly high inflation means that the Committee’s policy rate is currently far too low to prudently manage the U.S. macroeconomic situation. Moreover, U.S. monetary policy has been unwittingly easing further because inflation has risen sharply while the policy rate has remained very low, pushing short-term real interest rates lower. The Committee will have to move quickly to address this situation or risk losing credibility on its inflation target.”

As a result:

Source: James Bullard/ St. Louis Fed

Thus, while Bullard is clearly on the hawkish end of the spectrum, he’s advocating for 12 or more rate hikes by the end of 2022. Therefore, while the gold price remain sanguine due to the Russia-Ukraine conflict, the potential for seven to 12+ rate hikes is profoundly bearish. Moreover, with financial conditions already tight and poised to tighten further, these environments are often unkind to the entire commodity complex.

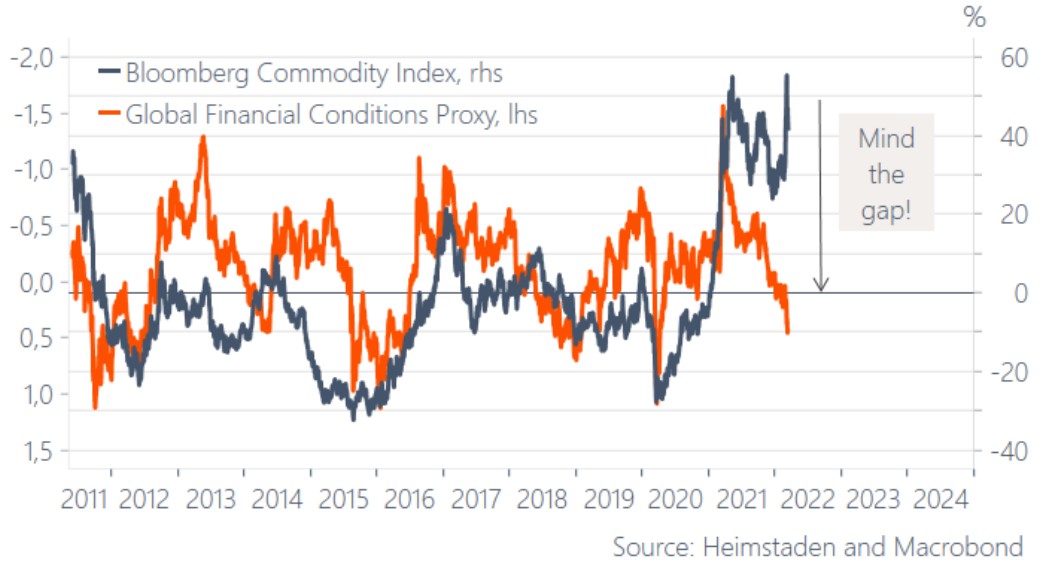

Please see below:

To explain, the blue line above tracks the year-over-year (YoY) percentage change in the Bloomberg Commodity Index, while the orange line above tracks the inverted YoY percentage change in global financial conditions. For context, inverted means that the latter’s scale is flipped upside down and that a falling orange line means that financial conditions are tightening.

If you analyze the relationship, you can see that tighter financial conditions often result in weaker performance by commodities.

Moreover, with the Fed poised to raise interest rates several times in the coming months, the liquidity drain should intensify. As a result, the PMs may suffer sharp declines when the profound divergence reverts to its historical norm.

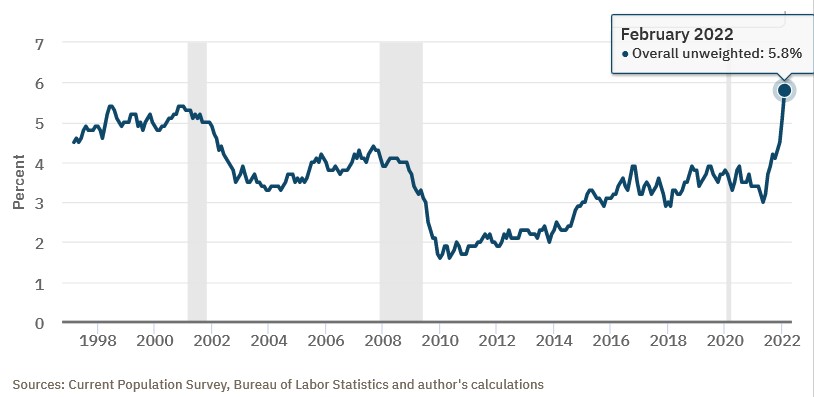

Furthermore, with the Fed still behind the inflation curve, a 25 basis point rate hike does little to calm the pricing pressures, and with the Atlanta Fed’s wage tracker hitting an all-time high in February, the wage-price spiral is unlikely to unwind without swift monetary intervention.

Please see below:

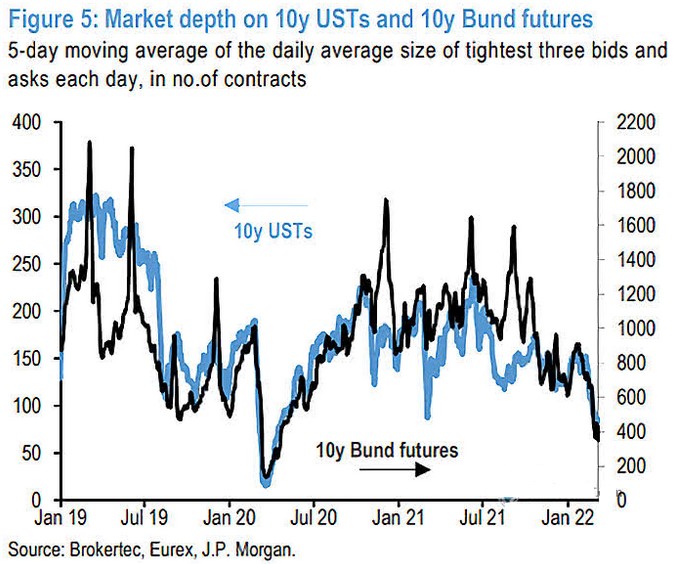

Finally, I noted previously that Treasury market depth continues to deteriorate. To explain, I wrote on Mar. 16:

The U.S. 10-Year Treasury yield rallied again on Mar. 15 and closed at another 2022 high of 2.15%. Moreover, with liquidity in the futures market continuing to deteriorate, more yield spikes could be on the horizon.

Please see below:

To explain, the black and blue lines above track the market depth for 10-Year Treasury and Bund (German bonds) futures. If you analyze the right side of the chart, you can see that the five-day moving average of the tightest bid-ask settlements continues to decline. As a result, a shallow market has resulted in more contracts being settled with wider bid-ask spreads.

In turn, this creates liquidity risk, as buyers may not be there when large sellers want to unwind 10-Year Treasury futures positions. Due to that, yields often spike when sellers outweigh buyers. As such, the more the blue line declines, the more it increases the chance of a taper-tantrum-like event.

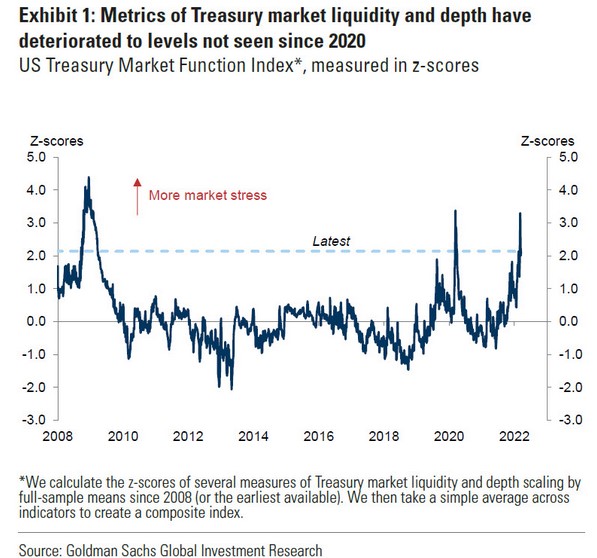

To that point, with data from Goldman Sachs singing a similar tune, the lack of liquidity in the Treasury market is near crisis levels. As a result, the Fed’s hawkish disposition could spark a rapid rise in interest rates.

Please see below:

To explain, the blue line above tracks the z-score of Treasury market liquidity, or lack thereof. If you analyze the right side of the chart, you can see that the liquidity crunch is more than three standard deviations above its average. As a result, if large sell orders can’t find any bids, a rapid rise in U.S. Treasury yields could profoundly impact the PMs.

The bottom line? While the prices of silver and gold have ridden the momentum of the Russia-Ukraine conflict, their medium-term fundamentals are worse now than they were in 2021. Back then, the Fed parroted the “transitory” narrative, and the PMs could take solace in their dovish pushback. However, the inflation outlook has worsened in the last few months, and the commodities’ fervor is only accelerating the problem. Moreover, when doves like Kashkari turn hawkish, the game has changed. As a result, the PMs may learn this lesson the hard way over the medium term.

In conclusion, the PMs declined on Mar. 18, as bearish realities are starting to catch up with gold, silver, and mining stocks. However, war premiums are still embedded, and they haven’t priced in the implications of the Fed’s battle with inflation. As such, sharp slides should confront the PMs over the next few months as the Fed’s rate hike cycle starts to have its desired effect.

Summary

To summarize, as with other armed conflicts in the past, gold is beginning to stop benefiting from the turmoil of war and is no longer responding as vigorously to shocking headlines as it did a few weeks ago. The changes can also be noticed in the USDX, and they mean one thing for gold.The changes can also be noticed in the USDX, and they mean one thing for gold.

Despite the ongoing Russian invasion of Ukraine, and despite gold being the traditional safe haven in times of turmoil, the overall outlook for the precious metals sector remains bearish for the next few months, and the medium-term outlook for the yellow metal remains pessimistic.

As silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,