Gold: The Great Depression 2.0?

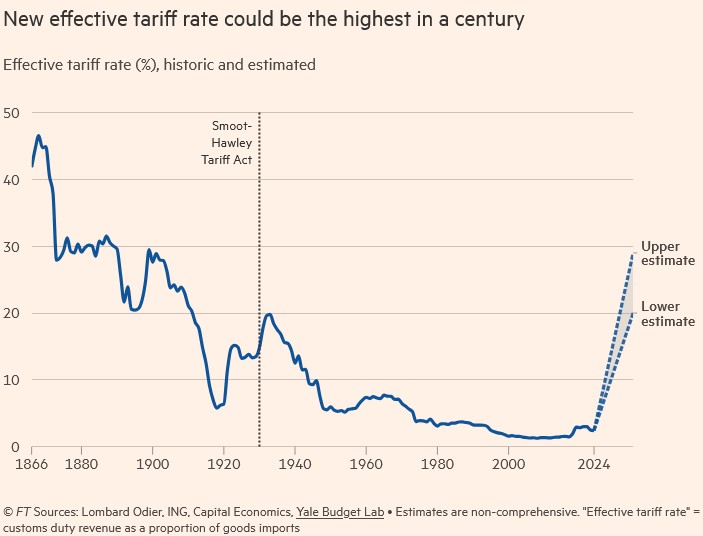

On “liberation day” the Trump administration declared economic war imposing the highest tariffs in the world averaging 24 percent, up from 2.5 percent in 2024. Then on the day the reciprocal tariffs were to take effect, he abruptly “paused” his sweeping tariffs on much of the world, apart from China. Then with a looming global recession, Mr. Trump blew up his own liberation day as the US stepped back from the precipice and negotiated a 90-day temporary ceasefire in their trade war with China, to allow for a new trade deal to be thrashed out. However the “floor” tariffs overall remain at their highest levels in decades will still ripple through supply chains, reducing but not eliminating the economic pain. Neither side could declare victory but the suspension of the tit-for-tat tariffs de-escalates a dangerous game of chicken that saw plunging markets, empty ports and threats of a global recession. Not changed however is the economic uncertainty.

Unchanged is the president’s contempt for the traditional world trade system that laid waste to long established customs, damaging the trust of America’s allies, and faith in the dollar. It is likely there will be more deals, many are nonbinding but the economic shockwaves will ripple through the decades. Moreover, he has erected a protectionist wall around the world’s largest economy that will isolate them from the world. And it is not all about tariffs, there is a bigger picture.

Domestically, he has consolidated his extraordinary powers with his executive branch at war with everyone from the civil service, to the courts, to the armed forces, to education in an attempt to remake America. In building a new world order, he destroyed the old order that the US helped create. To some, democracy is being diminished but to others, it is being remade. In shades of 1984, science has been disproved with a drop in measles vaccinations threatening an epidemic. A revolution is at work. The market’s verdict? The S&P 500 fell more than 20 percent in three days in a “Sell America” market meltdown that devastated American households whose savings rate is only 0.6 percent of GDP but 26 percent of their wealth in stocks. The bond market, the country’s credit line reeled as highly leveraged hedge funds unwound bad basis trades, amid wild swings in Treasury prices, as 10-year Treasury bond yields spiked to 4.5 percent. Despite retracing the losses in the S&P500 after the president paused most levies, the damage has been done and major worries remain.

In 100 days a Trumpian revolution has created more uncertainty in business, the media and in the president's own party of which many have withheld criticism for fear of being branded a traitor, or worse a Democrat. Amid economic self-harm, he has consolidated his powers, using unique emergency powers to bypass the other branch of government, Congress. The good news is that, despite his intermittent style of negotiating that engulfed the world in chaos, terror, and confusion, he has so far retreated on significant economic decisions. Yet the market has not yet priced in a recession that will be much broader and consequential, weighing heavily on consumers. As an example despite companies front-running Trump’s tariffs, the once robust US economy contracted over the first quarter for the first time in three years. Since the tariffs are yet to take effect, the downturn is a warning of what is to come.

No one wants to be a target of the president’s bullying as he remakes the country. To deport immigrants, he invoked the 1798 Alien Enemies Act. To stop 42 pounds of fentanyl, he declared a national emergency, slapping tariffs on Canada. At one time criticism was normal but even the fifth estate has softened their criticism after litigation threats and the banning of some members from interviews. Trump has even silenced America’s Big Law firms in a vendetta against those who represented cases against him in the first term, extracting $1 billion of pro bono work in exchange for reversing executive orders against them. He targeted students for deportation and attacked America's prestigious Ivy League universities by slashing billions in funding, particularly for scientific research. Social media too is being reshaped with his own Truth Social medium. Then there is the all-important financial industry which has capitulated, quickly dropping net zero and DEI policies. If America continues to diminish democracy, is it America?

The Worst Is Yet to Come

The law is the final bulwark against political corruption. The president has escalated the fight with the judiciary and in an attempt to expand his powers, his raft of executive orders defies a century of carefully crafted precedents that served the US so well. It is the president’s willingness to violate judicial orders that raises concerns for the erosion of the rule of law. The more he tests, the more he shifts to a more authoritarian side. The more chaos, the greater the president’s control.

On foreign policy, Donald Trump is having a more difficult time and his struggles to win the wars in Ukraine and Gaza are now caught up in diplomacy. Amid the changing American political landscape, Mr. Trump’s territorial ambitions to enlarge the United States of America by takeovers of Greenland, Panama and Gaza has emboldened its peaceful neighbour Canada to put up a not-for-sale sign. The great negotiator often negotiates with himself on many levels. On climate change he did a 180-degree turn, gleefully scrapping renewable energy projects, and renewed a love affair with fossil fuels, whilst its main competitor China ironically will meet its net-zero targets due to its lead on renewable energy.

Yet the worst is yet to come. The president's attack on the judiciary is part of his attempt to test the constitutional bounds of the American legal system and the rule of law, which is the cornerstone of American democracy. Donald Trump has ignored laws, fired three Judge Advocate Generals and trampled the First Amendment rights protecting all people residing in the United States. The president also threatened to impeach a district court judge for trying to halt some of Mr. Trump's most egregious actions. The president has even ignored the Supreme Court’s order to return a mistakenly deported man. Ahead lies a constitutional crisis when this president attempts to run for a third term. The diminishment of democracy starts like this.

The Consequences of Chaos

Trump and his acolytes believe that the declaration of economic war will coerce foreign countries to lower their trade barriers, allowing the great negotiator to reset global trade in order to restore US military power and retain the dollar’s hegemonic power. Trump’s fear-based negotiating stance is all about gaining the upper hand but his intervention in the economy is the most of any president in American history. Yet maybe there is a method in this madness. Why not go tariff-free if others go tariff-free? Drop the subsidies and barriers and the US does the same. Free trade would be free trade. That would make the pain a gain, but alas, too good to be true.

First, this president forgets that tariffs did not work in his first term and in declaring economic war against friends, foes and penguins, he shows little understanding of how global economies and trade works. Despite his pledge to prevent inflation from getting worse, the president's largest tax increase in history increases the likelihood that the economy could experience stagflation like that of the 1970s or, worse, a depression of the 1930s. Because of America's significant reliance on imports for everything from toys, to auto parts, to food for daily needs, tariffs are anti-growth and de-coupling from China would have been a disaster for the United States. Oil prices had fallen to their lowest points in four years during the turmoil, and instead of celebrating a decrease in inflation, the president's actions hurt the exact oil sector he pushed to "drill, baby drill." Given the rapid depletion of shale wells and cessation of China’s ethane imports, the hiatus will hurt current and future production as well as the impact from the 25 percent tariffs on steel and aluminum, two heavy users of oil. The president believes that tariffs are tax cuts but they really are a stealth national VAT tax that will drive up inflation. President Trump is naively trying to unscramble the egg, if you can find one today.

Second, the geopolitical impact is much broader and despite the detente between the world’s two superpowers, China is challenging America’s incumbent dominance. Since the Second World War, global trade has flourished, contributing to a rising economic tide that lifted all boats as bilateral trade and interdependence benefited both countries. According to the World Trade Organization, punitive tariffs alone would cut North American exports by about 13% this year. Significant though, arch competitor China is less reliant on the US, importing fewer things from the US that it can’t get from others. The US, on the other hand, imports a lot of things that they can’t get elsewhere. China shipped about $440 billion to America, against $143 billion or three times the amount that America sells them. Nevertheless, China is the third-largest consumer of American goods behind Canada and Mexico. China retaliated in the tit-for-tat escalation, blocked exports of critical minerals and rare earths as well as boycotting America’s agricultural products, oil, coal including refusing deliveries of Boeings, America’s top export. Then there are the big US multi-nationals like Apple and Tesla which have a deep reliance on China’s consumer as well as the factory floor, central to their growth.

The destruction of America’s global credibility is a gift to China, strengthening and allowing the country to exploit relations of those caught between the US-China power play. While ironically Mr. Trump is trying to isolate China, the US would need the help from the EU, Canada, Mexico, South Korea and Japan, but they are the very nations that Trump slapped punitive tariffs because, they are “ripping off” the United States. The Middle Kingdom is already the dominant trading partner in Asia, Africa, the Middle East and South America allowing them the opportunity to strengthen relations at the upcoming BRICS July summit in Brazil. The EU’s twenty-seven members today buys more from China than the US, and with economic war breaking out, the EU is exploring alliances with China, Japan, South Korea and even Canada. For the first time in five years, there is talk of a trilateral free trade axis among China, South Korea and Japan following a meeting of industry ministers in Seoul. After liberation day, the United States’ twist and turns tariffs have deeply undermined the trust need to counter China. Britain and India recently signed a $29 billion free trade deal. Why not call Trump’s bluff and formalize free trade between all groups, putting existing rules in a comprehensive framework, sort of a Pax Globe, with the world split into two trading blocs? The United States would be very much alone. The next step is an alternate currency to the dollar.

PAX Americana is Dead

Burning the house down will leave few ashes. US farmers, important Trump supporters, are suffering as a result of China's boycott of American crops. However, they are also concerned about a plan to impose taxes on ships built or run by Chinese companies, which would prohibit the export of their foodstuffs, coal, lumber, and LNG. The penalties are causing increasing concern because China is the biggest bulk maritime player in the world. Farmers alone are already lining up for a $10 billion bailout as 20 percent of their income comes from exports, now caught up in Trump’s tariffs. In Trump’s first term, more than $27 billion of losses from agriculture exports were recorded as US share of China’s food imports fell 35 percent since 2016, prompting a $23 billion bailout to compensate farmers, according to the USDA. So much, for so little.

We believe the main reason for Trump’s single-minded protectionist agenda is that he longs for a bygone era when global trade was nascent and America’s manufacturing “might” dominated, before the rise of Japan, China and Germany. In the late 19th century, America had its own domestic industries such as car manufacturing, oil production, steel companies and a simpler way of life. American workers made American products bought by the American public. However Donald Trump’s nostalgic blueprint to make America a manufacturing powerhouse again is doomed to fail. First it took many decades for the US to industrialize, but then as labor rates got too high, the big multi-nationals shifted jobs and manufacturing to lower cost jurisdictions in Japan and China. Today US exports are only 11 percent of global exports. Americans would rather wear Nikes than make them.

If Donald Trump gets his way, there might be the odd car company that can make a car totally in the United States, but only a few of his billionaire buddies will be able to afford them. There are hopes that the tariffs are a negotiating ploy – get some quick deals in the 90-day reprieve period and declare victory. However most bilateral deals can take 2 years or more to negotiate with Trump’s first “major” US-UK trade deal’s genesis shortly after Brexit, five years ago. Then there is the need for Congressional approval. Moreover any new plant to move or build in the US would cost the automakers billions, take at least 3-5 years to build, and then, what would the next president want? Apple and Nike are unlikely to reshore because of simple economics. It seems more likely that companies will follow the Nvidia example and open a token manufacturing facility in the United States.

Mr. Trump’s global tariff regime will also drive up the prices for inputs into America’s own manufacturing production, increasing the cost of building capacity as well as making more expensive existing supply chains. Besides, where are those battery plants promised three years ago? Moreover, given high domestic wage costs, any new manufacturing would be heavily dependent on robotics which ironically are built in China. Problematic is that China has also put an export embargo on rare earths of which the Americans are heavily dependent as well as China’s processing capabilities. Moreover, not only are cars affected, but Mr. Trump was beginning to look like the Grinch as consumers faced paying $3,000 for that PlayStation or $1,000 for that cute teddy bear at Christmas. America vastly underestimated China’s leverage.

Presidential Power: Trump’s First 100 Days

To Mr. Trump, the last half century allowed other countries to “rip off America,” omitting that America had become more of a consumer society benefiting from the free flow of people and free trade between countries on a rules-based multi-lateral order, originally designed by America. The trade deficits meant a corresponding demand for dollars that helped America’s hegemony because as the value of the US dollar soared, countries recycled their surplus dollars into US Treasuries, financing America’s chronic deficits. Conveniently America excelled at finance and its deep capital markets allowed Wall Street to invest that capital surplus which further underwrote US economic growth. Today if Trump gets his way, that era is dead. Peter Navarro, Trump’s tariff guru, naively estimates that tariffs will raise $600 billion more a year in revenues which would take the tax share of GDP above 19 percent, assuming no more retreats. For them trade is one-sided, forgetting that it is two-sided, offset in large part by the capital surplus.

Crucially what both miss is that while the US economy ran a merchandise current account deficit for goods with the rest of the world, they also ran a whopping capital account surplus for services, exporting more than $1 trillion worth of services to the rest of the world. Those services included capital and software from Microsoft or products from Netflix, Apple, and Hollywood films. Included was the largesse from Wall Street’s financial engineers. Lost on Trump’s team is that the current accounts and capital accounts are intrinsically linked. Consequently if American tariffs reduce the trade deficit, then inflows will also decline, deepening Mr. Trump’s financial hole. Wall Street’s pre-eminence would also be at risk.

Mr. Trump’s first term tariffs and subsequent Mr. Biden’s tariffs did little damage with China having a global trade surplus near $1 trillion last year. China has reduced exports to the US by less than 15 percent and is well positioned to weather the storm, with $3.2 trillion in foreign exchange (excluding trillions held by its state-owned banks), 4% plus growth, lower inflation and a higher savings rate. In contrast US consumers are the engine that drives the US economy with at least one third today living paycheck to paycheck on maxed out credit cards and negligible savings. Doubling the cost of Chinese imports would only hurt them and add to inflation, hurting his voter base. At one time, “as goes General Motors, so goes the nation.” The all-important car industry too will be forced to raise car prices and reduce car production which would cost both American companies and consumers billions. Over half of vehicles sold in the US are imported with nearly 60 percent of those built in America have parts from overseas. Of more concern is that the president’s self-inflicted economic war has enabled him to amass the greatest power in the world. The question is what will the president do with this?

The End of Capitalism

Amid this tariff blitz, there are key questions as to how America will dig itself out of its financial hole, particularly since trillions of his 2017 tax cuts are also part of his remaking of America. America’s fiscal position has long been poor and getting worse particularly with the increased deficit-funded government spending to come. The so-called DOGE annual savings from downsizing government was originally estimated at $2 trillion, knocked down to $1 trillion and now less than $200 billion in savings. At the same time, a “made in America” recession will bring less revenues. Trump’s policies throw a grenade into America’s finances. Tariffs were supposed to bring revenues to offset his $5 trillion tax cuts. Best estimate is that tariffs will bring in hundreds of billions, not trillions. Problematic is that the president’s plan was to take billions or so of tariff revenues, as little as they are, to pay for his trillions of income tax cuts and military spending, a throwback to 1913 when tariffs were the only source of government revenues, but that was before income taxes, Medicare, social security, and nuclear weapons. So desperate to close the gap, there are discussions on how to curtail government transfers such as Social Security, Medicaid and Medicare, the untouchable holy trinity. Meantime the stop-gap debt ceiling bill expires this summer as Donald Trump’s own party is deadlocked with conservative hardliners, over his “big, beautiful bill” that extends his 2017 tax cuts and adds new breaks. History tells us that the cumulative impact of spending on both guns and butter leads to more inflation and often hyperinflation.

Meanwhile the US economy has become extremely stratified with 10 percent of American households owning 70 percent of the nation’s wealth, with the bottom 50 percent owning only 2 percent of the national wealth at the end of last year. Before the French Revolution, a period of societal and political change, the wealthiest 10 percent of people owned 90 percent of the wealth, with the bottom 50 percent similarly owning 2 percent. That did not last. America has the best universities in the world, the most advanced scientists and technological ecosystem. The Trumpian revolution has undermined all this for ideological and sometimes petty reasons. Pain for Americans will be unequal. Today billionaires, having made it in the private sector, are trying their hand in Trump’s government and voters only now appear to be alienated by the wide swath of mass firings and disruptions, particularly among those picking up social security checks. How this crony capitalism and potential conflicts of interest handles the eventual social unrest and political stability looms large. Of concern is that the tariffs and likely “exceptions” leave more room for this crony capitalism and self-dealing to capitalize on the nation’s sufferings, an accident ready to happen.

That the market remains at near all-time highs is due to the on-off expectations and optimistic hopes of a backtrack from Trump. “Buying the dip” in our opinion is foolhardy, particularly if Trump’s game of chicken is back on. With so few guardrails and the lack of coherence in Trump’s policies, there are risks of a bear market implosion in stock prices and housing, the largest assets held by American households. Signs are emerging that spending is slowing as the level of credit card debt soars. Despite Trump’s tariff retreat, higher prices and empty shelves are to hit in the second quarter. Left unsaid is that the false premise of Trump’s across-the-board tariffs, in imposing a national emergency under the 1977 International Emergency Economic Powers Act is a violation of the country’s rule of law. How can two uninhabited islands off Australia, populated by penguins be considered a threat to the most powerful nation in the world? The foundation of capitalism is the rule of law.

The US Dollar: A Safe Haven No More

The America-led Bretton Woods system was designed after World War II in 1945 which fixed the currencies of the world’s largest economies to the dollar, backed by the nation’s gold reserves. However, a couple decades later facing mounting costs from the Vietnam War and holding excess dollars, America’s creditors demanded gold for their dollars. One financial era came to an end and a new one began in 1971 when President Nixon scrapped the dollar's link to gold, leaving the dollar supported solely by America’s good credit. Since the adoption of floating exchange rates, the dollar has been the load-bearing keystone of the modern-day monetary system. The United States stood by its friends and deterred enemies as its military defended the free world and central banks held dollars in their reserves. And during times of stress, the dollar and Treasury debt were places to hide.

In exchange, the United States was able to finance their debt because of the dollar's "exorbitant privilege." As its capital surpluses flooded the world with dollars, the US financial market served as the hub of the global financial system. However, the fiscal imbalances and resultant credit booms and busts brought on by unrestrained debt and currency issuances resulted in the Great Inflation in the 1970s, the Asian financial crisis in 1997–1998, the subprime mortgage catastrophe in 2008, and the 2023 bull run.

With the United States turning its economic might and money into a weapon against its adversaries and allies, the fundamental foundations that supported the dollar’s allure as a store of value has been destroyed. The United States has used economic sanctions, prohibited Iran and Russia from utilizing the SWIFT dollar-based system, and now with the imposition of the highest tariffs in a century, the dollar is no longer good as gold, prompting other countries to diversify from the dollar and even set up alternate payment systems. With Mr. Trump’s trade war and gunboat diplomacy erecting a protectionist wall around the United States, he has become a defining issue for the dollar’s financial stability, marking the beginning of an era of global disorder.

Trump wants to project strength but we believe that America's protectionist policies and the economic chaos that follows will further diminish the US's export share of the world market, which will lower demand for dollar assets, making it more difficult to meet the US's enormous borrowing needs and grow its economy. Of concern is that the more America weaponizes the dollar or undermines its institutions like the Fed, the more international players will question America’s economic and political reliability and repatriate their trillions, further isolating America.

State of Play

Living beyond their means required the US to run trade deficits as well as budgetary deficits. America’s fundamental problem is that they do not save enough to finance their own economy and thus must borrow from the rest of the world and, the associated danger is that a rising interest burden will lead towards a fiscal crisis, like another depression. Tariffs unfortunately won’t change that.

Foreign holders own almost a quarter or $8.5 trillion of America’s $37 trillion of debt and the reduced appetite for US assets comes at a time when the Treasury needs them to keep rolling over or buy new debt. Simply the US does not have enough savings to fund their debt, so it must depend on the kindness of foreign investors and central banks to finance the government’s deficits. While most of the focus is on tariffs, the financial fallout is long lasting, particularly because the US continues to run damaging twin deficits, heading for an inevitable fiscal reckoning. America and the world are about to pay a steep price for the president’s single-mindedness. All this is of concern because the bond market and dollar, ordinarily a haven, collapsed on liberation day, amid fears of an unsustainable debt picture.

Earlier during Covid, the Fed financed America’s spending spree by conjuring up money from experimental quantitative easing which resulted in a whopping $9 trillion on its balance sheet that caused a near tripling in inflation. Yet rather than “rip off,” foreign capital surpluses actually helped finance the deficits. Middle East nations recycled their petrodollars to purchase Treasuries. China too invested its surplus dollars that helped plug the gap, however, ominously trade frictions has seen a shrinkage of China’s holdings to $800 billion from over a trillion last year. US Treasuries were once a haven in normal times but the president’s self-inflicted wounds have shaken confidence in US debt, raising concerns whether holders of US debt will be treated fairly. The risk is that in retaliation, foreign holders would repatriate or weaponize their Treasury holdings at a time when the market is under strain which would send rates even higher. America has become the largest debtor in the world, yet treats China, one of the largest creditors, as adversary Number One. That won’t last. Debt is America’s Achilles heel.

As such, the more Americans weaponize the dollar and trade, the greater the risk of a de-facto currency war with devaluation, user fees and capital controls. History shows that currency devaluation is next, in an escalation of trade wars. Already capital repatriation has caused a flight as the widely followed US Dollar Index (DXY), plunged almost 10 percent below 100. Coincidently the renminbi also weakened. That is when the American president blinked. This is how accidents happen.

Mr. Trump mistakenly believes that his nation’s ills are due to a strong dollar which makes goods expensive and a lower dollar would help boost exports. As a result Trump’s people are exploring a new role for the dollar in a “Mar-A Lago Accord” to duplicate Ronald Reagan’s Plaza Accord that depreciated the dollar in 1985. The Plaza Accord was an agreement that the US, Germany, France, Japan and UK would intervene to weaken the dollar to boost US exports. That worked but Japan lost two decades of growth. Although Trump believes tariffs will give him the stick to negotiate a lower dollar, co-operation of others is unlikely given the universal application of punitive tariffs. Ironically Mr. Trump does not need the accord, because his assault on the rules of law, sweeping tariffs and fiscal profligacy has sunk the dollar on its own.

Mr. Trump vs Mr. Powell

The global financial system is buttressed by the independent Federal Reserve. Of concern is that Mr. Trump’s war of words to lower rates is in conflict with Powell who sees tariffs raising inflation ruling out a preemptive rate cut. A subsequent debt implosion would add to the market’s woes, coming at a time when America’s public debt is at a record $37 trillion or 120 percent of GDP, the fourth highest after Japan, Greece and Italy. Worrisome is that Congress’ independent fiscal watchdog, the Congressional Budget Office (CBO) warned that runaway spending will top Second World War levels by 2029. Debt service alone is $1 trillion or more than the US spends on defense and there’s no sign of fiscal restraint. With uncontrolled federal budget close to $7 trillion, the budget deficit at 8% of GDP will rise with federal spending at 25 percent today, up from 19 percent in 2008. With $9 trillion of debt that must be rolled over next year and without those so-called DOGE savings, America’s debt levels are at unsustainable levels risking a repeat of the much feared near hyperinflation of the 1970s, or the 1930s. Consequently with fiscal policy hamstrung by America’s record indebtedness, investors are looking to that usual lender of last resort to bail them out. However, Fed Chair Jerome Powell said, “larger than expected” tariffs, means higher inflation which makes rate increases more likely to pre-empt another burst in inflation. The calvary is standing down, for now.

Job tenure during Trump’s second term in office is fleeting. To date the president has fired top judges in the military, FBI officials and even the Chairman of the Joint Chiefs of Staff. Yet just days after saying he wanted to fire Powell, Trump backtracked after his public criticism triggered another market selloff. However, in looking for a way to boost his popularity after the tariff debacle we anticipate fresh pressure on the Fed to open the fiscal taps given the impending larger deficits and ongoing inflation risks. Paradoxically the more the president challenges the Fed’s independence, the greater the risk of inflation expectations, lower markets and higher rates.

Although appointed by Trump in 2018, Powell’s term expires next May 15, 2026, and he has no plans to leave before his term expires. A similar incident occurred a half century earlier in 1971, when Richard Nixon imposed a 10 percent import tax, ordered a freeze on wages and prices, and coerced Fed Chair Arthur Burns into lowering rates in order to increase his prospects of winning re-election. Burns gave in, and the monetization of Nixon's deficits and the Vietnam War during prosperous times helped cause the Great Inflation of the 1970s and near hyperinflation, necessitating the next Fed chair, Paul Volcker, to push the economy into a recession to stop inflation. The debt to GDP ratio was 34% at the time. These days, it is 120 percent, and deficits of $2 trillion are commonplace. We worry that undermining the Fed's independence and pressuring it to lower interest rates and print more money could lead again to hyperinflation, a monetary phenomenon that recently occurred in Zimbabwe, Venezuela, and Türkiye. Of concern is the similarity between today’s climate and the geopolitical events of the 1930s, when democracy was put to the test, and failed.

1930s Redux

Before World War I, Germany was a superpower producing two-thirds of Europe’s steel and half its coal. After Germany's loss in World War I, the imperial government of Kaiser Wilhelms II was replaced from 1919 to 1933 by the short-lived democratic Weimar Republic, which was financially decimated. The war and the Versailles treaty's reparations devalued the mark, causing it to plummet from 320 to 7,400 per dollar by December 2022 due to more borrowings and money creation. This led to the disastrous Weimar hyperinflation where one dollar was worth 4.2 trillion German marks by November 1923. Recriminations and revolution soon followed, sapping the nascent democracy, paving the way for political upheaval, a move to authoritarianism and Hitler’s German Workers party. Soon after, Germany annexed Czechoslovakia in exchange for peace under the Munich Agreement signed by Britain, France and Italy, but that failed to stop the country’s expansion.

Beggar-thy-neighbor protectionism in the 1920s and 1930s devastated the global economy, and the Smoot-Hawley tariffs which were to restore the US economy caused a breakdown in multi-lateral commerce, further contributing to the world's descent into the Great Depression. On October 24, 1929, stocks opened 11 percent lower than the previous day, subsequently falling 25 percent in a few days. But then the combination of excessive government intervention, higher taxes and tariffs deflated the bubble-like markets. President Roosevelt, a Republican even went after big business and his New Deal helped crush the economy. He devalued the dollar to make US exports competitive but so did others. In April 1933, FDR signed the Executive Order 6102 making it illegal to own gold paying $20.67/oz and subsequently, revaluing gold to $35/oz so that the Fed could print more money to boost spending. Following the crash of 1929, the lessons of the Great Depression, German hyperinflation and political dysfunction should not be forgotten, at the risk of being repeated again.

Although there is nothing about life under Donald Trump that compares to the horrors of that time, there are some disquieting parallels from the leftward tilt of the Weimar years, to the diminishment of democracy, to the era of protectionism and to the falsehoods. Today there are familiar features including the glaring assault on global economies, self-harm from the tit-for-tat retaliatory tariffs, talk of revaluing the Fort Knox stockpile and a reckless fiscal policy. Pointedly there is also the step-by-step erosion of democratic freedoms, from the judiciary to free speech, and of concern like then there is little unified opposition. Donald Trump even calls mainstream media “fake news” (except for the Signalgate’s Mr. Goldberg of the Atlantic), when in the 1930s, there was the “press of lies.” Immigration then and today is top of mind issues. And very real is the slippery slope and crackdowns targeting foreign students and its universities. At the other extreme, yet less violent is Trump’s threat to annex Greenland, Canada, Gaza and the Panama Canal. Of concern is that the fragmented political culture paved the way for the Hitler years that descended into authoritarianism gradually, then all at the once. History shows that these should not be treated as musings, particularly when the US economy is weaponized to get what this president wants, including a Qatari jumbo jet.

The Best Trump Trade is Gold

One of the most damaging consequences though is the lasting harm to America’s international reputation as a safe haven for funds. The world is less safe today. Trump’s promise of a “golden age” has ironically made gold the prime beneficiary. Preservation of capital is the new currency. Why? Mr. Trump’s worldview is eccentric, a throwback to the depressing era of Thirties when America was very much alone, and happy about it. The problem is that in Trump’s “blast from the realpolitik past,” his protectionist trade aggression has united the “theys” as the world shifts from a uni-polar one to a multi-polar one. To be sure, Trump’s tariffs are here to stay. Mr. Trump says that tariff wars “are easy to win.” Chinese president Xi Jinping says there are, “no winners in a tariff war.” One of them is right. Ironically, China now provides more predictability for business than the US and, possesses the higher ground as the pillar of the global trading ecosystem. Beijing is unlikely to rollover to Mr. Trump given its financial and global trading strength. On the other hand, all this has created a risk premium for US assets.

Years of leverage and living beyond its means has left America’s fiscal flexibility constrained by its high level of debt and deficits. And now with the destruction of trust in Mr. Trump’s rational policymaking and in the rule of law, America’s financial system and global standing is being tested. Foreigners own a significant percentage of US debt. In markets, the most valuable currency is trust. Fears, turmoil, and the possibility of stagflation or even a depression has replaced earlier hopeful views that a Trump 2.0 presidency would be pro-business, low taxes, and spur new growth. Mr. Trump has control of government, the media, top law firms and elite universities. Now countries are rushing to bend the knee in exchange for exemptions, negotiated by either the great negotiator or one of his cronies. The only guardrail it seems are the markets and they are pushing back. The self-inflicted wounds have already caused an exodus of trillions of foreign direct investment dollars which is an overdue adjustment to the new world. US assets have become risky and a “bond” strike by foreign holders could materially impact the Treasury’s ability to fund the government’s deficits. The only certainty is Trump’s uncertainty. Gold is a creditable alternative to the dollar.

So what to do? Admittedly, no one including Mr. Trump, knows what’s next. However in our view, the best-case scenario is stagflation, a combination of slow growth and rising inflation as Mr. Trump retreats in a series of face-saving deals. Also if he does not repair relations with America’s allies, the toxic combination of his tax cuts, growing deficits, persistent inflation and negative growth, can only be financed by a massive dose of monetization, which will unleash hyperinflation. And, if that is not enough, another liberation day debacle would tip the global economy into another Great Depression, as the biggest tax hike in history and the inevitable supply aftershocks takes a big bite out of the world’s biggest economy. The best Trump trade is gold.

Recommendations

For the past three years, gold has been propelled by central banks buying physical gold seeking to diversify from dollar assets, in a reassessment of their exposure to the US economy. Central banks have purchased up to 20 percent of supplies or more than 1,000 tonnes annually for the last three years. After a six-month pause, the People’s Bank of China (PBoC) resumed purchases last November to about 2,292 tonnes adding 13 tonnes to its official reserves. China purchased 570 tonnes last year becoming the world’s fifth largest holder while its voracious consumers purchased 510 tonnes of gold jewelry, slightly behind India’s purchases of 560 tonnes. Official data shows that China tripled its gold holdings from a few years ago to 6 percent of total reserves. China is the world’s largest producer and is believed to have augmented “official” purchases with unofficial offtake from the Shanghai Gold Exchange (SGE), the world's largest physical gold dealer. Türkiye and Poland were also big buyers in April. The US remains the largest holder of gold at 8,133 tonnes valued at 42.22/oz. Given America’s financial woes there is talk of revaluing its reserves which would be worth some $800 billion, filling a financial gap. Can it be done? In 1972 the US revalued gold to $38/oz and subsequently $42.22/oz in 1973 and transferred $800 million into the country’s monetary base. Today revaluing America’s gold holdings would add $11 billion to the government’s coffers and, also put a floor under the price of gold.

Gold topped $3,500/oz and is up 25 percent year to date, as geopolitical uncertainties prompted investors into one of the few haven assets left. Amid fears of a trade war, investors poured into the gold backed Exchange Traded Funds (ETFs), purchasing 226.5 tonnes in the first quarter up from 113 tonnes last year according to the World Gold Council (WGC). China has given the green light to insurance groups to purchase and hold physical gold reserves. We do not yet know how high gold will go. For a long time we called for $2,000/oz, then $3,000/oz and $3,200/oz. If the dollar is no longer the world’s currency, we believe gold could revert back to its former role and $4,000/oz is the likely next target. However given recent doubts about the world’s largest debtor’s credit worthiness, the moon might not be high enough.

Gold miners put in better performances with average all-in costs of $1,500/oz but we believe that we are still in the early stage of their move because the group remains underowned. With margins today at 60 percent, gold miners have raised dividends and instituted buybacks. M&A activity was active as companies sought to replace declining reserves since it is cheaper to buy ounces on Bay Street than to explore. With miners today generating huge cash flows and after having dusted off old projects, they are looking to replace depleting reserves. Last year, M&A activity showed that the average paid for an ounce of in-situ reserves was close to $250/oz. This bull market has just begun.

Pointedly not all gold companies are alike. Agnico Eagle Mines is generating huge cash flows such that they have boosted dividends, paid down debt and bought back shares. Newmont, however, has underperformed due to the clean-up from previous expensive acquisitions of newly acquired Newcrest and Goldcorp which left them with huge writedowns and restructurings. Nonetheless gold miners are resorting to the M&A musical game of chairs to boost production and reserves but there are so few chairs around. Barrick sold its stake in Donlin Gold for $1 billion as the project was not in their short-term plans. China’s CMOC group acquired Ross Beaty’s Lumina Gold, a project in Ecuador. We like Agnico Eagle and Barrick among the seniors as well as mid-tier developers like B2Gold, McEwen Mining and Eldorado for growth. Lundin Gold and Endeavour are favoured as potential participants in the M&A merry-go-round.

Agnico Eagle Mines Ltd.

Agnico Eagle had a barn burner first-quarter earning $1.53/share or $770 million on production of 874,000 ounces at all in cost of $1,200/oz. More importantly the senior producer recorded free cash flow of $600 million dollars reflecting its largely North American asset base which allowed the paying down of debt from $1.5 billion in 2024 to effective net zero debt status today. Agnico’s underground Meliadine averaged 6,200 tpd. Hope Bay had 30 km of drilling as Agnico proves up a resource which will include plans to utilize Agnico’s Nunavut infrastructure adding 400,000 ounces in 2030. Agnico’s success is to utilize existing facilities (such as Canadian Malartic) to exploit satellites Odyssey, Marban or Wasamac. Upper Beaver could add 200,000 ounces a year beginning in 2030. Although Agnico Eagle trades at a premium to its peers, we like Agnico for its organic growth pipeline, low-cost Canadian base and seasoned management. Buy.

Barrick Gold Corp.

Barrick Gold announced the $1 billion sale of its 50 percent interest in Donlin Gold in Alaska which was a non-core asset given its isolated location and a $7 billion price tag to build the mine. In the quarter Barrick produced 758,000 ounces but all in costs rose to $1,775/oz due to planned maintenance at PV and Nevada JV. At the same time, Barrick is building Reko Diq in Pakistan (37-year reserve life) and expects to spend a billion dollars this year on this long-term project. The cost for phase 1 alone is about $6 billion but will boost Barrick's copper output. Barrick has only the Hemlo mine left in Canada and there are reports that this 143,000-ounce producer is for sale which would leave Barrick with no operating mines in Canada. Barrick has changed its name from Barrick Gold because of its growing copper base, resulting in dropping the iconic GOLD symbol inherited from Bristow’s Randgold. The name change does not alter Barrick’s premium gold assets but Barrick Mining Corporation is designed to boost its investor base and the new symbol of B is a mistake, given our expectation that gold is THE precious metal, not copper. Meantime Barrick remains locked in discussions with the Mali government over Barrick's Loulo-Gounkoto mine, which resulted in the suspension of mining. The mine accounts for 15 percent of Barrick’s production. The Malian government seized three tonnes of gold over the tax dispute despite an agreement with the government in February. Barrick’s patient approach helped settle lengthy but successful negotiations in PNG and Tanzania which are now up and running. Nonetheless, we like Barrick’s array of long-life high-quality Tier I assets, track record in growing reserves and recommend its purchase down here.

B2Gold Corp.

B2Gold is building out the $1.5 billion Goose/Back River project in Nunavut and released a new life-of-mine plan that boosts gold production based on 2.5-million-ounce reserve at 6.82 g/t, producing 270,000 ounces a year for nine years. Goose will be in production Q2 this year, adding 140,000 ounces. In Mali, Fekola Regional was delayed due to permits under the 2023 mining code but the flagship should produce 540,000 ounces this year. Otjikoto and Masbate were in line with expectations. A feasibility study at Gramalote in Columbia is to be completed this year and could be producing 240,000 ounces annually sometime in 2029. B2Gold’s balance sheet has $330 million of cash and undrawn $800 million RCF. We like B2Gold here for the development potential of Fekola Regional, Gramalote and Goose.

Eldorado Gold Corp.

Eldorado is building out Skouries in Greece which is 66 percent complete, but the company raised its capex to $1.2 billion with commissioning planned for Q1 2026. Eldorado’s first quarter results were mixed on earnings of $0.35/share from production of 116,000 ounces from Lamaque, Kışladağ, Efemçukuru and Olympias. Free cash flow was $76 million (excluding Skouries). Production at Olympias in Greece was disappointing due to problems with the flotation circuit. At Skouries, procurement is complete with $84 million spent in the quarter. Eldorado has a well-funded balance sheet with liquidity of $1.2 billion including $978 million of cash and equivalents. We like Eldorado for Skouries which is coming on at the right time of the cycle. Buy.

Endeavour Mining PLC

Endeavour Mining had a strong quarter from its mines in Senegal, Burkina Faso and Côte d’Ivoire, producing 341,000 ounces at AISC of $1,129/oz that generated record free cash flow of $409 million. Endeavour’s balance sheet is strong with net debt reduced by $354 million to $378 million. Endeavour’s Mana Mine in Burkina Faso had higher production on better grades. A technical update following completion of BIOX expansion at flagship Sabodala-Massawa’s underground is scheduled around year end with first ounces possibly in 2027. Houndé had a strong quarter. Development is on track at Assafou in Côte d’Ivoire, a potential Tier I asset as part of the company’s $75 million exploration expenditure this year. A resource update is expected in the second half with construction maybe in 2026, and 2028 for first production. We like Endeavour’s valuation here for both dividends and growth despite its West African geographic risk.

IAMGOLD Corp.

Mid-tier IAMGOLD had mixed results producing 161,000 ounces in the first quarter at AISC of $2,731/oz. Côté Gold produced 54,000 ounces to IAMGOLD’s credit but Westwood’s struggles continue producing only 34,000 ounces at $1,908/oz. Essakane costs increased due to higher fuel costs and lower grades. The balance sheet has $745 million with $316 million cash and a credit facility of $429 million, plus a gold pay obligation. Nonetheless we believe it will take time for Côté to get up and running, so we prefer B2Gold in the interim.

Lundin Gold Inc.

Lundin Gold had a barnburner quarter producing 117,000 ounces at all in cost of $980/oz from 100 percent owned Fruta del Norte (FDN) in Ecuador. Lundin announced a $100 million special dividend or $0.41/share after generating $171 million free cash flow in the quarter. FDN is one of the richest gold mines in the world and lowest cost producers. The company delayed its resource estimate at Bonza Sur (one km from FDN) because of positive news from Trancaloma, a nearby large copper/gold porphyry on the east border of Bonza Sur. Lundin has 14 drills working. We like Lundin here for its cash flow, high grades (10.4 g/t in quarter) and potential to grow Fruta del Norte. We also think the miner with a strong balance sheet and steady cash flow will be a participant in the M&A merry-go-round.

Newmont Corp.

Newmont generated $1.2 billion in free cash flow. However, Newmont’s production was off 21 percent due to the sale of non-core assets from the expensive acquisitions of Newcrest and Goldcorp. While Newmont’s asset sales were timely, the writedowns and consolidation of both companies is problematic. Despite asset sales, Newmont has 11 operating mines with costs remaining a problem with AISC at $1,650/oz, increasing 13 percent, suggesting there are still problems with Newmont’s remaining legacy assets. At Lihir, restructuring costs increased in part to the rebuild of two autoclaves and lower grades. At Boddington, the scheduled plant shutdown meant they processed low grade stockpiles. Cadia, Brucejack and Red Chris are cash devourers. Sustaining costs at Yanacocha also hurt Newmont’s cost profile. As such, we prefer Barrick here because it will take time for Newmont to turn itself around. Management remains top heavy.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/.

********