Gold: Guns and Butter Redux

Devastating mudslides, damaged homes, and forced evacuations were triggered by storms in California. Hillsides that had been destroyed by fires and droughts and had no vegetation to absorb the rain were vulnerable to landslides and mudslides. In Sierra Nevada’s higher elevations, heavy mountain snow of 6-10 feet raised the risk of avalanches.

After rates fell to rock bottom levels to recover from the pandemic, the US government's reckless spending led to an enormous debt load that flooded the economy with cheap dollars. Because of this massive money printing exercise, inflation picked up and America has accumulated debt on a horrific scale. We believe that “guns and butter” spending for climate change and wars has led to a greater tolerance of inflation and higher debt, but like the situation that precedes a landslide or avalanche, there is a point which can’t be pinpointed exactly, we are going to be buried in a landslide or avalanche of cheap dollars.

It has happened before. The Bretton Woods monetary agreement caused the dollar to collapse between 1960 and 1970. President Nixon was forced to halt a dollar run and close the gold window in 1971 due to America's massive debt, which was partially caused by the Vietnam War, which led to two decades of high inflation and financial instability. Then in 1985, the US, Germany, France, Japan, and the UK were forced to devalue the dollar once more because America's liabilities had surpassed its assets. And today once again that moment is upon us. Mr. Biden proposes a guns and butter fantasy, spending on wars plus trillions for greening the economy that led to the superboom conditions reminiscent of the seventies. With inflation picking up and stock market records being broken around the world, gold broke two records in weeks. Everything is going up.

Corrupting Era of Easy Money

Bull markets climb walls of worry. However, we are told it is different this time. Despite signs of headwinds, complacency rules the day. Stocks are overbought, led by the “Magnificent Seven” which represents half of the US economy and an outsized influence on the market. In Europe there are eleven companies, the “Granolas” that fueled Europe’s Stoxx gains. In Japan, the benchmark Nikkei 225 closed above all time highs set 34 years ago. Nasdaq 100 is trading at a PE of 33x. And amidst this irrational exuberance, investors have dismissed worries over inflation as policymakers and officials take a hands-off and “what me worry” approach, caring little about investor safety. This will change. Confidence is fragile.

In this sense, market conditions today are reminiscent of past fiscal and asset bubbles about to deflate. There was the internet stocks during the dotcom bubble era in 2000, prompting then Fed Chair Alan Greenspan to describe the state of markets as “irrational exuberance”. Prior to that there was the Nifty Fifties implosion and before that the Roaring Twenties, and then of course the classic tulip bulb mania. New era thinking certainly is not new. Back then, investors believed that opportunities would grow to the sky and the world would be transformed.

For many, there are speculative hopes that the Fed is close to a dovish pivot and prematurely loosen the monetary reins, perpetuating yet another boom/bust cycle with valuations comparable to the peak levels of the dot.com mania. Artificial Intelligence (AI) for example has improved our lives, and if believed, could also destroy our lives. No question AI could improve productivity and living standards but if it’s too good to be true, it must be too good to be true. AI has actually been with us for the half century but only with the arrival of Siri or Alexa has become common in our lives. But this elixer can do more and now with ChatGPT, open AI and others, why bother with fund managers to beat the index – let AI weed out the winners. Amid this boom, valuations have priced in this transformation and an AI seeded stock bubble is set to burst. Today the Magnificent Seven are the investor darlings but now down to six. AI hype is reminiscent of the telecom bust in the past. None of these manias ended well. Too much money is chasing too few opportunities – history always repeats.

Then only a year since three mid-sized banks, Silicon Valley, Signature and First Republic collapsed, another regional bank, $114 billion New York Community Bank (NYCB) reported half a trillion in provisions for credit losses, requiring a billion-dollar bailout by former US Treasury Secretary Steven Mnuchin. Regional banks hold roughly 80% of commercial real estate loans and are small enough to fail and, systematically important as the big banks. The implosion comes at a critical moment with over a trillion dollars of commercial property mortgages coming due within two years as plunging office values take hold. US commercial real estate busts are all too common, dating back to the sub-prime crisis of 2008 and the collapse of S&Ls in the 1980s. Concern today is that the bad property debts significantly outstrip the reserves of the big banks, ensuring yet another bank run disaster.

Similar dangers stalk the central banks' significant holdings of securities purchased earlier to support their economies and are now running huge losses due to increasing interest rates. For instance, the Bundesbank, the central bank of Germany, has lost almost $20 billion as a result of increased expenses, necessitating additional funding and support from the government. First time in 20 years, the European Central Bank (ECB) lost one billion euros. In the interim, the Federal Reserve's balance sheet has increased dramatically from $4 trillion in 2019 to $7.6 trillion today, with indications that another wave of quantitative easing may be on the horizon. Losses will increase. Risk often ends up where it started. Who is going to save the central banks?

A World at War

US foreign policy has once again been put to the test by the never-ending wars, and after nearly four years of trial and error, America has even asked its arch-rival foe, China, for assistance in using its significant influence with Iran. American power is waning in a world of aggressions. These days America finds itself caught in a multi-polar world of transactional international relations where many powers compete for influence, partly of its own making. After becoming nearly self-sufficient in oil, US policy and presence in the Middle East declined, culminating in the humiliating retreat from Afghanistan. Then energy embargoes, weaponization of the dollar, sanctions and subsidies further isolated America. America has put all its eggs in the Israeli basket, leaving it vulnerable and divided against itself, diminishing its global clout and power to deter adversaries.

The US for example was the lone veto of UN Resolutions demanding a Gaza ceasefire. Western hegemony is threatened as Iran’s influence increases through its “axis of resistance” policy, wielding unrivaled power through its proxies in Syria, Lebanon, Yemen, Iraq and Jordon. Once America’s backyard, Iran-backed Houthis in Yemen blocked the Red Sea and attacks on US bases reopened old wounds, challenging American influence. All this explains that with US election year politics in high gear, the developments shift the tinderbox’s balance of power, starting back when President Eisenhower pushed for regime change in 1953. Since then, no president has got the Middle East right.

Wars are expensive. Israel’s economy has shrunk 20% with its credit rating reduced due to weakening finances which forced them to borrow $60 billion or three times the size of its 2022 budget deficit. Stretched to the limits of America’s capabilities, the conflicts in Ukraine and Gaza are absorbing scarce resources and labour which will take years to recover, particularly when the US government spends more on interest payments than it does on defense, making it the second largest part of the budget. America was once the leader, military, economically and a beneficiary of globalization that brought them real benefits. But as hellish headlines emerge from the war in Ukraine, the new reality is that although spending almost a trillion dollars on America’s vaunted military that colossus can be left impotent by a $2,000 drone.

But the problem runs deeper. Globalism is in retreat. America has dominated the world so long that division has set in with the changing geopolitical shifts threatening not only its global hegemony but its supply chains and trade routes. America is paying for its mistakes. For too long, America was complacent and since World War II, the US has had a poor record of diplomatic and military engagements winning only one war (Iraq). Taking a page from Iran, perhaps they should better equip proxies like Ukraine or even Israel to defend their strategic interests.

Today the isolationist “America First” policy under Mr. Trump is made worse by Congressional divisions which has undercut military assistance for Ukraine. Realistically to enforce its policies, America would need to put boots on the ground, but allies are worried. The war is a wake-up call since world players also notice that despite Russia being largely cut off from the western global financial system, the country prospers with higher revenues, putting additional pressure on Europe. China and India have become Russia’s benefactors, weakening the US-led coalition and, eroding US power. Consequently, Europe preoccupied with economic recovery, must also boost their defense capabilities against a more confident Russia. Worrisome is that Donald Trump’s desire to fold America’s defense umbrella exposes NATO members like Canada and others’ chronic failure to reach the two percent of GDP spending on defense. Russia? That country spends 7% of its GDP on defense, compared to America’s spending of 3.5% in the face of proliferating foreign threats. China? That country plans to spend $230 billion or 1.3% on defense.

Trump Redux

All of which deepens investor concern over the dollar. The US electorate is too polarized as its politics is shaped by divisions made worse by Mr. Trump. To raise revenues, Mr. Trump the epitome of unpredictability, threatens to ratchet up trade tensions with across-the-board tariffs on imports despite sparking the last trade war which saw inflation roar ahead. We believe Trump’s second term will be an echo of the first. But this time in an escalation of the trade war during his first term, he risks a repeat of the Smoot Hawley tariff debacle which was meant to protect the American economy, but triggered a devastating trade war, ending with the Great Depression. Today an isolated United States will need to expand revenues, thus this second term president might consider an “excess profits” tax, leveled on corporations and individuals, ironically to pay for his tax cuts set to expire. And then reversing his position arguing against banning popular Tik Tok, owned by China-based ByteDance, the GOP introduced a bill to ban the well-liked platform. Mr. Trump may be part of the problem, not the solution.

Like Mr. Trump’s personal situation, the nation’s finances are in disarray and unsustainable. If Trump follows through with trade restrictions on allies and China in particular, the pressure will grow. All this is inflationary and in an echo of the Thirties, restricting China’s access to America’s markets would meet a tit-for-tat response, akin to the protectionist trade war in the Thirties. Meantime Mr. Trump has recreated the GOP in his own image and today the current frontrunner is a transaction man with a price for everything. Although unpredictable he likes to negotiate, make deals and win, or at least the perception of winning. He “won” the last war with China or so he thinks. NATO? He is already victorious with Europe pledging to spend more. Of concern is that should the Republican nominee prevail, then three of the world’s biggest democracies, India and Indonesia will not only be run by strong authoritarians, but all are supportive of Russia. With more than half of the world electing new leaders this year, none is more pivotal than the United States, and the world.

Demise of the Dollar

The US dollar is the keystone to US power. However, with a more resilient US economy dashing hopes of rate cuts, the dollar has risen this year. Nonetheless de-dollarization moves to reduce reliance on the dollar for trade and financial transactions have seen a decline in dollar usage as a prelude to a lower dollar. Further Bidenomic’s guns and butter fiscal fiction which dropped trillions of dollars from Washington undermines the dollar. America’s debt overhang casts a long shadow.

Things are not that simple. Today America has 1.4 jobs available for every unemployed person with the strongest labour market since the 1960s. Persistent growth in services has become a bigger share of inflation dynamics. And another debt ceiling brinkmanship looms in April to be followed by a potential sell-off partially if Donald Trump’s “America’s First” agenda and dose of isolationism cedes the global field to its opponents. Next year increased government spending or another round of tax cuts would widen the budgetary deficit already set to grow another 50%. Trump's proposed tax cut ideas would increase inflation. Deficits do matter. The main concern is America’s mounting $35 trillion debt is spiraling out of control with the cost of servicing at 3% of GDP. Additional spending and excess liquidity is set to rekindle another bout of inflation and America’s gridlocked politics and isolation debases confidence in the dollar.

The expected amount borrowed by the US government as a percentage of GDP is 6%, which is over twice as much as the average of 3.7 percent for the previous 50 years. At 23% of GDP, up from 19%, government spending is still the key driver of the economy. The US national debt has skyrocketed over the last four years, rising from $11 trillion to $35 trillion since the pandemic. With trade and budgetary deficits, public debt to GDP is at an all-time high of 130% of GDP, and there is no end in sight to the wars that are eroding the US economy and its culture. Money supply has increased by 40% in the last few years but has only decreased by 2.5% annually as a result of policymakers' addiction to spending. Consumer debt (mostly mortgages) is at a record high of $17.5 trillion or a 24% increase since the pandemic. Americans are spending more and savings less. At 3.7 percent, US joblessness is at a 50-year low. Like the government they are spending beyond their means at an unsustainable pace. Simply, too much money is chasing too few goods.

While the supply of Treasuries has been big, so has demand. However that demand is tenuous, particularly since the Fed was the big buyer until now, shaking foreigners’ faith in America and usage of the dollar. That episode is eerily familiar when in 2022, investors balked at then Prime Minister Liz Truss unfunded tax cuts, sending markets into a free fall, and soon after the collapse of Credit Suisse. Confidence is fragile.

Next year, a new US government, likely headed by Mr. Trump will release a budget with new spending and a likely replacement for his expiring 2017 tax cuts. Deficits are set to grow further with the government needing $1 trillion every 100 days. Recent projections from the Congressional Budget Office (CBO) show that interest payments on US debt alone will top $1 trillion, more than the US spends on defense. Politically, the American people will elect another inflationary president and a dysfunctional Congress – no one stands for sound money. The US has accumulated debt on a unprecedent scale, a situation that precedes a landslide or avalanche. No wonder the dollar has lost roughly 90% of its value since 1971. And the weaponization of the dollar has prompted both friend and foe to look for alternatives. The election will be pivotal, with one candidate who can’t seem to remember and the other who can’t seem to forget.

Gold: The Ultimate Store of Value

Gold hit another record high at $2,182/oz after setting a new all-time record last year buoyed by record purchases by central banks. Gold was up 13% last year and having finally reached our oft repeated target, we now expect gold to hit $3,000/oz within 18 months, supported by continuing central bank purchases as part of the de-globalization trend. As usage of the dollar falls below 60%, growing geopolitical unrest, persistent inflation and a flight to safety also underpins the gold price. Then of course there are growing concerns over dysfunctional American politics. Could a Trump II actually work? The consequences could be catastrophic – for the world, and democracy. The world is getting more dangerous. Gold will be a good thing to have.

In the meantime, Chinese consumer prices fell 0.8% in January, a statistic that would typically be praised in the West, according to western media. Because of its position as a global exporter, China has the greatest reserves in the world, valued at $3.2 trillion, according to the State Administration of Foreign Exchange (SAFE). The superpower rivalry has hurt America because foreign capital has plugged America’s fiscal holes, a precarious position as its level of debt rises. However latest data also shows that China has reduced its US treasury holdings from over $1 trillion to $798 billion in January due in part to the strained relations with the US and the need for diversification. Meantime the yuan has fallen almost 10% against the greenback last year. Noteworthy is that China’s gold reserves have increased for the 16th consecutive month, which is denominated in dollars, giving China an effective hedge against a drop in the dollar and holdings.

"Gold still represents the ultimate form of payment in the world as gold is always accepted," stated former Fed Chair Greenspan. Central banks have been buying gold at record levels in the last two years, with purchases of over 1,000 tonnes yearly in 2022 and 2023 alone, accounting for about a third of mine production. Some central banks have been aiming to match the reserves of Germany, France, and Italy at 4% of GDP. This gold rush resulted in a record 1,136 tonnes being acquired by central banks in 2022. The BRICS too were big buyers as some sought to avoid Russia-style sanctions as well as diversify their holdings to avoid further dollar debasement. Poland purchased 300 tonnes boosting holdings to 3% of GDP. Bank of Mongolia bought 16 tonnes. Ironically, with no gold in its reserves, gold-producing Canada was conspicuously absent.

China and India, two of the world’s biggest consumers of jewellery, have a robust domestic jewellery market. With 375.16 tonnes produced last year, China led the world in gold production. The country's Shanghai Gold Exchange (SGE), the biggest physical gold market, helped China increase its holdings to 2,257 tonnes or 2% of GDP. China has the fifth largest stockpile behind the US which has 8,133 tonnes. On a retail level, the SPDR Gold Share ETF saw net outflows which were purchased by the central banks. Simply, there is more demand than supplies.

All in all, increased geopolitical uncertainties, forever wars in Gaza and Ukraine together with inflation have generated worries about the US and its dollar. For now the fear of additional sanctions prompted many to diversify and hedge their bets in a de-dollarization move. The global monetary system has evolved into a multi-order, multi-currency and multi-trading world with regional players not only diversifying from dollars but developing alternate dollar-payment system. Gold is money. The value of gold is not conferred by governments, its supply is limited and unlike fiat dollars, gold cannot be created with a click to effect desired economic outcomes. Gold is a universal store of value with no counterparty risk and is playing a role in this multi-currency system. Gold is a good thing to have. The avalanche is coming.

Recommendations

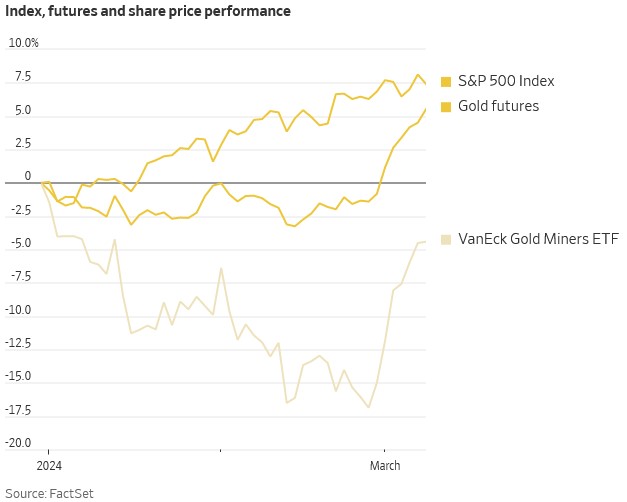

A two-tier market is developing with record bullion prices but the biggest miners haven’t enjoyed the same success. Helping gold is that the supply is constrained because miners are producing less gold. While gold was up 13% last year, Van Eck Gold Miners ETF (GDX) has lost 16%. Mining costs also skyrocketed to AISC at $1,400/oz. As a result, there is less spending on exploration, the lifeblood for the industry. Meantime production and reserves are declining forcing some players to make ill-advised takeovers to replace depleted reserves. The world’s biggest gold producer, Newmont paid a whopping premium to buy Australia’s Newcrest and recently took a $2.5 billion writedown, dumping some mature miners from its last two big acquisitions. Also dimming enthusiasm for gold is increased nationalization as governments try to pluck the feathers from the golden goose. Geopolitical risk has increased with the spread of resource nationalization. Centerra lost its flagship Kumtor and had to settle for paper for the loss of its cash flow. Panama has wrested control of its only mine, generating huge losses for First Quantum and Franco-Nevada.

Gold shares’ performance has been disappointing despite buybacks and robust cash flows. Declining reserves will mean continued active M&A activity in a game of musical chairs – the problem is that there are too few chairs. As such, we continue to recommend the senior players such as Agnico Eagle, Barrick and B2Gold for their quality assets. We particularly like the developers because they will be bringing on production over the next couple years such as McEwen Mining, Lundin Gold and Endeavour Mining. We also think mid-tier players like Eldorado and Centamin will be participants in this more active M&A market.

Agnico Eagle Mines Ltd.

Agnico Eagle had a record year with record gold production and a 10% boost in reserves to almost 54 million ounces following the acquisition of the balance of Canadian Malartic. The company’s three-year guidance plans production of about 3.4 million ounces in 2025. Producing 903,000 ounces in the latest quarter, the company is advancing projects at Detour underground, Wasamac and Upper Beaver. At Amaruq, mine life was extended with an additional 500,000 ounces. Agnico Eagle is Canada’s largest gold producer with long life mines at Detour Lake and Canadian Malartic. Agnico also disclosed additional production using the Macassa infrastructure by processing satellite deposits. Agnico Eagle generated almost $1 billion of free cash flow this year declaring $800 million in dividends. We like Agnico for its organic growth from operating mines in Canada, Finland, Australia and Mexico, all with little geopolitical risk. Buy.

Barrick Gold Corp.

Barrick had a transition year and production growth will be flat again. Costs also increased with AISC at $1,400/oz. With the company focused on growing organically, free cash flow grew by 50%. The company replaced more than 140% of their gold resources since 2019. Barrick’s longer-term outlook is driven by the huge Reko Diq in Pakistan which is expected to be a major contributor. In the Dominican Republic, Pueblo Viejo’s plant expansion was delayed, but is expected to catch up this year. Financially, Barrick has a stellar balance sheet permitting peak spending at $3 billion next year. In Nevada, the company has fast tracked 100 percent owned Fourmile project which is outside the Nevada joint venture with a view to releasing a prefeasibility study (PEA) this year. Barrick is the world's second-largest gold producer possessing the largest number of Tier 1 mines and this year will spend $1 billion on expenditures at Reko Diq and the Lumwana copper superpit expansion in Zambia. We like the shares here.

B2Gold Corp.

We like B2Gold here, particularly upon the recent weakness due to concern following an armed attack in Mali which temporarily disrupted operations. Although 300 km from B2Gold’s Fekola Mine, security is all-important. Discussion on fiscal terms under the 2023 Mali mining code is still ongoing with respect to the development of the Fekola Complex. The balance of Gramalote was purchased and an updated PEA this year is expected to focus on a smaller scale operation. Construction at the Goose mine in Nunavut is progressing with another tailings pond and extension of the solar plant. B2Gold has three operating mines and the Goose development project will come on stream early next year which will add 300,000 ounces. B2Gold recently received an offer from Rupert for its 70% interest in the B2Gold/Aurion JV for Aurion’s Northern Finland project which hosts 4.3 million resource at 2.2 g/t. B2Gold has a strong balance sheet with $300 million cash plus a $700 million line.

Centerra Gold Inc.

Centerra's Mount Milligan in BC had a good quarter as well as Öksüt in Turkey. Centerra's free cash flow totaled $80 million, and the company has a stellar balance sheet of $600 million of cash and no debt. Mount Milligan’s life could be extended beyond 2035 and Centerra is working on a PEA in that regard. A feasibility study for the Thompson Creek restart is expected mid-year. Centerra's proven and probable gold reserves were 3.6 million ounces. Looking ahead, Mount Milligan's all-in-cost are about $1,100/oz with production between 180,000 to 200,000 ounces and 55 million to 65 million pounds of copper. Öksüt’s fourth-quarter production was 88,000 ounces producing almost 196,000 ounces last year. While Centerra's results were decent, the company has two mines and the loss of Kumtor through the nationalization by the government has put a cap on the shares. Growth is elusive here. Sell.

Eldorado Gold Corp.

Eldorado is a mid-tier gold producer with the big Skouries project in Greece requiring capex between $375 million to $425 million. Higher labour costs accounted for the increase. Skouries is a company builder and should be in production by the third quarter of next year which will boost Eldorado's gold output by almost 45 percent from 2023 through 2027. Skouries is 70 percent complete and fully funded. Heap leaching at Kışladağ in Turkey should produce 190,000 ounces while Efemçukuru should produce 80,000 ounces. Eldorado produced 143,000 ounces in the last quarter and production will be up to 525,000 ounces. With contributions from Kışladağ, Olympias as well as from the Lamaque Complex in Québec. Eldorado has a strong balance sheet with total liquidity of $652 million, including $542 million of cash and $110 million revolver. We like the shares here.

Endeavour Mining Corp. PLC

Endeavour’s flagship Sabodala-Massawa mine accounts for 30 percent of the company’s asset valuation and is capable of producing more than 400,000 ounces per year. The Phase 2 Biox expansion will start up in the next quarter and process refractory ores which will boost output. Former open pit Massawa underground development work experienced delays but is less than 30 km from Sabodala processing plant so the increased output will be a major contribution. Lafigué in Côte d’Ivoire is Endeavour’s next mine which will produce 200,000 ounces annually at AISC below $900/oz with production slated Q3 2024. Endeavour’s shares were hit by the firing of their CEO for cause providing an excellent purchase opportunity to buy this growth producer. Endeavour has $500 million of cash with $500 million of senior notes due 2026. We like the shares for its growth production profile.

IAMGOLD Corp.

IAMGOLD had a good quarter and $3 billion Côté Gold is finally expected to be a contributor with the project almost 90 percent complete. Côté has about 5 million tonnes stockpiled and the company produced 465,000 ounces last year. Essakane is a major producer contributing 180,000 ounces in the fourth quarter for total output of 372,000 ounces with cash cost of $1,132/oz and AISC at $1,500/oz. This year IAMGOLD expects Essakane to produce between 330,000 to 370,000 ounces. Westwood saw an improvement but again costs were high with AISC at almost $1,800/oz. Hopefully Côté should produce 220,000 and 290,000 ounces at AISC of $1,200 an ounce. IAMGOLD is a mid-tier producer that has placed a big bet on completing Côté and this $3 billion plus mine will have inevitable teething problems, notwithstanding the arrival of Renaud Adams. IAMGOLD has $370 million of cash enough to fund the remaining $142 million at Côté. We see downside here. Sell.

Kinross Gold Corp.

Kinross had a decent quarter with production at Tasiast, Paracatu and a restarted La Coipa boosting results. Mauritanian Tasiast following the mill expansion had a record quarter and is expected to produce 600,000 ounces due to better grades and throughput. However, Kinross only added 1 million ounces to the 2.8-million-ounce resource at Bear Creek. So much money for so little results. Bear Creek is a long-term development situation and not a near term contributor. Kinross plans a PEA as a prelude to the billion-dollar plus expenditure to bring Great Bear into production. Kinross has a collection of mature mines and Bear Creek is still in the early development stage. We prefer more growth-oriented producers like B2Gold.

Lundin Gold Inc.

Lundin Gold had a stellar year producing 480,000 ounces at AISC $860/oz from Fruta del Norte in Ecuador. Lundin has the richest gold mine in the world, generating a billion dollars of cash last year which allowed the repayment of $72 million on its senior debt facility. Cash flow was largely directed to buying back their stream facility. In addition, the company drilled 55 km, looking for another Fruta del Norte (FDN). The company also plans a $36 million processing plant expansion which would increase tonnage and output (mill operated 4,500 tpd last year). Head grade was whopping 9.9 g/t. Lundin released a three-year guidance producing about 500,000 ounces this year at AISC under $900/oz which is among the best among its peers. Buy.

McEwen Mining Inc.

McEwen had a profitable quarter due to an accounting gain from selling down its interest to 48% in McEwen Copper’s huge Los Azules project in Argentina to Rio Tinto and Stellantis at a $800 million valuation. Los Azules is one of the world’s largest undeveloped copper deposits and a recent update of its PEA will form the basis for a bankable feasibility study next year. The sale allowed McEwen Mining to top up its balance sheet and with the equity interest of McEwen copper, an investor receives McEwen’s gold mines for free. McEwen Mining shares has a large US following and was one of the better share performers. Meanwhile McEwen’s Fox development has turned around with exploration results showing surprising rich grades. McEwen has a large stake in Timmins and the Fox development gives the shares upside with other mines in San Jose and Gold Bar in Nevada. We like the shares here.

Newmont Corp.

Newmont shocked the Street writing down $2.5 billion due to an impairment loss over its acquisitions. Newmont also reduced its dividend and put six mines and two projects on the auction block. The writedowns date back to the Goldcorp, Newcrest and AngloGold purchases which saddled the company with a mixed bag of assets but $8 billion of debt. The two Australian mines came with Newcrest and the dumping of six non-core assets is a reflection of the overpayment in its quest to become bigger. Instead, Newmont bought other people’s problems. Newmont is world’s largest gold company by production but in spending a lot of money in order to boost ounces the company has eroded shareholder value – the reverse of their peers. Operating the remaining 18 mines will still be a problem with operations spanning over four continents. We prefer Barrick here.

John R. Ing

*********