Gold Has Outperformed The Stock Market Since 2000

Strengths

- The best performing precious metal for the week was silver, with a fall of just 0.51 percent with platinum just behind that. Following wild price swings on heavy volume Monday and Tuesday in a suspected erroneous trade, gold traders and analysts remained bullish for a second week, reports Bloomberg. On Monday, 1.8 million ounces of the yellow metal were sold in a single minute and on Tuesday prices spiked in early European trading with about 815,000 ounces of gold bought in five minutes – a suspected reverse on the Monday fat finger trade.

- The euro has climbed to a 13-month high on speculation that Mario Draghi’s ECB is poised to reduce unprecedented monetary stimulus, writes Bloomberg News. This has allowed Europeans to pay the least this year to buy gold, the article continues, while comments from Fed Chair Janet Yellen this week did little to support the U.S. currency.

- HKEK and the Chinese Gold & Silver Exchange Society signed MoU on Thursday to consider cooperation on matters such as product promotion and storage vaults, according to a statement on the Hong Kong Exchanges & Clearing website. MoU signifies strategic partnership that aims to build a major gold and commodities trading center in Asia Pacific, said CGSE President Haywood Cheung in a statement, reports Bloomberg.

Weaknesses

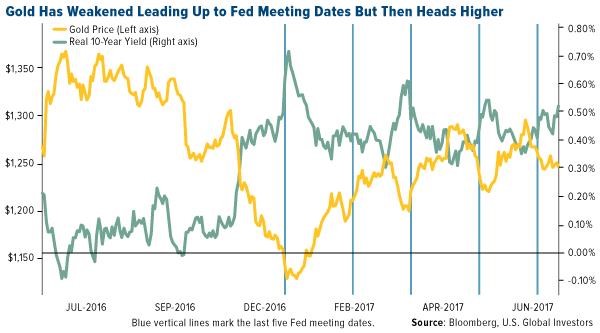

- The worst performing precious metal for the week was palladium, down 2.13 percent on money managers cutting their bullish bets on palladium futures to the least bullish level in three weeks. Bullion for immediate delivery is down around 2 percent in June, reports Bloomberg, and on course to end the longest run of monthly gains since 2010. Central banks around the world have taken a more hawkish stance on monetary policy, curbing the appeal of assets that don’t pay interest.

- On Monday, gold fell around $20 in a matter of seconds around 4am ET. While the yellow metal recovered a portion of those losses, it still traded down 1 percent. “No-one has a clue, apart from the unfortunate individual that pressed the wrong button,” David Govett, head of precious metals trading at Marex Spectron Group, said about the unusual plunge. Gold has gained 7.36 percent year-to-date, writes Bloomberg, but has struggled to break through its pre-election level of about $1,300.

- China’s gold imports from Hong Kong fell for a second month in May, reports Bloomberg, as world prices wavered. Data from the Hong Kong Census and Statistics Department show that the country purchased a net 44.8 metric tons, down from 74.9 tons in April.

Opportunities

- According to Bloomberg, global central bankers are all hinting that the cost of money is heading higher. Euro-area economic confidence jumped to its highest level since August 2007 and German inflation unexpectedly rose in June. In a note from BCA this week, the group writes: “If the U.S. dollar turns and the downside pressure on their currencies abate, emerging market central banks will no longer have to sell their FX reserves. If the banks take advantage of currency stability/strength to ease policy, it would underpin a cyclical improvement in their economies. EM assets and commodity prices, along with commodity currencies, would benefit if this would transpire.”

- There are two major developments that have emerged in the capital markets, writes Drew Mason of St. Joseph Partners. First, the dollar has broken its long-term major uptrend of more than a decade. Second, we’re seeing pressure on bonds, and long-term rates in particular are rising. And, despite these trends capping gold’s performance, gold (despite having no income stream attached to it as all the market pundits point out) has still outperformed the stock market since 2000 at a ratio of almost 2:1.

- Despite opposition from nearly the entire Trump Cabinet, the President and a few top advisers are “hell bent” on imposing tariffs on steel imports of 20 percent, reports Seeking Alpha. Penalties could eventually be extended to other imports too. In related sector news, Societe Generale raised its 2017 aluminum and gold price outlook, while cutting copper. Morgan Stanley listed palladium, gold and silver as its top picks, while cutting nickel.

Threats

- Tanzania’s parliament introduced three draft laws on Thursday, that would allow it to force mining and energy companies to renegotiate their contracts, reports CNBC. “They follow 18 months of wrangling between mining companies and President John Magufuli that have delighted Tanzanian voters but alarmed foreign investors,” the article continues. In a note from Luke Nelson at JP Morgan, the draft regulations contain a number of concerning provisions. For example, they suggest existing stability agreements could be renegotiated should the National Assembly find their terms to be “unconscionable.” Similarly, the drafts suggest future stabilization agreements shall be time bound and make provision for periodic renegotiation.

- Gabriel Resources is seeking $4.4 billion from Romania for destroying the value of the long-stalled gold mine project, reports Bloomberg. Gabriel says the government has unlawfully blocked permits, disregarded existing license rights and ignored all requests for conciliation and negotiation. The company was once worth more than C$2.7 billion, but its value has collapsed to a fraction of that, the article continues.

- Although historical patterns are all pointing to the fact that inflation should surge, these patterns may be in the process of breaking with history, reports Bloomberg. “Global labor markets have seen profound changes over the past decades, with significant implications for wage and price information,” the Bank for International Settlements said. “The question for many central banks is whether these developments have so weakened the relationship between inflation and labor-market slack that the recent tightening of labor markets poses little threat of an inflation overshoot.” Famous last words, perhaps.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of