Gold SWOT: Gold Pulled Back Last Week, With Silver Right Behind. Will The Yellow Metal Rebound?

Strengths

- Gold was the top-performing precious metal for the week, despite still being down around 1.5%. Global demand hit an all-time high in Q4, as investors sought safety amid geopolitical uncertainty and looked to diversify away from the dollar, according to the World Gold Council. Total demand reached 1,303 tons between October and December, driven by strong ETF inflows and bar and coin purchases, which hit a 12-year peak.

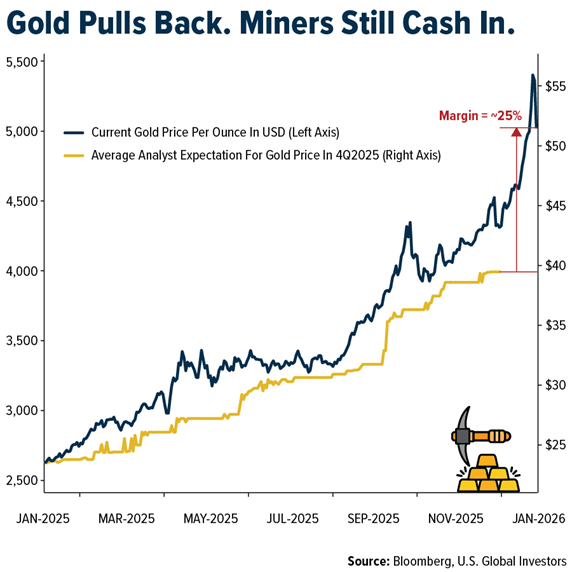

Even with the recent pullback in spot prices, gold miners can still experience roughly 25% expansion in non-operational margins. Realized prices, based on quarterly averages, flow directly into revenue with minimal incremental cost. Since most operating costs are largely fixed and input prices lag spot inflation, higher realized prices automatically boost margins through operating leverage—before factoring in efficiency improvements or cost reductions.

- As a strength, Hecla Mining Company is sharpening its identity as a pure-play silver producer following the Casa Berardi divestiture, which unlocks balance-sheet flexibility and redeploys capital while reducing operational complexity. Operationally, 2025 results reinforce that focus, with silver production up 5% year over year and record output and throughput at Lucky Friday, demonstrating improving asset quality and operating leverage to higher silver prices.

Weaknesses

- The worst-performing precious metal for the week was platinum, down over 21%. Silver ended the week down about 16%, despite falling intraday on Friday by more than 30%. Precious metals and copper experienced a sharp sell-off on Friday following the announcement that President Trump had appointed Kevin Warsh as the new head of the Federal Reserve. The dollar rallied around 80 basis points over the course of the day, as Warsh has a reputation as a more hawkish figure on inflation—appearing to be the opposite of what Trump had suggested regarding lower interest rates.

- Pan African reported H1 2026 operating results, with production slightly lower than estimated, although showing a 15% improvement over H2 2025, according to BMO. Costs were higher than expected, primarily due to increased share-based expenses.

- According to Scotia, Fresnillo’s 4Q25 attributable silver production totaled 12.2 million ounces, up 6% quarter-on-quarter but down 8% year-on-year, and 5% below their 12.9-million-ounce forecast. Gold production reached 135.2 thousand ounces, down 11% quarter-on-quarter and 34% year-on-year, falling 6% short of the 143.8-thousand-ounce estimate.

Opportunities

- Gold equities are trading at a 17% discount to bullion, with a free cash flow (FCF) yield of 6.0% based on 2026 estimates, or 7.0% at spot prices. The equities are cheap relative to bullion, as they have not been tracking the gold price at the same pace; therefore, valuations have room to move upward, according to Scotia.

- Allied Gold has agreed to be acquired by Zijin Gold International in a friendly all-cash transaction valued at C$5.5 billion. Under the agreement, Zijin will pay C$44 per share in cash, representing a 5.4% premium and a 27% premium over Allied’s 30-day volume-weighted average price, according to Canaccord.

- According to Raymond James, Franco-Nevada has announced that it has entered into a $100 million gold stream financing transaction with Orezone Gold to support its acquisition of the producing Casa Berardi Gold Mine and all other Quebec assets, including the Heva-Hosco Gold Project from Hecla Mining. The stream deliveries to Franco-Nevada consist of fixed deliveries of 1,625 ounces of gold per quarter for the first five years, followed by 5.0% of gold produced from the Casa Berardi Mine and other Quebec assets (excluding Heva-Hosco) and 2.5% of gold produced from Heva-Hosco.

Threats

- According to Bank of America, the perennial challenge of replacing mined reserves could be eased by lowering cut-off grades through higher gold and silver reserve price assumptions. While this approach is logical, it comes with the trade-off of lower production and higher unit costs, all else being equal.

- BMO recently suggested that the gold/silver ratio is in risky territory on a medium-term view. However, they note that price ratios could continue to diverge from historical norms if the current risk environment sustains safe-haven demand for non-gold precious metals, amplified by retail participation—even though these metals have traditionally behaved more like industrial metals.

- Heraeus observes, “The silver price rally has become the most extreme since 1980, when the Hunt brothers attempted to corner the market. On January 23, the silver price exceeded $100/oz, 54% above its 200-day moving average.” They add, “While investors may have legitimate concerns about geopolitical risks, U.S. monetary and fiscal policy, and the fate of the U.S. dollar, history suggests this rally is much closer to its end than its beginning.”

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of