Gold Investors’ Weekly Review

Frank Holmes of the USFunds.com summarizes this week’s strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,200.29 up $11.54 per ounce (0.97%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 4.24%. The U.S. Trade-Weighted Dollar Index gained 0.87% for the week.

Gold Market Strengths

Gold reversed losses after China cut benchmark interest rates for the first time since July 2012. Additionally, Standard Chartered raised its forecast for 2015 average gold prices to $1,245 per ounce, up from $1,160 saying that many of the factors pressuring gold will be neutralized. Standard expects dollar bullishness to fade and worries about deflation to subside.

The U.S. Mint has sold 2,570,500 ounces of silver coins so far in November. If the pace continues, total sales for the month would be around 4,284,167, up 257 percent from a year earlier.

The Dutch central bank shipped 122 tons of gold from safekeeping in New York back to Amsterdam, increasing its home reserves to 31 percent from 11 percent previously. The bank said it is joining other central banks that are keeping a larger share of their gold supply in their own country, contributing to a more balanced division of the gold reserves. This move may also have a positive effect on public confidence.

Gold Market Weaknesses

Hedge funds extended their fastest exit from gold this year, cutting bullish gold wagers for a third week. Holdings tumbled 49 percent over three weeks, the most since December. Additionally, assets in exchange-traded products backed by the metal dropped to the lowest since 2009, as the World Gold Council said third-quarter global demand was the weakest in almost five years.

The U.S. Geological Survey noted on Monday that gold production by U.S. mines in August had decreased by 11 percent from a year earlier.

Gold Market Opportunities

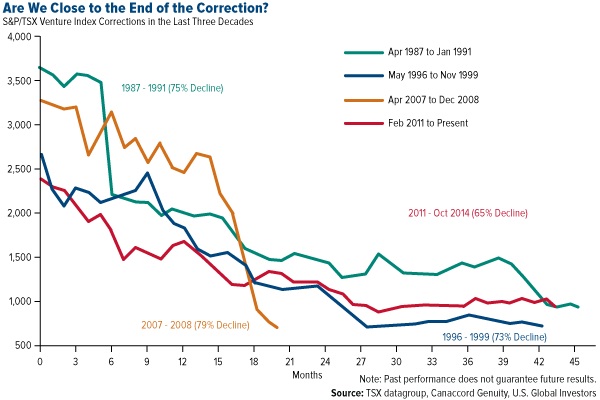

Canaccord Genuity’s study looking at the four major Venture Composite corrections in the last three decades found that historically, the up-ticks after the corrections have varied from 144 percent to 347 percent. They also note that the previous three corrections ended around the year-end. The current correction is the second-longest at 43 months and Canaccord believes we could be closer to the end.

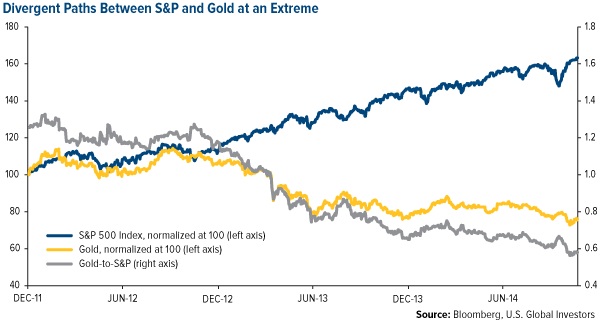

As can be seen in the chart, gold and the S&P 500 traded in a narrow range for much of 2012 but in the last two years the spread between S&P 500 and gold had widened significantly. For portfolio rebalancing at year end this presents an opportunity to readjust your weightings. Sell some of the assets that have been the strongest performers and reinvest the proceeds in the underperformers to reset your portfolio asset allocation mix back into balance for the new year.

The rate at which gold is lent for dollars is the most negative since March 2001 as refineries spend longer recasting bars from vaults to meet demand from Asia, where consumers prefer smaller ingots and jewelry. This signals a bottleneck in supply that could support or even increase prices.

Gold Market Threats

Goldman Sachs executives were probed on Thursday by members of Congress due to allegations that the bank had taken too large a role in the commodities market. The Senate subcommittee released a 400-page report saying that Goldman devised policies that made it hard to get aluminum out of its Detroit warehouses, pushing up the price of aluminum for American companies.

India is examining policy to curb the surge in gold imports that increased to $4.17 billion in October, up from $1.09 billion a year earlier. The policy measures are being considered to narrow the current account deficit and support the currency. As the second largest importer of gold, any measures would create a headwind for gold prices.

********

Courtesy of http://goldsilverworlds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of