Gold Likely To Stay Elevated On Safe Haven Demand

Last week spot gold closed at $1,284.77, down $3.11 per ounce, or 0.24 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.62 percent. Junior-tiered stocks outperformed seniors for the week, as the S&P/TSX Venture Index off just 1.16 percent. The U.S. Trade-Weighted Dollar Index finished the week lower by 0.62 percent.

Strengths

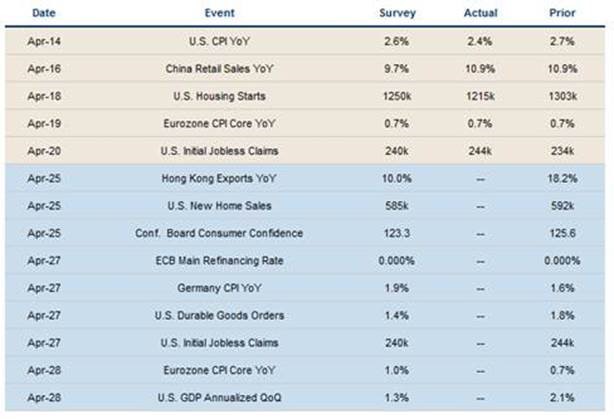

·All the precious metals were off slightly this week with platinum, gold and palladium off 0.16 percent, 0.24 percent and 0.28 percent, respectively. Treasuries extended their gains earlier in the week as soft inflation data from the U.S. fed into the markets and the dollar dropped, reports Bloomberg. Macro news ranging from inflation data casting doubt on the pace of rate hikes to the U.S. decision not to label any countries as currency manipulators have extended the advance in haven assets.

·Gold climbed to a five-month high in New York, reports Bloomberg, with the Bloomberg Dollar Spot Index falling 0.3 percent. “Gold will likely stay elevated given safe haven demand,” Barnabas Gan, economist at OCBC, said. “I won’t be surprised if gold breaches above its $1,200 handle in the foreseeable future.” On Friday, gold traders and analysts surveyed by Bloomberg were bullish on the yellow metal’s price outlook for a sixth week.

·Sberbank, Russia’s largest bank, is looking to finance the direct import of gold to India, according to Aleksei Kechko, Managing Director of the company’s Indian subsidiary. India is the world’s second largest importer of gold, and a direct trade between India and Russia would be beneficial to both countries. Russian officials have already signaled their desire to conduct transactions with BRICS nations using gold, writes Russia Insider. In related news, India’s Trade Ministry is preparing a proposal to cut the gold import duty to 2 percent in two years from 10 percent, ET Now and Newswire reports.

Weaknesses

·Silver stood out as the worst performing precious metal for the week with a loss of 3.30 percent, as hedge funds cut net bullish silver positions in the futures market. According to analysts at Commerzbank, demand for gold coins in the U.S. proved very muted in the first three months of the year. Analyst Eugen Weinberg wrote “Retail investors in the U.S. have clearly been put off by the increase in the price of gold.” The U.S. Mint sold 166,000 ounces of gold coins in the first quarter of the year, a third less than a year earlier.

·Gold fell sharply for the second day this week as someone dumped $3 billion notional ahead of the London Fix, reports ZeroHedge. In a somewhat related note, analysts from Standard Chartered believe the relative strength index implies gold prices are overbought at the moment, reports FXStreet.com, which could stall prices in coming sessions.

·Shandong Tyan Home Co. says it is no longer pursuing Barrick Gold Corp.’s stake in its Kalgoorlie Super Pit mine in Australia, reports Bloomberg. The Chinese company is blaming tightened controls on outbound investment and foreign exchange, the article continues. In other company news, Newcrest’s shut down of its Cadia mine could cost the company nearly 9 percent of annual earnings, writes UBS analysts led by James Brennan-Chong. Shares of the company fell 4.6 percent on Tuesday after it announced Cadia will not meet fiscal year 2017 guidance after the seismic event.

Opportunities

·Gold’s top forecaster for the last quarter, Intesa Sanpaola SpA, says that the metal’s price could hit $1,350 by year end, citing faster inflation and geopolitical tensions. Similarly, silver could climb to $19 an ounce by year end, after already gaining 15 percent so far in 2017. BMI Research also noted this week that it remains bullish on gold and expects silver to perform even stronger as well. Platinum and palladium on the other hand, are likely to face pressure from a slowdown in car demand in the U.S. and China, said Daniela Corsini with Intesa Sanpaola.

·According to the Bloomberg Intelligence team, the Fed could be “one and done” in 2017 when it comes to rate hikes. “Unless things are very different this time, declining crude oil prices, bond yields and copper vs. gold aren’t consistent with further interest-rate increases,” the article reads. Looking at history, expectations for higher rates may be too aggressive unless these Fed tightening companions reverse higher, the article continues. In a separate article from BI, the team writes that $1,400 gold resistance might be the new $1,300. On a related note, ZeroHedge reports this week that Li Ka-shing, the richest man in Asia, has a renewed and urgent interest in diversifying his assets into gold, both mining firms and the physical asset itself. Some of the biggest billionaire investors on the planet are seeking out the metal as wealth protection insurance.

·Seeking Alpha writes that 2016 was a record year for Klondex Mines, with production of 151,007 gold-equivalent ounces (GEOs) from its Nevada operations and 10,199 GEOs from True North. This brings total production to 161,289 GEOs, or an increase of 26.3 percent from the previous year. For 2017, Klondex is guiding for production of 210-225k GEOs. Klondex is a proven mid-tier gold producer that owns and operates all of its mines. M Partners, in a note out this week, announced that it is increasing its target for Klondex to C$8.25 from $8.00, driven by its revised estimates on Klondex’s True North mine and Midas. Even Clarus Securities writes, “Our thesis continues to be that Klondex offers best-in-class production growth, low cost production and a solid management execution track record. Clarus maintains its buy target price of $8.50 per share.

Threats

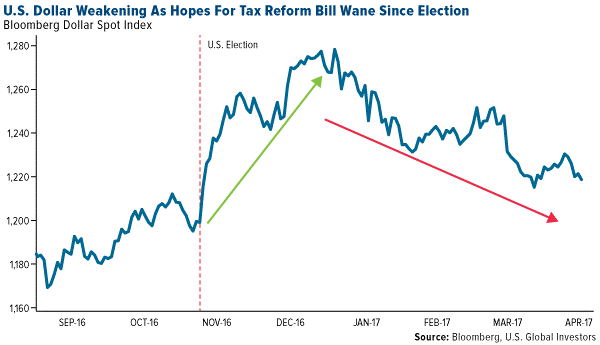

·Currency traders and strategists (who make a living in the $5.1-trillion-a-day currency market) say that the core assumptions of U.S. dollar appreciation being one of the selling points of Trump’s border tax plan is “laughable,” reports Bloomberg. These traders are saying you’d be hard-pressed to find anyone in the market who believes it will result in the greenback strengthening 25 percent as the border tax plan suggests. Another note from Bloomberg states that the dollar has resumed the downward trajectory it established at the start of the year, and could fall an additional 4 percent in the coming weeks (if one believes that the U.S. currency moves in sync with real yields and Treasuries).

·Laurence Fink, CEO of Blackrock Inc., says that lackluster growth in the U.S. economy and uncertainty around the Trump administration’s ability, poses a risk to markets, reports Bloomberg. Fink mentioned a pullback in car sales and a slowdown in M&A activity as indications of the uncertainty. “There are warning signs that things are getting darker,” he said. Speaking of the U.S. economy, U.S. central bankers appear to be on course to raise interest rates twice more this year and remain confident in their forecast for growth around 2 percent, reports Bloomberg.

·A new study out shows that exchange-traded funds appear to be making stock markets dumber and more expensive, reports Bloomberg. Researchers from Stanford University, Emory University and the Interdisciplinary Center of Herzliya in Israel uncovered evidence that higher ownership of individual stocks by ETFs widens the bid-ask spreads in those shares (making them more expensive to trade and therefore less attractive), reports Bloomberg. “Our evidence suggests the growth of ETFs may have unintended, long-run consequences for the pricing efficiency of the underlying securities,” wrote the researchers for the study. In a related matter, the SEC this month gave its final go-ahead for measures that would trigger the delisting process for an ETF should its index become overly concentrated, or stocks and bonds in an index become hard to trade.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of