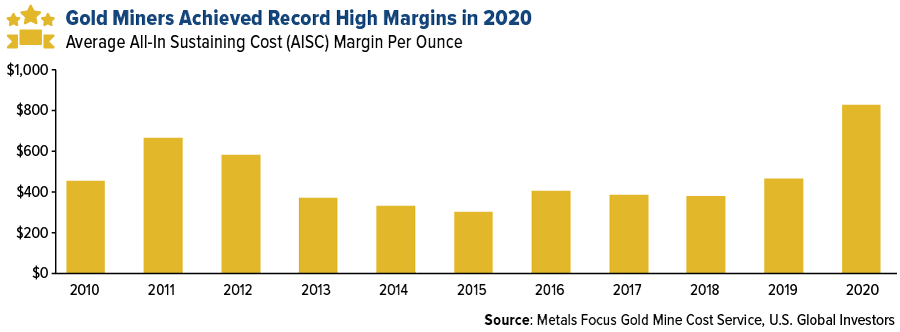

Gold Miners Recorded Record High Margins In 2020

Gold producers had their most profitable year ever in 2020, based on one metric. The average all-in sustaining cost (AISC) margin, which is the gold price minus the cost to produce the metal, hit a record $828 per ounce, according to Metals Focus. What this means is that for every ounce of gold a mining company produced in 2020, it got to pocket $828 on average. This is comfortably higher than the previous record of $666 set in 2011.

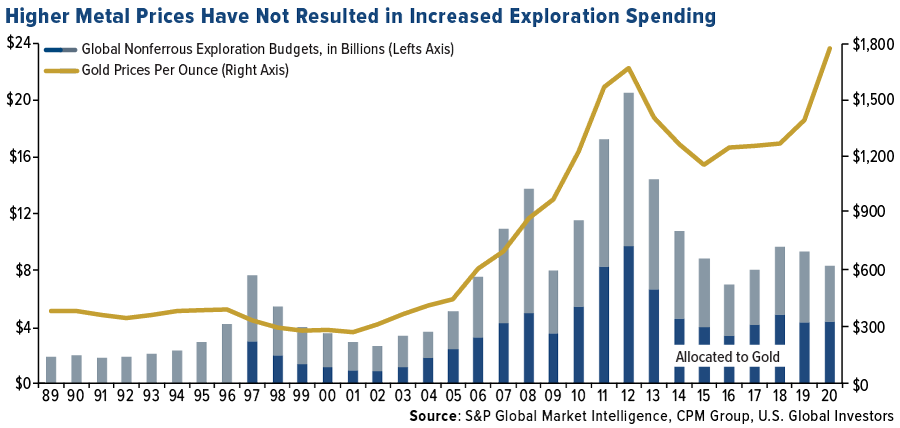

The price of gold hit a record high of $2,070 in 2020, which helped increase revenues. But companies have also been focused on cost discipline. We didn’t see gold miners’ exploration budgets increase significantly in 2020, due in part to the pandemic, which forced mine closures in China, South Africa, Peru, Mexico and elsewhere.

Exploration spending in the goldfield rose about 1.2% from 2019 levels, to end at $4.34 billion. This came even as total nonferrous exploration budgets slipped to $8.3 billion, down 11% from the previous year, according to CPM Group data.

The producer with the world’s lowest cost per ounce in 2020 was Polyus, according to Kitco News. The Russian miner’s AISC was only $604/oz. Among other companies in the top 10 were B2Gold ($788/oz), Centerra Gold ($799/oz), Kirkland Lake ($800/oz) and Polymetal ($874/oz).

Record Financial Results for Precious Metal Royalty and Streaming Companies

Precious metal royalty and streaming companies also had a strong 2020. The world’s largest by market cap, Franco-Nevada, reported phenomenal results: record revenue of $1 billion, record net income of $326 million and record cash flow of $840 million. In addition, the company declared a quarterly dividend of $0.30 per share, a 15% increase from the prior dividend of $0.26.

Wheaton Precious Metals also reported strong 2020 results, with net income up triple digits compared to 2019. Annual revenue of $1 billion and annual operating cash flow of $765 million were both records for the company.

Royal Gold, the third largest royalty company by market cap, reported record revenue of $158.4 million during the quarter ended December 31, 2020, a 28% increase over the same period a year earlier. The company reported incredible operating cash flow of nearly $100 million, also a 28% increase. Its annual dividend was raised to $1.20 per share, the 20th consecutive annual increase.

Superior Efficiency

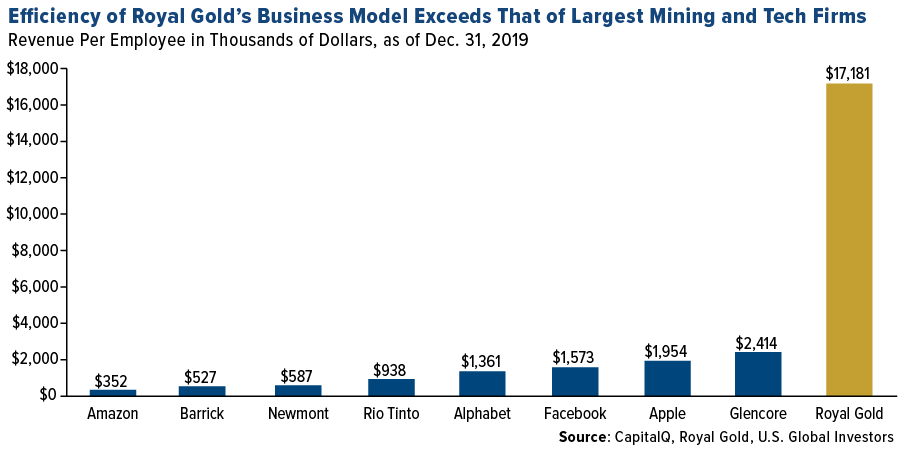

As many of you reading this know, we like royalty and streaming companies for a number of reasons. Compared to producers, their profit margins have historically been larger since they employ far fewer personnel than the miners and do not have high capital costs associated with developing and maintaining a mining project.

The chart below shows you just how efficient the royalty and streaming business model is. In 2019, Royal Gold generated an unbelievable $17 million in revenue per employee, which is many times more what some of the world’s largest mining and tech firms generated on a per-employee basis.

What’s more, royalty and streaming companies are more well-diversified than producers. Whereas most senior producers may have only between four to eight mines currently operating, royalty and streaming companies could have streaming agreements for as many as 23 operating mines, in the case of Wheaton Precious Metals.

Email us at [email protected] to receive even more information on gold royalty companies!

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Operating cash flow (OCF) is a measure of the amount of cash generated by a company's normal business operations. Operating cash flow indicates whether a company can generate sufficient positive cash flow to maintain and grow its operations, otherwise, it may require external financing for capital expansion. There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2020): Polyus PJSC, Polymetal International PLC, B2Gold Corp., Centerra Gold Inc., Kirkland Lake Gold Ltd., Franco-Nevada Corp., Wheaton Precious Metals Corp., Royal Gold Inc., Amazon.com Inc., Facebook Inc., Alphabet Inc., Apple Inc., Barrick Gold Corp., Newmont Corp.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of