Gold Mining Stocks Are Beating Bullion: A Win-Win

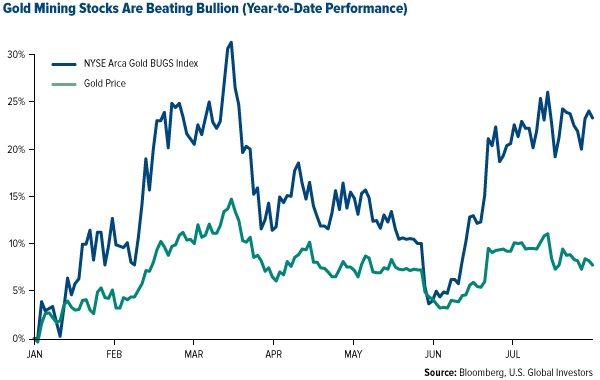

For the first time in at least a couple of years, gold mining stock returns are outpacing those of the yellow metal itself.

As you can see in the chart below, the NYSE Arca Gold BUGS Index has given back 22.31 percent year-to-date (YTD), whereas gold has delivered 7.74 percent.

This is good news for both equities and bullion. When miners are doing well, gold tends to follow suit. Indeed, since the beginning of the year, spot gold has seen steady growth following a lackluster 2013. As I noted earlier in the month, it’s been one of the best-performing commodities of the year so far, a mere nugget’s throw behind nickel and palladium.

Miners restructuring their business strategy.

Miners restructuring their business strategy.

Gold mining, to be sure, is a tough gig. When gold prices are between $1,000 and $1,200 an ounce, miners barely break even in terms of cash flow.

Last year was particularly brutal. The metal plunged 28 percent—from $1,675 to about $1,200—which was the largest annual drop since 1981.

To reduce risk, many companies have cut costs in several ways. Some have decreased capital spending. Others have sold off assets. Others still have placed exploration on standby.

Case in point: Comstock Mining Inc., a young mining company which we own in our Gold and Precious Metals Fund (USERX), has managed to shrink operating expenses from $4.4 million this time last year to $3.8 million, mostly by lowering legal and advisory expenses. Other realized annual savings have come from administration and staff reductions.

In a recent interview with The Gold Report, U.S. Global Investors portfolio manager Ralph Aldis addressed the company’s rising success:

Comstock started production over a year ago at about 10,000 ounces a year. It doubled that and now it's targeting a 40,000-ounce run rate in H2/14… The company has permits to reach 4 million tons per year so Comstock should be a 100,000-ounce producer by 2016. It's a situation where people are creating value and [Chairman of the Board] John Winfield knows how to make money.

Time to wake up to gold-diggers.

An equity that has performed exceptionally well this year is Klondex Mines Ltd., headquartered in Nevada. Not only does it represent the largest position in both USERX and our World Precious Minerals Fund (UNWPX), but we also own it in our Global Resources Fund (PSPFX).

One of the main reasons we’re so fond of the stock is that in 2013, when the Market Vectors Junior Gold Miners Index was down 61 percent, Klondex was up 28 percent. It’s currently up 30 percent YTD and is targeting free cash flow (FCF) by the end of the year.

“This is a great story,” Ralph said in the same interview. “Most people haven’t woken up to it yet.”

Royalty companies are thriving as well.

Other players in the gold space that have flourished in this climate are royalty companies, which provide upfront capital to miners in exchange for a stake in future output. Since royalty companies avoid the costly rigmaroles gold miners must deal with on a regular basis—securing permits and building infrastructure, among others—they often receive a healthy return on their investments.

Two such companies are Franco-Nevada Corporation, based in Toronto, and Royal Gold, based in Denver. We own both in USERX, UNWPX and PSPFX, as well as our All American Equity Fund (GBTFX) and Holmes Macro Trends Fund (MEGAX). Whereas Franco-Nevada has risen 42 percent YTD, Royal Gold has leaped 70 percent.

Looking ahead.

Gold might have taken a minor hit this week, but autumn is right around the corner, when the gold jewelry industry traditionally replenishes its stock. And with unrest in Ukraine and the Middle East continuing to drive the fear trade, as unfortunate as these events are, gold prices appear buoyant.

This bodes well not only for investors in bullion but also mining companies, which will likely proceed with cost-cutting initiatives to maintain or expand margins.

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Stock markets can be volatile and can fluctuate in response to sector-related or foreign-market developments. For details about these and other risks the Holmes Macro Trends Fund may face, please refer to the fund’s prospectus.

Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The Market Vectors Junior Gold Miners Index is a market-capitalization-weighted index. It covers the largest and most liquid companies that derive at least 50 percent from gold or silver mining or have properties to do so.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the funds mentioned as a percentage of net assets as of 06/30/2014: Klondex Mines Ltd. (1.34% in Global Resources Fund, 6.58% in Gold and Precious Metals Fund, 6.60% in World Precious Minerals Fund); Comstock Mining Inc. (3.57% in Gold and Precious Metals Fund, 2.12% in World Precious Minerals Fund); Franco-Nevada Corp. (0.53% in All American Equity Fund, 2.21% in Global Resources Fund, 2.45% in Gold and Precious Metals Fund, 0.55% in Holmes Macro Trends Fund, 1.16% in World Precious Minerals Fund); Royal Gold Inc. (0.58% in All American Equity Fund, 2.18% in Global Resources Fund, 3.14% in Gold and Precious Metals Fund, 0.59% in Holmes Macro Trends Fund, 0.91% in World Precious Minerals Fund).

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of