Gold: Never Normal Redux

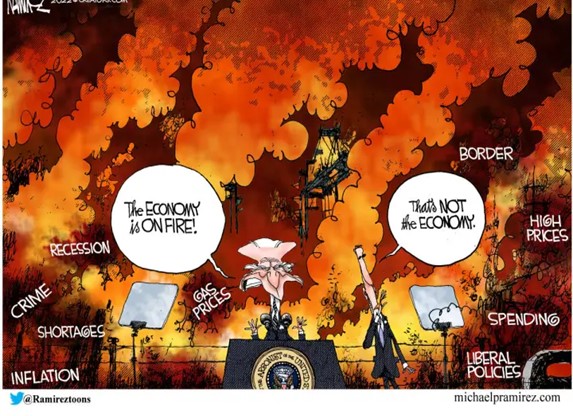

Those looking for a return to normal are in for a shock when they see what is happening to markets and the economy. Already parabolic hyperinflation has risen to a 79% annual rate in Türkiye, as President Erdogen refuses to make the sacrifices needed to stabilize their currency and economy. Similarly, the United States refuses to accept the harsh reality of high inflation nor the warning from the world’s richest man Elon Musk, who recently slashed Tesla’s workforce by 10% because he had a “super bad feeling” about the economy. JP Morgan Chase’s Jamie Dimon too warned of a “hurricane” to hit the global economy. Behind this new reality is a shift in the financial landscape whose underlying causes have more to do with the complacency of markets and governments. It is to be the never normal.

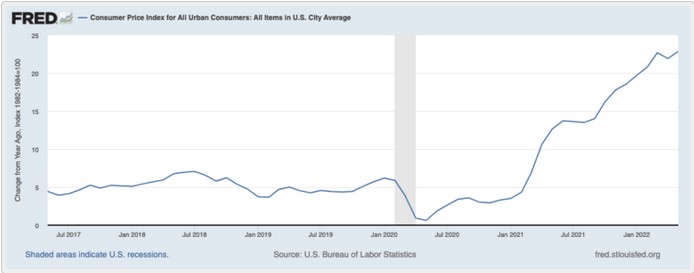

Start with financial markets which have started a bear trend in the longest selloff in decades as bonds, stocks, cryptos, and even gold collapsed on fears of higher interest rates. Additional rate increases will further bring down inflated asset prices. Fault lines are surfacing. The war between Russia and Ukraine, two large agricultural exporters have also rocked global grain and vegetable oil markets as inflation rages at levels not seen in forty years. Russia defaulted on its foreign debt for the first time since 1918 because its foreign reserves remain frozen under the West’s sanctions. The political fallout grows in the West as governments become deeply polarized with some losing majorities or even office. Consider that since the start of the year, more than an estimated $12 trillion in value has been lost or 60% of American GDP, the worst in 50 years. In the seventies, an oil embargo hit the economy, catching policymakers flat-footed causing them to misread inflation. Markets imploded in 1981 when Fed Chair Paul Volcker finally sent interest rates to double-digit levels pushing the economy into a recession to end a decades-worth of inflation that took a lost decade to recover. Unfortunately, that painful lesson has been forgotten.

It's All About Inflation, Stupid

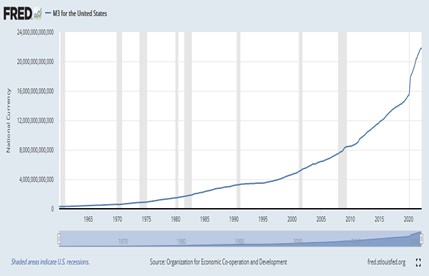

This time the Fed who earlier expressed reluctance to raise rates, believing that inflation was transitory, was again caught flat-footed. The Fed stuck with low interest rates too long and in continuing to pump out liquidity, maintained the very ultra-loose monetary framework with negative rates that helped push up inflation. And despite today’s tough rhetoric, interest rates remain low by historic standards and are still negative. Not so long ago, investors believed that the Fed could fix inflation by adjusting interest rates. Wrong. Money supply has increased 30% ensuring that inflation will be with us for some time to come as Washington’s printing press continues to work overtime. Despite using yesterday’s playbook, few recall the noted American economist Milton Friedman’s warning that “Inflation is always and everywhere a monetary phenomenon.” The stark reality is that even in missing the call, central banks are limited in their ability to tame inflation and in the supply/demand equation, they can’t control or alleviate the supply shortages. Nor can they end the war or Chinese lockdowns. All the Fed can do is cool demand, and that’s not working.

Meanwhile, the Biden government optimistically hopes that inflation might sink to 6%, while Fed rates remain at historic rock bottom lows of 1.50%-1.75 %. However, the thought that the fire can be snuffed out by a tepid 0.75 percentage point increase in rates is beyond belief. Inflation is almost five times the Fed’s 2% target, and rates might have to go more than 5 times too, just to reach “normal” levels. Inflation erodes the value of money and today there’s a series of one-off shocks and surprises similar to the Middle East wars and missing anchovies of the seventies. Today rises in global food and energy prices sparked by the Ukraine War pushed inflation higher such that inflationary psychology has become deeply imbedded. It is the never normal.

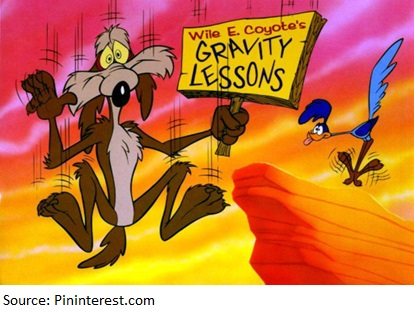

The tide could turn in other ways. If just a smidgen rate increase could erase about $12 trillion or more than half of US gross domestic product, what would happen if rates increased beyond the 6% or the expected rate of inflation? Cryptocurrencies are already down to a paltry $1 trillion. Does the market bloodbath presage deeper troubles? And what would happen when the Fed finally shrinks its $9 trillion portfolio, the largest bond portfolio in the world, selling into a market already steeped in losses as rates head higher. The Fed’s losses alone would need a government bailout! It is the never normal.

The 3 Rs (Russia, Rates, Recession)

There are other differences. In the seventies, Paul Volcker’s remedy of jacking rates to double-digit levels is unlikely to be repeated, until after the next presidential election when the three “Rs” (Russia, rates, recession) will dominate the scene, possibly paving the way for the president-in-waiting, Donald Trump. Noteworthy is that in three of the past four recessions, they were co-incident with presidential elections and each time, the incumbent lost power. Consequently, central banks and politicians do not have the stomach for a recession induced by double-digit rates, but they have few options. Another is that the central banks have been tasked with the contradictory goals of helping “green” the economy and curing the social issues of today. But today we are more indebted and this time the financing of both the social mandate and the war means the economy will take second place, boosting the odds of a repeat of the 1970s monetary blunder. The Fed is part of the problem.

Evidence is mounting that with inflation at 40-year highs and no doubt heading higher, we believe that rather than the normal boom and bust commodity cycle, the difference this time is that the superhot economy, juiced by almost $3 trillion in pandemic handouts and ongoing loose fiscal and monetary policies, has contributed to a rare supercycle seen only a handful of times in the past century. Durable goods remain strong. Unemployment is near all-time lows. Labour is in short supply in long-term care, hospitals, pubs and airports. Politicians and our central bankers know only to throw money at our problems and the Ukraine invasion only reinforces inflation’s uptrend. Looking beyond the doom and gloom, we believe the commodity supercycle will sustain growth and inflation following this pullback on misplaced recession worries. Prices are significantly higher than a year ago. And this time, markets remain tight, volatile, more exposed and leveraged with new players like the meme traders, commodity houses, private equity and even sovereign funds replacing Wall Street’s traditional banks. These structural changes will give added life to the boom, and bust. Another boost to inflation will be the dramatic increase in military spending as the world rearms itself in the wake of the new Cold War. The implication of a global push in military spending and growth will mean the need for more scarce critical minerals. Noteworthy is that raw material prices have almost zero input in the calculation of inflation.

Inflation Is a Tax

Worryingly, inflation hurts everyone, in particular the lower income who must pay more for basic needs. The pandemic and war have setback the push for social gains made over the past few years. Yet a “woke” society cannot exist when basic needs, goods and services go unheeded. Governments are warned. Norwegian workers protesting inflation have gone on strike jeopardizing gas exports to UK and EU. Inflation affects everyone, even poorer nations with Sri Lanka’s recent default the first of many. Worrisome though is that America remains the largest debtor in the world and will not escape unscathed. America’s biggest threat is its debt load.

Food has become weaponized with over 20 million tonnes of grain blocked due to the war in Ukraine, raising the prospect of global hunger. Ukraine, the breadbasket of the world, is an important supplier of grains and sunflower oil was expected to produce 50 million tonnes but limited storage capacity, the Russian blockade and lack of infrastructure delayed exports to the Middle East, Africa, and Asia who are highly reliant on Ukraine supplies. To date, talks to remove the blockade have faltered while commodity prices have skyrocketed, raising the risks of unrest and starvation in the poorer importing countries.

Americans are mad about inflation amid soaring energy prices, exacerbated by the government’s war against its own domestic oil and gas industry that stifled new supplies. Demand has skyrocketed, sending inflation higher and Mr. Biden’s numbers lower. Mr. Biden’s climate-conscious government pushed hard to make fossil fuels expensive relative to green alternatives. He succeeded. For all the talk of the war, half of the oil price hike occurred before the Russian invasion in part because Biden canceled the Keystone XL Pipeline, stopped oil drilling leases and today reversed course by asking former enemies Venezuela and Iran to boost supplies, despite the US being the world’s largest oil producer.

Energy is also of particular concern to Europe because the protracted Russian-Ukraine war exacerbates tight supplies created by years of underinvestment following the European push for green energy that made fossil fuels less available. Oil has gone up 500% during the past two years. Natural gas is up 150% this year. Moreover, the prospect of Russia restricting supplies of gas, exacerbated by shortages of pipelines and crude carrying vessels reinforced the burgeoning supercycle. Ironically carbon taxes and Biden’s risky “price cap” will also boost prices, a heavy cost to cut global carbon emissions. Simply, too much money is chasing too few goods or, energy molecules.

The government’s reaction? Self-sufficiency? Bring on incentives to fill the supply gap? Bring on more pipelines? Help the oil industry cope with the government-imposed pollution rules? More oil from Canada? No. Instead, the US government’s policy is to explore “windfall taxes” or a gimmicky gas tax holiday and the release of 180 million barrels of oil from reserves of which some was shipped to China. None will increase supplies to bring the price down, particularly before the midterms. And vilifying the oil industry for its profits only exacerbates the problem.

Climate Change Costs

Climate change is equally divisive. Ironically, to maintain their pledges of carbon-free orthodoxy, governments will need even more expenditures, having botched the past decade as the environment continues to heat up. With yet another global summit coming up at the UN Climate Change Conference in Egypt (COP27), the world is on track to top 2.4C by the end of the century, far exceeding the 2C upper limit at the Paris accord. Ironically the energy crisis will deepen America’s reliance on fossil fuels, particularly with the new rapprochement with the volatile Middle East where US relations with the Gulf states have been fractious, at the best of times. It takes multi-billions and years to bring on new oil and gas projects, so again the West undermines their net zero targets as they lock themselves into more fossil fuel projects.

Or there is Canada’s climate pledge promising to cut emissions by 40% by 2030, but our own bureaucrats could only identify half of the cuts, guaranteeing that Canada will not meet its commitment. Ironically, Canada is well placed to profit from the current geopolitical turmoil. It has abundant energy, food, metals and renewable energy. It lies next to the biggest market in the world. Yet it will not profit if it doesn’t invest, reform its health system or change the regulatory environment to get more energy from Western Canada. When it did try, the Liberal government spent $4.4 billion to purchase a profitable Trans Mountain Pipeline to accelerate its expansion. However today that pipeline is losing money and the expansion costs have skyrocketed to $21.4 billion from $12.6 billion.

America Is At War, With Itself

Inflation also caused a large shift in America’s economic, racial and social fabric, further deepening the cracks between both wings of American politics making it difficult to tackle big policy initiatives. Democracy is an institution, underpinned by a set of beliefs and values. At the heart of America is equality and the rule of law. However if a substantial enough part of the population no longer holds those beliefs or values, that undermines democracy. The country’s domestic disunity is a repeat of the Civil War era and strains the very tendons of democracy itself. Today the rule of law does not appear universal, applied lately by political whim. Authoritarian populism is on the rise. America is at war, with itself.

At the January 6th hearings, Americans learned that the past president not only attacked the political process but created an unprecedented crisis over the transfer of power in defiance of the courts, state officials and the country’s voters. Divisions run deep along party lines. Also along party lines is the US Supreme Court’s decision to rescind Roe v. Wade, putting the Court at odds with a majority of the population who supports Roe which enshrined women’s right to abortion for over half a century. The ruling makes culture wars between “pro” or “against” states inevitable. Tensions have also grown over other decisions like gun rights with the Court knocking down a 111-year-old gun law despite record weekly mass shootings. Extremism has become mainstream. It is the “new” democracy where in the process a single Democrat from West Virginia is more powerful than Mr. Biden, holding up his party’s agenda and helping a radical GOP in the process. Importantly all has lasting economic consequences.

Tower of Babel

Amidst the malaise of democracy, the financial, courts, and economy have become more politicized ushering in a new era of deglobalization. Over the past thirty years, the world prospered benefiting from globalization, the end of the Cold War, and growth of China but the pandemic and Ukraine war have resulted in a rise in the politicization of everything, aided by the emergence of social media. This change of habits ironically undermines democracy. Today politics is everything, undermining its own strengths and the ability for economies to innovate, adapt and grow markets. In the past, tribes shared and help move forward, based on commonality of ethnic backgrounds, cultural or allegiances to a faith, resulting in the very institutions and tenets of today. But the lack of common identity or loyalty to societal groups, amplified by social media resulted in the extremism of both the left and right. Demographics is a factor. The older generation does not spend much time on social media, sources much of their information from traditional sources like radio, TV or newspapers, and sharing platforms like churches, clubs or unions. Since 2005 the US has lost 25% of its newspapers. Meantime the social media savvy younger cohort gets their information digitally helping shape their social discourse. As such already riven with internal division, the social media platforms worsen the political, cultural and financial divisions, deepening the public mistrust in government which has sunk to a new low of 20%, according to the latest Pew Research Cater poll.

Social media platforms do more than provide information. The so-called town squares are now owned by Wall Street giants with record gains in user engagement and, of course in advertising revenues. Of concern is that they both support and undermine the political foundations of modern democracy. They have become the gatekeepers of society. Social media today censors, blocks, silences and affects free speech. The platforms spread information, and importantly, disinformation sometimes, with a bias against facts. They are also immune to legislative attempts to censor despite world-wide government attempts.

Politically, the result has fractionalized political parties as young and old view politics through different lenses. Old fashioned politics has been co-opted by the digital world. The conservatives feel the platforms are against them. Progressives too. As such there is an emergence of a multitude of distinct platforms, paving the way for the populist global surge where governments curry the favour of only a segment of the population, giving governments, judges and unelected officials huge powers. Mr. Elon Musk’s aborted acquisition of Twitter for $44 billion was to be one of the biggest acquisitions in tech history, showed that there are no limits for free speech, only a price tag. Free speech has become a corporate asset that can be bought and sold which is not good for democracy, notwithstanding the widely watched Depp-Heard libel case which garnered world-wide attention with 19 billion views. Social media has become a modern-day Tower of Babel. That is a dangerous development.

Mr. Biden’s Nanny State

Then within the social media vacuum, the Biden government has created a progressive nanny state, polarizing the country against a Trump-led GOP. And, since the last election, local legislatures have altered election rules in a gerrymandering push just in time for the November midterm elections which shapes up to be one of the most divisive periods in American politics, as crime, the economy and rising inflation upends democratic orthodoxy. Of concern is that in this new democracy, the lawmakers make the laws, courts are nominated by the party in power adjudicates that law, but all are seen to be above the law.

Beyond the digital world, there are the bread-and-butter issues. Politicians are scrambling ahead of the November midterms to pacify an electorate angry about rising inflation, shortages of “everything” including jobs and even baby formula. Surging fuel and food prices are eating into consumers’ spending. And the one thing that government believes is that they are blameless.

In his first term, Mr. Biden created the biggest entitlement state in less than four years with only a slim majority. In our view it was his government’s penchant to spend on welfare and other green and social issues, instead of investing in the supply-side of the economy that sent inflation higher. Take baby formula, in a subsidy scheme to help low-income families, the government became the largest buyer of formula and stopped foreign competition with a wall of tariffs from entering the United States. In the US, two firms account for 80% of all domestic baby formula production and when the FDA shutdown Abbott’s Similac plant over a safety issue, 20% of the market disappeared causing nationwide shortages and price hikes. Ironically to fill the gap left by the shutdown of domestic supplies, the government has imported supplies. From energy to household goods to baby formula, the shortages have become another “made in America” problem.

US-China Cold War

All in all, it is not surprising that Mr. Biden is polling only 33% ahead of the midterm elections. While war and plagues won’t last forever, the world’s mightiest nation could have a lame duck in office until 2024. Another solution to bring down inflation would be to scrap the stiff Trump tariffs still in place which have hurt Americans more than the Chinese. Trump era tariffs, sanctions and export controls were part of a trade war that America lost, yet Mr. Biden ironically maintained them despite that they are part of the recent inflation surge that led to his drop in popularity. To be sure easing the tariffs would cut US consumers’, businesses’ and farmers’ costs as well as reduce inflation. However, diluting or dropping the tariffs would be a reminder that America lost Trump’s “easy to win” tariff war.

China and the Western countries have benefited from global trade with China’s share at almost 20%. For two decades, China has climbed step by step towards global eminence and in turn the West has become more dependent upon China’s markets, manufacturing, robotics, and now financial might. The US and China have a long history of co-operation dating before World War II and the America helped open up markets becoming China’s biggest trading partner.

However, starting with Donald Trump, a new Cold War with China coincided with the global decline of US power and influence. For example, following the Russian invasion, sanctions against Russia were not supported by Africa, Latin America, the Middle East and Indo-Pacific. Despite Australia’s close alliance with America, more than 35% of Australian exports go to China (iron ore, wine, coal and LNG), however, the Chinese are reducing Aussie imports, as relations between Beijing and Canberra worsen. The recent escalation and sabre-rattling is more of an extension of Washington politics where ideological differences and rhetoric aimed at the domestic audience have become more important than sovereignty, co-operation or even economic differentials. There is a cost. Vilifying China and antagonizing Western allies, the danger is that when Washington misuses its power, any decoupling would hurt America more. Furthermore, a polarised America has made the West a less attractive and reliable partner for Asian countries.

China has been demonized for breaking the US-led embargo and not joining the West’s sanctions, however, India has doubled its imports of discounted oil. Heavily reliant on Russian energy, Europe too is buying Russian oil and gas. Canada broke the embargo by sending a turbine key to Russia’s Nord Stream pipeline. Brazil wants energy from Russia. The United States still buys uranium from Russia. Moreover, the Middle East led OPEC has not followed the US initiatives. Noteworthy also is that China has not sold arms or provided aid to Russia, nor Ukraine with whom China is its largest trading partner. However amid such mistrust and the demonization of the world’s largest market and supplier of resources, the central question must be asked, why is China considered so bad? Simply, China is guilty of challenging America and its half-century sphere of influence.

Getting China Wrong

For decades, China’s global economic influence overtook America as Chinese growth had a major influence on its trading partners as America turned inward. China has been a hot destination for multi-nations eager to tap into the world’s largest market paving the way for globalization, lowering prices in the West. China is Germany’s top trading partner. Foreign investors have sunk hundreds of billions into the Chinese economy helping to boost the economy to the second largest in the world representing 25% of the world’s growth. And Chinese savings alone is gargantuan with $50 trillion of assets within its borders, far above what is in the US. Luxury brands sales reached $74 billion, doubling over a two-year period. More than 90% of Apple products are manufactured in China by outside contractors. Prevented from traveling by Covid, consumers shopped at home aided by government’s free trade zones and the all-important Party Congress this fall, China is expected to introduce more incentives to boost their domestic market, becoming more self-reliant and lessening America’s hegemony. Noteworthy too is that inflation is benign in Asia averaging between 2 and 2.5%, unlike the near 10% rate on both sides of the Atlantic, leaving ample room for fiscal and monetary stimulus as rates there remain low.

China also extended its influence in Latin America through $130 billion of bank loans and corporate investments of $72 billion, specifically for critical minerals. It is an important investor in oil and mining as China spreads globally, taking a page from America’s Marshall Plan that rebuilt Europe. China will always be a big factor in Asia, however, in the past 15 years, its state banks have loaned $137 billion to Latin America and have made almost $90 billion in acquisitions. China is South America’s biggest trading partner and 20 nations in the area have signed on to Beijing’s Belt and Road Initiative (BRI). Unfortunately, the downside is that a growing percentage of loans to the lower and middle developing countries have become non-performing and potentially caught in a debt trap and rather than restructurings with a haircut, many will find that the agreements were “loan to own”.

China is already the dominant player in the clean-tech industry accounting for almost three-quarters of the global EV battery production, processing 90% of critical rare earth elements and is the world’s leader in solar panels and wind power. Easing tariffs on Asian solar panels (except China) helped save 50,000 jobs but Biden’s vilifying the domestic fossil fuel industry cost 150,000 jobs. And despite spending billions and billions in subsidies to boost domestic EV battery capacity, the West will still lag China since CATL, the largest Chinese EV battery maker is expected to have more capacity by 2028 than Europe and the US combined. Meantime Chinese imports of LNG from US collapsed 95%, while Russian imports increased 50% this year as Russian energy imports are up 55%, overtaking Saudi Arabia as China’s top supplier.

Consequently, the commercial rivalries between the two superpowers have taken a backseat to geopolitical rivalries. Globalism and free markets were replaced by state nationalism and security concerns. Competition and confrontation instead of co-operation seems to be the order of the day, splintering the global economy into rival competing blocs. China has a crucial role in the world order. Now the politicians are in charge and the US could be falling into the “Thucydides Trap”. Food has become a major concern. Defense spending another. Energy has become a battlefield, critical minerals another. China and others are pushing their economies to be self-sufficient in both as well as boosting technology itself. China is better prepared than America, particularly since they have become heavily reliant on China and Russia for energy, goods, resources and capital.

Economic sanctions to make the Russian invasion painful have backfired with Russia paradoxically making more money than before as the oil boycott pushes up prices. Russia is selling its wheat at record prices, and the ruble reinforced with capital controls and a gold backing has outpaced the US dollar reaching 7-year highs. While Europe scrambles to replace diminishing imports, China and India have gobbled up cheap oil at a discount. And, those Russian oligarchy funds found new homes in the Middle East, Asia and even the US. Sure the sanctions have hurt Russia’s oligarchs, but a yacht or two missing is unlikely to hurt much.

However, while the longer-term impact of the West’s sanctions will no doubt hurt, the West faces skyrocketing food and energy prices as food like energy has been weaponized, dividing and sidelining the West’s green agenda as countries scramble for energy supplies. Germany has even restarted those mothballed carbon-emitting coal plants and faced with shortages this winter has backtracked on defense promises. America needs friends, not more, enemies. Worrisome is that the confiscation of Russia’s sovereign reserves and its citizens’ yachts, without due process and the respect of property rights so entrenched in America’s Constitution, the rule of law was so easily subordinated. With or without sanctions, the US is at war with itself.

America’s Achilles Heel

As such China has become less reliant on the West for trade and finance. Today China has become the second largest overseas holder of US Treasuries and as the two superpowers decouple, Chinese investment has dried up. In the last quarter, the world’s second largest holder of Treasuries has reduced its holdings for the fourth straight month. The paradox is that selling will become a problem for the Fed who is counting on foreign money and Chinese savings to fill its financing gap as it promises to wind down its bond-buying programme. The Chinese retreat will be costly.

For decades the cost of money was near zero. Money was cheap, even free. Money became paper claims on everything resulting in the biggest stock market and housing boom in history. Free money also encouraged greater risk and leverage. Liquidity was larger than the economy. So was asset prices. Volatility went sky-high. But today it is the three “Rs” that mar the outlook amid the highest inflation in decades as liquidity implodes. Needed is not more taxes, but pro-growth fiscal, trade and energy policies to offset the impact of higher rates. Climate change too can be pro-growth, however not at the expense of shutting down important fossil fuel energy, at least until adequate renewables can be in place. Regulatory reform is needed. It is not so different this time.

A bigger worry is that faced with rising fears of significantly higher rates, investors have dumped risky assets like stocks, bonds, cryptocurrencies and even gold. The yields on 10-year Treasury notes topped 3.50%, its highest since 2011 before pulling back to 3.00%. Inflation is running at 40-year highs with wholesale prices up 11.3% and the US dollar up 12% this year driven by haven money. The dollar is near parity with the euro. The yen itself plunged to 24-year lows down 15% against the dollar, raising fears of a return to a currency war and competitive devaluations as the Bank of Japan kept interest rates low despite a global push to increase rates. Japanese exporters will benefit. China has been silent as it slowly bypasses the American financial system, using its capital flows to strengthen China. Ironically the strongest currency lately, is the Russian Ruble which has outperformed the US dollar as the Bank of Russia lifted the price for buying gold at RU5.000 for a gram of gold. As such the G-7 is exploring a gold import ban which would only send the price higher.

The financial turbulence has led to successive devaluations from the euro to the yen to the looney against the dollar as higher rates send the greenback higher. This time, market forces are pushing down currencies, but the devaluations raise the risks of the “beggar thy neighbour” competitive devaluations of the Great Depression when countries drove their currencies down to get an export advantage. Currency devaluations make a country’s exports cheaper and imports more expensive. In Europe, energy will cost more but they will be able to sell more. It was the threat of a currency devaluation that pushed Trump to wage his losing trade war.

Ultimately flow of funds will determine a country’s balance sheet which is America’s Achilles heel since they rely on outside financing and buy more than they produce. There are winners and losers as there are creditors and debtors. China is the world’s largest creditor, a winner.

The End of Dollar Hegemony

In 1944, the West came together at Bretton Woods and established the economic and financial framework for the postwar era. They provided the basis for institutions and the West prospered led by America. That monetary orthodoxy lasted until 1971, when President Nixon devalued the dollar by abandoning the gold standard which was the collapse of Bretton Woods and the US dollar. The gold peg, fixed at $35 per ounce was the benchmark for Bretton Woods’ fixed exchange rates. Post 1971, the US was an economic and financial superpower as the global monetary and financial order benefited from the dominant position of the US dollar which remains the world’s reserve currency as other currencies “float” against the dollar. We believe that position should not be taken for granted as the world’s currency system is built on a foundation of a fiat currency backed by the “full faith and credit” of the US government.

Since America went off the gold standard, the thrust of US policy was to boost growth, asset prices and consumption but on borrowed money. They succeeded. Never in history has there been more money printed in the world unleashing a tsunami of debt and since then, there have been a series of currency crises, booms and busts, new currencies (EU) and in 1985, the dollar was devalued again. And 50 years later, misadventure and instability persists in a return of the “stop-go” policies of the 1970s and 1980s that boosted inflation, leverage, devaluations and recessions. Noteworthy is that the dollar’s share of global trade has declined while dollar liabilities have increased which is the structural weakness of the world’s leading currency as it raises the risk of all those fiat dollar’s flooding back to America.

Yet today the dollar is trading at its highest level in 20 years as a safe-haven as higher rates offer the promise of higher returns, attracting foreign money. This causes a problem as the US economy also imports inflation from overseas. And while it makes imports cheaper, America’s exports have been weak with Microsoft reducing its guidance blaming the stronger dollar. Meantime other central banks are raising rates at a faster pace. The Euro is now at par for the first time since 2002 helping exporters but hurting energy imports. Chinese exports jumped nearly 18% led by exports to the US and Southeast Asia. China has slowly internationalized the renminbi with a recent swap arrangement with the Bank of International Settlements (BIS). Currently China’s international framework has allowed China and Russia to avoid US sanctions and there are talks of setting an alternative basket reserve currency among BRIC members, bypassing the American financial system as a multi-polar currency system evolves following the confiscation of Russia’s foreign currency reserves.

In The Dollar We Trust?

Deficits borrow from the future. Back in 1977, inflation was 6.5%, the national debt was 34% of GDP. The last financial crisis in October 2009 was the biggest financial crisis since the Depression and to save Wall Street, the world’s bankers convened an emergency meeting in Washington to do “whatever it takes”. Subsequently, central banks began unlimited purchases of government debt and a meltdown was avoided but at great cost. Since then, to solve crises including the pandemic stimulus, G-7 central banks have purchased or created more than $25 trillion of government bonds, avoiding another depression. But debt has been monetized. And today with the Ukraine bills not yet in, federal debt has skyrocketed from one third of GDP in 2008 to 130% of GDP today. June inflation was 9.1%, a 40-year high, as America spends more money that they do not have, another big boost to inflation.

A greater irony is that when the Fed raises rates, the market value of its assets will fall potentially below the face value of their assets, leaving the central bank to need help. The Fed’s balance sheet will fall, for the wrong reason. For example, the Fed holds some $2.7 trillion holdings of bonds and promised sales would swamp the $5.5 trillion bond market which supports the US mortgage industry. That would leave the Fed with major losses, risking a downward spiral in bond prices and worse, pushing up yields and the collapse of the all-important housing market. Concerns about high inflation and the Fed’s failure to act weighs heavily on foreign sentiment and trust. Central banks hold dollars in their reserves and their holdings of US debt have declined this year producing big losses and a disincentive to hold dollars.

A two-decade decline in rates made debt levels superfluous since borrowing costs were minimal. However, the cost of debt is about to rise and the bills are only just coming in. At fiscal year-end September 21, the US debt interest cost was $573 billion, but today debt to service is estimated at $863 billion, larger than military spending of $746 billion and medicare spending of $700 billion – and that is before next month’s increase which will increase the carrying cost of American debt to over $1 trillion. Who then will buy America’s debt?

The US must keep rates high to attract money, but it hurts their economy. Given the United States’ reliance on foreign capital to finance its large twin deficits, any reduction in foreign flows would find the Fed itself needing others to support America’s debt. Today, Americans are told their economy is the strongest. It is illusory. The structural weakness is that their economy and currency are built on debt. America’s economic, racial and cultural gaps have caused an ideological polarisation undermining American influence and democracy itself. Even after the invasion, Russia’s economy supports a debt-to-GDP ratio of only 20%, China’s ratio is 68%. The United States’ ratio is 130%, and still rising. Today America is in denial and no one wants to confront their unsustainable national debt. Today’s high rate of inflation is simply foreshadowing of what is to come as the US monetize its national debts. This is what is happening in Türkiye today. By printing ever increasing amounts of money to finance the national debt, the Fed lost control of America’s monetary orthodoxy, debasing its currency. It is not so different this time. A crash is looming.

Gold Is an Alternative to the Dollar

Gold on the other hand has skyrocketed from $32/oz to over $2,000/oz two years ago. For thousands of years gold has shown that it is difficult to be manipulated nor can it be created with a click like QE or MMT. Governments cannot rely on QE alone and instead of taking the necessary structural reforms to solve our problems, have pursued the experimental policies that led to the inflation problem of today.

Today, we believe America’s dollar hegemony has ended with new challenges in this inflationary era. For one thing threats of higher inflation, the protracted war, central bank purchases and a commodity supercycle provide a solid underpinning to gold. Gold is simply a hedge against the growing uncertain global outlook and a classic inflation hedge against the dollar devaluation.

Gold historically has done well in periods of turmoil but lately its performance has been disappointing. Gold’s non-performance is frustrating investors as sentiment shifts downwards with investors withdrawing $1.7 billion from ETFs last month. Nonetheless, central banks keep buying gold as an alternative to the dollar. While gold earlier made an attempt at new highs, it has drifted near $1,700 on fears of higher rates and a stronger dollar. Gold often acts inversely to the dollar.

Today gold is stuck in a trading range frustrating both traders and investors. Yet in the last quarter, gold has not gone down as much as bonds, stocks or bitcoin. With the S&P bond index off 8%, the S&P 500 more than 20%, crypto plunging 75%, gold was largely unchanged, outperforming everything. Priced in euros, Europeans have seen the price of gold go up 7% in the same period.

e can recall that higher interest rates are actually bullish for gold. During the 1970s, from 1971 to 1974 the Fed boosted interest rates from 3.75% to 13% and gold soared from $35/oz to over $180/oz. And from 1977 to 1980, rates went from 4.75% to over 20% and gold rose from $142/oz to a new record high at $870/oz. Then in the 2001-2011 bull market, gold jumped to $1910/oz. As a store of value gold has always surpassed its previous peak and does well, particularly in times of high inflation like the 70s when easy monetary and fiscal policies and a surge in oil prices led to near hyperinflation. As such we continue to expect gold to reach $2,200/oz. This bull market has only just begun.

Recommendations

Meantime the industry is enjoying free cash flow led by Barrick and Newmont. How come the developers and exploration players are laggards? Simply, without institutional players, ETFs attention has been focused on M&A candidates and the more liquid senior miners. But gold mining is not easy as some players have seen their mines confiscated or run into execution problems. Gold Fields has bid $6.7 billion for Yamana in an effort to diversify, but some shareholders are balking at the hefty premium price for mature assets. Then there is Kinross who gave away almost 25% of their cash flow, walking away from Russia and accepting a knocked-down $340 million price. Or there is Centerra who not only left a profitable gold mine in the Kyrgyz Republic but received nothing from the government’s brutal nationalization of that mine. Silver producer Hecla is acquiring the rest of one of Yukon’s oldest silver plays, Alexco’s Keno Hill in an all-share deal for a 23% premium because of the scarcity of plays.

Analysts are speculating on more M&A activities suggesting that mid-tier producers with operating problems will merge to increase their size. Candidates suggested like Eldorado with its problem-prone Greek assets or even Oceana Gold whose Haile mine has trouble producing gold or IAMGOLD’s Côté white elephant are noteworthy. Or there is New Gold reducing its guidance again because of too much rain, at Rainy River. However putting two weak producers together will not produce one strong producer, only a weaker producer.

We thus continue to favour the senior producers because they will be the first to rally and are favoured by the ETF crowd. We like Barrick and Agnico Eagle for their Tier One assets and healthy reserves. We like growth-oriented Lundin Gold and believe Eldorado and Centamin will be participants in the M&A game. We also like the developers like Dundee which will produce 136,000 ounces and 16 million pds of copper as it develops Loma Larga gold project in Ecuador. We like McEwen Mining for their pipeline of projects and turnaround at Black Fox. We would avoid IAMGOLD, New Gold and take the Yamana bid and run.

Barrick Gold Corp.

Barrick Gold is the world's second-largest gold producer in the world with major assets in Nevada, Africa and South America. The gold miner has the largest array of Tier One assets which are cash flow machines, enabling the company to return a significant part of its success to shareholders. Barrick once built through acquisitions, has an array of projects that can be developed into Tier One assets including the recently announced ReKo Dig in Pakistan. Barrick’s production in the latest quarter was better than the first quarter and the company will meet guidance this year as low cash costs enables the company to throw off excess free cash flow of almost $400 million a quarter. At Kibali in Congo, the company is spending large dollars to expand and the company is a significant producer in that part of the world. Barrick is completing the processing plant expansion at Pueblo Viejo in the Dominican Republic which will enable the conversion of 9 million ounces to reserves, extending mine life into 2040. We continue to maintain our buy recommendation for exposure to Barrick’s array of quality assets, management’s capability and upside potential.

B2Gold Corp.

B2Gold had a strong quarter due in part to possessing one of the lowest cost gold producers in the world. B2Gold has three operating mines with flagship Fekola in Mali producing annual throughput of 9 million tonnes a year. B2Gold is updating a scoping study at Anaconda which boosted resource by 5 times and will likely be the fourth mine enabling B2Gold to use Fekola Mine’s infrastructure. At Otjikoto in Namibia, the Wolfshag underground development will start shortly. Moreover, an upgraded feasibility study is expected in this quarter at Gramalote which can be financed because B2Gold has a strong balance sheet. We like the shares for organic growth and management’s execution capability.

Eldorado Gold Corp.

Eldorado is a mid-tier producer with mines in Canada, Turkey and Greece with 15.3 million ounces of P&P reserves. Lower production in the quarter was reported at Kisladag in Turkey as the mine underperformed despite the HPGR was to boost recoveries. At Lamaque in Val d’Or, the completion of Triangle will boost ounces. Eldorado’s Greek operations are a major part of its reserves with Skouries and Perama Hill a potential 500,000 oz producer but will require big money to develop with a price tag at $845 million, a 19% IRR and payback of 4 years. The company may need a joint-venture partner. Eldorado is a hold here.

IAMGOLD Corp.

IAMGOLD shares have underperformed because of the delayed production and higher capital cost estimates at Côté Lake. Côté is only half complete but the capital cost has increased to almost $1.3 billion. We have long been skeptical of the acquisition of Côté Lake and view the project as a company wrecker, not builder. We also expect that IAMGOLD does not have the financing power to complete Côté with Essakane in Burkina Faso and Rosebel in Suriname (Westwood is underperforming) which are mature assets and not throwing enough cash flow to complete Côté’s development. We thus expect joint venture partner Sumitomo to step in and acquire Côté for a song leaving, IAMGOLD with very little. Sell.

Kinross Gold Corp.

Kinross’ $1.8 billion Great Bear acquisition in Ontario will release a preliminary resource estimate at the end of the year following an extensive drill program. The company hopes to develop the open pit and underground project to produce 500,000 ounces but not until 2029 and a billion dollars later. In our view the Great Bear project is not a replacement for Kinross’ core Russian Kupol and Udinisk projects which was dumped for almost nothing, notwithstanding that it represented about 25 percent of Kinross’ cash flow. Kinross is left with a hodgepodge of mature assets and with a meaningful loss of their cash flow, Kinross must both repair its balance sheet as well as finance Great Bear while optimising Tasiast, again sell.

Newmont Corp.

Newmont is the largest producer in the world and has finally restructured most of Goldcorp’s portfolio. Longer-term Newmont is bringing in the $1 billion Tanami Expansion #2 which will be completed by 2024. At the Yanacocha sulfides project in Peru, there is almost a $3 billion development cost at South America’s largest gold mine. Ahafo North’s capex is $800 million. The point is that Newmont’s projects are large possessing bright long-term prospects but in the near term, the outlook is a flat production profile. Newmont’s cash flow remains strong, enabling them to boost mine life and output.

*********