Gold Price 10 Years After Lehman Brothers

We know, it’s just a symbol. But it’s a powerful symbol of the most severe recession since the Great Depression. Yup, it’s another article about the Lehman Brothers’ collapse. But we really invite you to read it, as we thoroughly analyze the impact on that bankruptcy on the price of the yellow metal. You will also find out what can we learn from the 2008 banking crisis for the gold market.

Ten years! Really, we did not believe, but the calendar does not lie. Last month, a decade has passed since the Lehman’s bankruptcy. As people love round anniversaries, everyone is reflecting now upon that event. So we decided to put our two cents into the discussion. What we have learned over the past ten years about the Great Recession – and the gold market?

Let’s start from the price developments. The chart below shows the gold prices since the Lehman Brothers’ collapse. The obvious conclusion is that the last decade was overall positive for the shiny metal. Its price on September the 11th, 2018 was about 60 percent higher than on September the 12th, 2008, just before it all began.

Chart 1: Gold prices (London P.M. Fix, in $) since the Lehman Brothers’ bankruptcy

However, it is as obvious as a simplified observation. The more accurate description is that when the Global Financial Crisis burst, there was an impressive rally in gold until September 2011, when it peaked. As the confidence returned to the financial markets, the gold bull market switched then into the bear market, which basically lasts until today (alternatively, we can say that gold has been in a sideways trend for a few years).

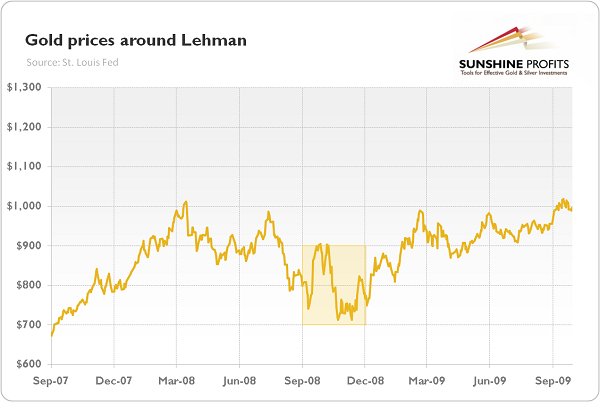

But let’s dig into the gold’s price behavior around ‘Lehman moment’ even more. As one can see in the chart below, the price of the yellow metal rallied in the second half of 2007, as the global economy started to reveal signs of an impending turmoil. However, after the Fed rescued Bear Stearns in March 2008, the price of gold plunged from $1,011 to $750 just before the Lehman Brothers’ bankruptcy on September the 15th, 2008. After that, it initially increased from $750 to $775. Gold continued the rally until September the 29th, when it reached $905.

Chart 2: Gold prices (London P.M. Fix, in $) around the Lehman Brothers’ bankruptcy (from September 2007 to September 2009)

However, it started to decline then, plunging to $712.5 (lower than before the rally) on October the 24th, 2008. It moved again above $1,000 not earlier than mid-2009. How could it be that in the very midst of the financial crisis and the most severe recession since the Great Depression gold prices plunged instead of soaring? The reason is that in the dollar-based monetary standard, cash is king. When the crisis erupted, market participants desperately needed liquidity. Hence, they started to sell their gold (either their own or borrowed) to obtain greenbacks needed to pay dollar-denominated debts. Another factor was that after its bankruptcy, Lehman had to liquidate its positions, including gold.

This is the first lesson from the 2008 banking crisis for the gold market. The yellow metal served as a hedge but in a sense that it was a source of liquidity. Hence, when the next financial crisis hit, the gold prices might initially fall before they started to rise. However, it does not have to be a reason to panic, as falling prices may be a signal of fire sales of markets on the brink of collapse.

The second lesson from the Lehman’s collapse is that the price of bullion started to rise when the effect of fire sales dissipated and when central banks’ activity became clear. The Fed injected liquidity and slashed interest rates almost to zero. This is why we devote a lot of time to analyze the US monetary policy – it’s one of the most important drivers for the gold prices.

The third lesson is that the first two lessons are useless. We are, of course, joking – but only to point out that the next crisis will not be like the last one. The commercial banks – including the systematically important financial institutions, such as Goldman Sachs, JP Morgan, or even Deutsche Bank – improved their capital, so the banking crisis is somewhat less likely. Hence, the gold will probably behave differently. For example, as central banks widely expanded the list of eligible collaterals, investors might not be forced to sell gold to obtain dollar liquidity. Therefore, the price of yellow metal may not drop initially when the next crisis bursts.

Another key difference is that the market participants are now accustomed to the quantitative easing. Hence, unless the central banks implement even more sophisticated tools of unconventional monetary policy (like negative interest rates), they should not panic – and the price of gold should not rally, at least not as much as in the period between 2009-2011.

On the other hand, the US fiscal position is now much worse than in 2008. Therefore, when the next crisis hits, the budget deficits will balloon, boosting the already high public debt. It should be negative for the dollar and positive for the gold prices.

The take-home message is that investors have to take into account the broad macroeconomic context. We mean the specific features of the given crisis. Not all recession are alike. They could be less or more severe. And only some of them are accompanied by the financial or banking turmoil. These are the best for the yellow metal. But if the next global crisis looks more like the Asian Financial Crisis – and there are some convincing arguments in favor for such scenario – rather than the 2008 Global Financial Crisis, the gold prices may actually not rally.

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.