Gold Price And Silver Price Updates

Gold sector cycle is up.

Gold Sector

$HUI is on a long-term buy signal.

Long-term signals can last for months and years and are more suitable for the long-term investors.

$HUI is on a short-term buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

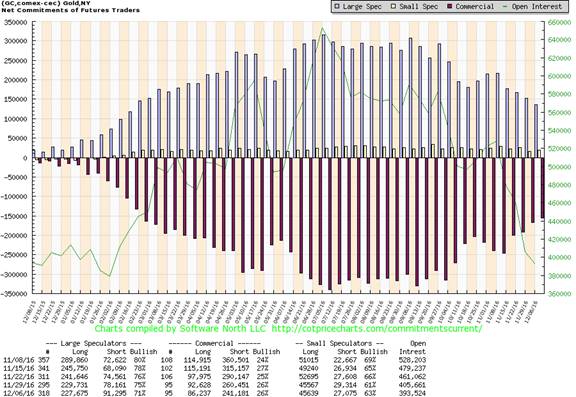

Speculation has dropped below level of previous bottom.

Summary

Gold sector is on a major buy signal and short-term is also on buy signal.

Cycle is up.

Trend is down.

A counter trend bounce is in progress.

Caution is advised.

Silver Sector

Silver is on a on a long-term buy signal.

Long-term signals can last for months and years and are more suitable for long-term investors.

SLV – short-term is on buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

Speculation is now at level of previous bottom.

Summary

Silver is on a long-term buy signal.

Short-term is on buy signal.

A counter trend bounce is in progress.

Silver is more volatile than gold, manage your risk.

Courtesy of www.simplyprofits.org