Gold Price Forecast – The Current Rally And Gold Miners’ Upside Target

The short-term dynamics of various parts of the precious metals sector offers many insights and opportunities to capitalize on. In today’s article, we’ll examine what the current upswing means across the metals’ world and with respect to gold and silver miners specifically.

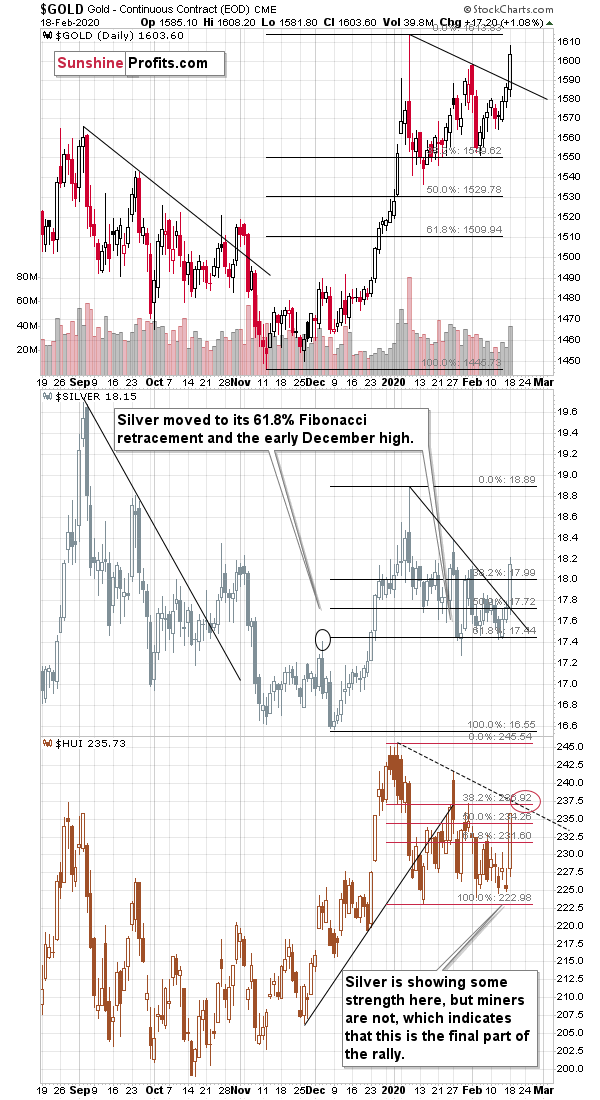

The HUI Index is a broad proxy of the mining industry. As far as the short term is concerned, we see that miners continue to move higher, but they do so below the rising support line that they had broken earlier this month.

The Gold Miners’ Message for Gold and Silver

Gold is getting very close to its previous 2020 highs, silver is getting closer to the middle of its 2020 trading range (taking into account also today’s pre-market upswing), while mining stocks… We’re just testing the yearly lows. Yes, they rallied profoundly yesterday, but they haven’t broken above the declining resistance line, while both: gold and silver did.

Overall, silver is showing strength here, but miners are very weak, which indicates that this is the final part of the rally. Of course, given gold’s and silver’s breakouts, the miners are likely to rally as well, but while gold might move to new highs, and silver is likely to soar particularly visibly at the end of the upswing, we expect mining stocks to remain weak relative to the metals. Yesterday’s powerful rally was quite likely a single swallow that doesn’t make a summer.

That’s simply how silver and miners perform in the final parts of the upswings. There might be a session at the very end of the rally when they pretend to be strong, but nothing more is likely. The upside target for the HUI Index is based on the declining resistance line and the 61.8% Fibonacci retracement based on the 2020 decline. It’s at about 235 – 237. Very close to where the HUI closed yesterday.

Once miners lag and silver laps gold in a clear way, we’ll get the clear sell-and-short sign. For now, it seems that the next move in the very short-term is going to be up.

That’s just one of the many gold trading tips. Let’s move on to the silver stocks.

Silver Stocks Examined

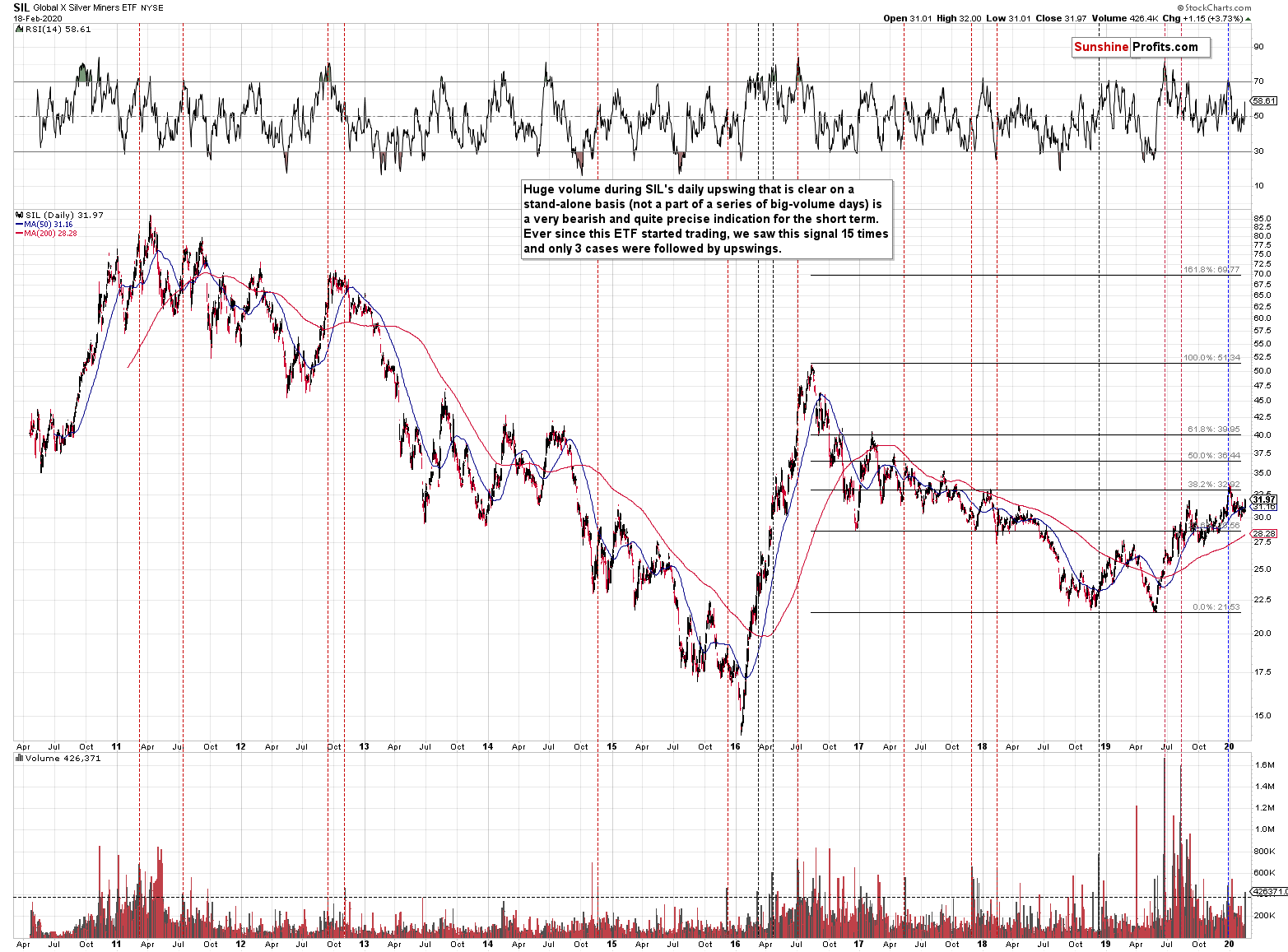

“Silver stocks reached their new yearly high on relatively strong volume” sounded very bullish, didn’t it?

The problem was – as we had explained in the previous Gold & Silver Trading Alerts – that reaching the new yearly high meant that silver miners were barely able to correct 38.2% of the decline from the 2016 high. And that’s compared to the decline alone. Comparing the recent rally to the one that we saw in 2016, we see that this year’s upswing is barely one fifth of the previous upswing (about 50% vs about 250%). That’s very weak performance – silver miners don’t really want to move higher, they are forced to move higher as gold and silver are increasing, but the size of the move emphasizes that it’s not the “true” direction in which the market is really moving.

The volume is also not as bullish as it seems to be at first sight. Conversely, huge volume during SIL's (ETF for silver stocks) daily upswing that is clear on a stand-alone basis (not a part of a series of big-volume days) is a very bearish and quite precise indication for the short term. Ever since this ETF started trading, we saw this signal 15 times and only 3 cases were followed by upswings.

Yes, silver stocks moved sharply higher on a very short-term basis, but please note that they had moved sharply lower on a very short-term basis in early 2016. The opposite of the recent price action was what preceded the biggest and most volatile rally of the recent years. If we see a reversal and invalidation of the breakout to new 2019 highs, we’ll have almost exactly the opposite situation and the implications will be even more bearish.

While silver stocks don’t provide any meaningful indications with regard to the short term, they point to a very bearish outlook for the following months.

Summary

The examination of recent moves across the precious metals’ sector shows that we’re close to the end of the short-term rally. At this stage, gold miners are likely to underperform both metals, and have the upside target of 235-237 currently. Silver stocks analysis goes to highlight the bearish nature of the medium-term outlook. It’s that merely 3 cases of high-volume days out of a total of 15, were followed by an upswing. Therefore, they’re sending a bearish message now.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s upswing without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,