Gold Price Forecast: Bitcoin Investors To Turn To Gold

We have reason to believe that bitcoin and cryptocurrency investors are about to shift their investment strategy toward the precious metals, and that change should cause a notable influx of capital into the gold and silver sectors.

The trend in the ratio between bitcoin and gold has been rising steadily in bitcoin’s favor over the last 8 years – and it appears to be ready to break down in favor of gold again. As cryptocurrencies may be seen as competing “anti-fiat” alternatives to precious metals, this shift may represent an important current for the metals market.

In this article we will discuss the technical and fundamental setup which may cause cryptocurrency investors to soon become precious metals investors.

Bitcoin Targets $17,000

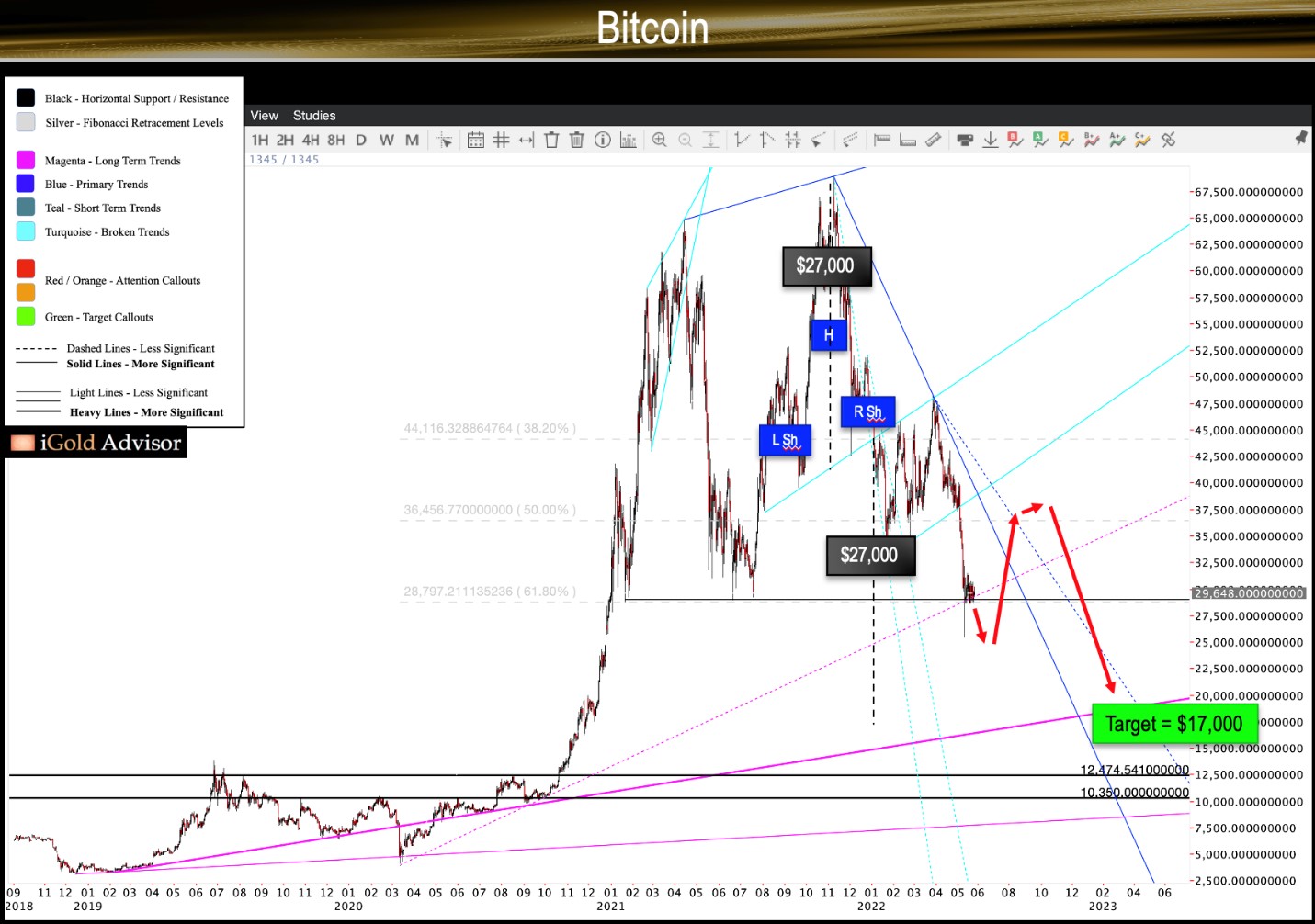

In order to understand the relationship between bitcoin and gold, we must first analyze the bitcoin market on its own. Below is the chart of bitcoin from 2018 through present:

Note that since topping in 2021 at $69,000 per bitcoin, the price of the cryptocurrency has fallen by over 56% to where it currently trades, just under $30,000.

Unfortunately for bitcoin investors, our analysis says that the token has further to fall.

A head and shoulders top pattern formed in bitcoin in 2021 (blue callouts), which features an amplitude of $27,000 (black). As the neckline of the pattern has already been broken, this pattern reveals a target of $17,000.

Further strong support exists for bitcoin in the range of $10,000 - $12,000 (black lines), representing the upper range of the consolidation from 2019 – 2020. We thus believe that the cryptocurrency will ultimately bottom somewhere in the $10,000 - $17,000 range, which is a 44% - 66% further decline from today’s prices.

Bitcoin to Gold Ratio

We next turn to the bitcoin to gold ratio, shown below in log scale:

Note that the ratio had been rising in favor of bitcoin since early 2015 (blue line). Perched now just above 15 ounces of gold to one bitcoin, the ratio is testing a critical area of support for the cryptocurrency.

Our target range for bitcoin calculated above says that the token has another 44% - 66% to fall over the coming months. If that is the case, then the bitcoin to gold ratio is going to decisively break down from its 8-year rising trend. In essence, the period of bitcoin strongly outperforming gold will be over.

Once the ratio breaks below 14 on weekly closes, the next area of strong support is near 5 (black dashed lines). This region represents horizontal support dating back to 2017. The ratio of 5 could very well be achieved with bitcoin falling to $10,000 per coin, and gold rising to $2,000 per ounce. Or, it could be achieved with bitcoin only falling to $17,000, and gold rising to $3,400 per ounce.

Either way, gold will be set to outpace bitcoin for the duration of the coming decline.

Why Will Bitcoin Correct?

Many fundamental triggers may cause the movement away from cryptocurrencies and back into gold:

- We have witnessed recently the “stablecoin” token Luna lose 100% of its value and wipe investors out. Investors may be fearful that this could occur in other cryptos, and turn to precious metals instead, as gold and silver can never lose 100% of their value.

- World governments have moved increasingly to tax and regulate cryptocurrencies, and this may cause those who favor privacy to shift to physical precious metals, which cannot be tracked.

- Finally, it may simply be that the pending decline in value in bitcoin sets investors to seek safety in gold.

Takeaway on Gold and Bitcoin

We have evidence that the bitcoin market is set for a further decline over the remainder of 2022. Any relief rally should be used to exit positions, especially if overleveraged.

A further decline in bitcoin will cause its ratio with gold to break down from an 8-year rising trend. This will be the first time gold consistently outperforms bitcoin since 2014.

The resultant psychology shift as cryptocurrency investors begin to flood back into precious metals should see the gold and silver markets gain notable traction. Presently, valuations are extremely depressed in the gold mining sector, and this may change when crypto funds comes rushing in.

As investors, we want to position ahead of this trend change. By the time the change gains momentum, most of the move will be over.

At www.iGoldAdvisor.com, we are preparing to purchase several precious metals investments. In addition to bullion, we plan to make highly-leveraged investments via private placements, which offer investors free warrants in gold mining companies in addition to their shares.

*********