Gold Price Forecast: The Clear Warning From The Miners

The geopolitical events have a way of driving the gold market – in the short-term, that is. And the news of rising U.S.-Iran hostilities is no exception, making it easy to get caught in the bullish sentiment of the day. As far as the short-term is concerned though, the HUI Index is practically screaming in investors’ ears: get out, get out now! In today’s article, we’ll dive into its message.

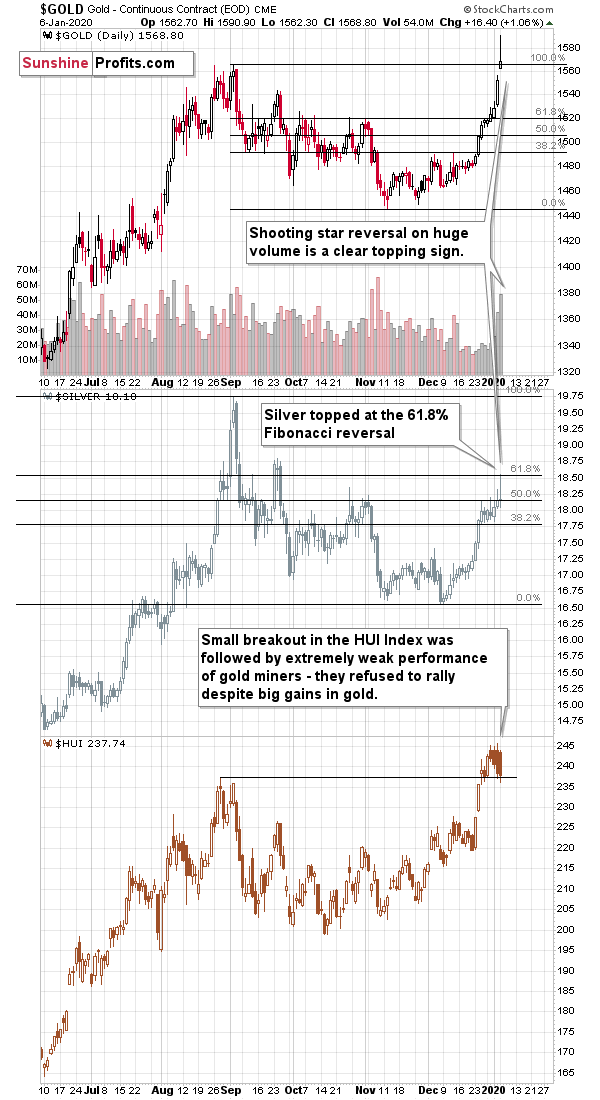

We can’t recall the date when the underperformance of gold miners relative to gold was more shocking. Gold rallied $24 and the Hui mining stock index not only has not rallied, but it actually declined by over 2 index points. One of the more reliable gold trading tips is to look for situations when gold is making new highs, but gold miners are not. If you were looking for an extreme example of this technique, that’s it.

So far this year gold is up by 3.00%, silver is up by 1.44%, and gold stocks are down by 1.73%. It’s not just very bearish for the precious metals market, it’s truly an extreme reading.

In terms of weekly price changes, the HUI Index managed to move higher by mere 0.34% (not even a full index point).

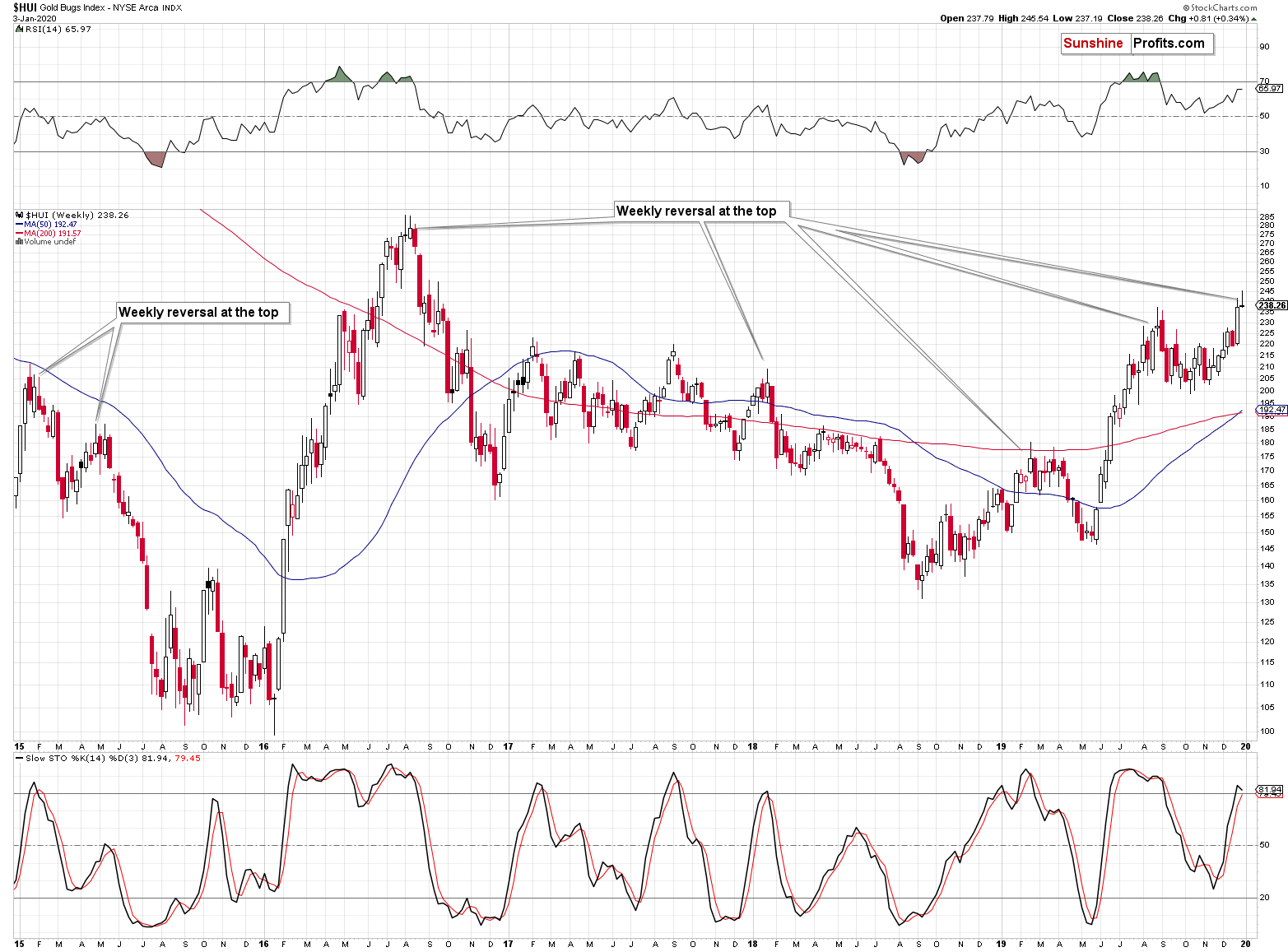

This means that the HUI Index jus formed a clear weekly reversal. Sometimes, these reversal take form of shooting star candlesticks (mid-2015, second weekly high of 2016, early 2018, early 2019), and sometimes we get gravestone dojis (first weekly high of 2016, and right now; the August high is also somewhat similar).

In all the above-mentioned cases, the weekly reversal in the HUI Index had very important implications. Combining this with the extreme weakness that gold miners are showing relative to gold and all the retracements just reached throughout the precious metals sector, it’s very likely that the rally in gold is just a very temporary development and that one should be prepared for much lower gold, silver, and mining stock prices.

Summary

Not only that the miners have been underperforming gold, they couldn’t rise even though gold did on Friday and Monday. And that is not a two-day phenomenon, as the 2020 comparison reveals. The HUI reversal hints that the recent gains in gold are most likely of merely temporary nature.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. Forecasting gold’s rally without a bigger decline first is likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,