Gold Price Forecast: Coronavirus And Deflation Grips The World

The coronavirus has rapidly taken center stage in world affairs over just the last month. With its terrible human casualties comes a nasty financial side effect: deflation.

The US stock market has just witnessed its worst weekly decline (-11%) since the Crash of 2008.

Oil prices fell more in a single day on Monday, March 9 (-33%) than on any other day in the post-Bretton Woods (1971) era.

Meanwhile, gold prices have touched 6-year highs above $1,700 this week.

This is deflation, loud and clear. Deflation can be defined as a period when the prices of goods and services fall; conversely, during deflation, the purchasing power of money rises.

Gold is the world’s oldest store of value – as such, it should rise increase in value during deflation when compared to other assets.

So, is now a good time to buy gold?

Lessons from the Crash of 2008

It is important for investors to remember that gold can indeed fall during extreme deflationary episodes.

Sometimes during the worst of asset liquidations, investors are forced to sell their gold holdings to cover margin calls and satisfy debts. Further, commodity index funds often include gold in their asset baskets, and will sell all holdings during panic events.

We need look back no further than the Crash of 2008 to remember that during the worst of the decline, gold fell together with stocks:

The key is that in 2008 gold held its value better than stocks in percentage terms. Further, it rebounded before stocks following the crash. The investor in gold, as a net sum, fared better than the investor in stocks during the global financial crisis of 2008.

We are again in the midst of a deflationary period. From the fear and chaos of the news, let us examine the evidence in a manner that takes as much emotion out of the equation as possible: by studying the cold, hard data.

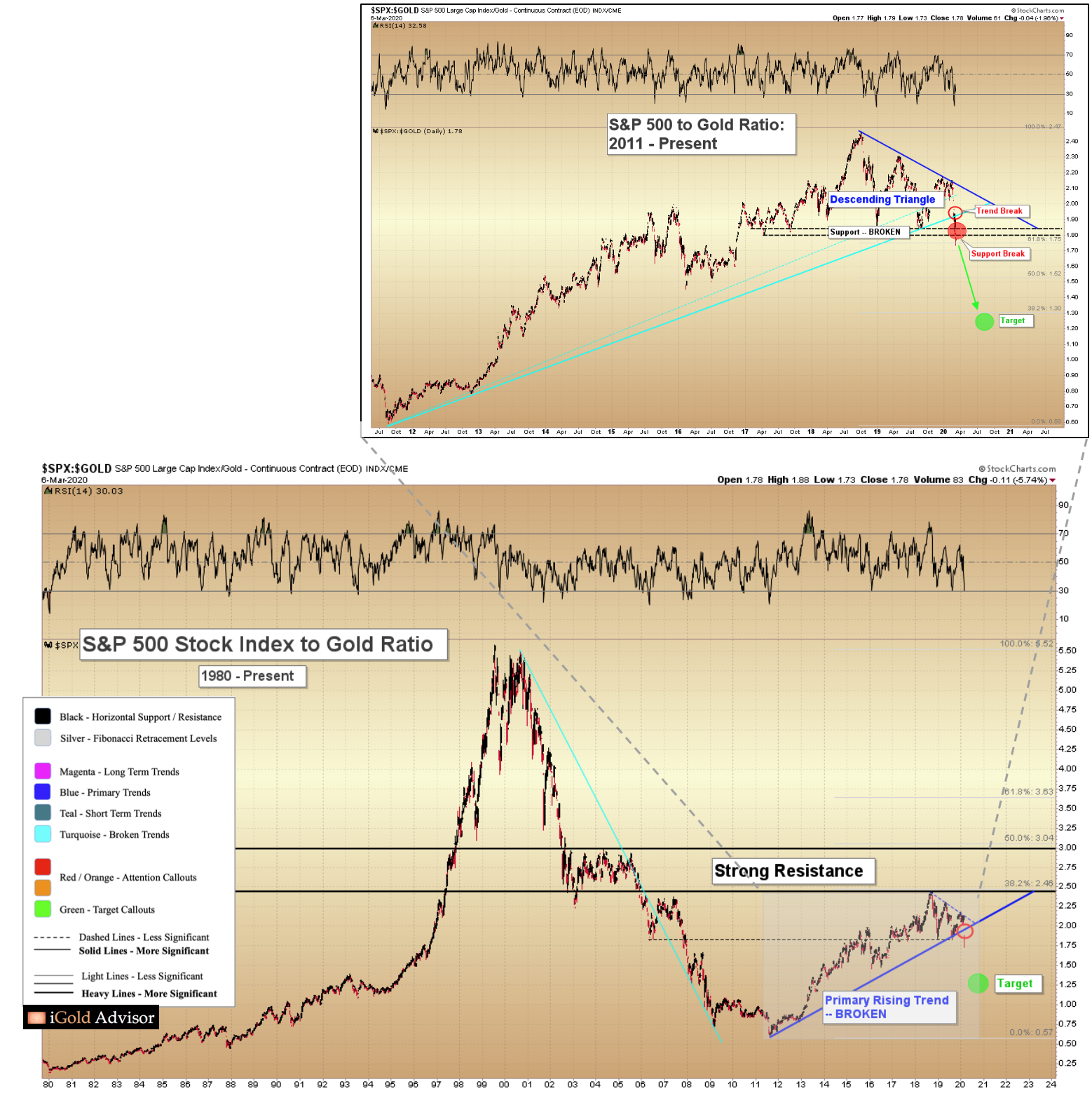

S&P 500 to Gold Breaks Down… In Favor of Gold

With gold’s advance last week and the stock market’s continued decline, the S&P 500 to gold ratio has officially broken down, in favor of gold. This ratio measures the number of ounces of gold required to purchase one share in the S&P 500 stock index. Closing at 1.78, note the clear breaking of the 4-year support level at 1.85 (black, zoomed-in chart).

As this was a descending triangle pattern (blue) above the 1.85 support level, the S&P 500 to gold ratio now targets 1.25 (green), calculated as equal to the amplitude of the highest portion of the triangle (0.60), subtracted from the breakdown point.

This target should be hit within the next six months.

This is an important development for gold investors. Before we consider the ramifications as per real-world targets, let us turn first to the numerator of the above ratio, the US S&P 500 stock index.

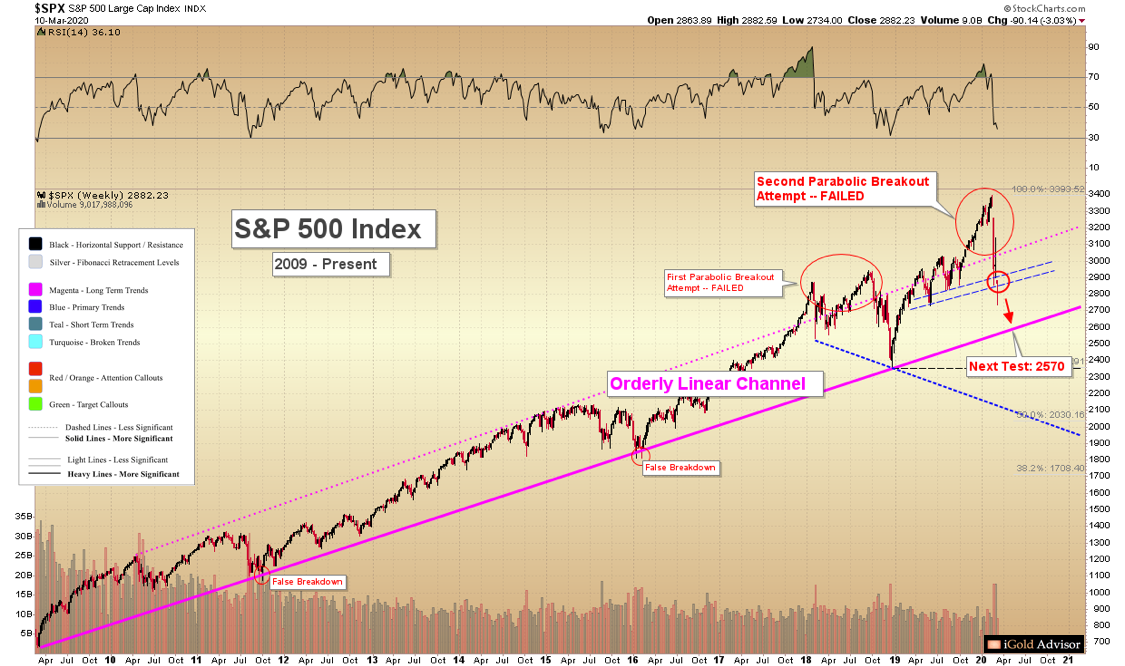

S&P 500 Tests Support

The S&P 500 ended last week at 2972, perched just at its 1.5-year rising (dashed blue) trend support. However, on Monday, the stock market made an initial break of this support, closing at 2882. Momentum suggests that the stock market is now set to break this support level over the coming weeks.

The next support level for the S&P 500 comes in at 2570 (red callout), or 13.5% below Friday’s close. This level is defined by the long-term rising boundary (magenta) of the stock market’s 11-year advance from the crash lows of 2009.

There is little support between Friday’s close and this 2570 boundary, and so 2570 could be reached within a matter of days.

In sum, from the stock market all-time high of 3393 set on February 19, to the next support level of 2570, the S&P 500 will be looking at nearly a 25% correction within less than a month. This is eerily reminiscent of the Crash of 1987 as far as percentage terms:

Stock Market to Gold Targets

Let us consider some real-world scenarios for stocks and gold using the projected 1.25 S&P 500 / gold ratio:

-

If the stock market bottoms above its next support, and merely falls to 2700

this implies a gold price of $2,160.

-

If the stock market reaches its next support, at 2570

this implies a gold price of $2,056.

-

If the stock market breaks its long-term trend and crashes all the way to 1550 (former 2007 peak)

this implies a gold price of $1,240.

Takeaways on the S&P 500 to Gold Ratio

-

The world is in the midst of the strongest deflationary period since the Crash of 2008.

-

Gold is set to outperform stocks, perhaps dramatically, over the next 3 - 6 months. However, the further that stocks fall the lower gold’s implied target.

-

During extreme deflation, it is still possible for both gold and stocks to fall simultaneously. Still, gold should hold its value better than stocks as a net sum.

-

The coming period may continue to be a “gold only” phenomenon for precious metals. During deflation, it is possible for all related metals assets (silver, miners, etc.) to decline, while “gold only” serves as the safe-haven.

Investors should own at least some gold in their portfolios as insurance policies against these “black swan” deflationary events. The S&P 500 to gold ratio breakdown suggests that gold will hold its value better than stocks over the coming months.

*********