Gold Price Forecast: Do Gold And Miners Have Any Post-Correction Energy Left?

Now that the correction is largely over (or about to be), will gold and miners decline right away, or will they see some minor upside before a deeper plunge?

Gold, silver, and mining stocks moved higher yesterday (Mar. 15), and they did so without the bullish push from the declining USD Index. Conversely, the USD Index ended yesterday’s session a bit higher. Is this strength an indication that a bigger rally in gold is on the horizon?

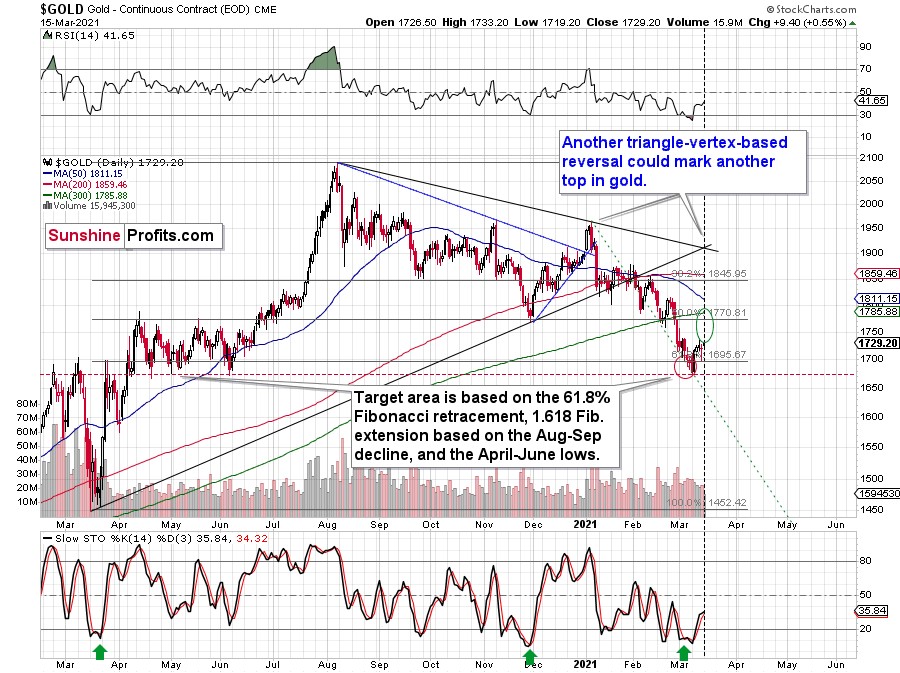

In my opinion, this is not necessarily the case. This kind of supposedly bullish action could still be a purely technical (emotional) development. This week’s triangle-vertex-based reversal is due more or less now (or it was due yesterday – more on that shortly), which means that the yellow metal is likely to reverse shortly or that it has already done so. If it’s about to reverse right now, and the next big move is going to be to the downside, it means that gold practically had to rally beforehand. Therefore, the fact that it did is relatively normal and neutral, not bullish.

Based on the above chart, the triangle-vertex-based reversal point was due yesterday. However, based on the chart below, it’s due today.

There might be slight differences between chart providers, which – if applied to relatively long-term lines – can distort the implications by a few pixels on the chart. These few pixels might mean a day (or so) of a difference in the case of the triangle-vertex-based formation.

Instead of going over charts of multiple providers on each day, it’s more useful to notice that the triangle-vertex-reversal points work on a near-to basis and thus expect a given reversal to take place close to the point suggested by the above technique, rather than going all-in based on the assumption that it will work perfectly. Every now and then it does work perfectly, but the “broad” approach is overall more useful.

At the moment of writing these words, I see that gold futures formed a small top just about $2 below the previous March high ($1,738). Consequently, both following scenarios would make sense in light of the current triangle-vertex-based reversal:

- Gold could decline right away as it doesn’t have to form a new high at the reversal point – just “a high”

- We could see another small, several-dollar rally, which would take gold to new monthly highs and make the triangle-vertex-based reversal work in a classic way, where it detects the final top for a given rally. The FOMC weeks tend to have higher intraday volatility, especially right before the interest rate decision is announced and during the press conference. This means that gold could move up and down in a quite volatile manner shortly.

Both scenarios seem quite possible and it’s hard to tell which of them is more likely. In both cases, it seems quite likely that another – big – decline will begin soon. Of course, I can’t promise that the rally is going to be completely over today, but this seems quite likely. And if not, it seems that it’s going to be over shortly, anyway.

And what about mining stocks?

The mining stocks remain in my upside target area, which means that they could have already topped, or that they could top a bit higher. Regardless, based on all the reasons that I discussed yesterday, and also based on the above comments on gold’s reversal, it seems that the days of this rally are numbered (and it’s not a big number, either).

The neck level of the previously broken head and shoulders pattern, the declining blue resistance line, the 50-day moving average, the late-February high – they all create a very strong short-term resistance not far above yesterday’s closing price. But does it mean that the mining stocks have to move higher from here, or that such a rally would be likely?

Not necessarily. While miners managed to close yesterday’s session above the November low, they didn’t manage to close the day above the January and early-February lows in terms of the closing prices. About a month ago, the GDX tried to invalidate the breakdown below these levels, and this move failed – it was followed by a decline to new yearly lows. Will we see the same thing once again? It seems very likely in my view – the history tends to rhyme.

But how low could the GDX ETF go? My previous comments on that matter remain up-to-date, but I would like to stress that just because the downside target area is relatively far, it doesn’t mean that we will necessarily hold our positions until it’s reached. If we see signs of strength that seem reliable (like miners refusing to decline even though gold moves lower combined with gold reaching an important support level while the USDX encounters resistance), I might write about temporarily closing this position – and perhaps even going long one more time – and we might be able to reap additional profits on the corrective upswing, just as I did earlier this month.

Our final downside target area ($15 – $24.5) is quite broad, because a lot depends on what the general stock market will do. I’ll be looking at gold for the key signs along with a few other factors (including the Gold Miners Bullish Percent Index) and determined the buying opportunity based on them – not necessarily based on the price of the GDX or GDXJ by itself.

Yes, this target is quite low, and thus might appear unrealistic, but let’s consider the following:

- Miners are slightly above their early-2020 high – just like gold.

- Gold is likely to decline to its 2020 lows or so

- General stock market might have just topped.

Considering all three above factors it’s clear that a move to even the 2020 lows is not out of the question.

And this means that junior miners might decline more than senior miners. A move from the current levels to the 2020 would imply a decline by about 50% in case of the GDX, and by about 60% in case of the GDXJ.

Summary

It’s very likely that the correction in gold and the miners is largely over and any small upside from here is bound to be temporary. The precious metals are on track for a medium-term downtrend.

After this short-term correction, the weeks that follow are not likely to be pleasant times for anyone who jumps on the bullish bandwagon just because prices moved higher in the previous months or based on some forum posts. Tread carefully.

What’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the yellow metal, forecasting gold’s longer term rally without a bigger decline first is thus likely to be misleading. Silver is likely to slide as well. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,