Gold Price Forecast: Gold Stocks Flash A Clear Signal For Gold Investors

Gold’s rally days appear to be numbered based given i.a. the weakness present in gold mining stocks. Gold miners usually lead gold, so examining their performance can often lead to extra insight into gold’s future price movement.

¯\_(ツ)_/¯

The above is what you’ll get if you type /shrug in the Slack communicator. The above also represents gold miners’ reaction to the fact that gold rallied about $100 in December. And this reaction is very important as it’s the cherry on the analytical cake baked using other signals that were available before this week. While elaborating on the details goes beyond the scope of this short essay, I’d like to discuss miners’ relative strength in greater detail.

On December 2 and December 3, gold rallied by about $11 (on both days separately, $22 when taken together). Consequently, gold miners – whose profits depend on the price of gold – should have rallied as well. Pretty simple, right?

At least this is what should have happened if the precious metals sector was truly in a bull mode. In the early parts of a rally miners lead gold, and right before (and at) tops, miners tend to lag behind gold or even decline despite gold’s rallies.

So, did miners rally as they should have?

No! It’s true that they ended the December 2 session higher, but by a mere $0.01, which means that they were basically flat. On December 3, the situation was even worse, as the value of the GDX ETF shares declined by $0.46.

Gold miners ignored gold’s rally, which told us – and still tells us – one major thing. Namely, the precious metals sector is not likely to rally after due to it being after a major bottom. Instead, it’s correcting within a bigger decline. This means that the next big move in gold miners and gold is likely to be to the downside.

The above were the early signs that the outlook is not as bullish as it may have seemed. And what followed – the shape of the price moves – simply confirmed it.

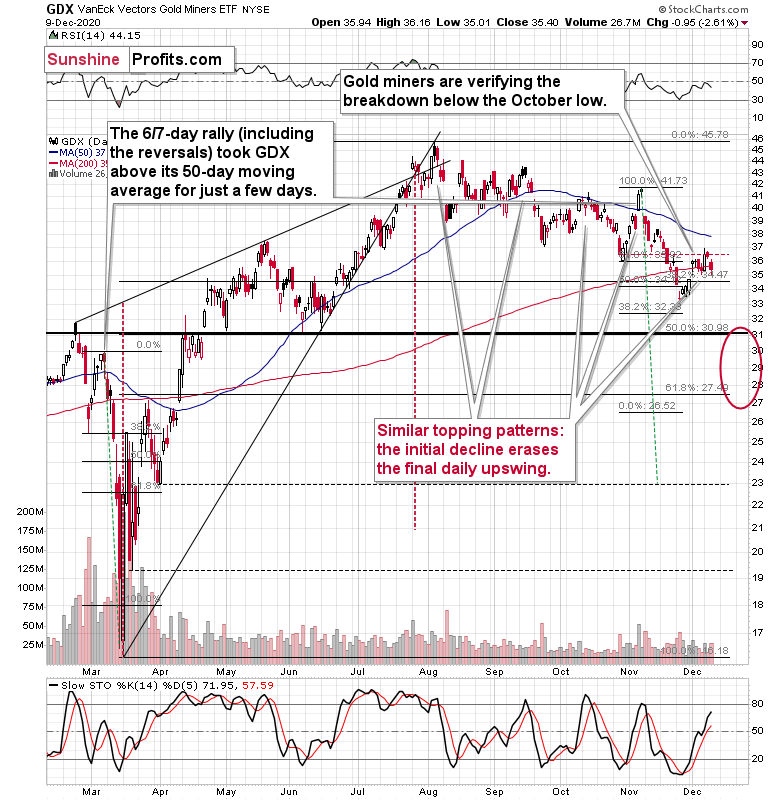

During the first visible daily rally that we saw after the previous local tops, GDX erased the final daily gain that it had made before topping. That happened on: August 7, September 17, October 15, and November 9. And we saw the same thing yesterday (Dec 9). Miners have just erased their December 8 daily rally.

The similarity to the previous post-top patterns indicates that the declines are not yet over. As indicated many times earlier, the next target for the GDX ETF is based on their February high in terms of the closing price – at about $31. Why use the closing price instead of the intraday high? Because the closing price already worked a few times before.

It stopped the rally (for just a while, but still) in mid-April. It stopped the declines in early May and in the first half of June. That’s why when gold slides to $1,700, I expect the GDX to move to about $31.

It will be very interesting to see if during this bottom gold manages to reverse or soar despite a rally in the USD Index. If we see nothing like that, this bottom might generate just a temporary rebound that is then followed by another slide. At this time, this scenario seems quite possible.

Can gold and miners move higher from here? Of course, they can, but this move is likely to be limited. While the USD Index could move to about 90, gold could once again move to about $1,851 - $1,866, and the GDX ETF could rally to $36.52 or so, which is the lowest daily close of October. In fact, miners could even correct to the mid-November high of about $38. Still, it’s likely that this would be just a very temporary phenomenon.

The outlook for gold, silver and mining stocks remains bearish for the next few weeks. It might be tempting to jump on the bullish bandwagon based on the rally that we saw this month, but based on many factors – including the weak performance of the mining stocks, it seems that the medium-term trend for gold – and the rest of the precious metals sector – remains down. Therefore, a different reaction would be justified toward the recent short-term upswing:

¯\_(ツ)_/¯

Thank you for reading my today’s analysis. Please note that it is just a small fraction of what my subscribers enjoy on a regular. If you’d like to read the premium details, I have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to my premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,